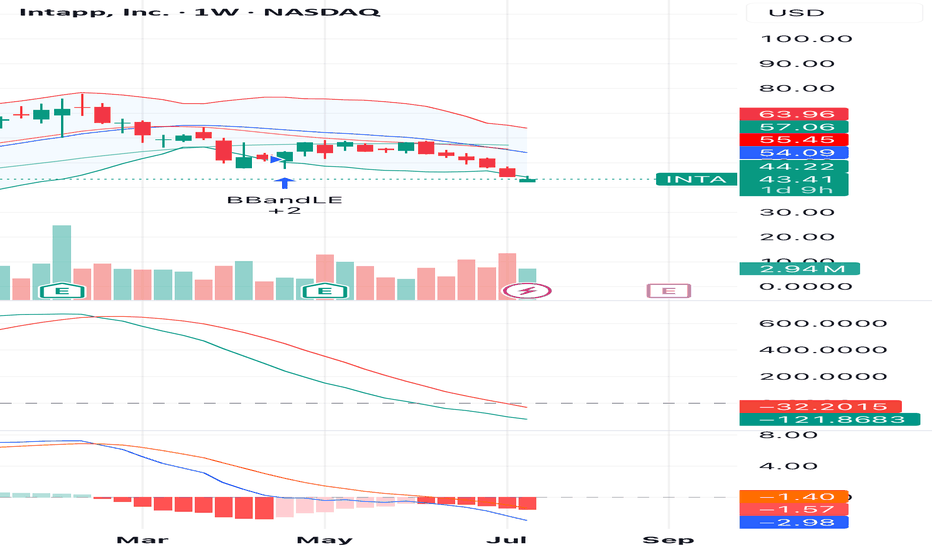

Potential Reversal for INTA – Weekly SetupINTA is showing signs of a potential reversal after a consistent downtrend. On the weekly chart, the price touched the lower Bollinger Band with increased buying volume and a bullish candle forming. This may signal the end of the selling pressure.

Momentum indicators such as MACD and KST are flattening, suggesting a possible shift in momentum. A break above $44.22 could confirm a short-term bounce.

📈 Entry Zone: $43.00 – $44.50

🎯 Target 1: $54.00

🎯 Target 2: $57.00

🛑 Stop Loss: Below $41.00

This idea is based on technical signals; monitor volume and market conditions closely.

INTA trade ideas

11/4/24 - $inta - Pass at $50, R/R unclear11/4/24 :: VROCKSTAR :: NASDAQ:INTA

Pass at $50, R/R unclear

- nothing i'd fade, growing flexing gross profit vs opex

- also tech B2B have put up good reactions to results all else equal so far this 3Q

- but stonk has gone from low 30s where I punted last Q to ~almost~ doubling. obvioulsy i traded out of this and recycled capital etc. etc. not surprised it kept riding, but so high? a bit surprised.

- don't love fact that stock comp remains high amt of "FCF" though again for stonks that go up, it's less an issue. nonetheless, it's still not real cash earned IMVVHO

- also adjusting for this SBC, PE of near 80x next year and 60x the following remains high.

- i'd rather watch this pitch go by

- a lot of names reporting (and i mean A LOT) this week in perhaps one of the funkiest risk weeks (team blueberry vs. team raspberry gonna have a jam fest). see no reason to punt at these levels, that's all.

- gl to all.

V

Intapp (INTA) AnalysisCompany Overview: Intapp NASDAQ:INTA is making strides in AI-powered solutions, with its partnership with Monarch acting as a key driver for improving operational efficiency and broadening its market reach. CEO John Hall has been vocal about the transformative role of AI in the company's strategy, positioning fiscal 2024 as a year of strong AI adoption. This could open up new avenues for growth, particularly in sectors that prioritize technological advancements in workflow and decision-making processes.

Key Catalysts:

Revenue Growth: In Q2, Intapp reported $114 million in revenue, reflecting a 21% year-over-year increase, which outperformed expectations and underscored the company’s solid growth momentum.

AI Integration: The strategic focus on AI development and partnerships, like the one with Monarch, is expected to enhance efficiency and drive client demand, particularly as AI becomes more ingrained in professional services and consulting sectors.

Market Expansion: Intapp’s ability to grow its market presence through AI innovations and its tailored solutions for sectors like legal, accounting, and financial services strengthens its competitive edge.

Investment Outlook: Bullish Outlook: We are bullish on INTA above $40.00-$41.00, viewing the stock as well-positioned for long-term growth, particularly as AI adoption increases across industries. Upside Potential: The upside target for INTA is set at $62.00-$63.00, supported by strong revenue growth and strategic initiatives in AI.

💡 INTA—Empowering the Future of Professional Services Through AI. #AIInnovation #RevenueGrowth #TechLeadership

8/13/24 - $inta - Long into print $338/13/24 :: VROCKASTAR :: MYX:INTA

Long into print $33

- 5x sales for >20% cagr growth

- great software margins/ profitable flexing

- negative: ALL of these co's seem to be indicating a weaker 3Q which has me probably keeping this size more of a sport (25 bps) than anything i'd go large/ size up.

- i'd want to dip buy if the result is "horrendous" or the guide spooks the mkt, bc it seems like the product/ traction and financials continue to remain healthy

- am i missing anything?

V

INTA Entry, Volume, Target, Stop, RiskEntry: when price clears 47.05

Volume: with daily volume greater than 233k

Target: 56 area

Stop: Depending on your risk tolerance; 44.07 gets you 3/1 Risk/Reward.

Risk: Low Volume Stock easily manipulated

This swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not take this trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.

Intapp INTA Cloud Software Services Tech LONG As can be seen on the 2H Chart INTA is on pacing over a 350% annualized gain

without any major pivots. The volume indicator shows a dramatic increase

in volume realtive to the year prior. INTA is capturing alpha consistently

in a hypergrowth mode as can be seen by reviewing the earnings beats quarter

after quarter. This is clear and obvious entry with earnings coming on

May 8th. I originally bought options last summer after the double bottom

and have added a couple of weeks before each earnings .

Price recently bounced down 10% from minor resistance representing

a small pullback with space above in the runup for the earnings report.

I see a potential return of 15% in 10 trading days or less and

75-100% for call options with expiration of 5/19/23 in consideration

of the pullback described above and shown on the chart