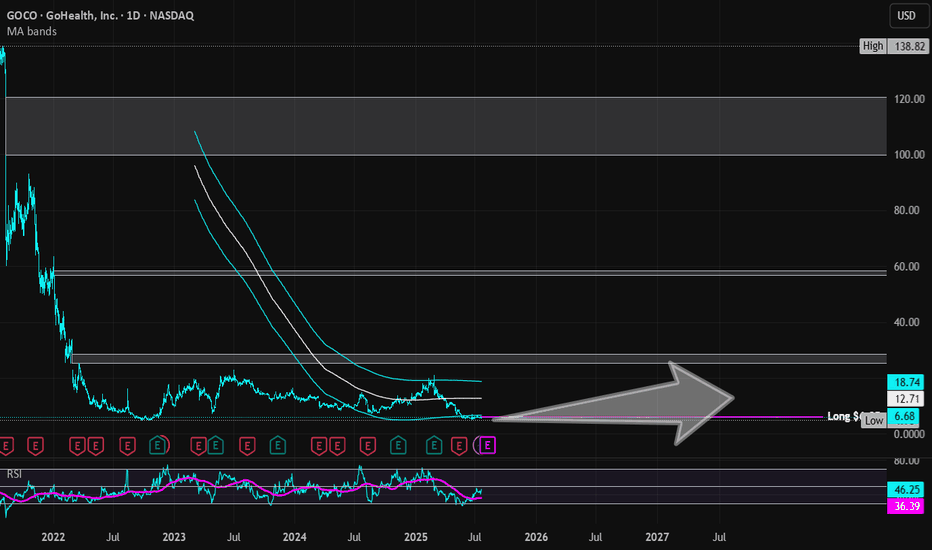

GoHealth | GOCO | Long at $6.05GoHealth NASDAQ:GOCO is a health insurance marketplace and Medicare-focused digital health company that uses a technology platform with machine-learning algorithms to match consumers with Medicare plans (Advantage, Supplement, Part D) and individual health insurance. Understandably, a lot of investors aren't bullish on this stock given all of the healthcare provider and services headwinds. However, if the company can overcome some of their financial issues and bankruptcy risk (debt-to-equity: 1.6x; quick ration of 1.1x, Altman's Z score of .3x), it may dominate the health insurance marketplace (but do not hold my word to that...). This is a purely speculative play at this point - those who are risk averse should absolutely stay away.

What truly caught my eye with this stock is that it is consolidating nicely within my historical simple moving average area. Often, but not always, this leads to a future change in momentum and propels the stock higher. It doesn't signal a bottom and there may be more room for it to plummet, but it is a bullish (overall) sign that shares are likely being accumulated by investors. Given the need for health insurance, particularly Medicare as the US / baby boom population ages, this is a company that may prosper IF it can get its financials in order.

Thus, at $6.05, NASDAQ:GOCO is in a personal buy zone (but very risky). Further declines may be ahead before a stronger move up.

Targets into 2028:

$10.00 (+64.5%)

$12.00 (+97.4%)

GOCO trade ideas

GoHealth (NASDAQ: $GOCO) Ready To Rise Like The Sun! ☀️GoHealth , Inc. operates as a health insurance marketplace and Medicare focused digital health company in the United States. It operates through four segments: MedicareÂInternal; MedicareÂExternal; Individual and Family Plans (IFP) and OtherÂInternal; and IFP and OtherÂExternal. The company operates a technology platform that leverages machine-learning algorithms of insurance behavioral data to optimize the process for helping individuals find the health insurance plan for their specific needs. Its products include Medicare Advantage, Medicare Supplement, Medicare prescription drug plans, and Medicare Special Needs Plans; and IFP, dental plans, vision plans, and other ancillary plans to individuals. The company sells its products through carriers and online platform, as well as independent and external agencies. GoHealth , Inc. was founded in 2001 and is headquartered in Chicago, Illinois.

GoHealth (NASDAQ: $GOCO) Looks Juicy As Ever! 🍊GoHealth, Inc. operates as a health insurance marketplace and Medicare focused digital health company in the United States. It operates through four segments: MedicareÂInternal; MedicareÂExternal; Individual and Family Plans (IFP) and OtherÂInternal; and IFP and OtherÂExternal. The company operates a technology platform that leverages machine-learning algorithms of insurance behavioral data to optimize the process for helping individuals find the health insurance plan for their specific needs. Its products include Medicare Advantage, Medicare Supplement, Medicare prescription drug plans, and Medicare Special Needs Plans; and IFP, dental plans, vision plans, and other ancillary plans to individuals. The company sells its products through carriers and online platform, as well as independent and external agencies. GoHealth, Inc. was founded in 2001 and is headquartered in Chicago, Illinois.

GoHealth (USA: $GOCO) Ready To Rocket In Near-Term! 🚀GoHealth, Inc. operates as a health insurance marketplace and Medicare focused digital health company in the United States. It operates through four segments: MedicareÂInternal; MedicareÂExternal; Individual and Family Plans (IFP) and OtherÂInternal; and Individual and Family Plans and OtherÂExternal. The company operates a technology platform that leverages machine-learning algorithms of insurance behavioral data to optimize the process for helping individuals find the health insurance plan for their specific needs. Its products include Medicare Advantage, Medicare Supplement, Medicare prescription drug plans, and Medicare Special Needs Plans; and IFP, dental plans, vision plans, and other ancillary plans to individuals. The company sells its products through carrier and online platform, as well as independent and external agencies. GoHealth, Inc. was founded in 2001 and is headquartered in Chicago, Illinois.

GoHealth (NASDAQ: $GOCO) Long Overdue For A Reversal! ⬆️GoHealth, Inc. operates as a health insurance marketplace and Medicare focused digital health company in the United States. It operates through four segments: MedicareÂInternal; MedicareÂExternal; Individual and Family Plans (IFP) and OtherÂInternal; and Individual and Family Plans and OtherÂExternal. The company operates a technology platform that leverages machine-learning algorithms of insurance behavioral data to optimize the process for helping individuals find the health insurance plan for their specific needs. Its products include Medicare Advantage, Medicare Supplement, Medicare prescription drug plans, and Medicare Special Needs Plans; and IFP, dental plans, vision plans, and other ancillary plans to individuals. The company sells its products through carrier and online platform, as well as independent and external agencies. GoHealth, Inc. was founded in 2001 and is headquartered in Chicago, Illinois.

GOHEALTH is it a buy?The stock broke out of a symmetrical triangle recently. However, the break out volume is VERY low. Usually I would like to see breakouts with good volume before entering.

On the other hand, 9EMA and 21EMA are about to cross soon.

I would only enter this stock WHEN the 9EMA crosses above the 21EMA with decent volume.

PT1: 13.3

PT2: 15.17

GOCO Possible Rounding Bottom/Cup and Handle 76% 172%GOCO appears to be forming a rounding bottom pattern...macd in positive territory with months of bullish divergence...buy in price is $12.50 (though it may not get there)...first target is $22 (76%)...possible retrace into cup and handle...second target is $34 (172%)...IT'S YOUR MONEY, DYOR!!

GoHealth formed head and shoulder and double bottom patternNASDAQ:GOCO broke out of the double bottom pattern and retested the neck line and is now about to break out of the head and shoulders pattern. Targets are shown on the chart, stop ideally at 11.6$.

Hit the like button and follow if you find this useful :)

This is only my own view and not financial advice, do your own analysis before buying or selling

Happy Trading!

GOCOThe young company, after the IPO, performed a correction and formed a reverse H&S pattern at the bottom, the neck level has already been broken and now the neck level is being retested. The target for the trade is + 35%, upon reaching the target it is necessary to watch the price behavior, since further growth is quite possible at least to the level of the historical maximum, since in this case the reverse H&S pattern is a pattern for entering a medium-term long, conditionally it can be considered the beginning of the third wave cycle. Stop trade - the stop level is displayed on the chart.

Double bottom and Bullish Flag FormationDouble bottom formation with breakout signalling a reversal in the downward trend. Price came back to test the breakout price level at 13.30 and rebounded.

At the same time, it looks like there is a bullish flag formation and accumulation at the 13.30 to 14.80 range.

Flagpole height: 3.50

TP1: 15.17 (resistance)

TP2: 17 (based on flagpole height)

TP3: 18.87 (previous support - resistance level)

GOCO Chart SetupBackground Info:

- Purchase Price $13.51 (a little higher than planned).

- GOCO closed at $13.31 on December 29, 2020

- GOCO AH $13.11

Predictions over the next month:

- Expecting a pullback to $13.04 within 1-2 weeks

- At or around $13.04, we should see GOCO begin to break out

TP1: $15 --> 10%

TP2: $17.5 --> 30%

SL: $12 --> -12%

High risk, higher reward play.

- EB