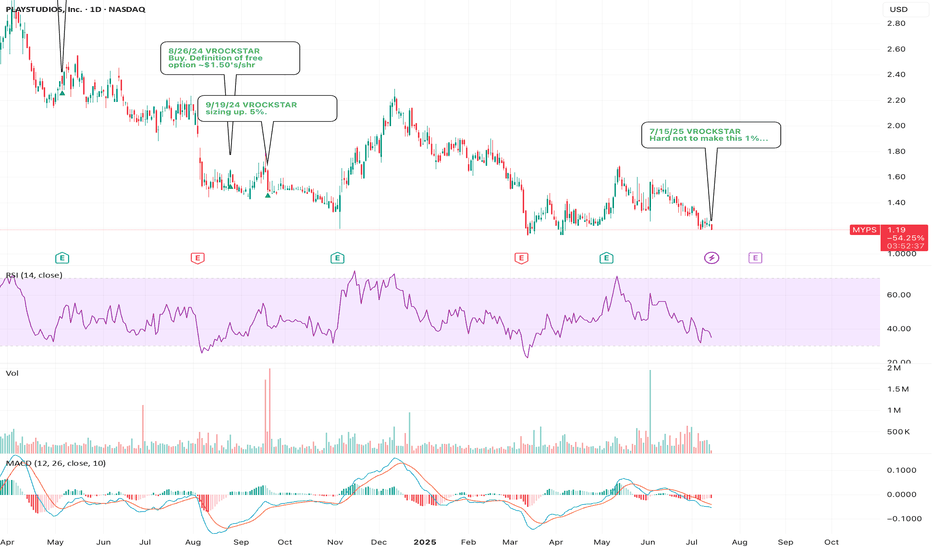

7/15/25 - $myps - Hard not to make this 1%...7/15/25 :: VROCKSTAR :: NASDAQ:MYPS

Hard not to make this 1%...

- i'll probably remind everyone to take it ez on this old man this week, i'm not supposed to be watching mkts, but here i am... at least keeping an eye out on my "price alerts"

- this is an old-friend name i've written about before

- at this price... $50 mm cap, founder-style social casino game transitioning into sweeps... cash generative, huge cash balance... if you're buying some of these yolo r-word names like NASDAQ:PLTR , $sym... i could go on and on... well NGMI

- you gotta think differently when all the apes ooohh ooohh and ahh ahh. you can't outperform by doing what everyone else is doing, unless you accurately use leverage. and if you're just using leverage on names that everyone else owns... well. FAFO. you'll see. take it from a guy who has paid for this tuition a few times.

- well lmk if u guys have an opinion here

- i'll dig in a bit more next week

V

MYPS trade ideas

9/19/24 - $myps - sizing up. 5%.zero change to thesis (so go read the other NASDAQ:MYPS post i did!)

- throw off a ton of cash

- weird micro cap, so it just trades like the wind *pfffff*

- ceo legit

- right niche free gamez in a bad consumer (don't trust the fake numbers, trust your eyes)

- sized up to 5% near $1.51 today

- ton of ammo in my cash rich book to get closer to 10% near low $1.40's (lol this mkt is a bit regarded. i'm still calling BS tbh... check out the long end of the curve... don't be fooled fam... it's okay to ride waves etc, but don't throw out logic, pls)

- what do u think?

V

8/26/24 - $myps - Buy. Definition of free option ~$1.50's/shr8/26/24 :: VROCKSTAR :: NASDAQ:MYPS

Buy. Definition of free option ~$1.50's/shr

- reviewing my green flagged names on a weird day like today when i'm a bit tail between legs but still show up to do the work (consistency and don't let one bad move affect you - size mgmt matters - not my best day, but i've had worse and i will have worse).

- so i came back to this one today. it's been a while since i took a look (May's results) and boy has it gotten even cheaper after less than ideal results in early Aug and sales don't look stellar.

- on paper, this would be a classical value trap. but i think there's more than meets the eye that merits a starter 1% position in my portfolio.

- first and foremost, the cash generation isn't purely stock comp, it's actual cash gen. average is about $10 mm a quarter, but we could argue if it's 5 or 10 mm going forward (in the comments). for a name that's $200 mm enterprise value but $100 mm in net cash =>> so it's a $100 mm value company... that's some pretty great cash flow dynamics. if it's really $40 mm a year cash gen, you're getting NYSE:VIPS style FCF returns without the chinese-style up-yours-delights.

- also the holders list is pretty solid. blackrock, vanguard, capital (was suprised to see my old friends in the cap table), clearbridge too - interesting.

- haven't taken the time to get to know mgmt, or the product so i'll have to reply to this post when i do with an update and would probably substantiate my growing size or remaining small.

- but for a 1% position, this seems like the literal definition of a great option that doesn't expire. these guys bought back $25 mm of stock from what i can see last quarter, the cash gen should substantiate continuing to do this. will need to pay attn to trends but i'd consider it a "long short"... let me get into that bc it's important to how i think:

- "long short" - i need a better phrase. but it's always better to find longs than shorts in a world where the denominator (fiat) continues to inflate. you can make way more money on the upside. unless you're using leverage (dangerous!) e.g. puts, downside on something is 100% max. and you better know what you're doing. ANYWAY, something that i consider a "long short" is something that is a play on a trend that you'd otherwise short but you can go long a vehicle that benefits from the trend going poorly. so this is a "long short" on the economy. they make games. cheap thrills. netflix is somewhat similar. facebook. digital stuff. the own nothing and be happy economy. so the poorer we all become, the less we want to pay 30% tips at the coffee shop. we make coffee at home. we play more games. i don't mean to end this on a sour grapes/ pessimistic note. anyway, a "long short" is just that. i think NASDAQ:MYPS counts in this potential bucket.

- downside should be fairly limited given 1/2 of the capital stack is net cash, they generate cash and trends are not truly awful (but let's be real - they ain't great hence the stonk px action).

- what do you think?

V

5/6/24 - $myps - punting small size long, decent setup5/6/24 - vrockstar - punting long here. Spac's all look like trash, so for s/t that's trading like the rest 1) the lift to sustained bid is defn requiring a great catalyst - and this seems like a decent biz w/ potential benefits of a stay-at-home-things-r-too-expensive-eCONomy and 2) cash gen, not burner, good balance sheet/ clean, "growing" or at least that's the first glance (even if it's sub 10%)... think we could see a 5-10% pop and any dips of similar magnitude would see a dip buyers step in. think R/R is a 2.5:1 here and i'm targeting 2.5-2.6$/shr exit here. not highest conviction play on my part, but it checks enough boxes to take a low size punt long.