MCHI trade ideas

MSCI China 2025 Q1 MSCI estimated fair P/E multiple for China

could rise from 11x to 12-13x if China successfully manages to bank on AI

If the market re‐rates Chinese companies due to possibly banking on AI both foreign and domestic investors could allocate more capital to Chinese equities ~$200bn of net portfolio flows for Chinese stocks

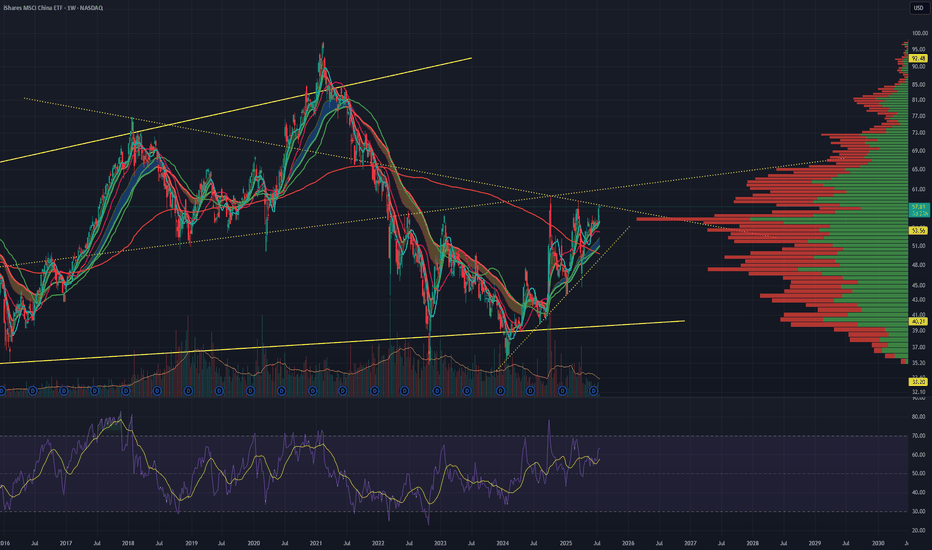

MHCI (China) finally a pullbackI was able to enter this position again on the rather hefty pullback. I went with Jan 60$ strikes for this to limit my downside. I am fine with holding a very volatile position. For those who hate that volatility, buying straight shares is definitely viable, my PT is still 69$. We could see a pullback as far as 47$ but I dont like to wait on momentum plays. If we see TSLA or PLTR blow up this week people will look to buy decimated corrections on other sectors. Do remember the prior elevated stochastic RSI lasted 13 weeks.

China MCHI small pullback before continuationI tend to ignore China since I really do not like their rampant painful policy changes. I tend to avoid single stocks for investing purposes in this region. The China sentiment however is very bullish and the stocks are undervalued. My plan here is to long an ETF instead which will reduce my single stock policy change risk. Between incentivized buybacks, reduction in down payments for second homes, and 500 billion dollar liquidity injection whales are looking to China.

This ETF and China index have broken all 4 moving averages in a single week, this is what I call a pivot. I marked how much further the stochastic RSI has to run this is a decent amount and can take some time.

My Plan:

Entry point is marked as the dashed red hopefully we get a pullback

TP 1 = 54$

TP 2 = 69$ (golden ratio correction thesis)

I will be utilizing Jan long calls likely spreads between high open interest strikes

MCHI: Buy exposure to Chinese marketsBased on past cycle history, the SHSZ300 (Chinese S&P 500 more or less) tracks the US markets bull runs, though starting with a large delay.

We're fed a lot of bad news about China, but the fact is, they're making some economic power moves, and positioning themselves for the AI Industrial Revolution.

The Chinese markets are bottoming out, and it's a good time to get exposure to the Chinese markets.

I will be buying in around the buy zone ($45 - $41).

#China #MCHI #KWEB

China!Hello friends

We are amassing a large long position in MCHI. Here is our reasoning:

Everyone is bearish

The Chinese money printer is going BRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRR

Very low valuations compared to historical levels

Chart looks good

MCHI , My worst trade of 2023 , REVIEW and ESTABLISH RULES So , Recently I longed MCHI and EWG in the same day , the sizing was correct and EWG was a good stage 2 buy, even though it lost with a gap down on the same day as MCHI , it was still a good trade , stage 2 uptrend , 50 SMA TB entry , with a contrarian idea adding to the trades potential but ultimately the other side betting for a move down was victorious on that one but it was still a good trade because it made sense it just simply didn't work.

MCHI on the other hand was not a good trade , I did miss this at the time and I was having a good run so perhaps that led to making the bad call but in any case I have broken down why it was a bad trade and established added guidelines to help me not repeat this in the future and since I think it was my worst trade of the year so far I wanted to air the dirty laundry .

\\

So basically , my strat trades ETFs and Stocks . Stocks will basically be near an ATH and or essentially trading above a GLB which really keeps me on the right side of the trend or helps to most of the time , but I sometimes you see stocks like NFLX which led the initial market recovery this year for example and I wanted a way trade that . So , I added the ability to trade ETFs that were emerging into new Stage 2 uptrends with a specific focus on the ones leading.

When things still looked pretty rough overall I looked through weeklies of all the etfs on the US market and that allowed me to identify some groups/areas that were ahead of everything else , those were BOTZ, XLC , SMH, some others , but using the weekly charts and scanning on finviz was how I found those , oh yea WGMI was another that has not worked quite as nice but was still ahead of the market at the time and seems to be making a bit of a move now . Most of those have worked pretty well though and I am trying to stay focused on them .

\

That all being said since ETFs is kind of a new part of my swing strat , I guess you could say I got a bit of a clouded judgement on MCHI .

Looking back on it here's what i see now that I think I need to guard against in the future.

1) I was hitting peak equity , this is a bit of an independant warning sign , I was expecting a pullback on equity because it almost always happens after a strong move up , but maybe i was getting a bit " cocky " i suppose you could say

2) The MCHI was actually not in a stage 2

3) The top 60% of its holdings were less than 50% in stage 2

4) There was excessive gap risk very easily observed by looking at the daily , gaps all the time ...

5) I did not place my stop with the gap risk in mind

Comparing to trades on WGMI, SMH, XLC and BOTZ in all those ones we were above the 200 ema or at the 200 ema in BOTZ's case and we for the most part had greater than 50% the top 60% of holdings in Stage 2s already , with the exception of WGMI which had only 50% and just happens to be the laggard of the bunch and has the messiest price action .

So , when I break down all the MCHI trade should have never been taken and until it is in a stage 2 it should not be re entered . It's price action is a bit more confusing than the others , I think , because most stuffs Stage 2 is pretty close to the 200 ema on daily but since MCHI sort of failed its first try to transition that sets the high noted on chart at $55.78 level as where Stage 2 would start , at this point in the chart .

So as a general "cheat" or "filter" rule here , my new rules will be defined as this:

ETF's can only be trade if they are above their 200 EMA on daily chart but ALSO in a confirmed stage two uptrend . The 200 ema is less important than the Stage 2 but I view moving averages as training wheels on a bike an you will most of the time not have a Stage 2 uptrend in a leading ETF without being above the 200 ema , so its a good rule of thumb .

Is the etf above its 200 Ema ? If not it's probably not something you should be trading.\

Still really want to trade it ?

Then ok , is it in a Stage 2 at least , that is then the bear minimum , but if you are not 100 percent certain it's in a stage 2 , its probably NOT. Don't make the same mistake as me here ;)

Will be printing this chart and putting it on the wall where it belongs , its history ;)

MCHI , would love to long this but im already at max risk Just want to note that I want this lol , but unfortunately cant have it without first derisking some stuff or getting stopped out on some things , either way open risk on newer trades is 4.29% ( 3 positions ) vs AUM of swing account , so ill have to just watch it ... it is a gappy name though , that being said . None the less look at how the last trade could have went , maybe will be the same this time around , just sharing .

Another thing this could happen with is SMH , that's another one that I am waiting for but depending how things go , might have to sit that one out too , time will tell , gotta respect risk .

Chinese stocks gap downChinese ADR stocks gapped down over the weekend. China's President Xi Jinping broke precedent over the weekend and secured a third term as the country's leader. The Chinese government's stricter stance toward technology companies over the past few years has dropped the stock price of Chinese ADR's continually for nearly a 2-year downtrend. MCHI has 632 holdings including the well known TME, BABA, JD, BIDU, PDD, NIO & NTES tickers. Here's levels on MCHI downtrend channel:

R3 = 47.97

R2 = 45.82

R1 = 43.67

pivot = 41.52

S1 = 39.23

S2 = 37.08

S3 = 34.78

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

www.tradingview.com

China's Economy Crisis: What You Need To KnowChina is the world’s second-largest economy. If that doesn’t impress you, consider this: It has grown from a ragtag collection of state-owned firms to the world’s second-largest economy in just 35 years. China is now the world’s largest producer of goods, from smartphones to steel, autos to aircraft carriers. In 2017 alone, China produced almost as much output as the U.S., Japan, Germany, France and Britain combined. However, there are signs that China is heading for a recession. The country’s stock market has crashed twice (in July 2015 and again in January 2016), and Chinese investors have lost a lot of money as a result. There are many reasons that explain why an impending economic crash in China is imminent...

China Has a Debt Problem

China’s debt-to-GDP ratio (Private Sector) is now over 250%, which is extremely alarming. China’s debt problem is a ticking time bomb that could go off at any moment. As interest rates rise in the U.S., the cost of servicing the debt will become more expensive for Chinese issuers. If China continues to grow its debt at its current pace, it could easily become the next Greece or Argentina, where economic collapse is imminent. The Chinese government has tried to curb the rise in debt by tightening its domestic monetary policy. That caused the country’s stock market to plummet and its currency to depreciate. China’s aggressive money-printing has helped to fuel an emerging debt crisis that could trigger a global economic slowdown. In fact, the Bank for International Settlements (BIS) says that China’s debt-to-GDP ratio has jumped from 150% in 2008 to more than 250% today.

The Chinese Yuan Is Dropping Like a Rock

China’s controlled currency is starting to depreciate. And that usually occurs before an economic crash. The Chinese yuan (also known as the renminbi) has fallen more than 7.7% against the U.S. dollar since March 2022. The yuan’s decline is partly due to the trade war with the U.S. China’s central bank has been intervening in the markets to prevent the yuan from declining too quickly. That’s caused the dollar to rise against other currencies. It’s also helped to fuel a rise in Treasury yields. A strong U.S. dollar is bad for American exports. But it’s also bad for China, since a strong dollar makes it more difficult for Chinese companies to compete abroad. China’s controlled currency is starting to depreciate. And that usually occurs before an economic crash.

CNH1!

Manufacturing Is Slowing Down

China’s manufacturing PMI has been falling for months. In July 2018, it was 48.3, which is below the 50 mark that separates growth from contraction. A number below 50 is also considered to be “bad”, while a number above 50 is “good”. The PMI reading for July 2019 was 49.7. This may sound like good news for those employed in the U.S. However, it’s not. A slowdown in the manufacturing sector usually leads to a fall in consumer spending and a slowdown in the economy. That’s because reduced consumer spending leads to fewer sales and an excess of inventory or unsold goods. That often leads to a drop in GDP.

China is Producing a Lot of Empty Buildings

As an economic crash approaches, developers start to build a lot of empty buildings. That’s because people start to slow down their spending and are not prepared to make the necessary financial commitments. China’s ghost cities are the canary in the coal mine. These are cities where 90% of the buildings are either vacant or incomplete. Now, it’s interesting to note that China’s ghost cities were entirely vacant as recently as 2010. At that time, few people would have predicted that China would build an entire city and have no one living in it.

China's shadow banking problem is a major concern for the Chinese economy. Shadow banking refers to financial services provided outside of the traditional banking sector. These include weaker institutions such as peer-to-peer lending, pawnshops and informal lending networks. Shadow banking is often used to circumvent government restrictions on the traditional banking system, which can make it harder for the government to monitor and control the overall economy. Shadow banks are also more likely to lend to high-risk borrowers, fueling asset bubbles and economic instability. As a result, shadow banking has become increasingly important in China as the country's economic growth has slowed. Despite its importance, understanding shadow banking in China is difficult due to its complexity and lack of transparency. It is best to keep an eye on developments in this area as they could have a significant impact on the Chinese economy in coming years.

China Consumer Confidence Index

China Unemployment Rate

Conclusion

In the final analysis, there are many signs that indicate that a looming economic crash in China is imminent. Indeed, analysts expect that the country could be poised for a major economic slowdown in the near future. If this happens, it will have a negative impact on global economic growth. Investors should be careful about which companies they invest in and may want to avoid companies that are heavily reliant on the Chinese economy.

MCHI CHina PennantThe Chinese keep pumping futures, here's their chart using MCHI ETF which gives us a clearer picture because it accounts for currency.

Big pennant, I guess we should all have seen that....

So I'm guessing next week is decision time, possibly Monday. Virus cases over 1 million, rising exponentially....

www.worldometers.info