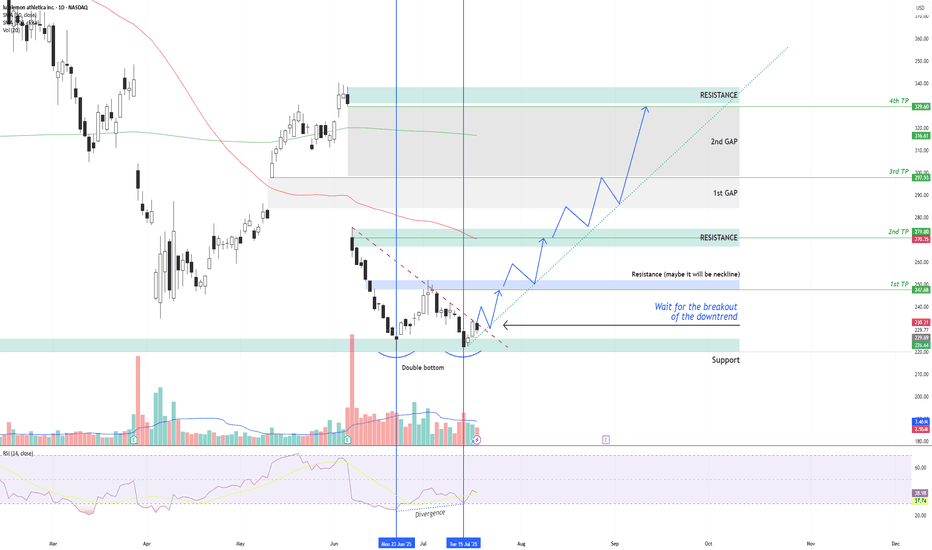

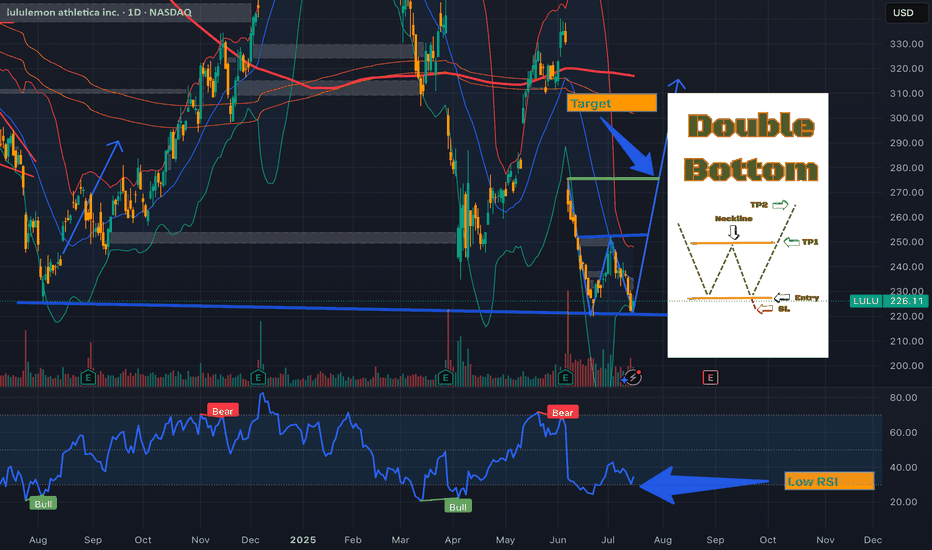

LULU – Double Bottom + RSI Divergence: Multi-Target Setup After LULU NASDAQ:LULU is showing signs of a potential bullish reversal after forming a double bottom structure around the $220 support zone , along with a bullish divergence on the RSI indicator.

Two vertical lines highlight the divergence: while price made a lower low, RSI formed a higher lo

Key facts today

Lululemon (LULU) is rated Neutral by J.P. Morgan, with a price target of $224 for December 2026. Growth opportunities exist internationally, but U.S. challenges affect margins.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

14.67 USD

1.81 B USD

10.59 B USD

104.43 M

About lululemon athletica

Sector

Industry

CEO

Calvin R. McDonald

Website

Headquarters

Vancouver

Founded

1998

FIGI

BBG000R8ZVD1

lululemon athletica, Inc. engages in the business of designing, distributing, and retailing technical athletic apparel, footwear, and accessories. It operates through the following segments: Company-Operated Stores, Direct to Consumer, and Other. The company was founded by Dennis James Wilson in 1998 and is headquartered in Vancouver, Canada.

Related stocks

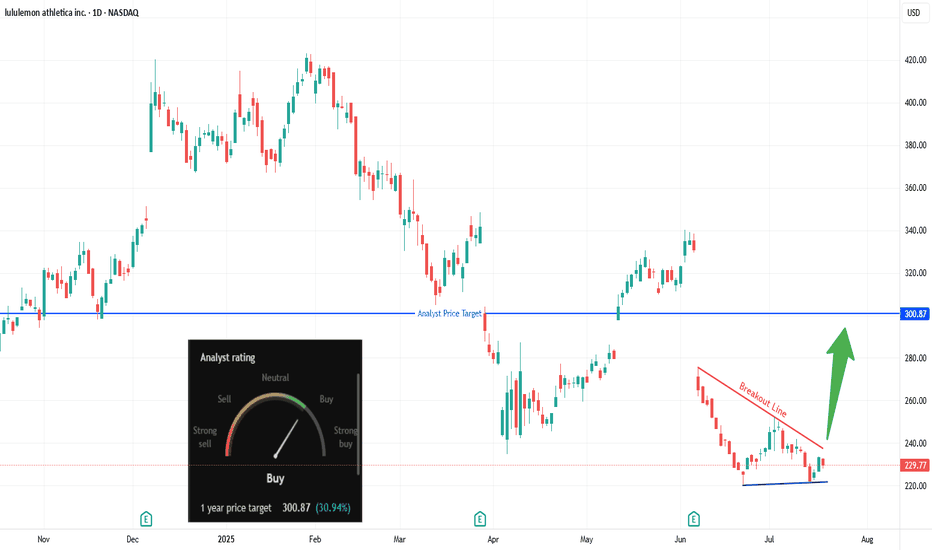

Are Bulls Quietly Loading Up on LULU?Trade Summary 📝

Setup: Descending wedge forming after sharp drop; price testing breakout line.

Entry: Above $240.

Stop‑loss: Below $220 swing low/support.

Targets: $260 , $293–$301 (analyst target).

Risk/Reward: ~3:1 (tight stop, multi-level upside).

Technical Rationale 🔍

Ke

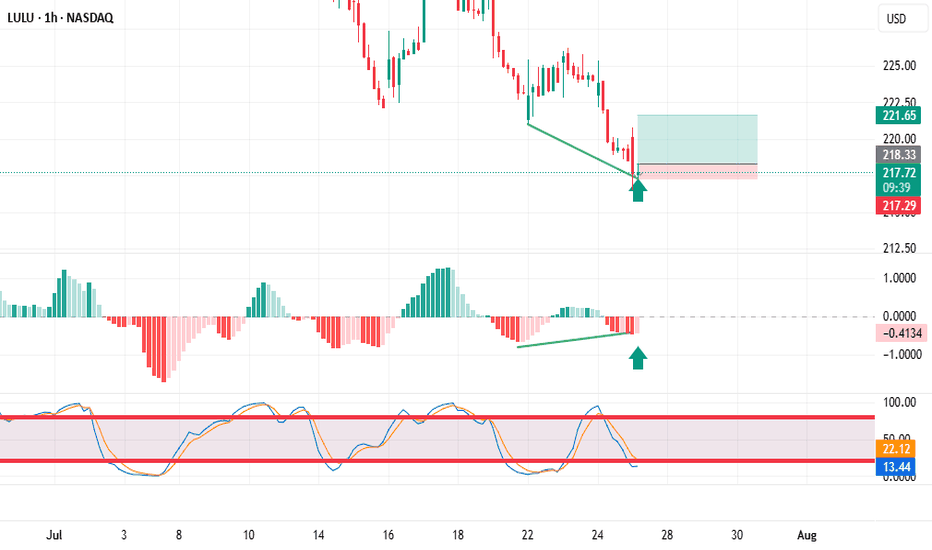

Trading stocks using Dr. Elder's "Three Screen Method"The first thing I do is check the weekly chart. Here I see excellent price divergence relative to the MACD indicator

Then I switched to the daily chart and saw the same excellent divergence as on the weekly chart.

The hourly chart also showed excellent divergence. placed a pending buy order

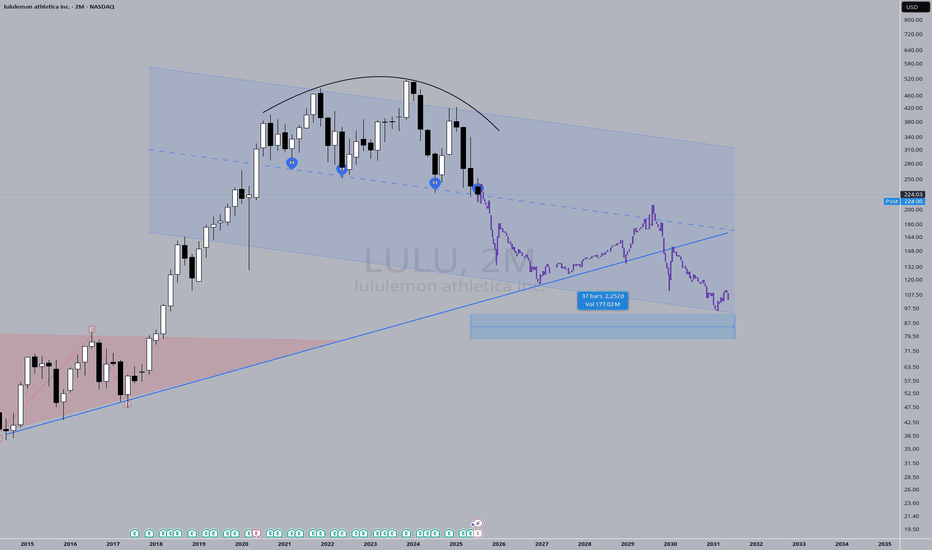

Mega-ultra macro LULU takePrice action has "knocked" on the support door FOUR times. It's got to give sometime soon. Fashion brands come and go, I think LULU has had it's time to shine, now it's time for another brand to emerge and take its place.

I say "Mega-ultra macro" to recognize the absurdity of a 6-year guess. The pr

Going to HonoLULULululemon shares fell almost 20% after the company warned tariffs and consumer caution would hurt profits.

Here are some of my bold statements about this:

Tariffs are sector-wide, not Lululemon-specific

Nearly all premium athletic and apparel brands—Nike, Adidas, Under Armour, VF Corp (The

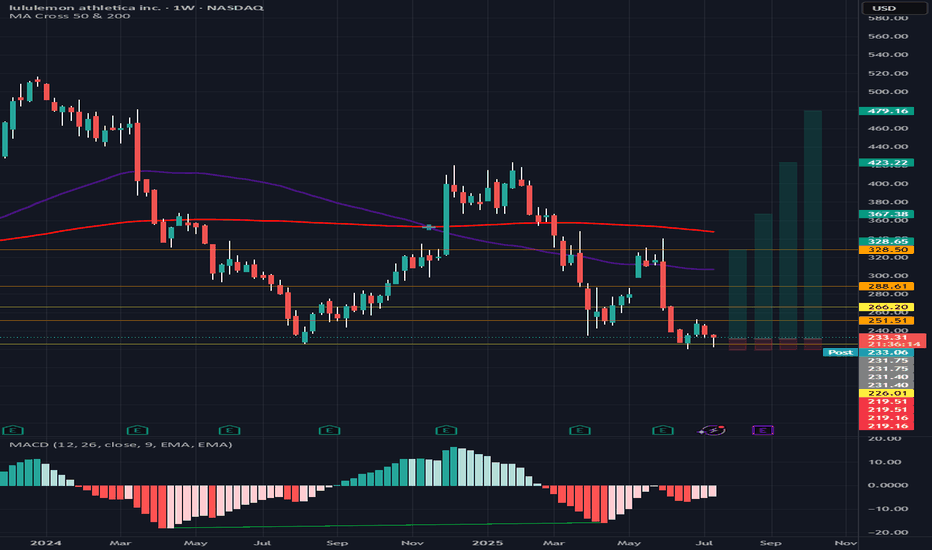

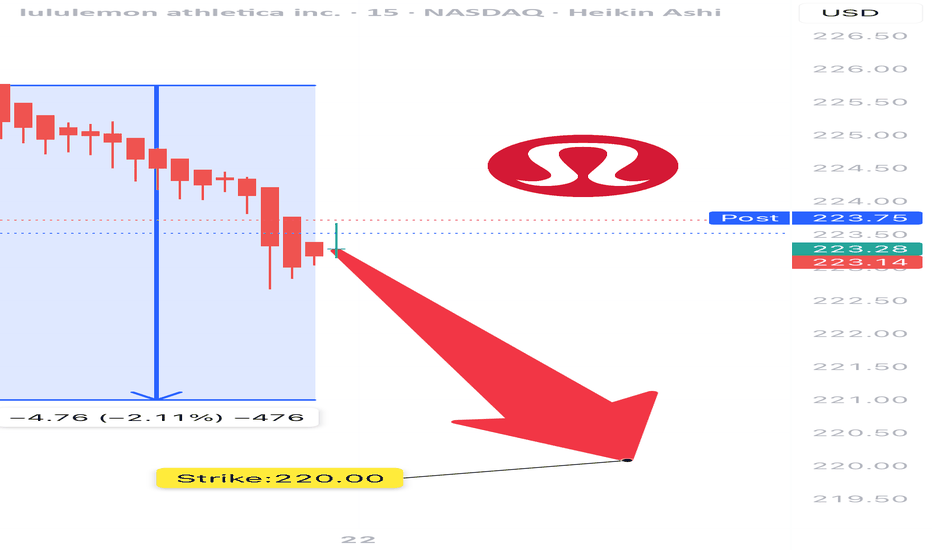

LULU Weekly Bearish Setup – 7/21/2025

📉 LULU Weekly Bearish Setup – 7/21/2025

💥 RSI Breakdown | 📉 Institutional Bearish Flow | 💰 Premium Risk-Reward

⸻

🧠 Multi-Model Consensus Summary

🟥 RSI: Daily 36.1 / Weekly 29.9 – Bearish Momentum Confirmed

📉 Volume: Consistent sell pressure across models

📊 Options Flow: Mixed signals, but bearis

Double Bottom Pattern on LULU“LULU is forming a potential Double Bottom on the daily chart, with two lows around $222 (support) and a neckline at $252. The pattern suggests a bullish reversal if the price breaks above $252 with strong volume. RSI is showing bullish divergence, and the 50-day MA is converging near the neckline,

Stocks SPOT ACCOUNT: LULU stocks my buy trade with take profitStocks SPOT ACCOUNT: NASDAQ:LULU stocks my buy trade with take profit.

Bought at 236 and take profit at 245.

This is my SPOT Accounts for Stocks Portfolio.

Trade shows my Buying and Take Profit Level.

Spot account doesn't need SL because its stocks buying account.

Higher end consumption has officially broken downThe charts of Lululemon, Louis Vuitton, Restoration Hardware & Target are showing significant signs of weakness as all of them have broken important 3M closing support lows. Regardless of what you hear, these charts show that the high end consumer has been slowing consumption for quite some time and

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where LULU is featured.

Frequently Asked Questions

The current price of LULU is 219.43 USD — it has increased by 0.34% in the past 24 hours. Watch lululemon athletica stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange lululemon athletica stocks are traded under the ticker LULU.

LULU stock has fallen by −5.74% compared to the previous week, the month change is a −6.43% fall, over the last year lululemon athletica has showed a −15.92% decrease.

We've gathered analysts' opinions on lululemon athletica future price: according to them, LULU price has a max estimate of 500.00 USD and a min estimate of 155.00 USD. Watch LULU chart and read a more detailed lululemon athletica stock forecast: see what analysts think of lululemon athletica and suggest that you do with its stocks.

LULU reached its all-time high on Dec 29, 2023 with the price of 516.39 USD, and its all-time low was 2.17 USD and was reached on Mar 6, 2009. View more price dynamics on LULU chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

LULU stock is 1.86% volatile and has beta coefficient of 1.03. Track lululemon athletica stock price on the chart and check out the list of the most volatile stocks — is lululemon athletica there?

Today lululemon athletica has the market capitalization of 26.30 B, it has decreased by −5.20% over the last week.

Yes, you can track lululemon athletica financials in yearly and quarterly reports right on TradingView.

lululemon athletica is going to release the next earnings report on Aug 28, 2025. Keep track of upcoming events with our Earnings Calendar.

LULU earnings for the last quarter are 2.60 USD per share, whereas the estimation was 2.58 USD resulting in a 0.60% surprise. The estimated earnings for the next quarter are 2.88 USD per share. See more details about lululemon athletica earnings.

lululemon athletica revenue for the last quarter amounts to 2.37 B USD, despite the estimated figure of 2.36 B USD. In the next quarter, revenue is expected to reach 2.54 B USD.

LULU net income for the last quarter is 314.57 M USD, while the quarter before that showed 748.40 M USD of net income which accounts for −57.97% change. Track more lululemon athletica financial stats to get the full picture.

No, LULU doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 39 K employees. See our rating of the largest employees — is lululemon athletica on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. lululemon athletica EBITDA is 3.01 B USD, and current EBITDA margin is 27.83%. See more stats in lululemon athletica financial statements.

Like other stocks, LULU shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade lululemon athletica stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So lululemon athletica technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating lululemon athletica stock shows the sell signal. See more of lululemon athletica technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.