LTBR trade ideas

LTBR Long Trade Setup – Eyeing the Breakout!🚀

✅ Trade Type: Long

🕒 Timeframe: 30-Minute

🎯 Entry Zone:

$16.34 (Current breakout level after consolidation)

🔻 Stop-Loss (SL):

$14.77

Smartly placed below the recent support and ascending triangle base

🎯 Target Zones:

TP1: $18.58 (Red line – intermediate resistance)

TP2: $21.86 (Green line – extended move target / supply zone)

📊 Risk-Reward Ratio:

Strong R:R (≈ 1:2.5 or more)

🔍 Chart Analysis Notes:

Ascending triangle pattern with a tight consolidation near resistance

Strong bullish move prior to consolidation indicates buyer control

Volume is healthy; price respecting trendline

Yellow zone is likely a prior resistance flip or decision level

📌 Pro Tips:

Watch volume spike confirmation on breakout above $16.50-$16.70.

Trailing stop using ATR 1.23 is a smart way to lock in profits.

Take partial profit near $18.58, especially if momentum weakens.

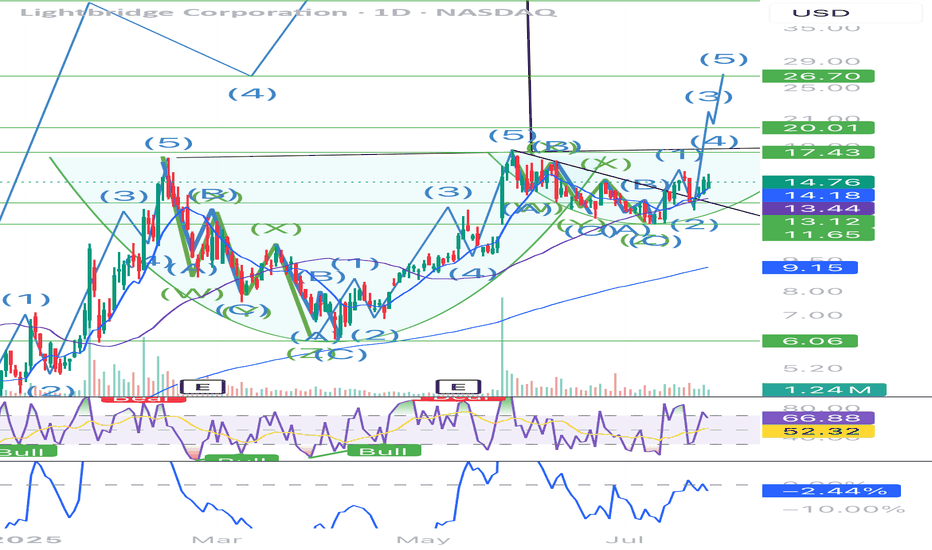

Lightbridge (LTBR) – Daily Chart Analysis As of March 28, 2025, Lightbridge (NASDAQ: LTBR) is trading at $7.80, down -3.07% on the session with a recent test of critical confluence support. Price has lost near-term momentum and is currently sitting near a key inflection zone. The setup presents a decision point where bulls must defend structural levels to avoid deeper continuation to the downside.

Technical Structure Overview

Current Price: $7.80

Recent Rejection Zone: $10.17 – $11.96

Support Levels Below:

$7.73 (current test area, horizontal support)

$6.82 (local structural shelf)

$5.60 – $4.45 (wider demand zone)

Sub-4 range includes prior basing levels: $3.70 / $3.03 / $2.53

Gann Fan Overlay:

Price has broken below the 1/1 and 1/2 fans and is currently hovering near 2/1 and 3/1 levels.

Breakdown below this fan cluster implies increasing downside risk and loss of geometric support.

Volume Profile:

Thin participation below $7.70 suggests risk of accelerated drop if price loses $7.73–$6.82.

Visible volume nodes exist below $6.00, reinforcing that support must hold above.

Momentum Indicators

RSI+

Currently flat just below the midline (~41.49), signaling loss of bullish momentum.

No divergence present; no confirmation of immediate reversal.

WaveTrend 3D

Bearish crossover confirmed and histogram remains negative.

Signal line trending lower, mirroring December’s breakdown structure.

Volume Buoyancy

Curve is fading with no current lift, showing decreasing underlying volume strength.

Momentum is significantly weaker compared to the January rally setup.

Trade Scenarios

Scenario 1: Support Reclaim and Reversal

Trigger: Reclaim and close above $7.80–$8.00 zone with increasing volume.

Confirmation: RSI+ turns up through 50; WaveTrend flips bullish; Volume Buoyancy curves upward.

Target 1: $8.77 (first resistance)

Target 2: $10.17–$11.96 (volume cluster + prior rejection zone)

Invalidation: Close below $7.73 with momentum confirming breakdown

Scenario 2: Breakdown Toward Lower Supports

Trigger: Clean daily close below $7.73 on rising volume

Confirmation: Continuation of negative WaveTrend + buoyancy deterioration

Target 1: $6.82 (local shelf)

Target 2: $5.60, then $4.45

Risk: Accelerated downside if $6.82 fails—volume is thin below this region

Scenario 3: Prolonged Base Building

Structure: Sideways chop between $6.82 and $8.77 for an extended period

Implication: Market digesting prior move, waiting on catalyst

Setup: Range trading opportunities until directional conviction emerges

Summary

LTBR is perched at a critical confluence of structure, Gann angles, and volume support. The failure to hold the $7.73–$7.80 area could accelerate downside into less defended territory. All three momentum indicators are currently bearish or flat, offering no immediate reversal confirmation.

Price is now testing prior base-building zones. This is a key spot where bulls must step in, or the next leg down toward $6.82 and $5.60 becomes increasingly probable.

Long Trade Setup Breakdown for Lightbridge Corporation (LTBR) !📊

🔹 Asset: Lightbridge Corporation (LTBR)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Rising Wedge Breakout

🚀 Trade Plan (Long Position):

✅ Entry Zone: $14.60 (Breakout Confirmation)

✅ Stop-Loss (SL): $13.23 (Below Support)

🎯 Take Profit Targets (Long Trade):

📌 TP1: $16.06 (First Resistance)

📌 TP2: $18.03 (Extended Bullish Target)

📊 Risk-Reward Ratio Calculation:

📈 Risk (Stop-Loss Distance):

$14.60 - $13.23 = $1.37

📈 Reward to TP1:

$16.06 - $14.60 = $1.46

💰 Risk-Reward Ratio to TP1: 1:1.1

📈 Reward to TP2:

$18.03 - $14.60 = $3.43

💰 Risk-Reward Ratio to TP2: 1:2.5

🔍 Technical Analysis & Strategy:

📌 Breakout Confirmation: Strong buying momentum above $14.60 signals continuation.

📌 Pattern Formation: Rising Wedge Breakout, suggesting continued bullish movement.

📊 Key Support & Resistance Levels:

🟢 $13.23 (Strong Support / SL Level)

🟡 $14.60 (Breakout Zone / Entry)

🔴 $16.06 (First Profit Target / Resistance)

🟢 $18.03 (Final Target for Momentum Extension)

🚀 Momentum Shift Expected:

If price sustains above $14.60, it could push towards $16.06 and $18.03.

Higher volume breakout would confirm strength in the trend.

🔥 Trade Execution & Risk Management:

📊 Volume Confirmation: Ensure buying volume remains strong after breakout.

📈 Trailing Stop Strategy: If price reaches TP1 ($16.06), move SL to entry ($14.60) to lock in profits.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $16.06, let the rest run to $18.03.

✔ Adjust Stop-Loss to Break-even ($14.60) after TP1 is hit.

⚠️ Fake Breakout Risk:

If price drops below $14.60 after breakout, be cautious and watch for a retest before re-entering.

🚀 Final Thoughts:

✔ Bullish Setup – If price holds above $14.60, higher targets are expected.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.1 to TP1, 1:2.5 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀🏆

🔗 #StockTrading #LTBR #BreakoutTrade #TechnicalAnalysis #MarketTrends #DayTrading #ProfittoPath

LTBR (SQUEEZE) for Tuesday October 22 ,2024LTBR had an impressive start to the week, closing 26% higher at $8.83, up by $1.82. The day's trading volume reached 12.31M, significantly surpassing the 30-day average of 1.05M. This surge followed the CEO's optimistic remarks on the growing demand in the nuclear sector, further fueled by the increasing needs for AI and chip power. The CEO also highlighted the product's mobility, which allows mega industries to remotely establish operations, making it an attractive investment for its safety, cost-effectiveness, and speed.

Please note that I am not a professional trader, so any trading decisions you make are at your own risk. I am simply sharing my personal thoughts on potential market movements.

LTBR Golden bullish cross!!!The 50 ema, red line, is about to cross the 200 ema and sma, on the daily. Golding cross baby!!

Stochastics RSI is over bought on the 4 hr and daily, fyi. The ADX is showing the buyers are still strong. The green and blue lines are the anchored V wap. Blue is the middle. I have 2 anchors. The previous high around $12 and the previous low around $2.75