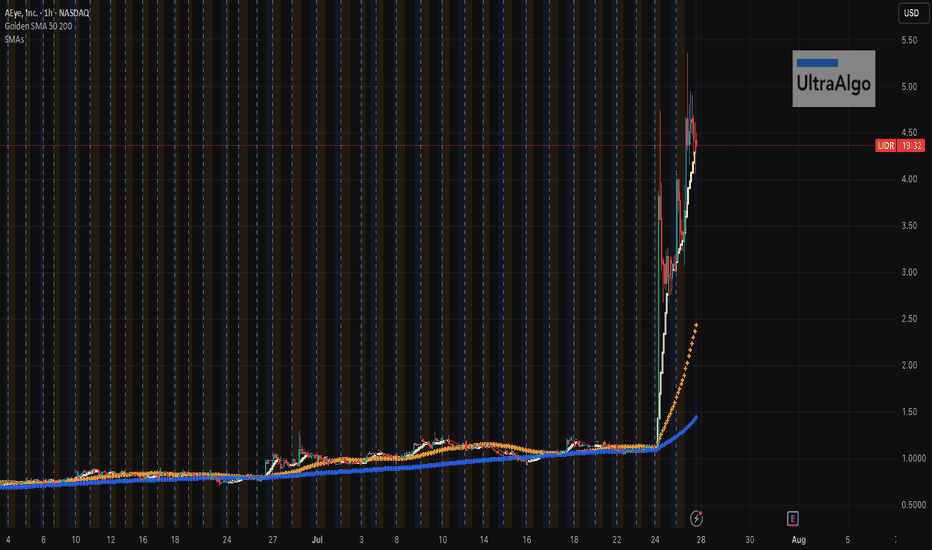

$LIDR Breakout Fueled by Ultra Bull...but it will likely fall NASDAQ:LIDR just unleashed a massive breakout from months of tight coiling — and it all sparked off an Ultra Bull signal near $1.00. Momentum exploded with back-to-back green surges, turning this sleeper into a rocket. Have a strong feeling that this will fall hard (just like every other time). Maybe pick-up on the way down as this spike will likely happen soon! Keep this puppy in your favs!

UltraAlgo flagged 3 Ultrabulls before the spike....it's too expensive now, but def one time keep an eye on X3-4!

LIDR trade ideas

LIDR a technology penny stock LONGLIDR in the past week enjoyed a price and volume surge as can be seen on the 2H chart.

It is currently price at a discount of 99% off the prior ATHs of three years ago. LICR makes the

laser and vision systems to be used in self driving vehicles which is part of the story for TSLA

and others in terms of future growth including the concept of RoboTaxis. That is to say LIDR

is part of the supply chain for EVs and will play a role in their market penetration in future

years. I will take a long trade here and swing it into the next earnings period for LIDR. My initial

target is 4 with a stop loss at 3.25 to be raised as the price moves higher.

LIDR: Currently In the BUY zone. Always a great stock to scalp. Lot of long term potential.

It has consistently pumped recently from its current price.

With good risk management, this is a good time to jump in and ride it into next week. $3 to $3.50 is a nice little scalp.

OR just SPOT and HOLD it’s not a bad pick.

Technical Analysis of AEye, Inc. (LIDR) AEye, Inc. (LIDR) has demonstrated significant volatility recently, closing at $2.58, a remarkable 115% increase. The trading volume spiked to 158.99M, substantially above the 30-day average volume of 5.46M, indicating a heightened market interest and potential shift in sentiment.

Current Price: At $2.58, the price has broken above the Ichimoku cloud, suggesting a bullish trend.

Conversion Line (Tenkan-sen) & Base Line (Kijun-sen): With the conversion line crossing above the base line, this signals a potential upward momentum continuation.

Lagging Span (Chikou Span): Positioned above the price, further confirming the bullish outlook.

Momentum Oscillators:

The significant spike in volume suggests strong buying interest, potentially driven by a catalyst such as news or earnings anticipation.

Based on the current bullish momentum and technical indicators:

Short-Term Bullish Target: $4.00, representing the next significant resistance level.

Stop-Loss for Long Position: $2.20, to manage downside risk in case of a pullback.

Trading Strategy:

Long Position: Enter above $2.70 with a target of $4.00, setting a stop-loss at $2.20.

Short Position: Consider entering if the price falls below $2.40, with a target of $1.80, and a stop-loss at $2.70.

AEye, Inc. (LIDR) shows a strong bullish sentiment driven by recent volume spikes and breaking key resistance levels. However, the overbought conditions on multiple oscillators suggest caution for new long positions. Traders should monitor the upcoming earnings report closely, as it may provide further direction for the stock. Given the current technical setup, a cautiously bullish stance with clearly defined stop-loss levels is advisable.

$LIDR is looking to POP big time!$LIDR Aeye Inc. is setting up for a big pop. The company in partnership with a fund recently announced a share purchase agreement with $125 million. Strengthening its balance sheet and ability to operate in a competitive environment. Multiple buys initiated at big funds.

$LIDR Target PTs 9-12-18 and higherAEye, Inc. develops vision hardware, software, and algorithms for autonomous vehicles. The company offers sensors, such as 4Sight A and 4Sight M. It designs iDAR, a robotic solution of artificial perception that fuses LiDAR, computer vision, and artificial intelligence for perception and motion planning for advanced driver assistance systems (ADAS) and autonomous vehicles. The company provides an iDAR platform that offers scanning and automotive reliability; Dynamic Vixels, a sensor data type that combines pixels from 2D cameras with voxels from LiDAR; and artificial intelligence and software definability. Additionally, it offers AE100 Robotic Perception System, a solid state iDAR based product for the autonomous vehicle, ADAS, and mobility markets; and AE200, which is designed to address the need for modular and high-performance sensors that are based on the iDAR platform. The company was formerly known as US LADAR, Inc. and changed its name to AEye, Inc. in March 2016. The company was incorporated in 2013 and is based in Dublin, California.