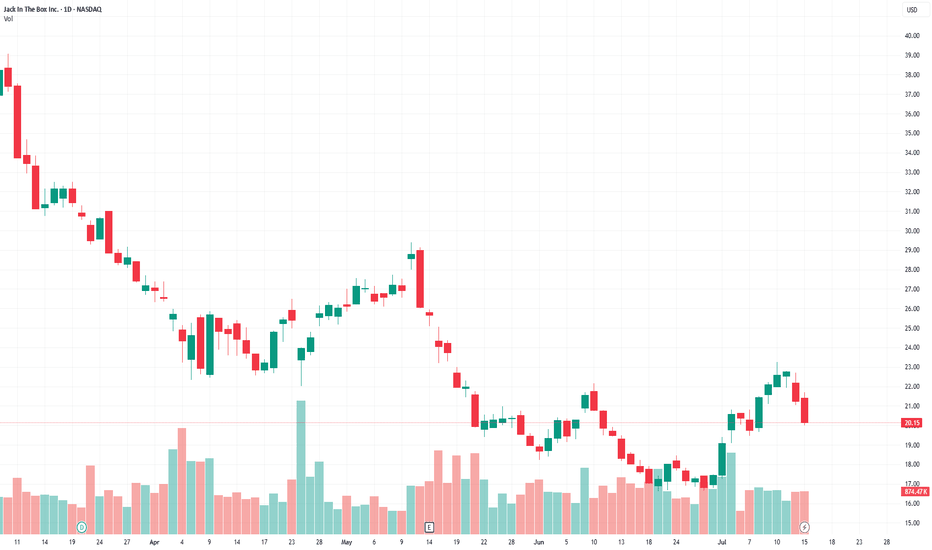

Jack in the Box | JACK | Long at $18.48Jack in the Box NASDAQ:JACK has taken a massive hit to its stock price since its peak in 2024 at just over $124 a share. It's currently trading around $18 and has entered my "crash" simple moving average zone. More often than not, this area signifies a bottom (or future bounce), but I view it more

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−10.85 USD

−36.70 M USD

1.57 B USD

18.11 M

About Jack In The Box Inc.

Sector

Industry

CEO

Lance F. Tucker

Website

Headquarters

San Diego

Founded

1951

FIGI

BBG000GZYVY1

Jack in the Box, Inc. engages in the provision of developing, operating, and franchising a chain of quick-service and fast-casual restaurants. It operates through the Jack in the Box and Del Taco segments. The Jack in the Box segment offers a selection of distinctive products including classic burgers and other product lines such as Buttery Jack Burgers. The Del Taco segment focuses on both Mexican and American favorites such as burritos and fries. The company was founded by Robert Oscar Peterson in 1951 and is headquartered in San Diego, CA.

Related stocks

Jack in the Box (JACK)Consumer Discretionary - Restaurants

Buy the dip: strategic plan, a number of shorts and the institutional interest.

Supporting Arguments

Strategic transformation program.

Large number of shorts and high dividend yield.

Interest of a large investor.

Jack in the Box, Inc. (NASDAQ: (JAC

Jack in the Box Inc. Reports Second Quarter 2024 EarningsJack in the Box Inc. ( NASDAQ:JACK ) reported Q2 2024 earnings, with same-store sales of 2.5% and Del Taco same-store sales of 1.4%. Systemwide sales were 1.6% and 1.3% respectively. The company's EPS was $1.26, while operating EPS was $1.46. The restaurant level margin was 23.6%, up 2.2% from the p

Jack In The Box Inc. (NASDAQ:JACK) Remains Optimistic for GrowthJack In The Box Inc. (NASDAQ: JACK) released its fourth-quarter financial results on November 22, 2023. The company reported earnings of $1.09 per share, which fell short of the estimated $1.15 per share. However, the revenue exceeded expectations, reaching $372.524 million compared to the projected

JACK IN THE BOX Price Hey my friends, JACK IN THE BOX is in a fake downtrend with high buy volume early in the session and hammer candle. The TIMEFRAME M1 we watch a marubozu with a low volume of purchase made. There is a good chance that the price will breakout and then put it away to arrive in a new one. And go to the

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where JACK is featured.

Frequently Asked Questions

The current price of JACK is 21.35 USD — it has decreased by −3.73% in the past 24 hours. Watch Jack In The Box Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Jack In The Box Inc. stocks are traded under the ticker JACK.

JACK stock has risen by 6.14% compared to the previous week, the month change is a 31.96% rise, over the last year Jack In The Box Inc. has showed a −62.67% decrease.

We've gathered analysts' opinions on Jack In The Box Inc. future price: according to them, JACK price has a max estimate of 61.00 USD and a min estimate of 19.00 USD. Watch JACK chart and read a more detailed Jack In The Box Inc. stock forecast: see what analysts think of Jack In The Box Inc. and suggest that you do with its stocks.

JACK reached its all-time high on May 10, 2021 with the price of 124.53 USD, and its all-time low was 1.63 USD and was reached on Feb 7, 1995. View more price dynamics on JACK chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

JACK stock is 5.11% volatile and has beta coefficient of 0.97. Track Jack In The Box Inc. stock price on the chart and check out the list of the most volatile stocks — is Jack In The Box Inc. there?

Today Jack In The Box Inc. has the market capitalization of 423.28 M, it has decreased by −8.41% over the last week.

Yes, you can track Jack In The Box Inc. financials in yearly and quarterly reports right on TradingView.

Jack In The Box Inc. is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

JACK earnings for the last quarter are 1.16 USD per share, whereas the estimation was 1.09 USD resulting in a 6.18% surprise. The estimated earnings for the next quarter are 1.17 USD per share. See more details about Jack In The Box Inc. earnings.

Jack In The Box Inc. revenue for the last quarter amounts to 349.29 M USD, despite the estimated figure of 356.69 M USD. In the next quarter, revenue is expected to reach 340.85 M USD.

JACK net income for the last quarter is −142.23 M USD, while the quarter before that showed 33.69 M USD of net income which accounts for −522.22% change. Track more Jack In The Box Inc. financial stats to get the full picture.

Yes, JACK dividends are paid quarterly. The last dividend per share was 0.44 USD. As of today, Dividend Yield (TTM)% is 7.85%. Tracking Jack In The Box Inc. dividends might help you take more informed decisions.

As of Jul 29, 2025, the company has 8.17 K employees. See our rating of the largest employees — is Jack In The Box Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Jack In The Box Inc. EBITDA is 308.44 M USD, and current EBITDA margin is 20.98%. See more stats in Jack In The Box Inc. financial statements.

Like other stocks, JACK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Jack In The Box Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Jack In The Box Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Jack In The Box Inc. stock shows the sell signal. See more of Jack In The Box Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.