NDXT trade ideas

Tracking the correlation/decoupling of BTC & tech stocks🚨🌊🔜👀This idea seems to be continuing on pretty well, showing the "slow" decoupling of BTC and the stock market. Currently the trend has been broken and there seems to be a confirmed retest of the upper trend. A good bounce off this should see the ratio move towards the 0.29 level and a break of that resistance level would signal a strong continuation. This (to me) would be the final signal that BTC has begun (perhaps in a big way) to decouple from the growth/fall rate of the stock market. This may be sparked by retail returning to the market, institutional investors taking a more BTC targeted strategy, or a combination of the two. If this is mostly caused by institutions then I would also be looking to see the "hype news" starting to come out, with headlines such as "Bitcoin will hit $100k" and things like that. As the US market goes into recession, big investors may just look to BTC and other cryptos to meet there profit-making needs. IMO this is how the next "short-term" bull-run may begin.

US Tech Index vs. BitcoinBy charting the growth rates of both the NASDAQ US TECH 100 and Bitcoin, it clearly shows a recent decline against BTC. This decline may also show the recent correlation Bitcoin has had with the NASDAQ, as the closer it gets to 0, the more correlated they are. It has broken an important trend, which is in favor of the growth rate for BTC. IMO this shows the beginning of a decoupling of the two, and the possibility that BTC will begin to grant more returns, even as the NASDAQ declines overall.

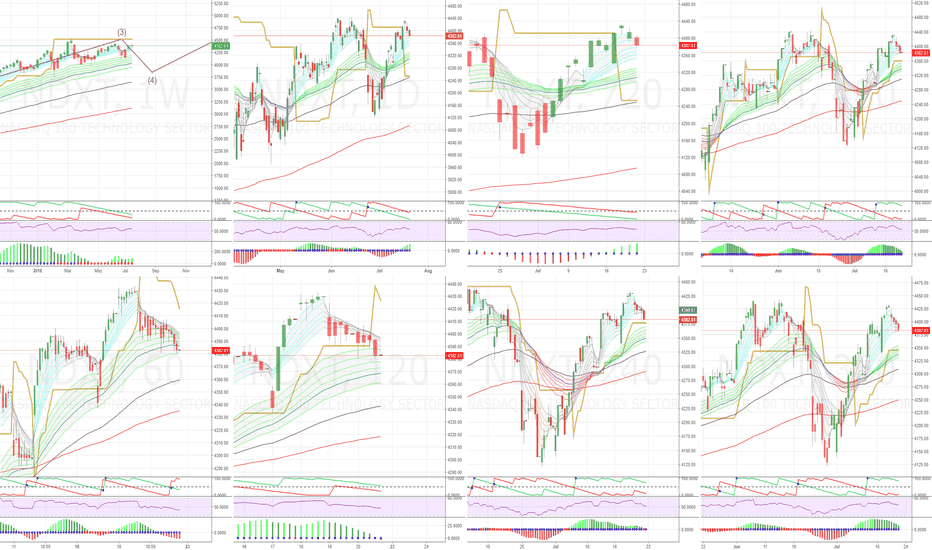

NASDAQ Tech Stocks Tech stocks have taken a hit after a major run up and earnings releases.

As we approach the 200D MA it's a key indicator historically of big price movement. What does this mean for us?

We'll likely see a big dip in tech stocks whereby they correct in order to give way to another price run up.

These movements take course over a significant period of time.

Price trend looks negative right now which indicates the state of the economy and would fall in line with a price movement upwards around economic recovery period starting.

The Tech Sector is Due for a CorrectionAfter explosive growth over the last few years, I think the time has finally come for a larger correction.

Here is why I think so:

1. The main bullish channel has been broken with the selloff that occurred early October and hasn't been able to break through the short term resistance for recovery. We could see another smaller ~10% run if the current support holds, but I don't think there is enough momentum for a breakthrough.

2. The RSI is nearing the correction point relative to the channel it's in.

3. Lastly, the 65 moving average crossed down on the 200 MA, which tells me that we may have topped out.

TL;DR: There may be some more short term upwards movement towards the resistance, however an overall downtrend is likely.

NASDAQ 100 TechI'm using this mainly to see how it influences other stock markets.

I've entered a small position size short on this based partly on experience on the 1H time frame. But that's not where the main action is.

This market tends to influence events in the Indian and Japanese stock markets.