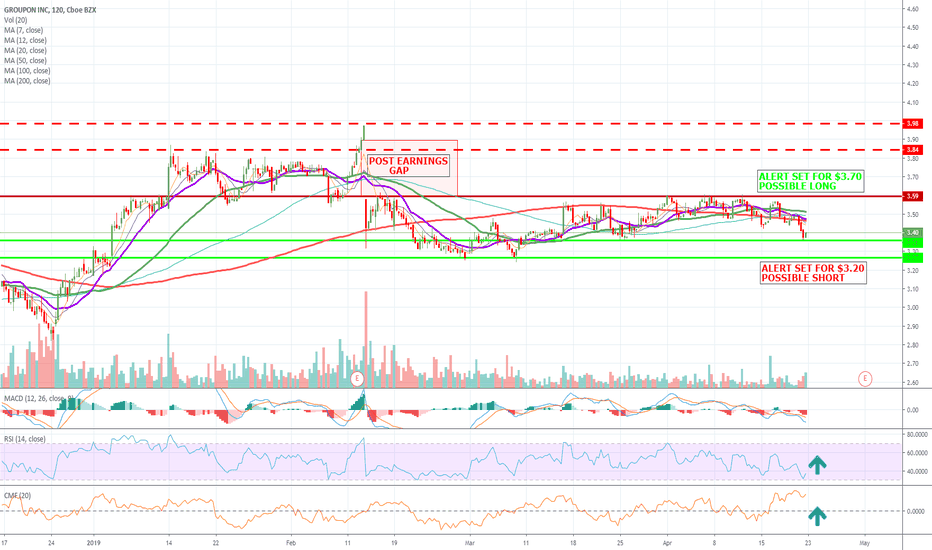

GRPN trade ideas

$GRPN Stock is well discounted, but is Groupon a bargain?This has made a few investors lose quite a few $$$$$$$. For the last three years Groupon has been trying to transform itself and in particular its financial situation. Results are due the end of April and we would suggest that it would be a pure gamble to enter this prior to those results. We will wait and see what the company have to say about the restructuring process and see if there is a light at the end of tunnel.

Groupon Daily Demand zone Groupon acts as the middleman between consumers and merchants, offering a variety of products and services at discounts via its online store. It offers consumers daily deals (in the form of online vouchers) from local merchants. Groupon also sells products directly to consumers. It generates revenue from the take rate on the purchase and/or usage of the vouchers (40% of total revenue) and from direct sales (60% of total revenue). More than 65% of Groupon's revenue comes from North America

That area is a well nested area and a cheap stock . marked where am going long with stop loss and Target profit

GROUPN GRPN price actionHello All, here’s my opinion regarding which direction the share price of Groupon (GRPN) is likely to go.

GRPN appears to be in somewhat of a sideways channel.

Within the past few weeks, the daily chart shows that the price of GRPN has “touched” the same top and bottom prices on multiple occasions without any significant breakthrough in either direction.

Unless there is a major increase in volume to the downside, I believe that there is a greater probability that GRPN will see higher stock prices based on the likeliness of a continuation move from the lows established in November and December of 2018.

For what it’s worth, GRPN shows some good fundamentals as well including the expectation of an estimated earnings beat (which we will soon find out).

That’s my 2 cents. Any feedback is welcome. Please keep it productive.

Happy trading.

Groupon (GRPN) earnings: is Vouchercloud the hope for the companGroupon reported better-than-expected first-quarter results, as last year’s restructuring is bearing fruit. While streamlining the operation is helping Groupon expand margins, the firm is continuing to increase marketing as a percentage of revenue. It has done so since 2015. Analysts speculate this is because of its lack of network effect and low switching costs, which forces Groupon to continue to increase its marketing spending.

Management upped its full-year guidance due to the strong first-quarter numbers and the accretive acquisition of Vouchercloud in April. The stock barely moved in reaction to the first-quarter numbers, which is concerning to many prospective investors.

www.finstead.com

GROUPON Short - 5.00 will take a big push to break through.5 dollar mark comes after a day of exceptional volume, approaching a descending trendline, nearing the 200 SMA and at a round number. Exhaustion will occur today - short at 5 bucks and cover at 4.5 before the bulls try again. Simple is good.

$GRPN Long - Oversold + huge buy volume + tested prev supportWent long on $GRPN 's dump today.

RSI dropped below 35 for the first time since June just before a nice run up.

Largest buy volume since fomo hit back at that same time during the increase.

Tested and found support on a previous level (green arrows).

Expecting to see a double bottom tomorrow (Thursday), after some fomo buy up occurs, before continuing north.