GoodRX | GDRX | Long at $5.00GoodRX NASDAQ:GDRX . Going long at $5.00.

Pros:

Revenue is growing and is expected to reach almost $1 billion by 2027

Debt-to-equity = 0.71x (low)

Monthly active users continue to increase (+7% during Q3 of 2024)

From a technical analysis perspective, the downward trend is starting to reverse, and the price has connected with my historical simple moving average (likely leading to a price increase)

Cons:

Not yet profitable

A lot of market competition

Insiders exercising of options outweighs awarding of options

No dividend

Targets:

$6.00

$7.00

$8.00

Substantially higher if partnerships emerge and profitability begins

GDRX trade ideas

Buy GDRX07-10-2024

Buy GDRX

Buy $7.95

Sell $9.06

Ask $1.11

TD Cowen analyst maintained a Buy rating on GoodRx Holdings today and set a price target of $16.00. The company’s shares closed yesterday at $7.92.

GoodRx Holdings has an analyst consensus of Moderate Buy, with a price target consensus of $9.88, implying a 24.75% upside from current levels. (TipRanks)

GoodRx Announces New Way for Consumers to Access Sanofi’s LantusGoodRx Announces New Way for Consumers to Access Sanofi’s Lantus for $35 at Over 70,000 Pharmacies Nationwide.

GoodRx (NASDAQ: GDRX), a leading resource for healthcare savings and information, today announced it is working with Sanofi (NASDAQ: SNY), a global leader in diabetes care, to offer a new way for people living with diabetes to access Lantus® (insulin glargine injection) 100 Units/mL in the U.S. for only $35.

This collaboration builds on Sanofi’s recent announcement to lower the list price for Lantus and cap out-of-pocket costs at $35 for all patients with commercial insurance, which goes into effect January 1, 2024. It leverages GoodRx’s reach and scale to broaden access and affordability for people living with diabetes and means that, effective today, all Americans with a valid prescription, regardless of insurance status, can use GoodRx at over 70,000 U.S. retail pharmacies to access a 30-day supply of Lantus for only $35.

"Efforts to make insulin more accessible have been at the forefront of the news for months, and a critical piece of delivering on this promise is making it as simple as possible for patients to get the lower price right at their regular pharmacy counter. Sanofi is taking action and providing Americans who need insulin with the ability to access Lantus in an easy and affordable way, regardless of insurance status. We’re proud to collaborate with them on this initiative," said Dorothy Gemmell, Chief Commercial Officer at GoodRx.

Patients can visit GoodRx.com/lantus to access the $35 price coupon, which can be redeemed at any pharmacy that accepts GoodRx, including CVS, Walgreens, and Walmart. This complements other savings programs already offered by Sanofi, including offering Lantus for $35 per month to people without insurance. GoodRx also offers supportive resources to help consumers holistically manage their condition, including discounts on continuous glucose monitors and coupons for diabetes medications, as well as a Diabetes Hub that offers diabetes-specific articles and resources written by medical experts on GoodRx Health.

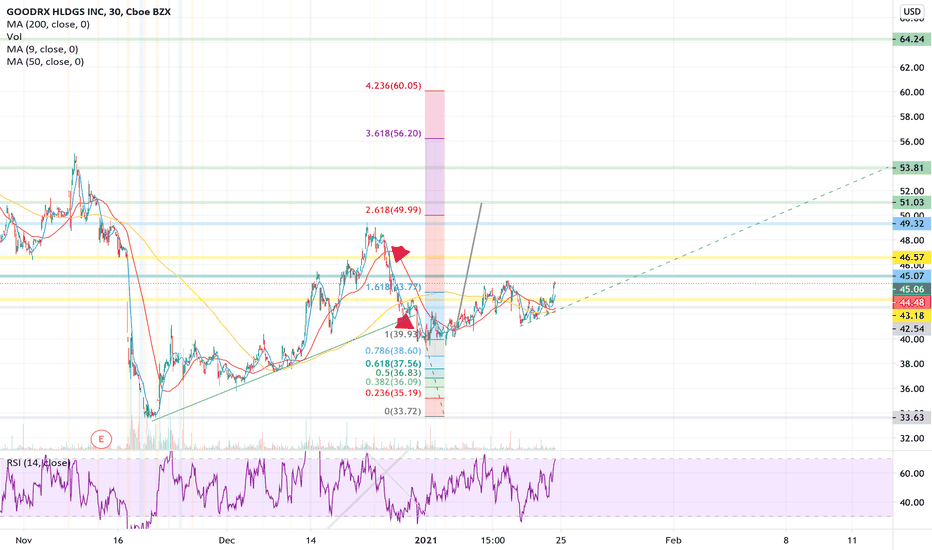

10/3/21 GDRXGoodRx Holdings, Inc. (GDRX)

Sector: Technology Services (Internet Software/Services)

Current Price: $43.97

Breakout price trigger: $45.40

Buy Zone (Top/Bottom Range): $42.60-$37.40

Price Target: $49.00-$50.00 (1st), $55.00-$56.00 (2nd)

Estimated Duration to Target: 23-25d (1st), 72-76d (2nd)

Contract of Interest: $GDRX 11/19/21 45c, $GDRX 12/17/21 50c

Trade price as of publish date: $3.40/cnt , $2.35/cnt

GOODRX Multiple Plays, Short and LongLoving the setup I am seeing right now for potential short and long positions on GDRX coming into key support market structure around 36.84.

Here is my thinking:

Strong downtrend since Feb. 11

Downtrend broken with move on March 09/10

Key range resistance established at 43.50 (formerly support)

Retracement move to recent and historical support level around 36.84

Depending on the coming price action, you could either:

Long the support reversal and exit somewhere before the 43.50 resistance depending on how greedy you want to be.

Short the support breakdown and look to take profits before the historical support around 33.64.

I won't include specific entry and exit points here, but if you want to chat feel free to send me a message :)

GDRX todaySo i have been investing in GDRX since its release in September 2020. They have been flowing between 40's and 50's for a while.

I hope this stock can push in the 60s or higher sometime soon. I am committed to this stock i am holding this stock. GDRX is a great entry level healthcare stock for new investors.

GDRX - starting Wave 3GDRX just completed a .618 W2 retracement and I believe it's in the process of W3, targeting its previous ATH.

Could soon break out of the wedge pattern that's been forming since IPO.

- AVWAP. Closed above some interesting points - from all time high, low from Amazon news, and recent swing high/low.

- Dark Pool. @soumyazen from Twitter has mentioned that GDRX has been getting a lot of love from dark pool buyers in January. Smart money is interested.

- Short Squeeze Potential. 25%+ short interest at the moment.

- Strong Fundamentals. GDRX still seems to be misunderstood. Amazon's entry into the pharmacy business may have caused an overreaction, as they would only be targeting ~5% of the industry (mail orders). GDRX has long-standing relationships with many PBMs, Amazon only has one.

Earnings call expected in February. Good luck to all!

(long GDRX 4/16 45c)