Long-term Potential in Crypto Strategy: Go Long on MICROSTRATEGY

- Key Insights: MicroStrategy is facing bearish momentum amid broader tech stock

pressures, but its strategic involvement in cryptocurrency offers a

potential hedge. Trading below major moving averages, it shows resilience

tied to its Bitcoin investments. Key support is seen at $230 and resistance

around $300, crucial for potential recovery as market sentiment stabilizes.

- Price Targets: Based on professional traders' insights:

- Next week targets: T1=$300, T2=$310

- Stop levels: S1=$225, S2=$215

- Recent Performance: Recently, MSTR exhibits a downward trend, trading below

50-day and 200-day moving averages. It reflects pressures from declining

tech and crypto markets, yet maintains resilience due to its strategic

crypto participation.

- Expert Analysis: Analysts recognize MSTR's bearish trend with the potential

for support at $230. However, its alignment with the crypto sector could

buffer against market declines. The trajectory around moving averages

remains critical for forecasting future movements.

- News Impact: With the issuance of 3.6 million shares for $1.2 billion to

acquire more Bitcoin, MicroStrategy amplifies its crypto exposure. This bold

stance underscores its commitment to digital assets amid uncertain market

conditions, potentially providing long-term gains despite short-term

volatility risks.

MSTR trade ideas

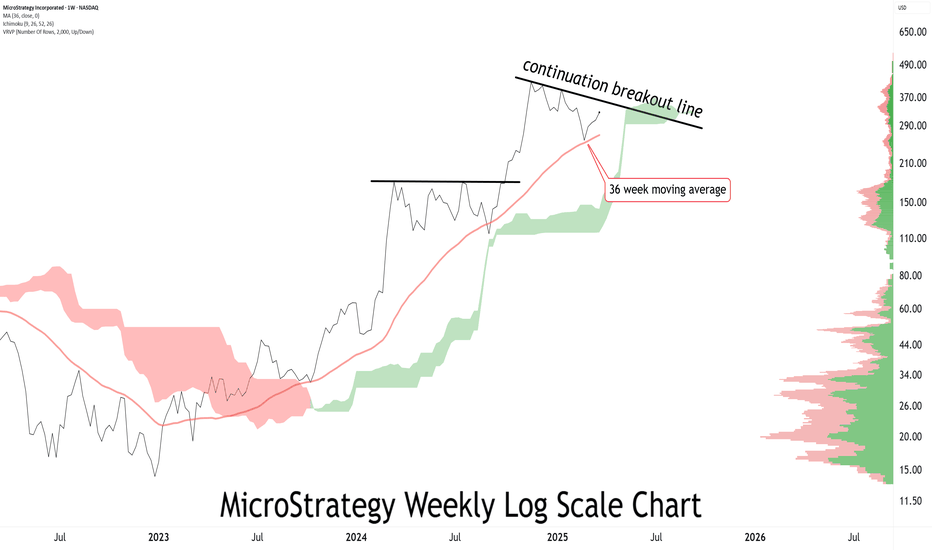

MSTR: Mid-term and Macro Price Structure As price holds below $344, odds favor a continuation lower to retest February lows, with later potential bounce and one more push to macro-support levels: 160/150-120 (with a potential extension to 105)

(see. recent idea on BTC price structure)

If BTC and broad market indexes show signs of stabilization and short-term strength over the coming weeks with MSTR price rising above 344, the odds are shifting to a more pronounce bounce to 400-460 resistance levels.

Weekly chart:

From a macro perspective:

as long as price remains below the 460 level, I consider the bullish trend since 2008 lows to have topped in November 2024, with current price action unfolding as part of a larger corrective Wave c.4 structure. Otherwise, If price reclaims ATH the door opens for an extension to 780-1280 resistance levels.

Monthly chart

Recent idea on BTC:

StrategySo they want you to sell your Strategy, because some idiot thinks he knows better than Saylor, when it was Saylor who fought for the accounting principals that allow corporations to own BTC on their books, and now almost 100 other corporations are playing catch-up. When BtC miners are buying BTC on the open market, all this does is confirm that Saylor is correct, and Bitcoin is no longer for sale.

Soon, you’re going to find out what happens to the BTC price as liquidity dries up, as everyone, including governments, go diamond hands.

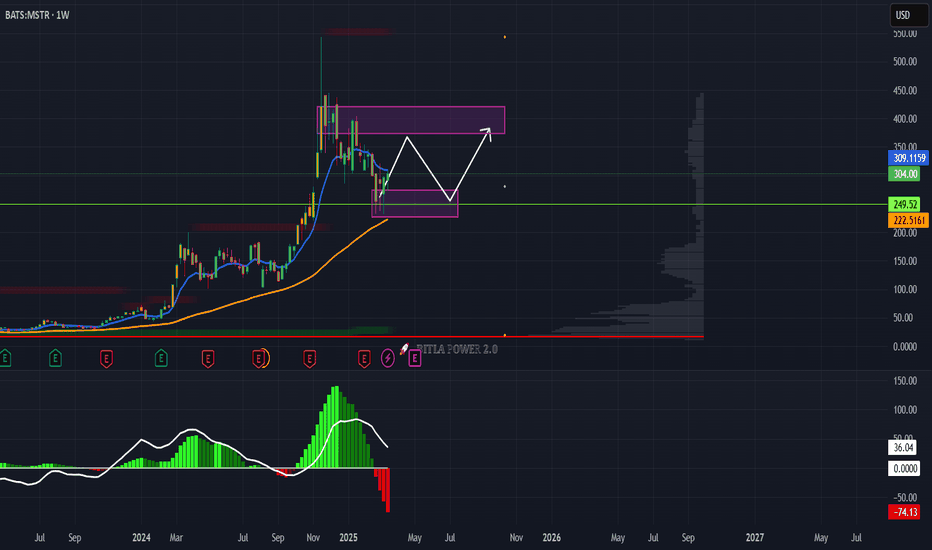

MSTR Ready for Breakout or Bull Trap? Here’s the Key Levels.Market Structure & Price Action

MSTR has recently formed multiple Break of Structure (BOS) and Change of Character (CHoCH) signals, suggesting a power struggle between bulls and bears. The chart currently shows price climbing into a descending trendline and pressing right up against key resistance near the $307 zone after rejecting the CHoCH zone from below.

* BOS confirms bullish intent, but it's climbing within a falling wedge, creating a potential breakout setup.

* Support held strong at $272 and $281, forming a higher low structure with growing bullish momentum.

Trendlines

* The falling wedge pattern is a bullish reversal pattern. Price is nearing the apex—expect volatility and potential breakout in either direction.

* A breakout above $307 with strong volume could trigger a squeeze toward $320–$344.

* Breakdown below the rising trendline near $297 could invite downside liquidity grabs.

Indicators Analysis

* MACD is showing bullish cross momentum, but it’s flattening—momentum is not strong yet.

* Stoch RSI is approaching the overbought zone, indicating a short-term pullback could occur before a true breakout.

Key Levels

* Support: $297 / $281 / $272

* Resistance: $307 / $320 / $344

* Reversal Zone: $272–$281 demand zone still valid if price drops.

Options GEX Sentiment

* GEX Walls are stacked around $325 and $344, signaling heavy call positioning—possible magnet if momentum confirms.

* IVR: 25.7 (low but rising)

* Call%: 42.6%

* IVx vs Avg IVx: +9.23% suggests bullish bets are heating up.

* GEX: Green across the board — bullish gamma tilt.

This GEX alignment suggests a call-dominant environment, especially above $307, increasing the probability of a gamma squeeze toward $320+ if bulls sustain pressure.

Trade Ideas

* Bullish Scenario: Long above $307 breakout with volume. Targets: $320, $344.

* Bearish Scenario: Short below $297 breakdown or wick rejection at $307. Targets: $281 / $272.

Conclusion

MSTR is coiling at resistance with bullish signals building. If it breaks $307 with volume, there’s room for a sharp move higher supported by strong call walls and GEX. However, fading momentum or a fakeout at this level can lead to a pullback to $281 or lower.

📌 Watch the volume and MACD for confirmation before entering either side.

Disclaimer: This analysis is for educational purposes only. Not financial advice. Always do your own research and manage risk accordingly.

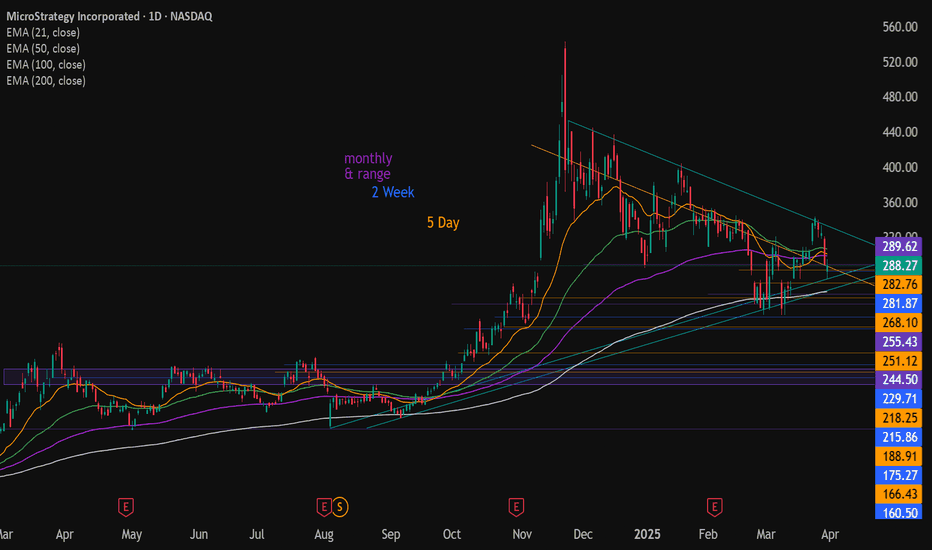

monthly and 2week @255.43 i doubt MicroStrategy will be able to hang on when all other crypto and stocks are breaking structure. the yellow trendline is the most touches i could get. all trendlines are on daily.

just broke below 100ema today. look where 200ema is. ???

since its going2b that kinda party, imma gonna stick my dikc in the mashpotatos~

MicroStrategy's Breakdown Looms: A Warning for BTC Bulls? Despite MicroStrategy's latest Bitcoin accumulation and bullish US crypto policy shifts, price action tells a different story that could spell trouble for BTC if key technical levels give way.

📉 MicroStrategy's Struggle: Bullish Accumulation vs Bearish Structure

MicroStrategy (MSTR) ended Q1 2025 with a deeply concerning price structure that signals the bulls are losing momentum despite an environment rich with crypto-positive headlines. From regulatory optimism to corporate adoption and even MicroStrategy's own record-breaking Bitcoin accumulation, the narrative seems bullish on the surface.

Between March 17 and March 23, MicroStrategy purchased an additional 6,911 BTC for $584.1 million, bringing its total Bitcoin holdings to over 500,000 BTC, valued at roughly $44 billion. Yet, instead of rallying, the stock plunged over 10% on Friday, March 28, closing just above the critical $288.20 support zone—a level highlighted in our March 10 analysis as a make-or-break point.

This divergence between news and price action is precisely why technical structure matters more than headlines. As MSTR continues to mirror Bitcoin's moves, failing to hold $288.20 could trigger a cascade of selling that reaches beyond equities and into the crypto market itself.

📊 Technical Setup: The Last Stand at $288.20

On the daily chart, a symmetrical triangle has formed, tightening price action and pointing toward an imminent breakout or breakdown. For now, pressure is building to the downside.

Failed breakout attempt at $342.97 confirms short-term weakness

Critical support: $288.20 (three-month major level)

Immediate downside targets: $264 → $248

Bearish continuation targets: $208 → $168 → $135

To avoid this bearish progression, bulls must defend $288.20 with conviction. If they can reclaim and hold above $327, it may revive short-term optimism and re-establish the recovery narrative.

But the longer the price stalls below $300, the more vulnerable MicroStrategy—and, by extension, Bitcoin—becomes.

🔗 The MSTR–Bitcoin Connection: Deeply Intertwined

The relationship between MicroStrategy and Bitcoin is unlike any other corporate-stock pairing in modern finance. With over half a million BTC on its balance sheet, MSTR doesn't just reflect Bitcoin's value—it amplifies it, functioning like a leveraged BTC ETF in the eyes of the market.

This is why Bitcoin's rejection at $87,355 last week happened almost in lockstep with MSTR's price failure at $342.97.

BTC bounced from $78,540 to $87,355, only to reverse.

As of writing, Bitcoin trades at around $82,194 after testing key support at $81,934.

Just like MSTR, Bitcoin is sitting on fragile ground.

📉 Bitcoin Levels to Watch:

Support: $81,934 (short-term) → $78,540 (major)

Breakdown zone: Below $78,540 → opens the path to $71,974

Upside trigger: Reclaim $87,355 → could push toward $91,000

The concern now is whether the bulls can sustain this support, or it's only a matter of time before Bitcoin follows MicroStrategy lower.

🧾 Fundamental Forces: Optimism vs. Reality

This pullback is happening despite favourable macro and crypto-specific developments, adding another caution layer.

✅ Positive Developments:

MicroStrategy's aggressive BTC accumulation

US administration signalling support for crypto reserves

Corporate adoption stories (GameStop exploring Bitcoin, growing ETF inflows)

🚨 But Price Action Isn't Responding:

Risk markets are stalling, with equities pausing near highs

Yields remain sticky, providing no support for risk-off demand in Bitcoin

The Dollar (DXY) remains in a fragile position, yet BTC hasn't capitalized on it

As we've said before: "What you need to know is usually revealed on the chart—before the news." This disconnect between headlines and price is a red flag.

🔄 Scenarios to Watch: Rebound or Breakdown?

📉 Bearish Scenario:

MSTR loses $288.20, BTC loses $81,934

Price accelerates to $264 for MSTR and $78,540 for BTC

Breakdown opens the door to deeper selloffs: $135 for MSTR, $71,974 for BTC

📈 Bullish Scenario:

MSTR reclaims $327, BTC reclaims $87,355

Momentum could rebuild toward $342.97 and $91,000, respectively

Macro tailwinds, such as Fed clarity or risk rally, would be required to sustain it

⚠️ Final Thoughts: Bulls Are Running Out of Room

While MicroStrategy's aggressive Bitcoin strategy has made it a flagship of corporate crypto adoption, the market doesn't trade headlines—it trades structure. And right now, that structure is deteriorating.

Unless bulls step in to defend $288.20 for MSTR and $81,934 for BTC, the risk of a breakdown grows sharply. Bitcoin and MicroStrategy may continue to move together, but if one fails, the other is unlikely to stand alone.

3/27/2025 MSTR_BearishHi traders,

There’s a high probability that MSTR will move lower from here. Friday’s session will determine its direction, as the weekly candle is forming a shooting star, but getting in early isn’t a bad idea.

The BTC chart also looks bearish— the 0.618 Fib level from the previous high and low has been acting as resistance for several days. We need to watch if the 50 SMA will hold as support, but I don’t think it will, given my bearish outlook on SPY.

My target is 250 area, 200SMA will act as support.

May the trend be with you.

AP

MSTR is a ticking time bomb.....down downMSTR is up almost 50% from 2 weeks ago. There is very little upside at the moment, and short term investors are itching to cash out asap! Great time to get into MSTZ (inverse) before this pops ahead of next weeks new round of tariffs that will depress stocks and crypto even more.

Best of luck and always do your own due diligence!

Assortment of OTM MSTR Puts

MSTR is filling my alerts for the optimal short zone mentioned previously.

I've explained the various macro bear trend setups in MSTR previously. For some additional stuff;

Generally a correction will be two legs. When it's not, there's usually at least 4. 3 corrective legs is rarer. Breaking under might have been a bear break.

If it was, a retracement is always fair game but now we're into the zone this can be faded.

Selling calls into the rally and buying an assortment of deep OTM puts on MSTR

Put $210.00 - Last: $1.22, Bid: $1.07, Ask: $1.21, Vol: 44.0, IV: 115.0%, OTM

Put $205.00 - Last: $1.09, Bid: $0.98, Ask: $1.12, Vol: 53.0, IV: 118.4%, OTM

Put $215.00 - Last: $1.27, Bid: $1.16, Ask: $1.34, Vol: 33.0, IV: 111.9%, OTM

Put $200.00 - Last: $1.00, Bid: $0.90, Ask: $1.04, Vol: 123.0, IV: 121.8%, OTM

Put $220.00 - Last: $1.40, Bid: $1.28, Ask: $1.40, Vol: 22.0, IV: 108.3%, OTM

MicroStrategy To $370?Hello friends! I'm back with an analysis of MSTR. As we can see, the price had a significant drop of 57% from November 2024 to March 2025. The price is highly correlated with Bitcoin, and said cryptocurrency is in a wave 4 within an Elliott wave pattern. Therefore, Bitcoin will be returning to test $110,000. Therefore, MSTR, holding 499,096 bitcoins, will see a very significant rise in its price. In the short term, MSTR will be going to test its luck at $370 per share. However, it is highly likely that it could return to $410 per share. MSTR has many technical and fundamental indicators in its favor to be a highly profitable value asset. The best buying zones are below $300 per share.

Disclaimer: This is only an opinion; it should not be used as investment advice or recommendation.