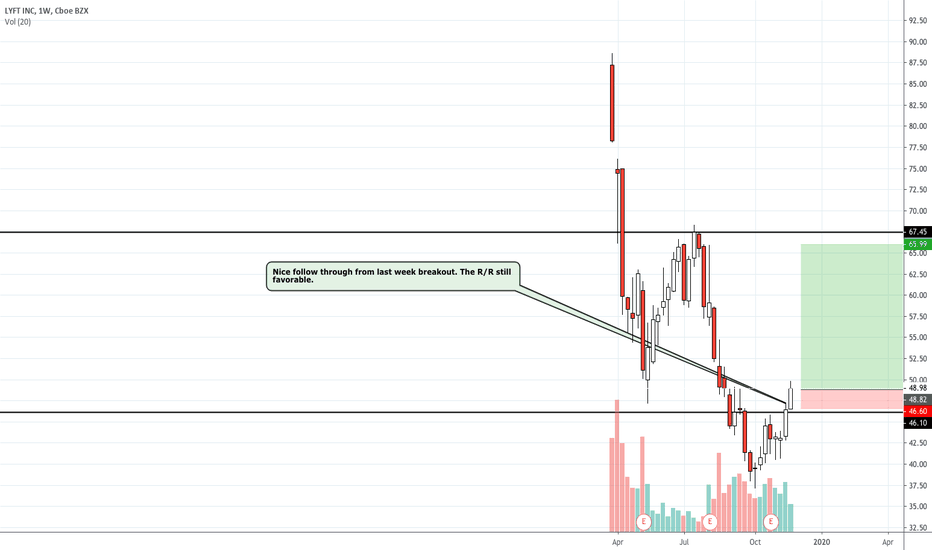

LYFT - LONG SETUP FROM ASCENDING TRIANGLELYFT is displaying a potential long setup as price is currently forming an ascending triangle pattern. A move above $50 would indicate a breakout to the upside, preferably with volume. Price above the 50 day is encouraging for a long position.

Price has been testing the $50 resistance since September 2019, consolidating for the past 15 months. Breaking out of the consolidation could begin an uptrend.

The risk reward with this setup is very promising, as a stop a few percentage points below is enough to provide confirmation that the breakout failed. Otherwise, the upside can be 20%+ in my opinion.

LYFT trade ideas

Lyft Will Break Past $50 Early 2021 - Conscientious StockHear me out here... Lyft is actually a more "green" company than Uber, aside from the fact that its brand is also a lot healthier in terms of corporate stewardship/driver care.

Uber is simply trying to replace drivers with robots, and in the long-term, that strategy is not going to do well in the face of competition from companies such as Google & Tesla.

However, in the short-term Lyft is going to continue grabbing more and more of the market. The pricing is fairer, to the point where I've seen it make more sense for my own earnings/time-value to take a Lyft than to take a bus (bus $5 one way, Lyft $6ish one way in this example). Furthermore, individuals who care about the environment will benefit more from using/investing in Lyft because it is a lot more efficient than Uber in terms of Co2 emissions.

Although there are shared rides for Uber, Lyft's biggest attraction is the shared ride (in my eyes). I don't have the research showing me that Lyft uses less carbon to transport people, but I can tell you that Lyft is going Carbon neutral and Uber is not: www.theatlantic.com

If you are looking for a stock to hold for the next decade, with a high chance of risk and an equally high chance of reward, then Lyft is it. Lyft may end up being acquired by a company like Google or Tesla if the chances are right, but I am not certain of that possibility. What I know is that a network of drivers and riders who appreciate low Co2 emissions and low costs is going to be valuable to the companies that are able to automate driving services using robots (if they want to acquire the network and feed it the technology to profit). Robotics can halve the price of a ride-sharing ride, so if it can do that who has the most to lose? Uber who started out as a "luxury service" and is trying its best to break into everything transportation (food, shared rides, etc), while battling scandals and such, or Lyft who started out as a ride-sharing app for the people BEFORE Uber was invented?

"Lyft may be smaller than Uber, but it has been around longer:

The Lyft app launched in 2012 (Uber, originally called UberCab, in 2009), but Lyft started life as a side project for Zimrides, a carpooling service founded in 2007 that leveraged Facebook and students for long-distance ride-sharing back when Uber was just a limousine-shaped gleam in the eye of Canadian co-founder Garrett Camp." - ride.guru

Yes, Google does have Google Maps which would be a perfect place to "inject" a robotic ride-sharing app into. However, the markets run on human emotions as far as robotics goes. Even though the media is doing its best to open our eyes to the future worlds that are possible through technology, a consumer WILL be more likely to trust Lyft even if it is still dependent on drivers because 1. that will ensure that drivers will still make a living before the majority is able to shift into new jobs (which could take upwards to a decade once robotic driving rolls out), than they will be to trust Google (working with the Chinese from time to time, censoring Google on the Chinese side, etc), or to trust Uber (company that wants to put profits above people, drivers, etc, and does not have a good innovative arm to do it regardless of the investment money that they've been given and continue to burn through).

Thoughts? Concerns? Critiques?

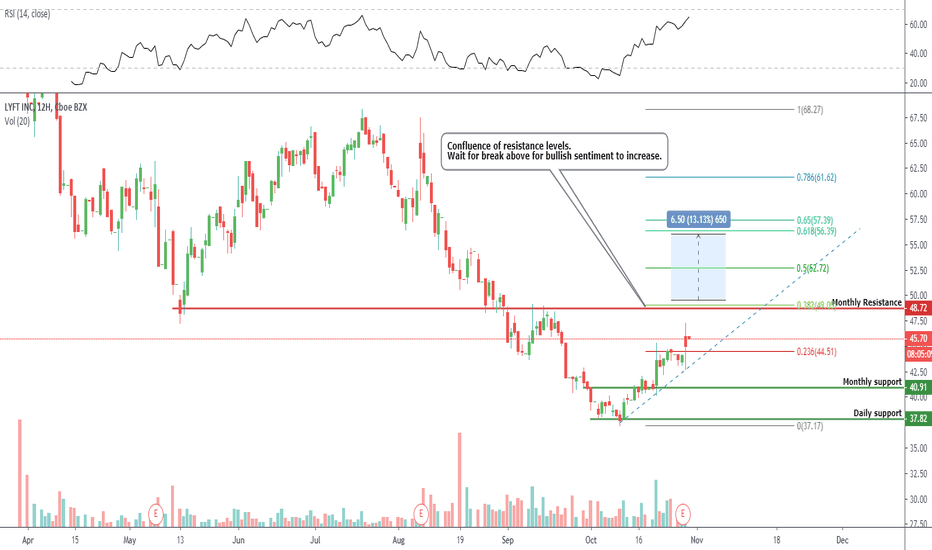

$LYFT finding support, reversal trade. Entry level $50.00 = Target price $57.00 = Stop loss $48.00

Indicators bullish.

Sentiment improving.

9.8% short interest.

Average analysts price target $67 | Overweight.

Company profile

Lyft, Inc. operates as an online social rideshare community platform. It helps commuters to share rides with friends, classmates, and co-workers going the same way. The company was founded by Marcus Cohn, John Zimmer, Rajat Suri, Matt van Horn, and Logan Green in June 2012 and is headquartered in San Francisco, CA.

$LYFT Set for Lift Off?LYFT

LYFT Inc (NASDAQ:LYFT) traded higher after signing strategic partnership with Juno, which is shutting down its ride-share operation in NYC. Gett, the global leader in corporate on-demand transportation, just announced the closure of its New York rideshare business, Juno, effective today, which can work as a boon for Lyft because Gett also announced a strategic partnership with Lyft to enable its corporate clients to access rides in the United States beginning next year.

As a corporate transportation leader, Gett serves over 15,000 companies, including a third of the Fortune 500. Through the Lyft partnership, Gett's corporate customers traveling in the United States will be able to request rides through the Gett app and be matched with a driver on the Lyft network. This partnership will allow Gett to expand its reach across the United States, seamlessly serving its business clients on the Lyft network, all through Gett's SaaS platform for business travelers.

Juno is shutting down in New York today as a result of both Gett's increased focus on the corporate transportation sector and the enactment of misguided regulations in New York City earlier this year. All Juno riders will be invited to join Lyft.

Read more at dailytrendingstocks.com

$LYFT Short targeting 33-32 current 43.23 BearishForming bullish pattern to be entered at 33.8-32.8 targeting higher than 48 on long term but for now its showing sign of decline targeting new lows above 32 then bounce from there .. Stoploss for this scenario is to break up 45.5 with close then its will turn to short-term bullish

LYFT UpdatedI admit when I'm wrong, in this case my previous chart was rushed to completion without averaging the trend-lines, my apologies.

All lines and connections have been averaged on the 'weekly' and 'daily' with step-line over log. When a stock is young, it is common to start measuring once the b-bands start forming. In this case I disregarded any performance prior to the end of April. The stock has an overall healthy-looking performance throughout. It will now push-off the 50MA as it overshot the upper b-band line (towards the 20MA). from those levels the stock can be re-labeled neutral-to-bullish.

$LYFT looks to profitability sooner than expected.CEO Logan Green earnings call opening statement.

Good afternoon, everyone and thank you for joining our call today. Q3 marks the third quarter in a row of outstanding performance since becoming a publicly traded company. Revenue grew 63% year over year. Active Riders grew 28%. Revenue per Active Rider grew 27%. Contribution margin was at a record high over 50%. Our top line momentum and our success with strategic initiatives in our core operations led to a 32 percentage point improvement and adjusted EBITDA margin year over year.

Our third quarter results demonstrated the significant progress Lyft has made on our path to profitability. Record revenue was generated by strong growth in both Active Riders and Revenue per Active Rider as we continue to increase engagement through product innovation and execution. Our continued focus on consumer transportation is yielding meaningful improvements in monetization and strong operating leverage. As a result of the continued strength of our execution, we are updating our outlook for 2019. Importantly, we now expect to be profitable on an Adjusted EBITDA basis in the fourth quarter of 2021.

Break above $49 with $56 possible target zone.

Short interest 8.88%

Average analysts recommendation Overweight | $69 price target.

LYFT before EarningsThis stock is an obvious short at this point. Can't expect good news on earnings release, but beware shorting this stock for one good reason. At these levels the company is an obvious buyout target, which would catapult it towards $50-65 at once. Unusual high volume spikes throughout the years can be detected (with little stock movement), which could indicate 3rd-party interest. But regardless of that, technically the stock is poised to touch down at the lower channel trend line. I like the company, but I don't like their stock.

(analysis posted per request)