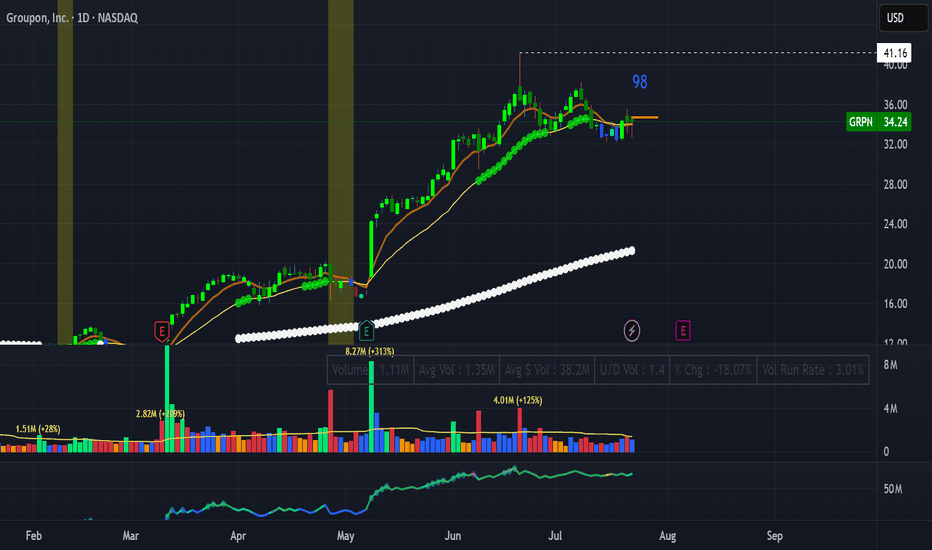

Pull back slingshot GRPNNASDAQ:GRPN

Setup : pull back slingshot

-RS 98

-uptrend

-contaction in volume

-EPS double digit up (2/3) ,Sales down( 0/3)

Play:

Entry trigger 34.69 break out with enough volume

Stop loss: under break out candle

Target: 2.5R or ride the EMA next pivot point 41,16

!!Not covered by fundamentals!!

GRPN trade ideas

GROUPON IS UP 10X - But more upside to come. #GRPN has been on fire.

It has also smashed through a major downtrend line and key horizontal level.

I expect the trend to continue.

"The company expects 2025 revenue between $493 million and $500 million and adjusted EBITDA of $70 million to $75 million, both topping Bloomberg's consensus estimates of $491.3 million in revenue and $74.8 million in EBITDA. Groupon also projects at least $41 million in free cash flow for the year."

#Roaring20's

GRPN Long Setup – Flag Breakout in Progress! 🚀

📊 Trade Idea Summary:

Ticker: NASDAQ:GRPN (Groupon Inc.)

Chart: 15-minute

Trade Type: Long

Setup: Bullish pennant near breakout

Entry: $29.48 (breakout level)

Stop Loss: $28.73 (below trendline)

Target 1: $30.44 (resistance zone)

Target 2: $31.48 (measured move target)

🧠 Why This Trade?

Breakout from consolidation after strong uptrend

Trendline support intact

Bullish flag near resistance + good R:R setup

Entry just above key psychological level of $29

🗣️ Caption for Social Media Post:

📈 GRPN Flag Breakout Loading!

Watch $29.48 breakout area — strong move possible if we reclaim that zone.

Targets: $30.44 → $31.48

Stop: $28.73 for tight risk control.

#GRPN #SwingTrade #StockAlert #ProfittoPath #MarketSetup #NASDAQMoves

GRPN – Groupon, Inc. – 30-Min Long Trade Setup!📈 🚀

🔹 Asset: GRPN (NASDAQ)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Ascending Triangle Breakout + Resistance Flip

📊 Trade Plan (Long Position)

✅ Entry Zone: Above $18.82 (Breakout zone + confluence)

✅ Stop-Loss (SL): Below $18.36 (Trendline + recent low)

🎯 Take Profit Targets

📌 TP1: $19.31 (Key resistance / supply zone)

📌 TP2: $19.95 (Measured breakout target / extension)

📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance):

$18.82 - $18.36 = $0.46 risk per share

📈 Reward to TP1:

$19.31 - $18.82 = $0.49 → (1.06:1 R/R)

📈 Reward to TP2:

$19.95 - $18.82 = $1.13 → (2.45:1 R/R)

🔍 Technical Analysis & Strategy

📌 Ascending Triangle Breakout: Resistance line breakout with rising lows

📌 Volume Support: Volume increasing as price nears breakout zone

📌 Consolidation Break: Tight range breakout indicates potential strength

📌 Retest in Progress: Yellow zone acting as previous resistance, now support

⚙️ Trade Execution & Risk Management

📊 Confirm entry after 30-min bullish candle close above $18.82

📉 Trailing Stop Strategy:

Move SL to breakeven once TP1 is reached

💰 Partial Profit Booking Strategy

✔ Book 50% at TP1 = $19.31

✔ Let the rest ride to TP2 = $19.95

✔ Raise SL above entry to lock in profits

⚠️ Breakout Failure Risk

❌ Setup becomes invalid if price breaks below $18.36

❌ Avoid entry without strong candle close above $18.82

🚀 Final Thoughts

✔ Ascending triangle breakout = bullish continuation pattern

✔ Decent risk-to-reward: up to 2.45:1

✔ Clean structure, low risk, and strong confluence setup

🔗 #GRPN #NASDAQ #BreakoutTrade #ProfittoPath #SwingTrading #ChartSetup #TechnicalAnalysis #AscendingTriangle #SmartTrading #StockMarketOpportunities

Stock Of The Day / 03.12.25 / GRPN03.12.2025 / NASDAQ:GRPN #GRPN

Fundamentals. The earnings report exceeded expectations.

Technical analysis.

Daily chart: Wide sideways, trend break level ahead at 13.82

Premarket: Gap Up on moderate volume.

Trading session: The initial impulse from the opening was stopped at 13.15, after which the price began to tighten to this level. There was a breakout and a quick return back behind the level at 10:15, but the structure of the tightening was not broken and the price continued to tighten to the level. Then the breakout occurred at 11:17 and the price stopped in trading range right on the level 13.15. We considering a long trade to continue the upward movement.

Trading scenario: breakout with retest (tightening with retest) 13.15

Entry: 13.23 when exiting upwards from the trading range at 13.15

Stop: 13.09 we hide it behind the trading range

Exit: Close part of the position at 13.51 when exiting downwards from accumulation, close the remaining part of the position when breaking through and returning below the daily level of 13.82.

Risk Rewards: 1/3

P.S. In order to understand the idea behind the Stock Of The Day analysis, read the following information .

GRPN Ascending Triangle | Targeting $14.14 ."GRPN is forming an ascending triangle pattern, signaling a potential bullish breakout. Currently testing resistance at $13.12, with a target set at $14.14. Key support is holding strong at $12.00, reinforcing the setup.

Key Levels:

Support: $12.00

Resistance: $13.12

Target: $14.14

Watch for volume confirmation to validate the breakout. A great opportunity for momentum traders!

#GRPN #Trading #TechnicalAnalysis #Stocks #Breakout #NASDAQ #BullishSetup #Investing

What are your thoughts on GRPN's next move

Groupon long position/swing trade idea - $NASDAQ:GRPNNASDAQ:GRPN may be a long from here. It put in a monthly indecision candle last month, along with a relative volume per range signal, after sweeping below a pivot near an area of interest. Also swept under prior weekly low and reversed, heading back toward prior week high.

I've started a tiny feeler position today looking for a potential weekly breakout and run up toward the highs around 19-20 and beyond, perhaps even starting a long run back up to the IPO price. I will tighten and add more if it takes out the weekly high.

Normally in this distribution I would only look for a long if it first dropped to $7.5, and it may still do that or continue lower, but the monthly relvol signal made me want to make an attempt at this one from here. Monthly and quarterly relvol signals tend to lead to the best trends.

GRPN Groupon Options Ahead of EarningsAnalyzing the options chain and the chart patterns of GRPN Groupon prior to the earnings report this week,

I would consider purchasing the 16usd strike price Calls with

an expiration date of 2024-8-2,

for a premium of approximately $2.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GRPN, THE LITTLE COUPON APP THAT COULD (EARNINGS CHART)Can it keep going? Technically, yes. I see numbers up to $40.

However, I'm posting this because I see this idea as far more likely to occur is some form.

It looks like a potential top is about to occur.

At these levels, with momentum, a drop could take price as low as $4. If not lower, down to $2.

It's hard to be bullish on this stock with a chart like this.

In other words, I'm saying, I don't know if there is more upside, and if there is, I'm okay with missing it because I'd rather not be wrong and ultimately lose money on the downside.

Mostly a question of risk vs reward.

I would ultimately be bearish overall.

I think the pink zone might see a top and I think we could see trends break all the way down to the blue zone.

Current pattern is highlighted.

GRPN Groupon Options Ahead of EarningsIf you haven`t bought GRPN before the previous earnings:

Then analyzing the options chain and the chart patterns of GRPN Groupon prior to the earnings report this week,

I would consider purchasing the 16usd strike price Calls with

an expiration date of 2024-4-19,

for a premium of approximately $4.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GRPN on a one month breakout LONGThis is to follow up my previous idea on Groupon. On the 2H chart, price is in a one month

sustained breakout from the volume profile and into the upper VWAP band lines both anchored

for end of 2023. The faster green RSI line crossed the 50 about the same time and basically

has not looked down. The slower RSI line has slowly risen from 55 to 65. This is in the consumer

discretionary sector and hot necessarily hinged to technology stocks. I see this as rock-solid

as it gets. I will load more shares now and also load more ona dip There was a big earnings

miss in November and then Goldman Sachs raised its target from 5 to 7.5 which seems like

a big adjustment after an earnings miss. I suppose GS knows their stuff.

Groupon is pushing into earnings LONGGRPN on the 15 minute chart here with a volume profile overlaid hada high volume area

breakout from mid December to mid January but then retraced and broke down. It

consolidated for one week about the POC line gained some accumulation and then moved

back up again. It broke above the high volume area on January 25th then retested it with

a light touch on Feb 5th getting support in the rejection. The relative volume has picked

up consistent with Wychoff theory ( this is not a fakeout). I see this as an excellent long

trade through the upcomng earnings. The dual time frame RSI indicator can be useful to

gauge strength minute by minute and so pinpoint entries and exits.

GRPN 3d Chart, Q1 2024GRPN went on an incredible run to close out 2023. It's filled the October '23 gap. But, that's 3 times it's gone at the same zone and failed to go through it. All this while forming a nasty negative divergence on the RSI.

If this can hold $12 convincingly, i expect this to revisit sub-$10 come Q2.

In my opinion, this is bearish until it can claim $14.25 and hold it.

GRPN Groupon Options Ahead of EarningsAnalyzing the options chain and the chart patterns of GRPN Groupon prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2023-11-10,

for a premium of approximately $1.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

GRPN short?GRPN is quite far away from SMA 200. I can also see head and shoulders formation over here. If valid, profit target would be around 7.50 USD. This level was important in the past. At this level, closer to the SMA 200 I would buy the stock for a long term investment. So the short would kinda speculative for me, long at around 7.5 great entry for 1+ year investment.