MQ trade ideas

$MQ looks good"Marqeta is a modern card issuing platform that provides the infrastructure and tools for businesses to create, manage, and control payment card programs, including debit, prepaid, and credit cards. They offer an open API platform that allows companies to build customized payment solutions, manage transactions in real-time, and gain insights into card usage. Essentially, Marqeta enables businesses to issue and manage their own branded payment cards, rather than relying on traditional banking systems"

"Marqeta is used by a variety of companies, particularly those in the fintech, on-demand delivery, and digital banking sectors. Some of Marqeta's notable customers include Klarna, Uber, Coinbase, DoorDash, and Western Union. Marqeta's platform allows these businesses to issue cards, manage payments, and build custom financial products. "

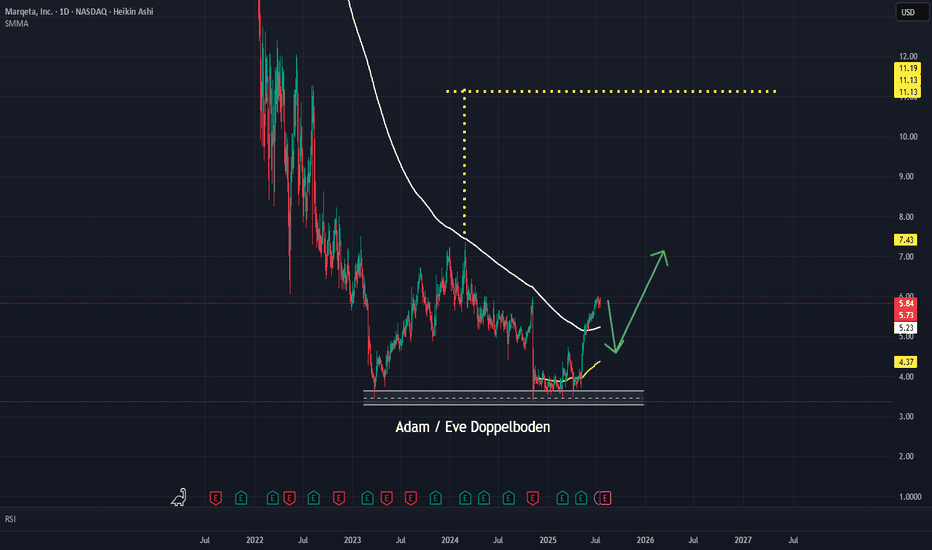

Yes I copy and pasted because I'm lazy. But these huge companies rely on their card issuing and management software. Looks like its either ready to break out, targeting a $9-$12 range.

Or if we don't break out now looking for further accumulation near $5 support.

MQ usstock going to rise 400-800% I am not a financial advisor 📌 before taking my analysis pls #DYOR

I am always available 😊 in private chatting box & check profile 😊 to get connected 😉

Let's get into the stock

From beginning of chart 📉📈 it's getting downtrend it's impossible to confirm upward trend 📉

Present 💝 there will trap 🪤 pump then it will complete real value 📍

The best buy are is $1.6 to $2.6

The best are to sell our liquid 💰 $4.8 ( PRINCIPAL TRADE )

and rest of the target is $8 & $12

If u know about this company pls comment below i went based on #TA.

Let me know about company good or bad etc ....

As per technical analysis if PRICE 3 month candle close below our entry ⛔ wave " C "

It's stop lose 🚏 invalid 📌

$MQ reversal play 👁🗨️*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

This afternoon my team purchased shares of FinTech company Marqeta $MQ at $4 per share.

Our Entry: $4.00

Take Profit: unclear (we will use the fib-tool to determine a good take profit)

Stop Loss: $3.75

If you want to see more, please like and follow us @SimplyShowMeTheMoney

$MQ - looking like a reversalNASDAQ:MQ Looks to be forming a reversal ☕️. $4.92 to $5 is a tough point of control resistance area hence the stock has been trading in narrow range. Took a starter position. Targets - $5.70, $6.50, $8.70. Downside risk - $4.26. I would probably add more if we see $4.26 and below. 💥🚀💰

Long | MQNASDAQ:MQ

Put it on your watch list, and enjoy this perfect opportunity.

Possible Scenario: LONG

Evidence: Price Action, Bullish Divergence, Dark pool activity, Options flow.

Entry point: current price, it can drop more but not important.

TP1: 30.5$

TP2: 32.5

TP3: 34.5

I expect it hit ATH very soon.

Call options, Strike 32.5$, 11/19/2021, after hour it dropped another 5%, it means call options should be cheaper tomorrow morning, and return at 29$ could be 100% and at TP2, 200% and at TP3 350%

*This is my idea and could be wrong 100%

Marqeta $MQ is accumulating

$MQ is accumulating between $8.40 and $12.43. It is still sideway not ready to buy but once It breaks $12.43 and stay above, It will be ready to get in. set your alarms...

Marqeta provides tools that allow its customers to create and issue customized payment cards that are specifically designed for their business needs.

Marqeta is disrupting a large and growing market. Purchase volume on U.S. payment cards was $7.97 trillion in 2020 and expected to grow to $12.86 trillion by 2025. Marqeta's total processing volume of $111.1 billion in 2021 is a small fraction of the market.

Marqeta has a win-win business model. Using Marqeta's tools, a customer earns interchange fees and delivers a better experience to its own customers. Utilizing Marqeta's tools is more of an opportunity than a cost.

Marqeta's tools are delivered via open, well-documented APIs. Vetted customers can create a card program and begin issuing cards rapidly, which should lead to rapid adoption of Marqeta's tools and growth in Marqeta's total processing volume.

MQ raised guidanceSaaS, high growth, fintech, what's not to like. Of course it's a "story stock" currently with customers like Affirm, DoorDash, Instacart, Klarna, and Square. Also they provide card services to crypto companies like Coinbase and various "rewards" cards like Fold or Bakkt.

They just released a small SEC filing saying they plan to beat guidance next month.

I'll be paying close attention to this.

$MQ swing trade*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

Recap: Marqeta $MQ has developed a card issuing platform that provides clients such as Coinbase, Doordash, and Square with the infrastructure and tools necessary to offer payment options without the involvement of a traditional bank. $MQ generates the majority of its revenue through transaction fees for cards issued on its platform.

My team took advantage of todays dip and purchased $MQ shares at $14.25 per share. Our first take profit is $17.50.

FIRST ENTRY: $14.25

TAKE PROFIT 1: $17.50

TAKE PROFIT 2: $19.50

If you want to see more, please like and follow us @SimplyShowMeTheMoney

$MQ we've hit our first take profit*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

My team entered $MQ on November 9, 2021 at $26.5 per share where we set $30 as our first take profit. We quickly hit this take profit when $MQ hit its high for the day in the morning at $30.28. Things however took a turn for the worst when a parent company began slowly unloading shares throughout the trading-session. Shorts took advantage and had a field day. These factors are what lead up to $MQ closing red today at $23.75.

Tomorrow should be very interesting for $MQ. Pre-IPO shareholders will be able to sell their shares due to Marqeta's lock-up period expiring after today. We however have no reason to believe that shareholders will sell their shares due to $MQ being under its IPO price. It just wouldn't make any sense. Especially considering the companies spectacular 3rd quarter earnings beat from yesterday where they reported a net revenue of $132 million.

My team made a gain of 13% from the shares we sold this morning at $30. Going forward we will continue to observe $MQ for additional buying opportunities.

Congrats to those of you who took this trade with us.

FIRST ENTRY: $26.5

TAKE PROFIT 1 (HIT): $30

TAKE PROFIT 2: $33.5

If you want to see more, please like and follow us @SimplyShowMeTheMoney

$MQ the future of finance*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

For the last couple of weeks my team has been analyzing digital finance company Marqeta $MQ. $MQ has developed a card issuing platform that provides clients such as Coinbase, Doordash, and Square with the infrastructure and tools necessary to offer payment options without the involvement of a traditional bank. $MQ generates the majority of its revenue through transaction fees for cards issued on its platform.

On August 11, 2021 $MQ released its earnings for the second quarter ending June 30, 2021. In this earnings report $MQ showed a 76% percent jump in net revenue driven by customer growth. $MQ also reported a net revenue of $122 million. $MQ however responded to this earnings beat by downtrading for the next couple of weeks. Before this report was released we must acknowledge the fact that $MQ was trading in an uptrend prior to the actual report. Many traders believe that stocks up-trending days/weeks into earnings are more likely to experience profit-taking unless the report is extraordinarily good. $MQ has however been downtrading since October 27, 2021 after reaching a new all-time high of $37.82.

Earnings for the 3rd quarter ending September 30, 2021 will be announced on November 10, 2021 post-market. $MQ is projecting a net revenue of $114 - $119 million. My team believes that this is a rather conservative projection.

You never know how the market will respond to good news or bad news. My team will look for further buying opportunities if $MQ falls post-earnings...this is a long term trade.

Lets get it!

My team entered $MQ today at $26.5 per share and have set our first take profit to $30.

FIRST ENTRY: $26.5

TAKE PROFIT 1: $30

TAKE PROFIT 2: $33.5

If you want to see more, please like and follow us @SimplyShowMeTheMoney

Go to the ATH!A consolidation above the 30 level is a return to the exit price and a further long scenario. But here it is possible stand, unloading, by indicators too much growth. But this is not always an indicator, if there is a buyer, he will chase it.

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated!❤️

💎 Want us to help you become a better Stock trader?

Now, It's your turn!

Be sure to leave a comment let us know how do you see this opportunity and forecast.