Momentum Burst Setup?Is this a good example of a momentum burst set up?

The price has made a 4% move today where I have made the buy.

The preceding 3 days have been small range days and in all 3 sessions the market closed below the open i.e. down days.

There has been an orderly consolidation with price moving sideways after an impulse move from 17.90s area.

Today's move is the first move outside of the consolidation.

Expectation: today is the first range expansion day of the momentum impulse move. Expectation is for 3-5 day follow up and an 8-20% move.

To monitor and see how the trade unfolds.

MYGN trade ideas

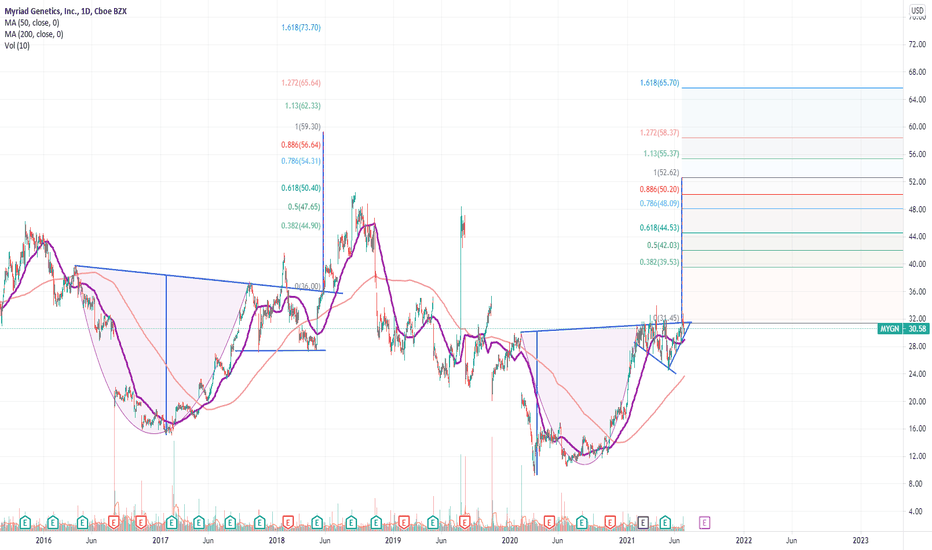

MYGN second cupFound a cup on this volatile stock. Previous cup made it to the 62% mark which is impressive.

Very weird handle. Seems to be in a broadening pattern and then is in an ascending triangle pattern. I would say wait to break cup top which should be soon.

T1: 38% depth at $39.50 and 62% depth at $44.53

MYRIAD GENETICS Chart Hello traders, MYRIAD GENETICS is in a fake bearish configuration with a large buying volume executed and a water carrying candle accompanied by a very strong lower leg. Looking at the TIMEFRAME M1 we see a marubozu with a large negotiated purchase volume, it goes towards the base of the bollinger for a new test. Then go to the highest to arrive on the VWAP once check, it go to the top of the range and test it. There is a good chance of breaking the price with the present momentum, then the zone to reach the second. And put on the high which comes to carry out the test of the bullish channel, before the check of the second range followed the breakout of this one with symbolic figure of 31.00.

Please LIKE & FOLLOW, thank you!

MYGN TankI thought about it and didn't publish this because my earnings plays for today didn't play out like it should have. CENT and USX both lost money but apparently "beat estimates", which is hilarious when the estimate is a loss. You'd think they were tech companies or something. At least CENT went down after a short squeeze rally, and we nailed XYL. In the end I came out even which is pretty lame.

In any case, this is the way it's supposed to work.... sorry I didn't post this one, but it's a complete crap shoot. Really pisses me off that CENT and USX didn't work out as planned, I knew they were both going to lose money. I guess so did everyone else.

Risk Reward, Plenty of Potential vs ProblemsMYGN has been a player for a while, large company, with actual earnings, however litigation and companies are generally a bad thing. "healthy" enough of a chart for me to participate, but I will not have much patience to the downside, stop in place.

**Long this last collapse, limited in size... confidence is enough to buy, not enough to bet the farm

Looking for a Nice Rebound to 31I think this stock will recover some of it's losses, regardless of the outcome of the potential FDA restrictions on drug suggestions. The stock has a solid business model and the company has said they are seeing increased demand. This new fields of genetics testing still needs to establish itself in the healthcare payer ecosystem, which presents some risk, but all in all I think the fundamentals are sound, making this a buying opportunity.

MYGN aggressive sell at right shoulder...MYGN is setting up a long term H&S. An aggressive sell option is triggering today on the close below the old pivot low with the stop past the head. H&S will not trigger until a break of the neckline near $27. Aggressive right shoulder buy and sell's fail, but the greatly increased risk/reward can help offset.

MYGN in a Tight Flag Pattern ?MYGN Price broke out from 2 1/2 months of a base formation. A price gap of nearly 10% with very high volume occurred as a result of better-than-expected earnings. Unfortunately, we shouldn't expect the Tight Flag pattern to be powerful, since it is coming out of a base formation pattern, and not a powerful uptrend, but there should be enough upside potential to make some money.

MYGN - Flag formation Momentum long from $18 or higher MYGN is another nice Flag formation with beautiful moneyflow accumulation. Anything close to $18 would be a good entry point or break of current label

* Trade Criteria *

Date First Found- February 19, 2017

Pattern/Why- Flag formation

Entry Target Criteria- Near $18 or Break of $18.67

Exit Target Criteria- Momentum

Stop Loss Criteria- $16.83

Please check back for Trade updates. (Note: Trade update is little delayed here.)

Price breakout last week above the US$17.40 level.As the price is revisiting the US$18.76 resistance, we may expect a short term pullback.

However, overall trend can be considered as positive. We may look for opportunity around the US$17-US$18 levels for accumulation.

Target: US$21.40-22.40, US$26.15-US$28.58.

Support: US$16.47

MYGN Earnings Oversold PlayMYGN took a beating after it's guidance underwhelm last quarter.

I do believe that the reaction was overdone.

MYGN has healthy revenue streams and growing drug and generics demand.

TA confirms a re-entering into trading range of:

PT 1: $25.00 for a ~20%+ return.

PT 2: $30.00 for a 50% return.