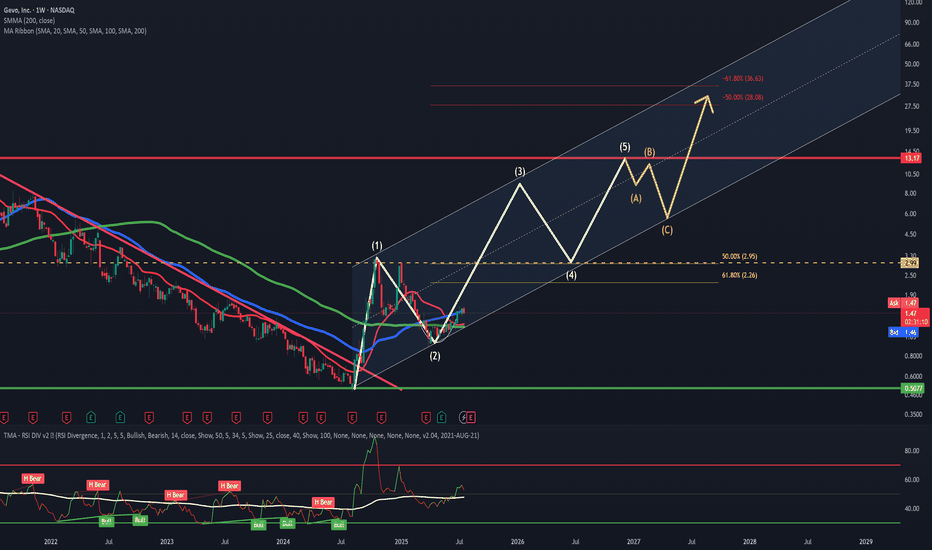

Looking goodAfter a clean breakout of the long lasting downtrend we suffered which ended on 3rd September 2024, we experienced explosive price action. This quickly got knocked off of it's feet due to it reaching 50.00% fib level, so a downtrend since then was expected given how extended we were.

Since the cool

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.34 USD

−78.64 M USD

16.91 M USD

227.37 M

About Gevo, Inc.

Sector

Industry

CEO

Patrick R. Gruber

Website

Headquarters

Englewood

Founded

2005

FIGI

BBG000P7S7L7

Gevo, Inc. is a renewable chemicals and next generation biofuels company, which focuses on the development and commercialization of renewable alternatives to petroleum-based products. It operates through the following segments: Gevo and Gevo Development and Agri-Energy. The Gevo segment focuses on the research and development activities related to the future production of isobutanol, including the development of the firm's proprietary biocatalysts, the production and sale of renewable jet and other fuels, the retrofit process, and the next generation of chemicals and biofuels that will be based on the company's isobutanol technology. The Gevo Development and Agri-Energy segment is currently responsible for the operation of its agri-energy facility and the production of ethanol, isobutanol, and related products. The company was founded by Christopher Michael Ryan, Matthew W. Peters, Peter Meinhold, and Frances Hamilton Arnold on June 9, 2005 and is headquartered in Englewood, CO.

Related stocks

Boom or Bust: What's Happening with GEVO?Gevo, Inc. (NASDAQ: GEVO) is turning heads with a massive influx of trading volume and recent institutional interest, including a notable position by State Street Corp holding $1.37 million in shares. Adding to the buzz, Congress has reportedly been buying this penny stock, fueling speculation.

Ana

Monday GEVO Trade Setup!🚀 🚀

🔻 **Stop Loss (SL):** Below **1.94**

📈 **Entry:** Above **2.11**

🎯 **Target 1 (T1):** **2.26**

🎯 **Target 2 (T2):** **2.50**

💡 **Why Trade:**

Anticipated triangle breakout on Monday with strong bullish momentum.

✅ **Conclusion:**

Prepare for Monday's open; monitor breakout conf

GEVO - The Sleeping Nephilim Giant Alarm Triggered (BIOFUELS)GEVO is priming for a big comeback. It's a sleeping giant. Has been on a down trend close to 2 decades.

For pennies on the dollar, this is an opportunity equivalent to mining bitcoin in 2009 and holding your bag for a very long time.

This is a long-term hold. 5+ years.

Someone believed in the Biofu

GEVO. Manipulation Short squeeze. How short positions are reset.This example is on paper company Gevo inc - manufacturing. Chemical industry. Specialized chemicals.

I will say that I combined the training idea with the trading one , how the stocks will be relevant for trading now, the potential first profit with confirmation of support can be about + 90%.

Gevo time to go (higher) Gevo

Short Term - We look to Buy at 2.96 (stop at 2.70)

A bearish Head and Shoulders is forming. 2.90 continues to hold back the bears. Previous resistance located at 4.08. Trading has been mixed and volatile. We look to buy dips.

Our profit targets will be 3.63 and 3.98

Resistance: 4.08 /

Prophecy: the Horrors of War shall drive Progress and Profits.As the war in Ukraine continues, geopolitical relations will shift. Dependence upon opposing countries will diminish. Self sustainability will be the focus for the coming months, if not years. However, alternative resources shall be needed to supplement finite resources. Alternative and sustainable

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of GEVO is 1.47 USD — it hasn't changed in the past 24 hours. Watch Gevo, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Gevo, Inc. stocks are traded under the ticker GEVO.

GEVO stock has fallen by −6.37% compared to the previous week, the month change is a 10.53% rise, over the last year Gevo, Inc. has showed a 140.98% increase.

We've gathered analysts' opinions on Gevo, Inc. future price: according to them, GEVO price has a max estimate of 14.00 USD and a min estimate of 1.50 USD. Watch GEVO chart and read a more detailed Gevo, Inc. stock forecast: see what analysts think of Gevo, Inc. and suggest that you do with its stocks.

GEVO reached its all-time high on Apr 7, 2011 with the price of 158,160.00 USD, and its all-time low was 0.46 USD and was reached on Jul 1, 2020. View more price dynamics on GEVO chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

GEVO stock is 4.17% volatile and has beta coefficient of 2.19. Track Gevo, Inc. stock price on the chart and check out the list of the most volatile stocks — is Gevo, Inc. there?

Today Gevo, Inc. has the market capitalization of 352.16 M, it has decreased by −7.59% over the last week.

Yes, you can track Gevo, Inc. financials in yearly and quarterly reports right on TradingView.

Gevo, Inc. is going to release the next earnings report on Aug 11, 2025. Keep track of upcoming events with our Earnings Calendar.

GEVO earnings for the last quarter are −0.09 USD per share, whereas the estimation was −0.10 USD resulting in a 6.62% surprise. The estimated earnings for the next quarter are −0.06 USD per share. See more details about Gevo, Inc. earnings.

Gevo, Inc. revenue for the last quarter amounts to 29.11 M USD, despite the estimated figure of 25.12 M USD. In the next quarter, revenue is expected to reach 46.46 M USD.

GEVO net income for the last quarter is −21.73 M USD, while the quarter before that showed −17.61 M USD of net income which accounts for −23.41% change. Track more Gevo, Inc. financial stats to get the full picture.

No, GEVO doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 29, 2025, the company has 122 employees. See our rating of the largest employees — is Gevo, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Gevo, Inc. EBITDA is −58.98 M USD, and current EBITDA margin is −399.61%. See more stats in Gevo, Inc. financial statements.

Like other stocks, GEVO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Gevo, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Gevo, Inc. technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Gevo, Inc. stock shows the neutral signal. See more of Gevo, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.