KC trade ideas

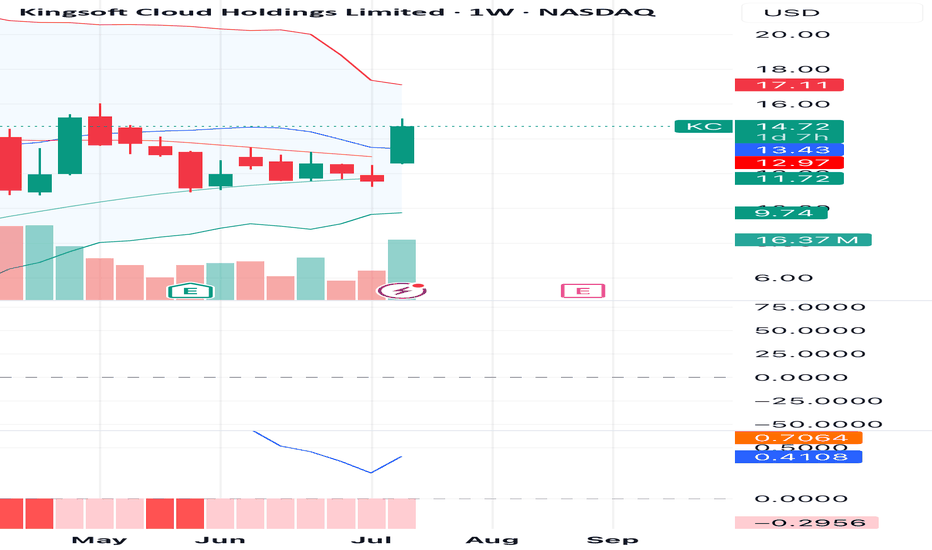

KC weekly breakout - bullish reversal in motion KC (Kingsoft Cloud Holdings) is showing a strong bullish reversal pattern on the weekly chart, breaking above the 20-week moving average for the first time in months with notable volume surge (16.13M). The breakout candle closed near the high of the week with a wide body, suggesting strength behind the move.

The MACD is beginning to curl upward from the oversold region, which could indicate a potential trend reversal forming.

🔹 Entry: $14.67

🔹 Target 1: $17.10 (previous resistance / upper Bollinger Band)

🔹 Target 2: $19.50 (gap-fill potential zone)

🔹 Stop Loss: $12.97 (below breakout candle low)

📌 Watch for follow-through next week. If KC maintains volume and holds above $13.50, the bullish setup remains valid.

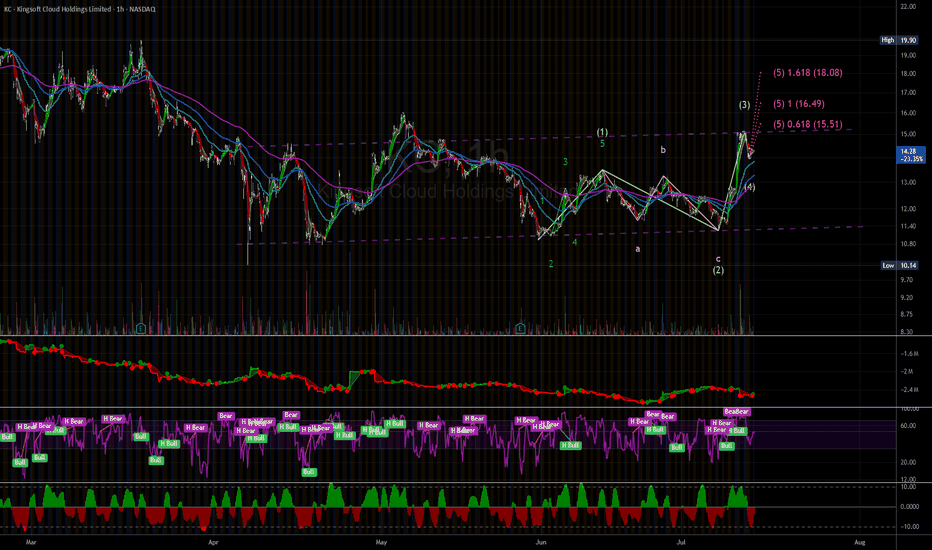

A US stock Breakout in our watch list👋Hello Traders,

Our 🖥️ AI system detected that there is a H4 or higher timeframe ICT Long setup in

KC for swing trade (a couple of weeks)

Here is a swing trade idea (since it is near support surface, we should use small lot size)

Please refer to the details Stop loss, Buy Zone,open for take profit.

We are waiting for next Long setup after price discount in coming days.

Boosting stock is highly risky, please do your own research on that coin before trading.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

Kingsoft Cloud Announces Q2 2021 Financial ResultsIn Q2 2021, the company generated CNY 2.2 billion in revenue, with a year-on-year increase of 41.6%.

According to Kingsoft Cloud's Q2 2021 financial announcement:

- Revenue rose by 41.6%, reaching CNY 2.2 billion.

- Gross profit hit CNY 119 million, representing a 46.8% growth.

- The gross profit margin was 5.5%, compared with 5.3% in the same period of 2020.

- Among the company's major businesses, its public cloud services recorded CNY 1.6 billion in revenue, reporting an increase of 20.5%; the revenue for its enterprise cloud was CNY 622 million, which extended 152.8%; and other businesses generated CNY 800,000.

- During the reporting period, Kingsoft Cloud's cost was CNY 2.1 billion, showing a growth of 41.3%; IDC cost hit CNY 1.3 billion, representing an increase of 28.3%; and the depreciation and amortization cost recorded CNY 183 million, which was a decline by 15.8%.

- Moreover, the firm's sales and marketing expenses reached CNY 96.1 million, with a decrease of 12.5%; its administrative expenditure was CNY 111 million, showing a decline of 35.1%; and its R&D expense recorded CNY 232.3 million.

- Healthcare field: the company adopted a customized project strategy in the Hubei Healthcare Data Center and Public Health Emergency Management Platform – a sub-project for constructing a healthcare data center and application support.

- Financial field: Kingsoft Cloud assisted in constructing Shandong Provincial Supply Chain Financial Platform 'Taifuxin.' At present, the firm has served nearly half of the large state-owned banks, accounting for 60% of the top 10 banks in China.

- Public services: the company successfully won the selection project to prepare the top-level design for the housing and urban-rural construction information center, helping it improve its information technology and business operating system.

China's SaaS: An 'Open Ocean' Up Ahead (2/4)China's cloud computing industry is still gradually developing, which implies infinite opportunities. When it comes to SaaS, the potential is even larger. This article is an overview of the country's cloud computing industry featuring the key players in the market, including Kingdee, Kingsoft, Youzan and Weimob.

Server device

In China, public cloud services have been increasingly popular, along with a number of existing customers showing desires to extend and customize the providers' offerings at their own expense. The country's cloud service value chain possesses enormous investment value at different levels. One reason is that the high cost of data migration generates solid user stickiness; the other reason is the relative independence of the sector from macroeconomic fluctuations. As projected by IDC, the cloud computing penetration among enterprises will increase to 15.8% by 2024 in China. By then, the market size will reach CNY 563.3 billion.

Currently, China's cloud market is at an early stage of development, with a lower market penetration rate compared with that in the United States. As per R&D World, China's spending on research and development (R&D) is expected to top with USD 621.5 billion in 2021, denoting a 25.5% share of the global R&D spending that year. In contrast, China's spending on cloud computing services only accounts for 6.2% of the global figure. It points to the fact that there is a great potential for the cloud computing market within China along with the continuing technological development.

11 out of the 20 most prominent tech companies in the US have been intensively engaged in the software-as-a-service (SaaS) business, which accounts for 40% of the value of those 20 companies. On the contrary, only 6 out of the 20 major tech players in China have SaaS business, occupying slightly 3% of the total value of those 20 largest Chinese techs. The industry's key players in China are the local SaaS providers such as Kingdee and foreign players that charge exorbitant prices in exchange for customized services.

Considering China's strict regulation on foreign companies, especially in various technology-related fields, the local companies are more likely to get the upper hand in the competition.

Kingsoft Cloud Holdings (KC:NASDAQ)

Kingsoft Cloud is the largest independent cloud service provider in China. Unlike many others in the space who tend to be narrowly segmented, it has extended from its original infrastructure-as-a-service (IaaS) model to platform-as-a-service (PaaS) to SaaS, forming a complete closed-loop that covers the entire cloud computing market to achieve cross-functional expansion as the scale grows. Kingsoft Cloud has built a comprehensive cloud platform consisting of extensive Cloud infrastructure, diverse products and industry-specific solutions across public cloud, enterprise cloud and AIoT cloud services. Powered by Kingsoft Group's enterprise service capabilities, Kingsoft Cloud is widely trusted in China and has inherited a huge customer base.

In the midst of fierce competition in the cloud service market, Kingsoft Cloud raised a total of USD 720 million in six rounds of funding in 2017-2018 and went public in May 2020. With sufficient cash reserves and the support from consumer electronics giant Xiaomi, Kingsoft has been able to survive and thrive. Its customer are, however, so concentrated now that the three largest of them account for 53% of its revenue.

Kingsoft Cloud's focused approach has made it a prime force in a few cloud industry subfields, such as games, video streaming, live streaming and finance. It is now expected to further boost its presence in various new verticals, where the main potential of the cloud market is mainly distributed. For example, Kingsoft Cloud recently shifted to the financial and government fields, enabling it to open up new business fulcrums beyond the public cloud business. In 2019, Kingsoft Cloud entered the field of Artificial Intelligence of Things (AIoT), which happens to be one of the key investment areas in China's 'new infrastructure' course.

Sunday Prep 6/27 - $KC is a short at the 20d and 50d SMAsVery defined downtrend here and I still think any pop back into the 20d is a nice spot to look for weakness. If that level doesn’t hold, the same idea can be revisited at the 50d. Both moving averages also have pivots in the same area for added confluence.

KC long over 40Total revenues were RMB1,728.8 million (US$1254.6 million) in the third quarter of 2020, representing an increase of 72.6% year-over-year.

Revenues from public cloud services were RMB1,309.7 million (US$192.9 million), representing an increase of 48.1% from RMB884.5 million in the same period of 2019.

Revenues from enterprise cloud services were RMB409.1 million (US$60.2 million), representing an increase of 257.3% from RMB114.5 million in the same period of 2019.

Net loss was RMB105.3 million (US$15.5 million) or -6.1% net loss margin in the third quarter of 2020, compared with net loss of RMB350.6 million or net loss margin of -35.0% in the third quarter of 2019. The profitability and margin have been improving on both year-over- year and sequential basis.

9.5 EV/S LTM

$KCEntry price : 65.85

Fundamentals :

- Sector: Software

- EPS % Chg (Last Qtr): 91%

- EPS % Chg (Previous Qtr): 49%

- 3 Year EPS Growth Rate: 0%

- EPS Est % Chg (Current Yr): 0%

- Sales % Chg (Last Qtr): 81%

- Sales % Chg (Previous Qtr): 60%

- 3-Year Sales Growth Rate: 74%

- Annual Pre -Tax Margin: -24%

KCThe young paper, after the IPO, consistently forms growth patterns, was initially formed by the H&P, after working out the goal of this H&S, it went into the formation of a flat channel, where it also formed an extended H&S channel in the left shoulder, after which it broke this channel upward and is now in the stage of retesting the resistance level , turning it into a support level. Hence, there is a 30% increase to the price level of 55.12. Trade with a target and a stop - place a stop at 37.55, it is mandatory here, since the company's fundamental is not yet clear and it is undesirable to leave it for the medium term.

Top 10 2021 Picks (KC)The China Data Center Market was valued at USD 13.01 billion in 2019, and it is expected to reach a value of USD 36.18 billion by 2025, while registering a CAGR of 19.2% during the period of 2020-2025.

Kingsoft positions itself as the independent anti-BAT (Baba and Tencents). It is okay to be number three as long as this commands a critical mass of demand: after all, the Chinese cloud market is a multibillion-dollar industry and even a small slice of this pie is quite a substantial fortune.

Arguably, Kingsoft Cloud knows that its eagerly advertised “independence” makes it more attractive to certain types of customers.

For one, there will always be mature companies and industries which may want to minimize their exposure to these three conglomerates for strategic reasons.

Expecting a wave 3 rally in 2021.