IREN Cup & Handle Breakout New Wedge Structure in PlayIREN confirms a classic Cup and Handle breakout above neckline, now transitioning into an ascending broadening wedge. Price is pulling back into the buy-back zone, offering a fresh opportunity to ride the next leg up.

Targets stretch from $40 to $63, as shown on the chart. RSI supports the move, and the overall structure remains bullish. Watch for reaction within the wedge for the next impulse.

📝 Share your thoughts

IREN trade ideas

Strong Fundamentals, Stretched ValuationThe Bull Case - Operational Excellence:

IREN delivered another impressive month with record monthly revenue of $86m, record 728 BTC (#1 among Bitcoin miners and surpassed Mara, Cleanspark, Cango, Riot, and BitFuFu) and record hardware profits of $66m in July IREN July 2025 Monthly Update. The company's operational metrics are genuinely strong:

Mining Efficiency: 45.4 EH/s average operating hashrate with best-in-class efficiency (15 J/TH) and healthy 76% hardware profit margin

AI Pivot Execution: Successfully expanding beyond Bitcoin with 2.4k NVIDIA B200/B300 GPUs and 98% hardware profit margin on AI services

Infrastructure Scale: Massive pipeline with 1,400MW Sweetwater 1 and additional 600MW Sweetwater 2 projects

The Valuation Concern:

However, the market appears to have gotten ahead of itself. IREN is trading at $18.32 with a 52-week range of $5.13 to $21.54, representing a ~257% gain from its lows. Current analyst consensus shows mixed signals - while 12 analysts give it a Buy rating with an $17.78 price target, this suggests minimal upside at current levels.

Key Risk Factors:

Bitcoin Dependency: Despite AI diversification, Bitcoin still drives 97% of revenue (~$83.6M vs $2.3M AI)

Execution Risk: Aggressive expansion timeline with April 2026 energization for Sweetwater 1 creates delivery pressure

Capital Intensity: Massive CapEx requirements for 2GW+ of planned capacity in a rising rate environment

IREN is operationally executing exceptionally well, but the stock price already reflects much of this success. The 320%+ rally from 2024 lows has created a situation where even strong execution may not drive meaningful returns from current levels. The company's transformation into a diversified digital infrastructure play is promising, but investors are paying a premium multiple for what remains largely a Bitcoin mining operation.

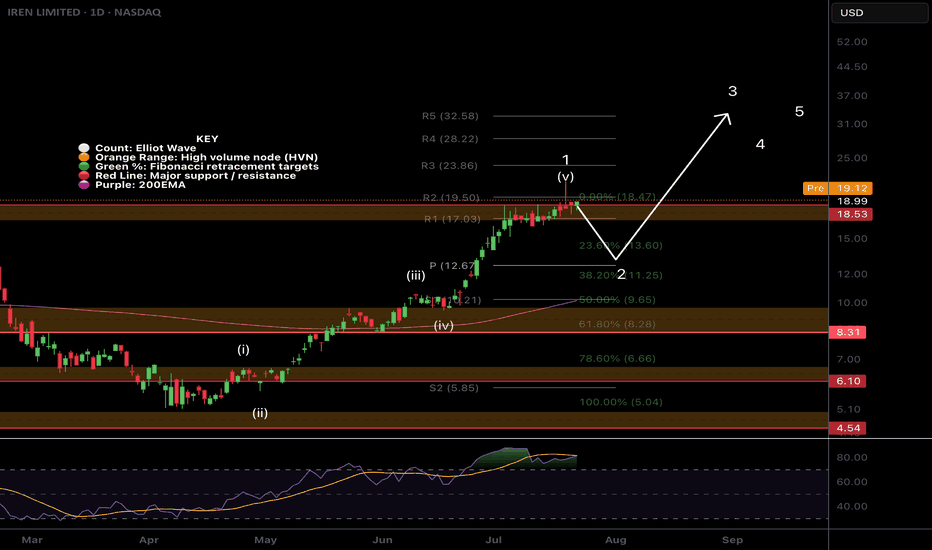

$IREN More downside after huge rally!NASDAQ:IREN is printing bearish divergence on the daily RSI at all tie high resistance.

An Elliot wave motif wave appears complete and wave looks underway with a shallow target of the daily pivot, 0.382 Fibonacci retracement and ascending daily 200EMA.

The daily red wick after printing a 20% start to the day is reminiscent of a blow off top in this asset trapping newbs with FOMO price discovery pump. Market behaviour in action!

Analysis is invalidated if price returns to all time high.

Safe trading

Market Update - 7/20/2025• Start of July was horrible, gave back all progress of the last 4-5 months, but then I made it back in the last week

• This was completely contrary to what the general indexes were doing so this made me realize that I should always prioritize my account feedback, rather than the general market for risk management decisions

• Crypto, quantum computing, aerospace & defense names are still leading

$IREN Killing It. More Upside?NASDAQ:IREN has poked above the true all time high range (Launch price dump excluded) in a high degree Elliot wave 3

Long term target remains the R5 weekly pivot at $40 but may over extend with a bullish Bitcoin and Macro economic tailwind, coupled with AI growth.

Many thought this was a greedy target at $5 but now that price is $16 it doesn't look so bad. You have to know when to let the runners run, that is were the big bucks are trading!

Any retracement of a decent degree should expect to find support at the weekly pivot $9.4 before continuing upwards and may present an excellent buying opportunity! I will be posting the signal levels on Substack.

As always ,all time high range will be the next support if price continues upwards from here.

Safe trading

$IREN Killing It. More Upside?NASDAQ:IREN has poked above the true all time high range (Launch price dump excluded) in a high degree Elliot wave 3

Long term target remains the R5 weekly pivot at $40 but may over extend with a bullish Bitcoin and Macro economic tailwind, coupled with AI growth.

Many thought this was a greedy target at $5 but now that price is $16 it doesn't look so bad. You have to know when to let the runners run, that is were the big bucks are trading!

Any retracement of a decent degree should expect to find support at the weekly pivot $9.4 before continuing upwards and may present an excellent buying opportunity! I will be posting the signal levels on Substack.

As always ,all time high range will be the next support if price continues upwards from here.

Safe trading

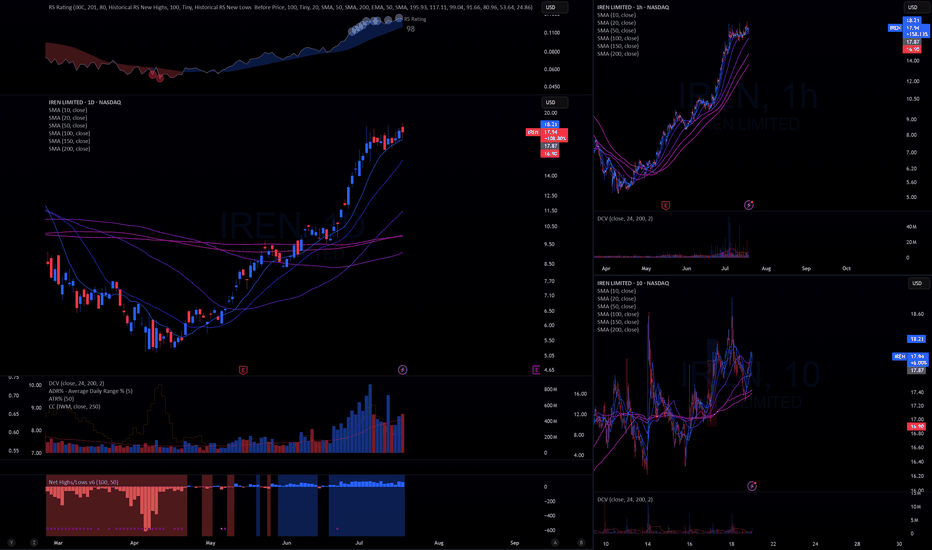

$IREN Long Setup – Ichimoku Cloud Breakout with MACD Momentum IREN is setting up for a strong long opportunity on the daily chart, showing clear bullish structure and momentum. Price has broken above the Ichimoku Cloud with confirmation from both Tenkan-sen and Kijun-sen alignment, and the future cloud remains bullish. This breakout has held for several weeks now, with consistent higher highs and higher lows forming since the April bottom. The MACD is also supporting the move, with both the MACD line and histogram in bullish territory and no immediate signs of bearish divergence. The setup presents a clean risk/reward profile: entry at $10.67, stop at $9.09 just below recent support and Tenkan-sen, and a target at $16.25, which aligns with the R2.5 pivot zone and historical resistance from mid-2023. That’s a risk/reward ratio of 3.53. Volume has been steadily building on up days, suggesting institutional accumulation. If price breaks and holds above the $11.25 pivot (R1), expect continuation toward the next resistance levels at $16.25 and potentially $19+. I’m viewing this as a 2–6 week swing trade based on the daily chart structure and overall trend.

$IREN Weekly Bb expansion + SMA bullish alignmentNASDAQ:IREN Weekly bollingers have only looked this sharply expansionary a couple times in history.

Weekly SMA total bullish alignment has likewise also happened a couple times in its history.

But this time the bullish cross confluence will happen from much higher levels with a much stronger fundamental position from an execution risk and near term catalyst standpoint.

IREN 09/06/2025Analysis HTF - Daily

execution LTF - 4H

Candle pattern - Bullish engulfing

Acceleration - Check

Volume - Check

Structure - lacking

Moving average - Check

Base rate - 70%(to hit stop loss)/30% To succeed

With the acceleration, volume pattern, and the break of the daily MA, I suggest a base rate of 60%/40%

IRENs Incredible Surge Continue next wWeek?NASDAQ:IREN has been on a rampage since the April surging 175% and nearing all time high! A great couple of trades for us so far!

Price is likely to hit all time high next week with such a strong trend, where resistance and a pullback is a high probability.

The weekly pivot is $9.77, the most likely area for price to find support just above the 0.382 Fibonacci retracement (which will be dragged up to the weekly pivot once a new high is made).

Price discovery terminal target are the R3 & R5 weekly pivot points at $28 and $40.

Safe trading

IREN has a couple resistances but will break through by the EOY

Support looks great and institutional buy will commence tomorrow pushing the stock higher. We will see higher prices as institutions look to sell at a higher price to retail in the future. Also AI is here to stay and they'll only make more money from GPU hosting and expansions.

Iren June PlayHad a good run up close to 10, healthy pullback especially given market conditions. Lots of instutional buyers bought at these prices and under. Classic structure shift into a sweep. Should be over 10 EOD Tuesday.

Extremely bullish crypto over a holiday weekend as well.

Not sure why bears so concerned about a 1-2% dilution. It's not all at once either.

A close below 8.7 would temporarily invalidate this entry.

Im 5k deep in calls since $6.8

Up quite a bit and rolled over to some deeper OTM contracts.

See you all at 15.

$IREN has the lowest all-in cost of mining a single coinNASDAQ:IREN is mining a single bitcoin at $40,000 all-in costs. When bitcoin appreciates to $150-200k, the miners with their rigs, land, infrastructure, balance sheet, hardware etc will be repriced higher. Thats the gain I would like to capture with this entry here at $9 a share.

This phenomenon will be seen throughout the entire sector, all miners will appreciate from here.

IREN Bullish Opportunity – Fresh Momentum from Demand Zone IREN Limited (IREN) recently pulled back into a key demand area between $6.20–6.80 and is now showing early signs of a bullish reversal, supported by rising momentum and renewed interest in the company’s AI and infrastructure expansion.

🔍 Technical Highlights:

✅ Rejection from major demand zone

✅ MACD bullish cross with building momentum

✅ RSI recovering from oversold levels

✅ Clean reclaim of the 9 EMA

✅ Higher low structure forming after extended downtrend

✅ Strength aligning with improving sentiment around AI-linked stocks

📈 Trade Setup:

🟢 Entry Zone: Current levels ($7.20–7.50)

🔴 Stop Loss: Below $6.10 (beneath the demand zone)

✅ TP1: $8.20 – first resistance

✅ TP2: $9.50 – breakout level

✅ TP3: $11.80 – previous swing high from December

📌 I’m personally in this trade with small capital and managing risk carefully due to its higher volatility.

This is a speculative but technically clean setup with solid upside potential if momentum holds.

Let’s see how it plays out!

Estimating IREN Share Dilution Using IREN/WGMI RatioLet's talk $IREN. It is the most efficient CRYPTOCAP:BTC miner of them all, but the dilution can get tricky at times.

One great way to try and get a handle on the offerings and potential dilution is to compare IREN's performance with that of the bitcoin miner ETF, $WGMI. If we see relative weakness in IREN in comparison to WGMI, we can conclude that it is most likely due to dilution. This would be even more conclusive if the dilution occurs close to the effective date of the offering.

So, what is the effective date? First, a company must register their offering with the SEC. However, they must wait for approval from the SEC prior to selling shares. The date they can start selling shares once approved is the effective date.

We can combine the Trading view "IREN/WGMI" chart with effective offering dates to figure out potential windows of dilution.

Important shelf offering dates and dollar amounts:

Registered: September 13, 2023

Effective: September 22, 2023 – $500 million

Registered: May 15, 2024

Effective: May 28, 2024 – $500 million

Registered: January 21, 2025

Effective: January 28, 2025 – $1 billion

Remember: When IREN's relative strength is weak in comparison to WGMI for a few weeks, it is relatively safe to assume that some dilution is happening.

The graph below (each candle on the graph represents one week) shows that the first major shelf offering effective date was September 22, 2023, followed by three periods of relative weakness.

We had similar periods of relative weakness following the second major shelf offering effective date of May 28, 2024.

After the most recent filing of a $1 billion dollar offering, and an effective date of January 28, 2025, we have experienced a window of weakness. We will likely get more windows of weakness ahead for IREN.

However, with that said, I believe this company has a bright future ahead. Keep an eye on this one.

IREN: Strong Growth, AI Expansion & Massive UpsideIREN ( NASDAQ:IREN ) just reported Q2 FY2025 earnings, showing huge revenue and profit growth:

Revenue doubled QoQ to $119.6M (vs. $54.4M in Q1).

Adjusted EBITDA jumped to $62.6M (vs. $2.6M in Q1).

Net profit of $18.9M, recovering from a $51.7M loss in Q1.

Bitcoin mining remains IREN’s core revenue driver, with 1,347 BTC mined (+65% QoQ) and mining revenue up 129% to $113.5M. Meanwhile, AI cloud revenue dipped slightly to $2.7M.

Financially, IREN is in a strong position with $427.3M in cash, lower electricity costs per BTC ($21,418 vs. $35,359 in Q1), and total assets growing to $1.85B. The company also raised $440M via convertible notes at 3.25% interest to fund expansion.

The AI & Compute Opportunity

Beyond Bitcoin, IREN is aggressively expanding into AI and high-performance computing (HPC) with its Texas hyperscale data centers:

Childress (750MW): New 75MW liquid-cooled AI/HPC data center in development.

Sweetwater (1.4GW): Expanding to 2GW total with the Sweetwater 2 project (600MW).

Mining capacity increased 50% to 31 EH/s and is on track for 52 EH/s by 2025.

Massive Valuation Gap

Despite strong growth, IREN trades at a low multiple (~4.6x 2024 EBITDA), which could drop to ~2.5-4x as Texas sites go live in 2025/26.

Sweetwater alone is projected to generate SEED_TVCODER77_ETHBTCDATA:2B + in annual free cash flow—more than IREN’s entire current market cap ($2.3B).

Applying standard data center multiples, IREN’s enterprise value could reach $20-40B—10-20x its current price, excluding the several billion in value from its Bitcoin business.

Bottom Line

IREN is rapidly transitioning from a Bitcoin miner to a major AI and HPC data center operator. With AI compute in high demand and limited supply, IREN’s undervalued stock could have massive upside. 🚀

IREN: Breaking the Chains and Ready to Run!IREN Limited (IREN) is setting up for a potential breakout, with the price holding above key support at $11.80 and strong bullish signals on both the daily and hourly charts. Bollinger Bands are tightening on the daily, hinting at an explosive move, while volume spikes and EMA alignment on the hourly suggest upward momentum. Watch for a breakout above $12, with targets at $12.38 and $13.50.