At it again INTC - LONGGood Morning,

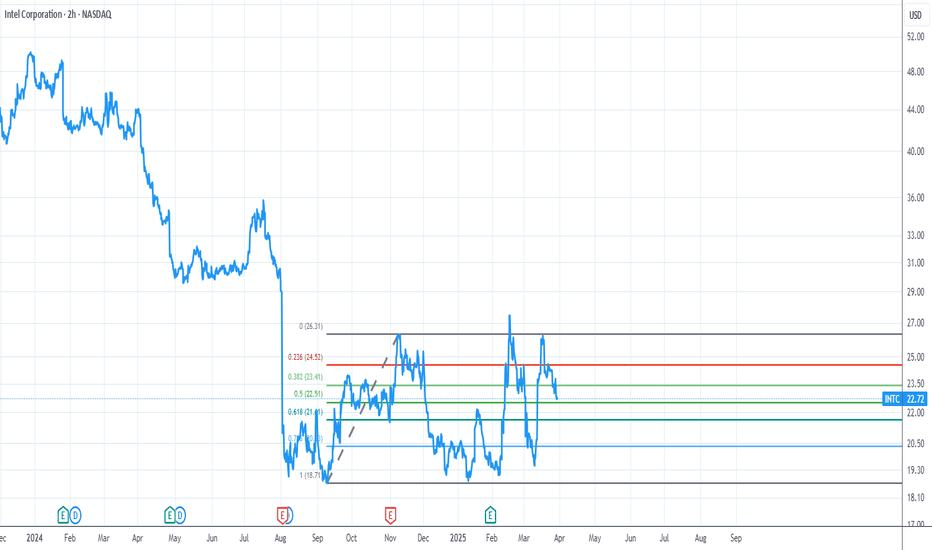

INTC what a fun trade, I have ran 3 profitable runs since December with INTC.

Investors do not seem to want to let go of the 19$ support zone. This is a great sign and as you can see from the many many bottoms, it wants to start moving up again.

Volume is still bearish......however showing bullish divergence since December. This continuous squeeze is building momentum for a nice movement upwards.

As always with SWING trading, aim small miss small.

Enjoy

INTC trade ideas

Intel - This Stock Is A Goldmine!Intel ( NASDAQ:INTC ) perfectly respects all structure:

Click chart above to see the detailed analysis👆🏻

Over the past couple of years Intel clearly established a significant downtrend, dropping about -70% after we saw the previous all time high. This bearish pressure is now ending though and if Intel manages to create a bullish reversal break and retest, a new uptrend is starting to form.

Levels to watch: $25

Keep your long term vision,

Philip (BasicTrading)

Intel Next Scenario MoveIt obvious the stock Rejected at 4h Red Zone which act as Strong Resistance that Intel cant go above despite recent good news.

we have three scenarios:

for sure all require patient the stock at current price may go anywhere its gambling rather than trading at this price.

Scenario One: the stock price go above 4h Red Zone which act as strong resistance, after re-test the zone its "buy signal after confirmation".

Scenarios Two: the stock will re-test the nearest support level at the Previous High (P. High)

@ 22.40$ roughly at this price we wait for "buy signal after confirmation".

Scenario Three: Re-Test the Institutional Candle price level at 19.80$ since the stock is side-ways movement and still not breaking this forever zone this option is highly valid !

Note: "buy signal after confirmation" Means that:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

Long Intel Corporation (INTC) – Long-Term Investment ThesisAs of April 2025, Intel (INTC) is trading around $22, revisiting a long-term multi-decade support zone between $15–$23, last tested during the 2008 financial crisis and early 2010s consolidation.

The chart reflects:

A historic resistance zone from the early 2000s that turned into strong support over the past 15+ years.

Current price action suggests long-term accumulation near a high-probability reversal area.

Technically, Intel is trading at a major cyclical low — a zone that historically preceded extended bull runs.

Why I’m Going Long Intel

Undervalued Levels: Intel has retraced significantly from its 2021 highs (~$68), now trading at nearly 1/3 of its peak, offering attractive value relative to fundamentals and peers.

Strong Historical Support: Price is sitting within a key demand zone not seen since the early 2010s, indicating strong institutional interest in this range.

Long-Term Recovery Potential: With ongoing investments in foundry services, AI chips, and strategic partnerships, Intel is positioning for a turnaround.

Asymmetric Risk/Reward: Limited downside (support holds) versus massive upside if Intel regains relevance in the AI and semiconductor race.

Investment Outlook

This is a long-term hold based on:

Technical conviction from historical support zones.

Belief in Intel’s fundamental turnaround story.

The stock’s undervalued nature relative to industry leaders like Nvidia and AMD.

Intel Golden TimeFundamental and Technical Analysis of Intel (INTC) Stock

Fundamental Analysis

1. Financial Performance: Intel is one of the largest semiconductor manufacturers in the world. However, in recent years, it has faced challenges, including a loss of market share to competitors like AMD and NVIDIA.

2. Industry Outlook: The semiconductor industry continues to grow, but Intel has lagged behind in advanced chip manufacturing, particularly in comparison to TSMC and Samsung in the 3nm segment.

3. Profitability & Revenue: Intel’s revenues have been volatile, and profit margins have been under pressure. Its large investments in manufacturing plants may lead to long-term profitability.

4. Macroeconomic Factors: A slowdown in the tech industry, reduced global demand for personal computers, and rising interest rates could impact Intel’s performance.

Technical Analysis

1. Support and Resistance Levels:

Key Support: Around $22, which is close to the current price level.

Key Resistance: In the $30-$35 range if the price starts to recover.

2. Overall Trend:

The stock has been in a downtrend, having dropped significantly from its all-time high of around $70.

The $22 level appears to be a strong historical support.

3. Indicators:

The RSI is likely in the oversold zone, indicating a possible reversal.

Moving averages probably confirm a bearish trend.

Conclusion

Fundamentally, Intel is in a rebuilding phase, but it still faces stiff competition from AMD and NVIDIA.

Technically, the stock is near a critical support level, meaning a rebound is possible, though the overall trend remains bearish.

For long-term investors, further analysis of Intel’s fundamentals is necessary. For short-term traders, confirmation of a price reversal at this support level is crucial before entering a trade.

Great Uncertainty with a Dramatic Twist: Intel’s Recent ShakeupIn a surprising move last December, Intel CEO Pat Gelsinger abruptly stepped down following a tense board meeting that revealed growing dissatisfaction with his turnaround strategy. The sudden exit—on a quiet Sunday—left the tech world stunned and set off a chain of dramatic leadership changes.

To stabilize the company, Intel temporarily appointed CFO David Zinsner and Executive VP Michelle Johnston Holthaus as interim co-CEOs. But the real twist came in March 2025, when the company announced the return of Lip-Bu Tan as the new CEO—a figure whose reappearance adds serious dramatic flair to the story.

Tan had previously resigned from Intel’s board in August 2024, seemingly stepping away from the company for good. His unexpected return just months later, this time as CEO, feels like a corporate plotline worthy of an Emmy—or even an Oscar—nomination. Adding intrigue, Tan had reportedly clashed with Gelsinger on Intel’s direction, making his comeback a powerful statement about the board’s new vision.

Meanwhile, both Gelsinger and Zinsner were named in a shareholder lawsuit filed in August 2024, alleging securities fraud tied to concealed operational setbacks. The case, however, was dismissed in March 2025 after a judge ruled there wasn’t enough evidence to prove the company misled investors.

But beyond the boardroom drama lies a more sobering concern: Intel’s financial health. To me, the situation increasingly mirrors that of Lehman Brothers before its collapse—over-leveraged, burdened by mounting obligations, and heading straight into intensifying macroeconomic and sector-specific headwinds. The semiconductor industry is cyclical, and as the winds shift, Intel may simply not be financially equipped to weather the storm.

Unless it secures a major loan or receives a government bailout, I believe Intel’s stock is significantly overvalued at its current price of $22. Based on its deteriorating fundamentals, market sentiment, and leverage risk, a fairer valuation could be as low as $2 per share. Ironically, that $2 level roughly aligns with a 30x price-to-earnings ratio—where many mature tech companies are trading—if one accounts for where Intel’s true earnings power might settle after the dust clears.

My Fibonacci levels also suggest a sharp dip toward $12 in the near term. And even if Intel does hit that level, I suspect it may only be a dead cat bounce—temporary relief before a deeper plunge.

With leadership drama, legal clouds, and financial fragility all colliding, Intel isn’t just facing a tough quarter—it’s staring down a full-blown existential crisis.

INTC Intel Price Target by Year-EndIntel Corporation (INTC) has been trading near a key technical support level, forming a triple bottom on the chart—a bullish reversal pattern that suggests a potential upside move. The stock currently trades with a forward price-to-earnings (P/E) ratio of 20.44, which reflects moderate valuation levels compared to industry peers.

Intel’s turnaround strategy, focused on rebuilding its foundry business and strengthening its position in the AI and data center markets, is starting to show signs of progress. The company’s push into advanced chip manufacturing and strategic partnerships with major tech firms have positioned it for improved revenue growth in the coming quarters.

Technically, the triple bottom pattern indicates strong buying interest at current levels, reinforcing the case for a potential breakout. Combined with the improving outlook for chip demand and Intel’s strategic shift toward AI, a price target of $28 by the end of the year appears achievable. This would represent approximately 15% upside from current levels.

Investors should monitor Intel’s progress in its foundry business and AI initiatives, as any positive developments in these areas could accelerate momentum toward the $28 target.

my favorite setup for next week!INTC looks ready for a explosive move higher in my opinion, nice consolidation after trend resistance from 2023 broke.. building support for its next move higher, push into 28-31 targets is possible short term in my opinion, if it can break that pivot level then 37-41 targets should follow 🎯

this may be my last chart of the week, if it is I hope you all had a profitable week 🤑 and i hope you have a great weekend. see you soon ✌️

INTEL CORPHI GUYS the pic above illustrates weekly path, continuation weekly sells to a false break.

The second pic illustrates daily structure to sells to clear tripple bottom weekly then we will see bulls again next month.

we are currently looking for sells on daily chart to h4,h2,h1 entries on candle close

INTC 20 Mar 2025 Analysis

INTC remains in a 158-day trading range (yellow box).

Attempt to breakout above the trading range on 18-Feb lacked follow-through buying and failed.

The recent strong move up to the March 18 high looks like a Buy Vacuum and bull leg within a trading range.

To see the definition of a Buy Vacuum, see the comment section on the tagged related post on the 20 Mar SPX analysis.

For now, because the market remains in a trading range, traders will BLSH (Buy Low, Sell High).

That means buying from around the lower third and selling in the upper third of the trading range.

Traders will continue to do this until there is a breakout from either direction with follow-through buying/selling.

Is INTC in a Wyckoff Distrubution?Serious question. Asking traders in the community that are more students of the methodology than myself.

I keep a casual eye on NASDAQ:INTC and have since the big drop last August that took it to juicy decadal lows. That alone had me interested in picking it up. Smarter minds than myself that follow chipmakers more closely have educated me to the fact that chipmakers operate in multi-year cycles of Research and Development to Market. The stock was never "dead" and likely a bargain. I have just been searching for a price action thesis to give me a risk framework for taking and holding the trade.

INTEL Bullish Reversal and Continuation NASDAQ:INTC is showing a strong rebound from a well-established support zone, as indicated by multiple price bounces.

Currently, the stock is testing a downward trendline resistance and is attempting to stay above the 200-day SMA, signaling a bullish trend shift. It might be time for Intel to fill that gap!

In my eyes, there are two options: A confirmed close above $26.2 could indicate further upside potential, with buyers gaining control. Volume has increased, suggesting growing bullish momentum. However, failure to break resistance could lead to another pullback first towards the 200 SMA and, if failed again, back to the lower demand zone.

Watch closely for this breakout confirmation in order for us to continue higher with a target of $30.

Intel seems to be a rudderless ship

30% uplift for a CEO change... that says quite a lot. What I think most people are missing is that for changing course of a semiconductor design, it takes at a minimum of 4-5 years. To catch up with someone that's already ahead (AMD), it takes around 6 to 10 years. AMD was playing catch-up with Intel for about 10 years (remember AMD Bulldozer?)

Ever since the Core/Core 2 architecture was launched, back in 2006, Intel has dominated the market - that was up until around 2018, when AMD further improved on their Ryzen architecture. It took ~12 years for AMD to get "back in the game". Lisa Su worked wonders with AMD since 2012, became CEO in 2014, and finally managed to usurp intel through an innovative new design, chiplets.

You want to know the biggest reason why Lisa Su has been so successful? Firstly, she is an Engineer, she designs solutions to problems. I have the utmost respect for her, and I thank her tremendously for bringing back competition to the industry. But one major contributor was the fact that Intel was resting on its laurels, they did not truly innovate. Ever since about ~2013, when they launched the ~i7-2600k (which powered my PC for almost 8 good years), all their future CPU's were very marginal iterations, ~5% uplift in performance from a generation to the next is a joke, especially considering the increased power consumption. I remember there were two generations where Intel intentionally sabotaged their own CPU's by replacing the soldered thermal interface with thermal pads, just to decrease heat transfer, and create a fictitious worse product, so they could have a better one released next year (having again soldered thermal interface). Yep, people were "delidding" their CPU, getting 20-30 degrees lower temperatures, because the "engineers" at intel wanted to either save a few cents, or most likely they wanted to release the next generation of CPU's without putting in any real work for improvement. Why do I think this is the case? Because intel was lead by bean-counters.

2005 to 2012, Intel was led by Paul Otellini, a person who had over 30 years of experience at the company. The development of the Pentium can be attributed to him (prior to becoming CEO), and during his tenure, Intel market share went from ~50% to 75% (as per cpubenchmark, though I really doubt it was below 90% at that time).

2012 to 2018, Brian Krzanich, the sunset starts, practically no innovation, one generation to the next are just incremental improvements.

2018 to 2021, Bob Swan, the then CFO took over as CEO, no comment.

2021 to 2025, Pat Gelsinger, an engineer, the lead architect of the 486 CPU took over. He had very good ideas, but in my opinion not enough time to implement them.

Now Intel has a new CEO, mainly knowledgeable in software, not in hardware. I guess only time will tell, but honestly, I think if Pat had a few more years, he could have pointed the ship in the right direction. As it stands, I do not have high hopes for Intel. My prediction is a drop to 15 by the end of the year. AMD doesn't rest on its laurels, Intel needs some innovation, and innovation takes time.

Anyway, all the above are my own thoughts, and I wrote them down for entertainment purposes only. Please perform your own research before opening any positions.

Intel (INTC) Shares Surge by Approximately 14%Intel (INTC) Shares Surge by Approximately 14%

As shown in the Intel (INTC) stock chart:

→ Trading opened yesterday with a strong bullish gap.

→ By the end of the session, shares had risen by approximately 14% compared to the previous day's closing price.

According to Dow Jones Market Data, INTC shares recorded their largest percentage gain since 13 March 2020, making them the top-performing stock in the S&P 500 index (US SPX 500 mini on FXOpen) on Thursday.

Why Did Intel (INTC) Shares Rise?

The surge followed the company's announcement of a new CEO appointment. Lip-Bu Tan, a former board member, has been named the new Chief Executive Officer, set to assume the role on 18 March. Investors reacted positively to the decision, as Tan previously achieved significant success as CEO of Cadence Design Systems.

As the Wall Street Journal put it:

"Lip-Bu Tan is Intel’s best hope for a turnaround—if Intel can be fixed at all."

Technical Analysis of Intel (INTC) Stock

In our previous analysis of INTC price movements, we identified an upward channel (marked in blue), which remains relevant.

The current bullish momentum may lead to a breakout above the long-term downward trendline (marked in red). If this happens, it could pave the way for a move towards the psychological level of $30, which served as support last year.

Intel (INTC) Stock Price Forecasts

"We really like the new CEO appointment," wrote BofA Securities analyst Vivek Arya in a note, upgrading Intel’s rating from "Underperform" to "Neutral" and raising the target price from $19 to $25.

According to TipRanks:

→ Only 1 out of 23 analysts surveyed recommends buying INTC shares.

→ The average 12-month target price for INTC is $23.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

INTC LONGIt seems to me that we are in a nice accumulation area for INTC with more positive news coming out from the company and large volumes around $20 level. The biggest scare seems to be current market volatility but so far the stock was unfazed. I'd say this is a good spot to buy for anyone interested in this company.