$OKTA Gen AI tailwinds are not materializing as of now!- I'm a seller of NASDAQ:OKTA at $124 . Company was undervalued at 70s but has run so much without tangible materializing Gen AI tailwinds.

- Theoretically, Agentic AI should have been a great tailwind for SSO but it appears that industry is not yet focussed on security aspect of it when it comes to agentic AI.

- Even on application level, companies are struggling with developing orchestration framework and deploying them at Scale.

- Risk/Reward is not suitable for me to stay long. Short or Avoid/sell $OKTA.

- I might change my mind if they prove themselves today May 27, 2025.

OKTA trade ideas

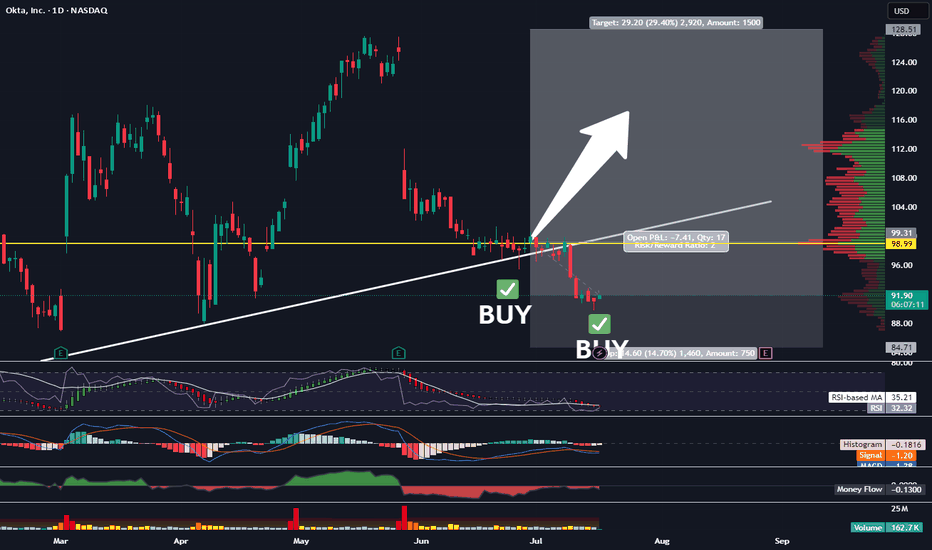

Picked Up More OKTATraders,

We’re nailing it in the stock division. Our portfolio has gained nearly 30% since the inception of our new indicator in Sept. of last year. And we’ve done that with 50% of our cash on the sidelines nearly the entire time, further reducing risk. It is amazing how I stumbled upon this new trade strategy purely by accident. Not by following anyone else on Youtube or TradingView or X. But simply by doing what I love to do and spotting trends and patterns. The combo of the indicators I have been utilizing is truly working, outbesting SPY hodl’ers by 3-to-1 since implementation.

At times, my indicator gives us more than one signal. This usually indicates that the move up will be stronger and more aggressive than previously indicated. Such is the case with our OKTA entry. We’ve got another BUY signal that has been given, and so, I am DCA’ing in. The target and SL will remain the same as our previous entry. All data can be found on the tracker.

Best,

Stew

Long OKTA To 128.50 For Nearly 30% PP. 1:2 RRR.Good Afternoon Trading Fam,

We are nailing it with our stock trades since implementing my new liquidity indicator. I've got another buy signal given here on OKTA with a 1:2 rrr ratio and potential profit of nearly 30%.

On the technical side, you can see that we are just above a large liquidity block where buyers have stepped in en masse in the past. Additionally, we have nice support being offered by our trendline. And finally, we have a large gap which often acts as a magnet and will most likely be filled sooner rather than later. The MACD has just crossed up, and our RSI is doing the same near oversold territory. All of these indications make this an easy choice for me, with an excellent opportunity to profit yet again.

More details on this trade and all of the others can be seen on my public portfolio, as always.

Best,

Stew

OKTA Trade Analysis | Technical Swing Setup with ~9% UpsideEntry: $104.43

Target: $114.76

Stop: $100.90

Risk/Reward: 2.93

This swing trade in OKTA was initiated following a pullback to key technical support levels. Price action has stabilized near the top of the Ichimoku cloud (Senkou Span A), which aligns with the daily Pivot Point around $100.58. The bullish cloud structure remains intact, and the Kijun-sen is flat—both signs that the broader trend is still constructive.

While the MACD histogram is negative, the deceleration in selling pressure suggests potential for momentum to reverse. Previous setups with similar MACD behavior in April led to a strong move higher. The target aligns with R1 resistance at $112.71, giving the trade a clearly defined technical ceiling. Candlestick action over the past few days has shown lower wicks and rejection of downside, pointing to early signs of buyer interest.

This is a trend-continuation setup with a tight stop below the cloud. If price closes under $100.90, the trade will be exited to manage risk. Until then, the structure supports a move higher. This trade follows a strict risk/reward framework and fits within a broader strategy focused on technical precision and disciplined execution.

OKTA - DAY TRADE IDEAOKTA is setting up for a day trade scalp long...perhaps an aggressive swing trade as well. The day trade is a much higher probability of success around the $98.50-$99.30

Okta's stock has seen some volatility recently. After a strong rally earlier this year, it pulled back following cautious guidance from the company. Despite beating expectations on sales and earnings for Q1 fiscal 2026, investors were concerned about slowing growth, leading to a 14.6% drop in its stock price.

Okta reported $688 million in revenue, a 12% year-over-year increase, and positive free cash flow of $238 million, but its GAAP earnings were significantly lower than its adjusted earnings. The company maintained its full-year revenue forecast of $2.85 billion to $2.86 billion, reflecting 9% to 10% growth, but analysts tempered their optimism due to macroeconomic uncertainties.

Technicals

- Multiyear Support

- 50 % Fib Retrace

- Upsloping Trendline

- Positive Divergence building on 1/ 4 hour chart.

$OKTANASDAQ:OKTA reports earnings post-market tomorrow.

📉 Expecting intraday pressure down to the $118 zone.

➡️ Potential continuation toward $112 over the next two weeks.

🛑 Watching for support to form between $110 – $112.

30-minute chart attached for context.

#Stocks #Trading #OKTA #Earnings #TechnicalAnalysis

$OKTA is ready to RIP! 58% UpsideNASDAQ:OKTA was a big name I was talking about end of last year before we took a big dip in the markets...well we are back at the CupnHandle breakout level now and this trade looks ready to RIP!

Warning earnings on May 27th!

- Looking for a close on Friday above the breakout level for an entry here

- Green H5_L inidcator

- CupnHandle breakout

- Volume shelf launch

- Bullish Wr%

$139 First target

Measured Move is $186 for the cupnhandle

Not financial advice

Okta: Strong In a Weak Market?Okta has been quietly fighting higher, and some traders may see opportunity in its latest pullback.

The first pattern on today’s chart is the series of higher weekly lows since November. That contrasts sharply with the S&P 500 and Nasdaq-100, which have made lower weekly lows.

Second, the 50-day simple moving average (SMA) began the year by rising above the 100-day SMA. A “golden cross” above the 200-day SMA followed in February. The next month, the 100-day SMA rose above the 200-day SMA. That sequence, with the faster SMAs above the slower ones, may reflect a positive long-term trend. (See the circles.)

Speaking of the 100-day SMA, OKTA is trying to hold that line this week.

Finally, bullish price gaps following the last two quarterly reports may reflect improved fundamental sentiment in the cybersecurity company.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Stock Of The Day / 03.04.25 / OKTA03.04.2025 / NASDAQ:OKTA #OKTA

Fundamentals. Earnings report exceeded expectations.

Technical analysis.

Daily chart: Uptrend, update of the previous high.

Premarket: Gap Up on increased volume.

Trading session: The price has been trading in a wide range of 101.50 - 104.50 for a long time after the initial impulse at the opening of the session. Volumes for buying appeared after 2:00 p.m. and the price confidently broke the high of the day 104.50. We are considering a long trade in case a retest and holding the price above the level.

Trading scenario: #breakout of level 104.50

Entry: 105.13 when exiting upwards from the range above the level 104.50

Stop: 104.38 we hide it behind the level 104.50 with a small reserve

Exit: We observe a pure trend movement after entering the position. Close the position at a price of 108.35 before the session closes.

Risk Rewards: 1/4

P.S. In order to understand the idea behind the Stock Of The Day analysis, read the following information .

One Good Trade: OKTA Is A Prime Complex PB Candidate OKTA has a few components that we have talked about in recent days and I normally like these plays when the greater market plays nicely. In this case it doesn't look like we can get filled on a stop order. If that happens, I would like to keep this on a list for a second bull leg break out.

Here are the pattern traits we can see in OKTA:

* Earnings Gap

* Holding earnings support

* Complex pullback

* Breakout of a complex pullback

I have previously discussed all of these traits in other videos.

Good Luck and Good Trading!

OKTA bull flag inside a bull flagNASDAQ:OKTA had a great earnings report and is currently bull flagging on the daily...

on the monthly chart we can see a bigger compression happening and the daily consolidation is happening at the top of the monthly resistance...

it has also successfully tested and closed above the 9/21 EMAs on the daily

a breakout can lead to a big move

alerts are set on the daily flag, for now

$OKTA consolidation in bullish flag/pennantNeed to wait for confirmation of breakout from flag/pennant.

Q3 provided bullish fwd guidance for Q4 which reports Feb '25. Fy25 will have a product portfolio with incremental innovation to grow vs. base period. Fy23 data breach issues mostly in the base period now.

OKTA forming a cup and handle pattern (BULLISH)Okta recently came out with earnings and we saw a surprise on all aspects of its numbers and EPS positive surprise of ~15%. On the technicals, it seems to be forming a cup and handle pattern which is considered very BULLISH. Together I expect this stock to rally over the short term with an upside of over 20% from here. 100 $ here we come!!!

$OKTA - It will most likely break through this timeNASDAQ:OKTA The combined resistance of the 200DMA and the trendline is making it hard to break through. But if it retests the trendline, it will most likely break through it.

Targets are in the chart.

As always, I share my opinions and trades. I'm not suggesting that anyone follow my trades. You do you.

Can Identity Security Redefine the Future of Digital Trust?In the labyrinthine world of cybersecurity, Okta Inc. emerges as a beacon of strategic innovation, transforming the complex landscape of identity management with remarkable financial resilience. The company's recent economic performance reveals a compelling narrative of growth that transcends traditional technological boundaries, showcasing how strategic investments and technological prowess can turn potential vulnerabilities into competitive advantages.

The digital landscape is becoming increasingly defined by complex security challenges, and Okta has established itself as a key player in this critical area. With a subscription revenue growth of 14% and strategic investments of $485 million in research and development, the company shows a strong commitment to advancing the possibilities in identity and access management. This approach is not just about providing technological solutions; it embodies a comprehensive vision for creating secure and seamless digital experiences that enable organizations to effectively navigate the increasingly intricate technological environment.

Despite facing significant market challenges, including intense competition and cybersecurity threats, Okta has transformed potential obstacles into opportunities for innovation. By maintaining a laser-focused approach to workforce and customer identity solutions, the company has survived and thrived, turning operating losses into a pathway toward profitability. The transition from a net loss of $81 million to a net income of $16 million underscores a strategic metamorphosis that challenges traditional narratives of technological enterprise, suggesting that true innovation emerges not from avoiding challenges, but from confronting them with intelligent, forward-thinking strategies.

As digital transformation continues to reshape enterprise security, Okta stands at the forefront of a critical revolution. The company's journey illustrates a profound truth: in an era of unprecedented technological complexity, the most successful organizations can transform uncertainty into opportunity, security into innovation, and technological challenges into strategic advantages. Okta's trajectory is more than a corporate success story—it's a testament to the power of visionary thinking in an increasingly interconnected world.

12/3/24 - $okta - Long print ~$80, setup B+12/3/24 :: VROCKSTAR :: NASDAQ:OKTA

Long print ~$80, setup B+

- if one thing is clear, it's that beats and misses are ultra-super-duper-did-i-mention-ultra magnified these past Q's and especially this 3Q reporting season

- the beats, however, are sending stuff ape'ing so if you can find decent setups, it probably pays to neck out a bit until the punch bowl gets taken away

- i have followed NASDAQ:OKTA for a while and made a private comment (prior to opening up my writing) earlier this year. the math just didn't make a ton of sense to me then, SBC was still an issue, valuation was not obvious and it proved to be pretty spot on - the stock has effectively been dead money

- but given the beats we've seen from panw, zs (albeit stonks haven't really reacted - but valuation for these is in the stratosphere which is why i've just been in watch mode), okta presents an interesting case where if you look at google trends (as it's a consumer facing B2B)... they're squarely up and to the right. with all the russia russia russia, china china china rhetoric... identity mgmt remains a great "factor"

- while again, the SBC issue does rub me the wrong way, the stonk isn't broken, momentum is good and so i'm not going to count it against the valuation just yet which puts cash yield in the 5% range growing >10% which... with a unique biz is a good setup.

- again PE in high 20s... i think u can do better e.g. i love NYSE:TSM most of all tech-related names (i don't put NASDAQ:NXT in that bucket, which is my largest single name and consider more "infra-energy"), but again... a beat, a raise, any positive speech could easily send this NASDAQ:OKTA to fil it's sub $100 gap from last Q.

- i'm not wed to it tho, i'm borrowing some upside using Jan ITM calls, so any down move if it's -10-15% or w/e i can decide to reload, adjust etc and won't hurt the bank of V. but if it runs, it's probably a multi-day situation as we've seen with a lot of the recent beats esp given the current tape.

what do u think?

V