Robinhood, WonderFi and hidden gems with massive upside?📢 Big News: Robinhood (NASDAQ: HOOD) is Buying WonderFi for C$250 Million

Robinhood just announced it’s buying WonderFi, a major hashtag#Canadian hashtag#crypto company that owns popular platforms like hashtag#Bitbuy and hashtag#Coinsquare. The deal is worth almost C$250 million where WonderFi shareholders will get 41% more than what their shares were worth just days ago.

💥 Why This Matters:

Robinhood is going global: this move gives them a big entry into the Canadian crypto market, which already has over C$2.1 billion in assets.

More crypto tools for users: WonderFi brings advanced technology that will help Robinhood grow its crypto trading, staking, and storage services.

Stronger team: WonderFi will keep running with its current team, and they’ll now be part of Robinhood’s growing presence in Canada.

🧠 What Could Happen Next?

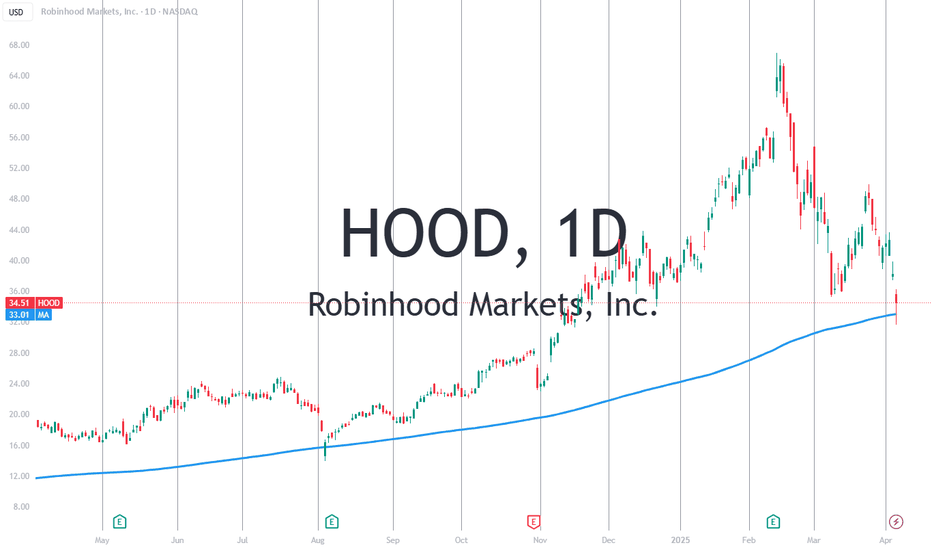

This shows Robinhood’s plan to be more than just a U.S. trading app - it wants to become a global platform for crypto and finance. If all goes well, and regulators approve the deal, it could push the stock higher. As the chart shows, the price is getting close to previous highs, and good news might send it even further.

📅 The deal should be finished by late 2025.

hashtag#Robinhood hashtag#HOOD hashtag#Crypto hashtag#WonderFi hashtag#Fintech hashtag#Investing hashtag#NASDAQ hashtag#Trading hashtag#Canada

HOOD trade ideas

Uptrend set to continueNASDAQ:HOOD Uptrend remain intact and is set to continue higher after the stock has broken out of the downtrend corrective channel/bullish flag. In this retrospect, the stock is looking at a terminal end to the corrective 3-wave move.

Long-term MACD is looking at a return of a long-term upside momentum after histogram turned positive. Stochastic oscillator confirms its oversold signal and 23-period ROC is back above the zero line. Elsewhere, volume is in a healthy expansion!

HOOD daily chart: breakout or fakeout? Key zone approaching.Robinhood's stock has formed a falling wedge pattern on the daily chart, indicating a potential bullish reversal. The price has broken above the 0.618 Fibonacci level at $44.00, suggesting further upside potential. Next targets are $48.40, $52.79, $58.22, and $67.00. RSI and MACD indicators confirm bullish momentum.

Fundamental Factors:

Robinhood continues to show revenue and profit growth, supporting positive investor sentiment. The company is expanding its services and attracting new users, strengthening its market position.

Scenarios:

Main scenario: continued rise to $48.40, then to $52.79 and higher.

Alternative scenario: pullback to $39.71 with potential decline to $36.00.

HOOD – Inverse Head & Shoulders + Ichimoku Cloud BreakoutRobinhood (HOOD) has broken out of a strong inverse head and shoulders pattern and cleared the Ichimoku Cloud, confirming a bullish trend shift. Both price structure and trend indicators support continuation.

Trade Setup:

Entry: $52.50

Stop Loss: $49

Target: $80

Risk–Reward: ~1:7.8

With volume picking up and bullish technical confluence, this breakout could trigger a move toward the $80 level — a major psychological and structural target.

#HOOD #IchimokuBreakout #InverseHeadAndShoulders #TrendReversal #BullishMomentum #SwingTrade NASDAQ:HOOD

$HOOD Weekly RecapNASDAQ:HOOD Weekly Recap

Market Structure: Price remained confined within the downtrend, failing to break out. Watching for more macro-positive catalysts that could help push it above the trendline.

Market Bias: The recent pullback aligns with broader market sentiment and may serve as a foundation for a potential move toward previous highs.

BX-Trender: The weekly BX-Trender histogram showed improvement, hinting at a possible reversal on the horizon.

HOOD Long Term Key LevelsIdentified Key Levels for HOOD for Long-term Holding

Disclaimer:

The information provided on this TradingView account is for educational and informational purposes only and should not be construed as financial advice. The content shared here reflects personal opinions and is not a recommendation to buy, sell, or hold any financial instrument. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results. We do not guarantee the accuracy, completeness, or timeliness of the information provided. Use the information at your own risk.

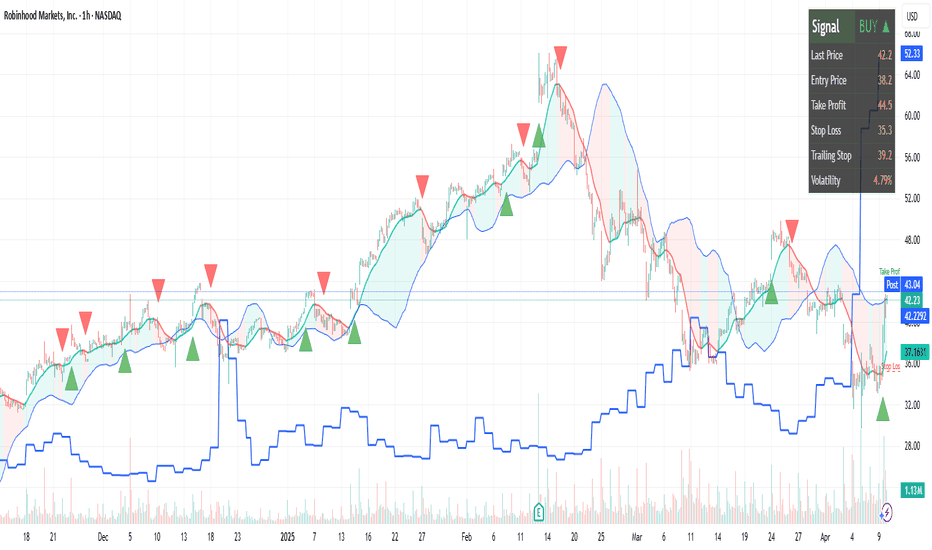

HOOD Tariff Relief dips to buy: $41.28 strong, 39.42 better longHOOD got sold in panic then bought in fomo.

We of the Fib Faith indulge in logical serenity.

We plan and execute calmly and deliberately.

$ 41.28 Bounce would be strong to target $49.16

$ 39.48 better entry with tp1=$45.44, tp2=$49.16

$ 37.12 is a must hold or else it was a bull trap.

==============================================

Bull Trap Confirmed: HOOD's Rally Faces Exhaustion Part 2Hey Traders after the success of our last month trade on Tesla hitting all targets more than 35%+

With a Similar Trade setup I bring you today the

NASDAQ:HOOD

Hey Guys sorry but i just had to Reinitiate this trade with some updates

Short opportunity on Hood

Based on Technical + Fundamental View

-Market structure

-Head and shoulder pattern

-Caught in a Bull TRAP

Pro Tip

If today's day Pinbar's low broken tomorrow we can place a trade. (Morning Trade)

Target 1 - 35.52$

Target 2 - 30.81$

Target 3 - 26.26$

Stop Loss - Above Entry Candle

For Rest of the Details follow Part 1!

NOT AN INVESTMENT ADVISE

HOOD to S&P by 2026!?!-From Meme to MajorsWhile skeptics may still associate NASDAQ:HOOD with meme-stock mania, I'm betting on the company's evolution:

Consistent revenue growth with expanding crypto + options volume

Clear move toward profitability and institutional trust

Increasing daily active users + net deposits = sticky growth

Expansion into IRAs, advisory services, and full-stack finance

Regulatory overhangs are fading — and brand loyalty among Gen Z is rising

Technically, NASDAQ:HOOD has bottomed and is building long-term support above key levels.

Fundamentally, it’s positioning to replace a legacy fintech in the S&P within 12–18 months.

This is the kind of contrarian bet that makes a career.

Watch for quarterly surprises, buybacks, and improved margins.

Target timeframe: April 2026

Thesis checkpoint: $20+ breakout in 2025

Drop your thoughts — bullish or bearish — and follow for updates.

why Robinhood’s stock ($HOOD) could be considered bullish:Analyst Upgrades : Robinhood has received positive upgrades from analysts, with a target price suggesting a significant upside. The company's growth in digital wealth management, AI-powered investing, and new banking features contributes to these bullish forecasts.

Strategic Investments : High-profile investors, such as Cathie Wood’s ARK Invest, have increased their stake in Robinhood, signaling strong confidence in its future growth potential.

Product Diversification: The company continues to expand its services, with new offerings like Robinhood Strategies, an affordable robo-advisor, which is expected to attract a broader customer base seeking wealth management solutions.

Positive Analyst Sentiment: Robinhood has an average "Buy" recommendation from analysts, reflecting general market optimism and the stock's positive outlook over the next 12 months.

Strong Earnings Growth: Robinhood's robust revenue growth rate (over 58% in the last 12 months) reflects its expanding market share and the potential for continued financial success.

Analyst Price Targets: Multiple analysts have set a price target for Robinhood with significant upside potential, indicating that there is room for further price appreciation in the coming year.

Market Positioning: Following political shifts, Robinhood's stock has benefited from increased interest in cryptocurrency trading and favorable market conditions, showing how external factors can favor its performance.

Technological Advancements: Robinhood’s investment in AI tools like Robinhood Cortex enhances its platform’s value proposition, improving user experience and engagement, which could lead to increased retention and growth.

Diversified Revenue Streams: Robinhood’s move into banking, offering high-yield savings accounts, allows the company to tap into new revenue streams, reducing its reliance on traditional brokerage commissions.

Favorable Market Sentiment: Robinhood is seen as part of a broader trend of stocks benefiting from shifts in market sentiment, particularly around the "Trump trade," showing how political and economic cycles can impact stock performance positively.

These factors together suggest a promising outlook for Robinhood’s stock, positioning it for continued growth and potential upside.

Robinhood: Turn Off the SELL Button?I don't have to remind you what Vlad and the boys did back in 2021

Crime has always been a part of Markets..I get that

Crime will ALWAYS be a part of markets as long as GREED is rewarded

But thats where Regulators are supposed to help hold the crooks accountable..right?

As we all know that has NEVER happened

Why? Because the size of fines are never large enough to truly deter..they are simply a cost of doing business

But hey...according to the crooks we see paraded across our TV screens we need LESS REGULATION anyways because you know..FREE MARKETS!..and all that stuff right

Ok cool, well then lets do the whole Free Market thing..you know the whole, "We need LESS REGULATION because Free markets will take care of Bad Businesses" thing

Well then thats fine by me...

MAJOR PUT POSITION COMING SOON..Vlad

And GME is going to provide me with the ammo..now isnt that poetic :)

Robinhood (HOOD) – Daily Chart AnalysisAs of March 25, 2025, Robinhood (NASDAQ: HOOD) is approaching a high-volume resistance level near $48.15–$48.48. Price has been rallying off a March low and is now testing key areas of confluence that could either trigger a breakout continuation or prompt a corrective move.

Technical Overview

Price Structure

Current Resistance Zone: $48.15–$48.48, aligning with the Volume Profile High.

Support Structure: Ascending trendline stretching from August 2024 lows; recent price behavior has respected this line cleanly.

Fibonacci Levels

0.5 retracement at $56.49

0.618 extension above $60

These are potential upside targets if current resistance is cleared on volume.

Momentum and Trend Indicators

RSI

The RSI indicator has turned upward and exited its prior downtrend channel.

The last three times this indicator rebounded from its lower band (circled on chart), price followed with a sustained bullish leg.

Currently printing near 54.68, suggesting renewed momentum without being overbought.

Trend

Recently flipped bullish: the green histogram has turned positive, and the wave has crossed above its signal line.

Previous flips from similar structure (highlighted by white dots and wave crossovers) have marked strong trend beginnings.

The clean separation between the wave and signal line is a confirmation of strength.

Volume

The most important tell: the recent reversal mirrors August and September 2024 setups nearly identically.

The March 10, 2025, bottom was accompanied by a smooth upward curve and bullish divergence.

The projected yellow path (shown on the chart) suggests volume support is building under price, signaling sustainable upside.

Scenario-Based Outlook

Scenario 1: Bullish Breakout

Price breaks above $48.48 with volume.

Indicators confirm momentum across all three custom tools.

Target: $56.49 (0.5 Fib), then $60.00–$62.00 (0.618 Fib + psychological level).

Scenario 2: Rejection & Pullback

Price stalls at Volume Profile High.

Pullback into trendline or full retracement toward Buy Zone ($37–$36).

Watch for renewed confluence from RSI+, WaveTrend 3D, and Volume Buoyancy for long re-entry.

Summary

Robinhood is at a critical juncture. Momentum across the RSI+, WaveTrend 3D, and Volume Buoyancy is aligned to support continuation—but the price must clear the Volume Profile High to confirm. If rejected, the trendline and deeper demand zone provide defined levels to reassess. Indicators suggest the recent bottom was a structural low with strength building beneath the surface.

This setup offers a favorable risk-reward profile in both breakout and pullback scenarios, provided the indicators continue to support momentum and volume follows through.

Bull Trap Confirmed: HOOD's 8% Rally Faces ExhaustionHey Traders after the success of our last month trade on Tesla hitting all targets more than 35%+

With a Similar Trade setup I bring you today the NASDAQ:HOOD

Short opportunity on Hood

Based on Technical + Fundamental View

-Market structure

-Head and shoulder pattern

-Currently will be trading at supply zone which was a recent support and now an ideal place for a reversal to create the right shoulder of the bigger head and shoulder pattern - Daily time frame.

1. Declining User Growth and Transaction-Based Revenue

2. Regulatory and Legal Challenges

3. Rising Costs and Profitability Pressures

4. Intense Industry Competition

5. Macroeconomic and Market Volatility

Technical View

Head and shoulder pattern - Pretty visible. Right shoulder is yet to be formed, Which makes an ideal place to SELL with a great Risk Reward ratio.

Pro Tip

Wait for a bearish candle stick pattern to execute trades on end of the day keeping stop loss somewhere above the supply zone.

Target 1 - 35.52$

Target 2 - 30.81$

Target 3 - 26.26$

Stop Loss - 44.72$

Fundamental View

1. Declining User Growth and Transaction-Based Revenue

Robinhood’s revenue model relies heavily on Payment for Order Flow (PFOF), which makes it vulnerable to fluctuations in trading activity. After a pandemic-driven surge in 2020–2021, user growth stalled, with monthly active users dropping 34% YoY to 14 million by mid-2022. Transaction revenue fell 55% in Q2 2022, and while assets under custody grew to $140 billion by Q2 2024, the platform’s dependence on volatile crypto and meme-stock trading amplified revenue instability.

2. Regulatory and Legal Challenges

The SEC’s scrutiny of PFOF and proposed trading rule changes threaten Robinhood’s core revenue source. In 2022, New York regulators fined Robinhood’s crypto unit $30 million for anti-money laundering violations. Ongoing legal risks, including backlash from the 2021 GameStop trading restrictions, have further eroded institutional trust.

3. Rising Costs and Profitability Pressures

Operating expenses surged due to aggressive marketing, technology upgrades, and compliance investments. Despite workforce reductions (23% layoffs in 2022), profitability remains strained. The company’s shift toward diversified products like retirement accounts and credit cards has yet to offset these costs.

4. Intense Industry Competition

Traditional brokers like Fidelity and Charles Schwab adopted zero-commission trading, neutralizing Robinhood’s initial edge. Newer platforms like Webull and Public.com also captured younger investors with advanced features, while Robinhood’s limited product range (e.g., lack of wealth management services) hindered retention of high-net-worth clients.

5. Macroeconomic and Market Volatility

- Interest Rate Sensitivity: As a growth stock, HOOD declined amid rising rates in 2022–2023 and broader tech-sector sell-offs.

- Recent Market Turmoil: On March 10, 2025, HOOD dropped 18% alongside crypto-linked stocks like Coinbase due to Bitcoin’s price volatility and fears of inflationary tariffs under new U.S. policies.

- Retail Investor Pullback: Reduced discretionary investing and crypto crashes (e.g., Bitcoin’s 71% plunge in 2022) dampened trading activity.

NOT AN INVESTMENT ADVISE

cup and handle pattern may be forming on the weekly chart HOOD"Potential Cup and Handle Pattern on NASDAQ:HOOD

A cup and handle pattern may be forming on the weekly chart of HOOD. The cup formation can be seen from August 2024 to February 2025, with a high point of around $55.00 and a low point of around $14.00. The handle formation started in late February 2025 and is currently ongoing.

Key levels to watch:

Resistance: $50.00

Support: $39.00

A breakout above the resistance level could confirm the pattern, potentially leading to a bullish trend. Keep a close eye on this stock! Weekly Daily and Monthly all look good.

#HOOD #cupandhandle #stockmarket #trading"