Key facts today

In 2025, Alphabet, Google's parent, is among the top tech firms expected to invest $340 billion in AI data centers and product development, boosting U.S. GDP by 1.3%.

South Korea has delayed its decision on Google's map data export request for 60 days, allowing the company to address security concerns amid U.S. pressure in trade talks.

Harvard University's investment portfolio held about $114 million in Alphabet (GOOG) stock at Q2 2025, ranking it among their largest holdings.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

9.47 USD

100.12 B USD

349.81 B USD

5.04 B

About Alphabet Inc (Google) Class C

Sector

Industry

CEO

Sundar Pichai

Website

Headquarters

Mountain View

Founded

2015

FIGI

BBG009S3NB30

Alphabet, Inc is a holding company, which engages in the business of acquisition and operation of different companies. It operates through the Google and Other Bets segments. The Google segment includes its main Internet products such as ads, Android, Chrome, hardware, Google Cloud, Google Maps, Google Play, Search, and YouTube. The Other Bets segment consists of businesses such as Access, Calico, CapitalG, GV, Verily, Waymo, and X. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

Related stocks

GOOG | Long | Breakout After Ranging Base | (Aug 2025)GOOG | Long | Breakout After Ranging Base | (Aug 2025)

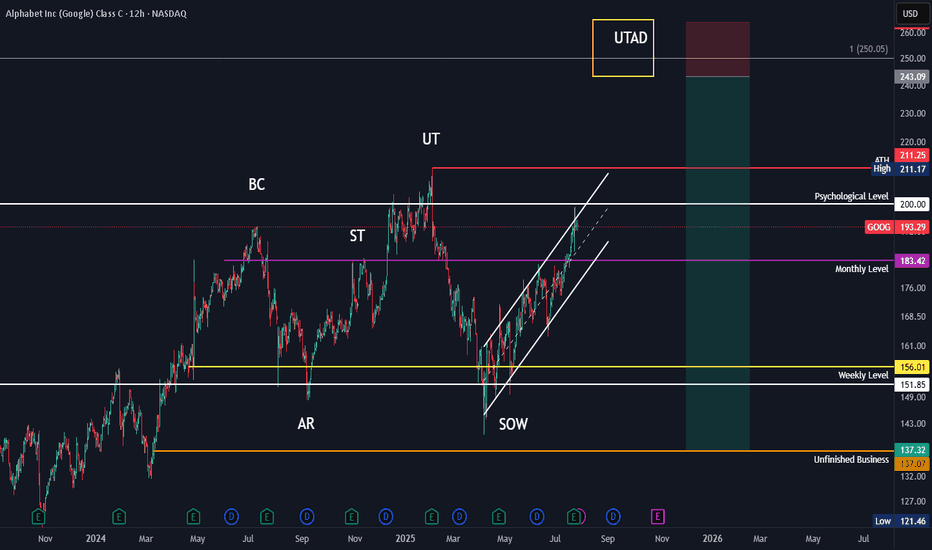

1️⃣ Short Insight Summary:

GOOG has been ranging for nearly a year between ~$125–$185, forming a strong accumulation base. If it successfully retests the $181–182 zone, I’m looking for a breakout entry with a long-term upside.

2️⃣ Trade Parame

Big Money is Buying GOOGL Calls — Are You In?

## 🚨 GOOGL WEEKLY TRADE IDEA (Aug 4–8)

**Institutional CALL Buying Surges — \$197.50 CALL Setup Triggered**

---

### 📊 Model Consensus Breakdown:

* **🔁 Call/Put Ratio**: **3.33** — strong bullish options bias

* **📉 RSI**: Weak Daily & Weekly = ⚠️ caution zone

* **💰 Volume**: Institutional call f

GOOGL Poised for a Breakout! Aug. 5GOOGL Poised for a Breakout! Key Gamma Levels Driving the Next Move 🚀

Technical Analysis & GEX Insights

GOOGL has been grinding higher after finding support around the 185–186 zone and holding the bullish recovery trend. Price is now consolidating just under 195, setting the stage for a potential b

GOOGL Holding the Uptrend – Is $200 Within Reach? Aug 7📊 Technical Analysis (1H & 15M Chart)

GOOGL continues to respect the ascending trendline formed from the August 1st low, bouncing cleanly from higher lows and holding above 194–195 support. On the 1H chart, MACD remains slightly bullish with histogram building positive momentum, and Stoch RSI is try

$GOOG Eyes Breakout Above $198Currently at $197.12, NASDAQ:GOOG is trading above both its 50-period SMA (~$196.00) and 200-period SMA (~$192.50) on the 30-minute chart. The trend remains bullish with support holding firm at $192.50, and bulls are watching closely as the price flirts with resistance near $198.75. This steady gr

Waiting for a buy trigger.Google stock is at a good spot where it could make a strong upward move. At this price level, we see multiple confluences both in terms of trend and from the perspective of indicators and oscillators. So, if it manages to break through this level, the price could move nicely.

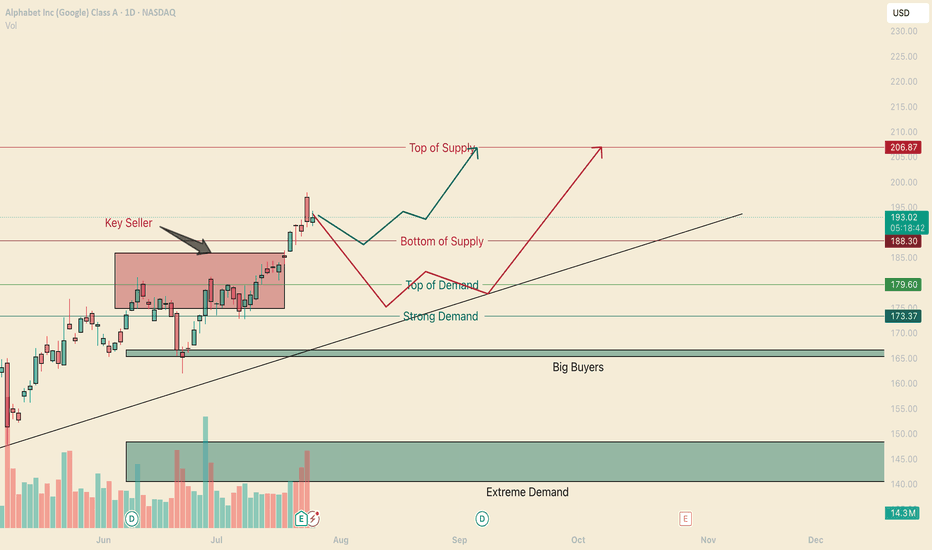

Google Buyers Entered Seller Territory.Hello, I am the Cafe Trader.

To finish off our series of the MAG 7 we have GOOGL up next.

If you have been keeping up, I will offer insight into Long term and short term interest. Google has taken out a key sellers on July 21st, and also closed inside the supply zone. This is very bullish, bulls

GOOGL Forecast – Dual AI Model Confirmation📊 GOOGL Forecast – Dual AI Model Confirmation

🔹 Posted by WaverVanir | VolanX Protocol

NASDAQ:GOOGL is showing strong bullish structure backed by both Smart Money Concepts (SMC) and AI model consensus.

🧠 VolanX AI Protocol Forecast (30-Day)

🎯 Target: $223.08 (+13.3%)

📈 Accuracy: 98.2%

📉 Drawdown

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US2079KAF4

ALPHABET 20/50Yield to maturity

6.91%

Maturity date

Aug 15, 2050

US2079KAG2

ALPHABET 20/60Yield to maturity

6.84%

Maturity date

Aug 15, 2060

US2079KAE7

ALPHABET 20/40Yield to maturity

6.07%

Maturity date

Aug 15, 2040

GOOG5025299

Alphabet Inc. 0.45% 15-AUG-2025Yield to maturity

5.81%

Maturity date

Aug 15, 2025

GOOG6065579

Alphabet Inc. 5.3% 15-MAY-2065Yield to maturity

5.50%

Maturity date

May 15, 2065

GOOG6065578

Alphabet Inc. 5.25% 15-MAY-2055Yield to maturity

5.31%

Maturity date

May 15, 2055

GOOG6065581

Alphabet Inc. 4.5% 15-MAY-2035Yield to maturity

4.70%

Maturity date

May 15, 2035

US2079KAD9

ALPHABET 20/30Yield to maturity

4.29%

Maturity date

Aug 15, 2030

US2079KAC1

ALPHABET 16/26Yield to maturity

4.18%

Maturity date

Aug 15, 2026

XS306443038

ALPHABET 25/54Yield to maturity

4.08%

Maturity date

May 6, 2054

GOOG6065580

Alphabet Inc. 4.0% 15-MAY-2030Yield to maturity

3.98%

Maturity date

May 15, 2030

See all GOOG bonds

Curated watchlists where GOOG is featured.

Frequently Asked Questions

The current price of GOOG is 202.09 USD — it has increased by 1.13% in the past 24 hours. Watch Alphabet Inc (Google) Class C stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Alphabet Inc (Google) Class C stocks are traded under the ticker GOOG.

GOOG stock has risen by 5.13% compared to the previous week, the month change is a 13.29% rise, over the last year Alphabet Inc (Google) Class C has showed a 24.48% increase.

We've gathered analysts' opinions on Alphabet Inc (Google) Class C future price: according to them, GOOG price has a max estimate of 250.00 USD and a min estimate of 180.00 USD. Watch GOOG chart and read a more detailed Alphabet Inc (Google) Class C stock forecast: see what analysts think of Alphabet Inc (Google) Class C and suggest that you do with its stocks.

GOOG reached its all-time high on Feb 4, 2025 with the price of 208.70 USD, and its all-time low was 24.31 USD and was reached on Jan 12, 2015. View more price dynamics on GOOG chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

GOOG stock is 3.11% volatile and has beta coefficient of 0.93. Track Alphabet Inc (Google) Class C stock price on the chart and check out the list of the most volatile stocks — is Alphabet Inc (Google) Class C there?

Today Alphabet Inc (Google) Class C has the market capitalization of 2.39 T, it has increased by 2.99% over the last week.

Yes, you can track Alphabet Inc (Google) Class C financials in yearly and quarterly reports right on TradingView.

Alphabet Inc (Google) Class C is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

GOOG earnings for the last quarter are 2.31 USD per share, whereas the estimation was 2.18 USD resulting in a 5.82% surprise. The estimated earnings for the next quarter are 2.33 USD per share. See more details about Alphabet Inc (Google) Class C earnings.

Alphabet Inc (Google) Class C revenue for the last quarter amounts to 96.43 B USD, despite the estimated figure of 94.04 B USD. In the next quarter, revenue is expected to reach 99.51 B USD.

GOOG net income for the last quarter is 28.20 B USD, while the quarter before that showed 34.54 B USD of net income which accounts for −18.37% change. Track more Alphabet Inc (Google) Class C financial stats to get the full picture.

Yes, GOOG dividends are paid quarterly. The last dividend per share was 0.21 USD. As of today, Dividend Yield (TTM)% is 0.41%. Tracking Alphabet Inc (Google) Class C dividends might help you take more informed decisions.

Alphabet Inc (Google) Class C dividend yield was 0.32% in 2024, and payout ratio reached 7.46%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 9, 2025, the company has 183.32 K employees. See our rating of the largest employees — is Alphabet Inc (Google) Class C on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Alphabet Inc (Google) Class C EBITDA is 138.86 B USD, and current EBITDA margin is 36.45%. See more stats in Alphabet Inc (Google) Class C financial statements.

Like other stocks, GOOG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Alphabet Inc (Google) Class C stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Alphabet Inc (Google) Class C technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Alphabet Inc (Google) Class C stock shows the strong buy signal. See more of Alphabet Inc (Google) Class C technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.