IBB trade ideas

Bullish on IBB breakoutThe 119.57 level may offer some resistance but we believe a breakout is imminent. However, we are going to pony up a little bit of premium to buy us a couple of months for the move to materialize.

The September 21 $119 strike is being offered at $3.40. This will require a nearly 3% gain at expiration to breakeven. Should the 119.57 level be bested, 126 could easily be achieved. 122.50 is needed to breakeven, 126 doubles our $3.20 investment.

NASDAQ Biotech ETF (IBB) - Bullish Breakout Options TradeOn Friday's Options Action, the crew analyzed the performance of the biotech sector. The NASDAQ Biotech ETF (IBB) that tracks the large cap names have underperformed the overall sector recently. IBB has recently formed both a long term cup & handle formation and an inverted head & shoulders, a bullish setup. Coupled the largest 5 names in this ETF reporting earnings this week, provides a potential catalyst for the ETF to break higher. Expecting IBB to breakout to the upside, Michael Khouw suggests buying a Sept 113/119/125 Call Spread Risk Reversal for a $0.70 Debit. As of Friday's close, this spread is trading at $0.65.

We've structured this trade in OptionsPlay so you can analyze and view this trade along with the supporting technical chart at your convenience.

View this OptionsPlay on IBB - app.optionsplay.com

Cost: $65

Max Reward: $535

Max Risk: $11,365

POP: 43.18%

Breakeven: $119.65

Days to Expiry: 61

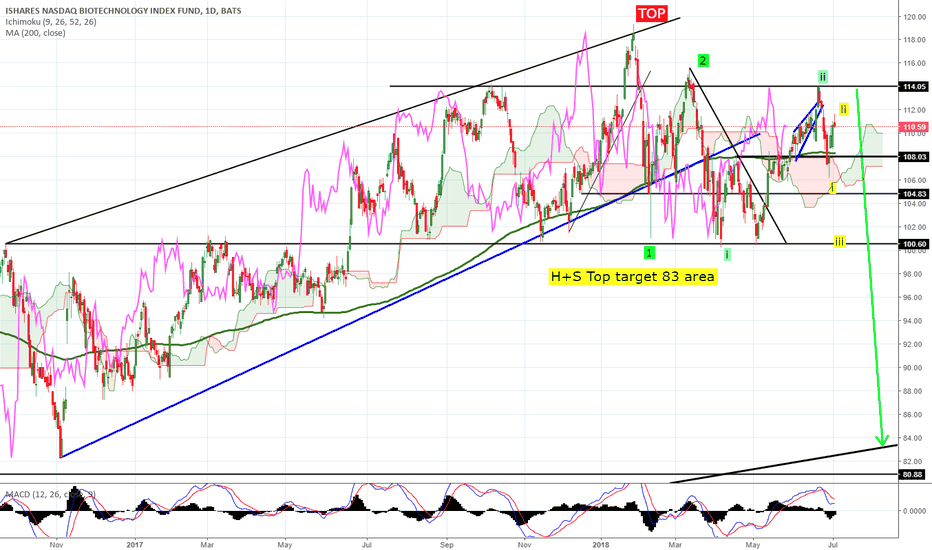

IBB short biotech going to low 80sIf this chart pattern plays out we are looking at a huge downside acceleration.

EW count is on the precipice of a third of a third of a third wave lower.

Also classic H+S top with neckline break needed for confirmation (target 83 area).

Short 110.50, stop 115.50, target sub 85 level coming weeks/months. 5/1 return/risk.

Bullish Options Action Trade for June 4th, 2018On Friday's Options Action, the crew analyzed the performance of the biotech sector. Large cap biotech stocks have underperformed small cap over the past few years and started to show signs of outperformance lately. Many of the larger cap biotech names have very cheap valuations and have bottomed over the past few weeks. Coupled with the bullish channel on IBB suggests a bounce higher to the upper trendline. Expecting IBB to trade higher, Michael Khouw suggests buying a July 103/110/117 Call Vertical Risk Reversal for a $1.25 Debit. As of Friday's close, this spread is trading at $1.60.

We've structured this trade in OptionsPlay so you can analyze and view this trade along with the supporting technical chart at your convenience.

View this OptionsPlay on IBB - app.optionsplay.com

$IBB Longer term view looks fine for now.The weekly & monthly on $IBB still looks intact to me. Since the sentiment is overly bearish I think I should think on the contrarian. Weekly and Monthly approaching this 100D SMA and it may take some time but I would keep this as a side chart or block scan alert