Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.67 USD

312.44 M USD

1.53 B USD

67.18 M

About Lantheus Holdings, Inc.

Sector

Industry

CEO

Brian A. Markison

Website

Headquarters

Bedford

Founded

1956

FIGI

BBG006Q52RD0

Lantheus Holdings, Inc. engages in the provision of diagnostic imaging and nuclear medicine products. The firm develops products that help healthcare professionals in patient management and outcomes and assists clinicians with the detection of cardiovascular disease. It operates through the U.S. and International geographical segments. The U.S. segment produces and markets products, radiopharmacies, PMFs, integrated delivery networks, hospitals, clinics, and group practices throughout the United States. The International segment offers direct distribution in Canada and third-party distribution relationships in Europe, Canada, Australia, Asia-Pacific, Central America, and South America. The company was founded in 1956 and is headquartered in Bedford, MA.

Related stocks

$LNTH Potential Healthcare sector leader NASDAQ:LNTH holds a negative net debt to ebitda ratio, with a forward p/e ratio around 16. Revenue growth was up over 18% for the TTM, and operating margin was around 40% compared to ~15% for healthcare companies in the drug manufacturing industry.

Technically, there is a potential wedge forming,

LNTH longI am long LNTH here, the company simply has outstanding revenue and earnings growth. They have Moat in the sense that they hold key radiologic products that are needed for a variety of patients. The pump and dump looks like a hedge fund, also with RFK taking health seat I believe the overreaction is

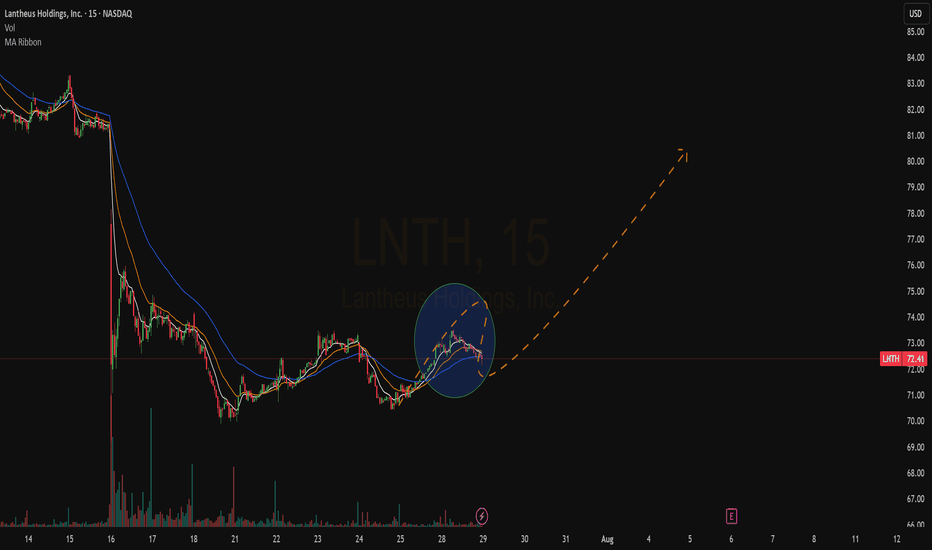

$LNTH From wild to tamed period NASDAQ:LNTH has been exhibiting tame behaviour now that the uncertain period during down trend has caused unnerving traders to buy and sell. It has reversed with strong earnings recently and now is on the uptrend forming the 2nd #Goldencross. I am selling my house so to speak to go all in. LOL.

Lantheus ST Cup & Handle?I think Lantheus may be worth a look here. A six month chart indicates a nicely formed cup and handle formation recently. It jumped up on February 22nd, after turning in a good quarterly report. Looking at a longer term chart (a few years) it could be a nice double bottom LT.

All bets are OFF, wi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

HRG5717197

Lantheus Holdings, Inc. 2.625% 15-DEC-2027Yield to maturity

−4.51%

Maturity date

Dec 15, 2027

See all LNTH bonds

Frequently Asked Questions

The current price of LNTH is 72.78 USD — it has decreased by −0.71% in the past 24 hours. Watch Lantheus Holdings, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Lantheus Holdings, Inc. stocks are traded under the ticker LNTH.

LNTH stock has risen by 3.15% compared to the previous week, the month change is a −10.62% fall, over the last year Lantheus Holdings, Inc. has showed a −36.15% decrease.

We've gathered analysts' opinions on Lantheus Holdings, Inc. future price: according to them, LNTH price has a max estimate of 159.00 USD and a min estimate of 81.00 USD. Watch LNTH chart and read a more detailed Lantheus Holdings, Inc. stock forecast: see what analysts think of Lantheus Holdings, Inc. and suggest that you do with its stocks.

LNTH reached its all-time high on Jul 16, 2024 with the price of 126.89 USD, and its all-time low was 1.76 USD and was reached on Feb 10, 2016. View more price dynamics on LNTH chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

LNTH stock is 0.96% volatile and has beta coefficient of 0.60. Track Lantheus Holdings, Inc. stock price on the chart and check out the list of the most volatile stocks — is Lantheus Holdings, Inc. there?

Today Lantheus Holdings, Inc. has the market capitalization of 5.01 B, it has decreased by −11.24% over the last week.

Yes, you can track Lantheus Holdings, Inc. financials in yearly and quarterly reports right on TradingView.

Lantheus Holdings, Inc. is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

LNTH earnings for the last quarter are 1.53 USD per share, whereas the estimation was 1.66 USD resulting in a −7.65% surprise. The estimated earnings for the next quarter are 1.68 USD per share. See more details about Lantheus Holdings, Inc. earnings.

Lantheus Holdings, Inc. revenue for the last quarter amounts to 372.76 M USD, despite the estimated figure of 379.67 M USD. In the next quarter, revenue is expected to reach 387.94 M USD.

LNTH net income for the last quarter is 72.94 M USD, while the quarter before that showed −11.79 M USD of net income which accounts for 718.70% change. Track more Lantheus Holdings, Inc. financial stats to get the full picture.

No, LNTH doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 29, 2025, the company has 808 employees. See our rating of the largest employees — is Lantheus Holdings, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Lantheus Holdings, Inc. EBITDA is 510.36 M USD, and current EBITDA margin is 33.28%. See more stats in Lantheus Holdings, Inc. financial statements.

Like other stocks, LNTH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Lantheus Holdings, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Lantheus Holdings, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Lantheus Holdings, Inc. stock shows the sell signal. See more of Lantheus Holdings, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.