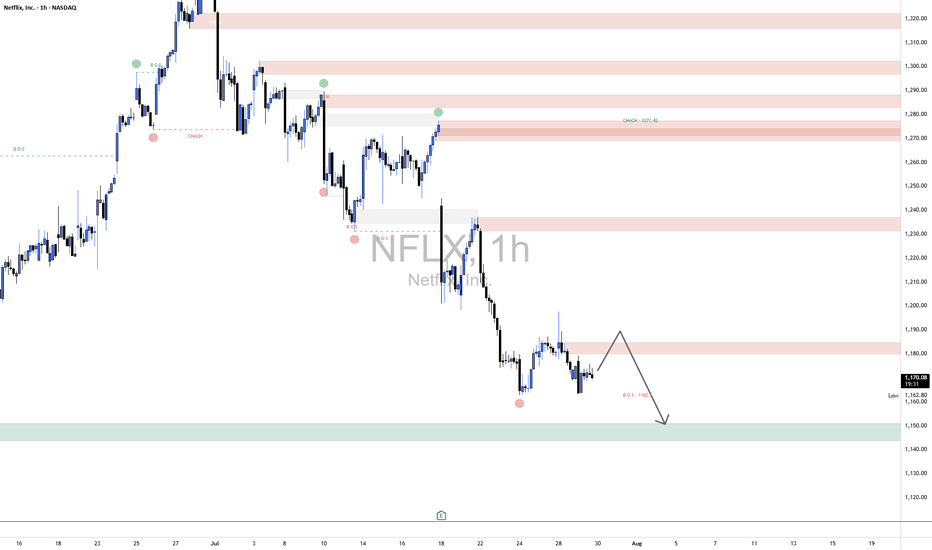

NFLX RANGEIs NFLX aiming the top of the range (1190-1197)? Currently not breaking down below 1162. It's the end of July and things may be getting hot! For the next play :)

Fed Powell speaking at 2/2:30p today. I think it's expected that his words may move the market. We may just range some more. I will asses

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

24.00 USD

8.71 B USD

38.88 B USD

422.15 M

About Netflix, Inc.

Sector

Industry

Website

Headquarters

Los Gatos

Founded

1997

FIGI

BBG000CL9VN6

Netflix, Inc operates as a streaming entertainment service company. The firm provides subscription service streaming movies and television episodes over the Internet and sending DVDs by mail. It operates through the following segments: Domestic Streaming, International Streaming and Domestic DVD. The Domestic Streaming segment derives revenues from monthly membership fees for services consisting of streaming content to its members in the United States. The International Streaming segment includes fees from members outside the United States. The Domestic DVD segment covers revenues from services consisting of DVD-by-mail. The company was founded by Marc Randolph and Wilmot Reed Hastings Jr. on August 29, 1997 and is headquartered in Los Gatos, CA.

Related stocks

Netflix Options Flash Green – $1170 Target in Sight?

## 🚨 NFLX Options Alert: Quiet Volume, Loud Calls 🚨

**Earnings Loom, Institutions Lean Bullish** 💥

🔹 **Models Align:** 4 out of 5 models flash *Moderate Bullish*

🔹 **RSI**: Daily (35.6) cooling off, Weekly (56.1) still rising

🔹 **Call/Put Ratio**: 1.47 → Bullish positioning building

🔹 **VIX**: At

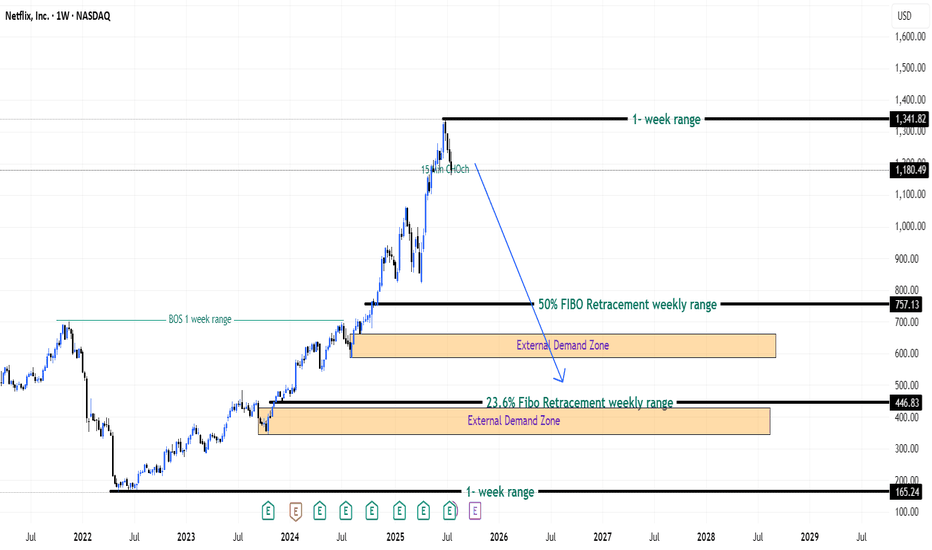

Bulls Quit? Bears Ready! - Netflix Stock (USA) - {27/07/2025}Educational Analysis says that Netflix (USA Stock) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1)

Turning the side for NetflixNetflix NASDAQ:NFLX may go through some serious correction soon after the stock rallied a lot till the high of 1337. Furthermore, the stock has confirmed the head and shoulder reversal with the latest bearish candle rejecting the neckline resistance @ 1188.14. Furthermore, the bearish divergence h

NFLX Short1. Market Structure Overview

The broader market structure has shifted bearish following a Change of Character (CHoCH) around 1277.42, where price broke below a prior higher low, suggesting a possible trend reversal. This was later confirmed by multiple Breaks of Structure (BOS) at lower levels, espe

NFLX Wait For Break Out Fibo Level

## 📈 \ NASDAQ:NFLX WEEKLY TRADE IDEA (AUG 5–9)

**🔥 BULLISH FLOW | CALL/PUT RATIO: 1.84 | CONFIDENCE: 65%**

---

### 🧠 AI-DRIVEN SENTIMENT

* **Weekly RSI**: 54.9 ✅ (Bullish Momentum)

* **Daily RSI**: 38.4 ↗️ (Climbing but still weak)

* **Volume**: 📉 0.7x last week = Low institutional follow-thro

NFLX CRACK!!Classic breakdown move from a rising F flag!

Massive Head and shoulders formed, that head test followed through, taking out stops, and now failing off the top of the channel.

Screaming CAUTION to the bulls!

Nice simple short setup for bears.

Click boost, follow, and subscribe. Let's get to 5,000

NFLX WEEKLY OPTIONS TRADE (07/28/2025)**🎬 NFLX WEEKLY OPTIONS TRADE (07/28/2025) 🎬**

**Institutions Are Buying Calls – Should You?**

---

📈 **Momentum Breakdown:**

* **Daily RSI:** Mixed ➡️ Possible short-term weakness

* **Weekly RSI:** Bullish bias intact ✅

🔥 Overall = **Moderate Bullish** trend confirmed on the **weekly timeframe*

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

NFLX5862368

Netflix, Inc. 5.4% 15-AUG-2054Yield to maturity

5.50%

Maturity date

Aug 15, 2054

NFLX5862367

Netflix, Inc. 4.9% 15-AUG-2034Yield to maturity

4.55%

Maturity date

Aug 15, 2034

NFLX4764899

Netflix, Inc. 4.875% 15-APR-2028Yield to maturity

4.38%

Maturity date

Apr 15, 2028

USU74079AN1

NETFLIX 19/29 REGSYield to maturity

4.24%

Maturity date

Nov 15, 2029

NFLX4901374

Netflix, Inc. 4.875% 15-JUN-2030Yield to maturity

4.03%

Maturity date

Jun 15, 2030

NFLX4826528

Netflix, Inc. 5.875% 15-NOV-2028Yield to maturity

4.00%

Maturity date

Nov 15, 2028

NFLX4908613

Netflix, Inc. 6.375% 15-MAY-2029Yield to maturity

3.90%

Maturity date

May 15, 2029

US64110LAN64

NETFLIX 4.375% CALL 15NV26Yield to maturity

3.88%

Maturity date

Nov 15, 2026

XS198938050

NETFLIX 19/29 144AYield to maturity

3.34%

Maturity date

Nov 15, 2029

XS207282979

NETFLIX INC. 19/30 REGSYield to maturity

2.76%

Maturity date

Jun 15, 2030

XS198938017

NETFLIX 19/29 REGSYield to maturity

2.69%

Maturity date

Nov 15, 2029

See all NFLX bonds

Curated watchlists where NFLX is featured.

Frequently Asked Questions

The current price of NFLX is 1,180.37 USD — it has increased by 2.67% in the past 24 hours. Watch Netflix, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Netflix, Inc. stocks are traded under the ticker NFLX.

NFLX stock has risen by 0.85% compared to the previous week, the month change is a −9.00% fall, over the last year Netflix, Inc. has showed a 91.60% increase.

We've gathered analysts' opinions on Netflix, Inc. future price: according to them, NFLX price has a max estimate of 1,600.00 USD and a min estimate of 833.00 USD. Watch NFLX chart and read a more detailed Netflix, Inc. stock forecast: see what analysts think of Netflix, Inc. and suggest that you do with its stocks.

NFLX reached its all-time high on Jun 30, 2025 with the price of 1,341.15 USD, and its all-time low was 0.35 USD and was reached on Oct 10, 2002. View more price dynamics on NFLX chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NFLX stock is 1.97% volatile and has beta coefficient of 1.24. Track Netflix, Inc. stock price on the chart and check out the list of the most volatile stocks — is Netflix, Inc. there?

Today Netflix, Inc. has the market capitalization of 500.77 B, it has increased by 0.13% over the last week.

Yes, you can track Netflix, Inc. financials in yearly and quarterly reports right on TradingView.

Netflix, Inc. is going to release the next earnings report on Oct 15, 2025. Keep track of upcoming events with our Earnings Calendar.

NFLX earnings for the last quarter are 7.19 USD per share, whereas the estimation was 7.07 USD resulting in a 1.75% surprise. The estimated earnings for the next quarter are 6.93 USD per share. See more details about Netflix, Inc. earnings.

Netflix, Inc. revenue for the last quarter amounts to 11.08 B USD, despite the estimated figure of 11.06 B USD. In the next quarter, revenue is expected to reach 11.52 B USD.

NFLX net income for the last quarter is 3.13 B USD, while the quarter before that showed 2.89 B USD of net income which accounts for 8.13% change. Track more Netflix, Inc. financial stats to get the full picture.

No, NFLX doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 8, 2025, the company has 14 K employees. See our rating of the largest employees — is Netflix, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Netflix, Inc. EBITDA is 27.91 B USD, and current EBITDA margin is 66.68%. See more stats in Netflix, Inc. financial statements.

Like other stocks, NFLX shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Netflix, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Netflix, Inc. technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Netflix, Inc. stock shows the buy signal. See more of Netflix, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.