Nano Nuclear (NNE) –Powering the Future of Clean U.S. Energy 🇺sCompany Snapshot:

Nano Nuclear Energy NASDAQ:NNE is a pioneering U.S.-based microreactor company developing compact, modular nuclear power solutions for defense, medical, and national grid applications.

Key Catalysts:

Nuclear Innovation Meets Energy Independence 🔌

NNE is at the forefront of advanced nuclear tech, supporting America’s push toward energy resilience and decarbonization.

Its microreactors are designed for fast deployment, critical for defense bases, hospitals, and remote power needs.

Strong Market Momentum 📈

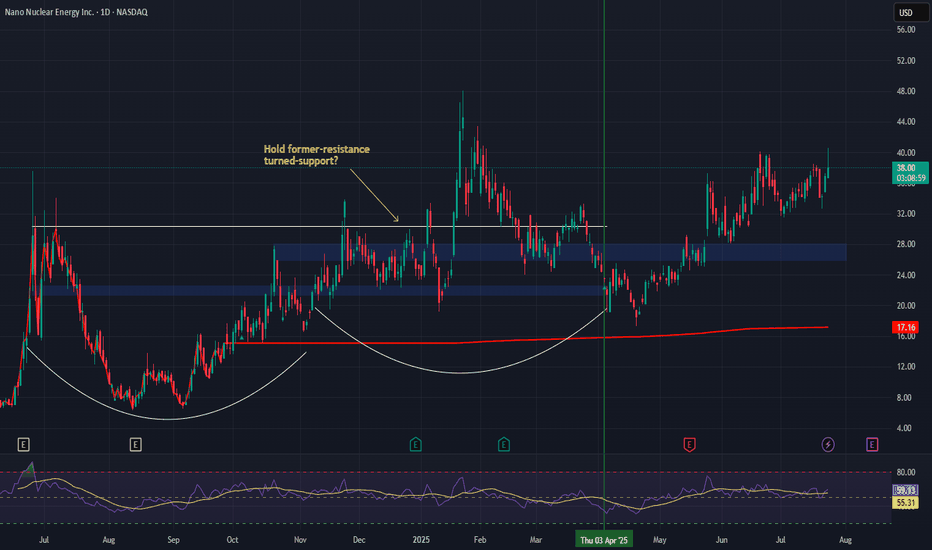

Since our initial entry on April 3rd, NNE has surged 74%, reflecting rising investor interest in nuclear solutions.

After printing a higher high, the stock is pulling back toward a key support zone.

Policy & Investor Tailwinds 📊

U.S. energy policy is increasingly focused on nuclear as a clean base-load source, giving NNE a strategic edge.

Growing institutional attention on microreactors as scalable, next-gen energy infrastructure.

Investment Outlook:

Bullish Entry Zone: $26.00–$27.00

Upside Target: $58.00–$60.00, supported by innovation, policy alignment, and long-term energy demand.

🔆 NNE is shaping up as a high-conviction play on America’s nuclear energy future.

#NNE #NuclearEnergy #Microreactor #CleanEnergy #EnergySecurity #DefenseTech #GridStability #Innovation #GreenEnergy #NextGenPower #EnergyIndependence

NNE trade ideas

$NNE long, price action improving, Reclaiming key AVWAPsNASDAQ:NNE consistently reported good news since the beginning of the year, but price action has been middling at best since the broader risk off sentiment began earlier in the year with tarriff announcements. Speculative names like these were not the go to for playing a bounce and have lagged, but we've started to see related spec names, notably SMR peers NYSE:OKLO and NYSE:SMR get bid higher.

NASDAQ:NNE has recently reclaimed the IPO AVWAP and the September low AVWAP. The broader uptrend remains intact and I would back up the truck around $20... but i don't think we see that price and that a strong bounce towards the January 31 high AVWAP at 30 is imminent. We're bouncing hard at the 20 and 5 day SMA's today and if we can clear the resistance at 30, I think NASDAQ:NNE keeps chugging towards old highs around $40 where I'd want to be out of most of the shares

WedgePrice is 23.36 facing resistance from the 10 EMA(blue)and the 50 EMA(purple), the last fully printed candle is a small body with a longer upper shadow. Price is also consolidating inside a Demand Zone. In addition, the closing prices of the candles have formed an inverse head and shoulders inside a falling wedge. We need a break past the EMAs and Higher Highs and Higher Lows past 25.07 for some good bullish action, if rejection at the EMA's ,we might see fall back to the 20.00 price range or lower.

Nano Nuclear Energy – Pioneering Next-Gen Small Modular ReactorsCompany Overview:

Nano Nuclear Energy NASDAQ:NNE is revolutionizing clean, compact nuclear power with small modular reactors (SMRs), addressing data centers, remote sites, and disaster relief energy needs.

Key Catalysts:

ZEUS Microreactor Development 🚀

Successfully assembled first hardware, marking a key milestone toward commercialization & revenue generation.

Patent-Backed Innovation 🏆

Filed four new patents in February 2025 for its Annular Linear Induction Pump (ALIP).

Strengthens NNE’s edge in molten-salt & liquid-metal reactor technology.

Surging Global Electricity Demand ⚡

Aligns with the growing need for cost-effective, sustainable energy solutions.

Ideal for off-grid, military, and high-demand industrial applications.

Investment Outlook:

✅ Bullish Above: $21.50-$22.00

🚀 Upside Target: $44.00-$47.00

📈 Growth Drivers: Breakthrough SMR tech, patent leadership, and clean energy demand.

🔥 Nano Nuclear – Powering the Future, One Microreactor at a Time. #NNE #NuclearEnergy #CleanTech

The flagGood day please see chart for key level and visual representation of the flag

📌 Hypothetical Strategy

✅ Momentum Entry (Bullish Breakout of Flag):

Condition :Detail

Trigger :Close above $30.50 with bullish candle and volume and clears possible flip zone

Stop Below $29.50

Target 1 $31.50

Target 2 $32.27 (key resistance)

✅ Value Entry (Pullback to 200 EMA / Flag Support):

Condition :Detail

Trigger :Pullback to $29.60–$29.70 (200 EMA zone)

Entry :On bullish candle (engulfing, hammer) and clears possible flip zone

Stop Below $29.40

Target $30.50–$31.50

✅ Bearish Setup (Flag Failure):

Condition :Detail

Entry :If price breaks below $29.40 and breaks strong below 200 EMA

Stop Above $30.00

Target $28.00 → $26.96

🎯 Hypothetical Strategy (Final Rule):

🔥 The best trade is a momentum breakout long if price closes above $30.50 with volume and clears possible flip zone.

Second best = value bounce from 200 EMA ($29.60) and proceeds to clear possible flip zone

Only short if flag fails and $29.40 breaks and proceeds to break below 200 EMA.

Nano Nuclear Energy (NNE) Priced to Buy!📈 Stock Watch: Nano Nuclear Energy (Ticker: NNE) 📉

🛒 Buy Zone Alert: NNE is currently sitting at the bottom of its daily trend pattern. Historically, this zone has been a strong support level, often marking the bottom of short leverage around 24.

📊 Options Market Heating Up:

Rising volatility in options trading suggests that big moves could be on the horizon. Increased activity might indicate that institutional and retail traders are positioning themselves for a potential breakout.

⚠️ Risk vs. Reward: If the trend holds, this could be a solid buy opportunity. As always, manage risk and stay sharp—volatility can swing both ways!

What do you think—buy the dip or wait for confirmation? 💬 Drop your thoughts below!

#NanoNuclearEnergy #NNE #StockMarket #TradingOpportunities #VolatilityAlert #BuyZone

nne thought on possible tradethe demand for power is obvius. i like to se a range with tight narrow candles (day) and of course big volume on breakout day at least like 3 times average. to me selling pressure is fading and its not looking ready yet , but on hour time frame it starting to make moore like a steady pattern with higher lows for me entry day i look at 1 hour to be very tight closing above 10 ema and 21 ema and sl low of day

NNE: Explosive move coming upThings that I like

- Market gapped down 1% due to hot inflation data. NNE had a false breakdown and showed strength by being the first few to recover.

- Decreasing volume on consolidation

- "Long term" resistance turned support.

- Relatively new IPO stock and has potential to multibag. Fibo extension of 0.786 brings us to 52.77, which is 50% upside from here. If I use bull flag pole to measure, its even higher.

- AMEX:NUKZ is the strongest sector across over 60 sectors that I track. See attached excel table in chart. Tailwind behind us.

My trade plan

- I have entered early. Heheeee =) At 32.25, as soon as I saw the false breakdown and power move up in 15mins chart.

- Although I have put in some fibo extension key levels, I'm not expecting myself to TP at those levels. In fact I really like this chart and how IPO stocks can multi-bag. So, I will be looking for opportunities to add instead (Mark Minervini style here). But if there are signs of top, I will take partial profits too.

Nano Nugold I wrote about nuclear in my previous post, so am not gonna give a speech about that. I also wrote that Nano Nucelar was one of the good candidates, but that it is also volatile. Nano nuclear is making Micro reactors, nano reactors and are just firing up under that new energy flow.

I am buying up on this dip, even though i know its risky, but i find all of this with SMR and so on fascinating and it sounds like from what i am reading that this is the future.

The dip is in the whole market, which indicate that its not a mistake from Nano Nuclear. These dips comes from time to time and is a place to buy the stock a little cheaper then usual.

The dip, the fundamentals and the price hitting the bottom of the bullish triangle makes me think of NASDAQ:NNE as a 🚀

NNE is going up again to test new resistant?NNE is moving up to test resistance at 36.8.

NNE bounced off the EMA25 (white line) with a promising volume profile.

You can see the Point of Control (POC)—yellow label—rising with a positive delta (154.55K). Additionally, all spreads at the upper wick show positive data, indicating that sellers could not overpower buyers.

If Monday's opening price is higher than 35 and/or the closing price exceeds 36.8, this stock is likely to rise further to test a higher resistance level.

IMO technically, it's 70% chance to going up again.

Not Much to SayThere is really not much to say. The price has run to fast today to get bthrough without any profit taking.

We don't have much price history and an see 3 waves only. But we see that we have fulfilled each Fibonacci extension so far. Each such rise has been followed by a correction. It may be same now.

1/23/25 - $nne - Fade-U 1011/23/25 :: VROCKSTAR :: NASDAQ:NNE

Fade-U 101

- no revenue

- inferior meme

- taking you to the ol' school. fade u(niversity)

- here's the lesson "investing is 90% about risk management and risk management is 90% about not losing money and investing in companies with no discernible way of generating a return in the next several years are... called, hope, dreams, then tears and apologizes."

- so don't be the guy writing that letter to your wife's boyfriend asking for more 0dte funds.

- class is dismissed

V

Bullish form in NNE NASDAQ:NNE shows several bullish signs that indicate a strong potential for an upward move.

1) An ascending triangle form and cup and handle form.

2) Reaching the bottom of an ascending channel + 50 SMA is used as a support.

3) Bear gap at $28.6 that may be closed quickly, considering the fact that NASDAQ:NNE tends to have no gaps at all.

In general, NASDAQ:NNE looks very attractive with a great bullish potential.

Mid-week check-in - 11/27/2024NASDAQ:NNE is reporting earnings today and I have a large long position. It could go either way. Also have NASDAQ:LX and NASDAQ:API working out beautifully, but concerned about the market being extended short term, so I did some risk management tactics on some of the weaker movers in my portfolio. It always happens that when I have 1) a generally extended market short term, 2) large unrealized profits and 3) being highly invested, in this case over 100%, that the market corrects sharply and I lose a ton of money. I want to avoid that now, just learning from my mistakes. If we pull back (and I think there is a high probability of that happening in the next few days), I will still lose a lot, but at least my risk is more managed than if I just blindly let my stocks run "because they didn't trigger my sell signal yet" -> that's what I would have said 6 months ago.

On my large account yesterday I put half of my entire account in a treasury ETF ( LSE:AGGG ) to hedge because it seems like the macro environment shifted and bonds are back in play. I'm guessing this because of the news + all my commodities/energy names selling off. So far it's working well, will see if the market continues to agree with my idea going forward.