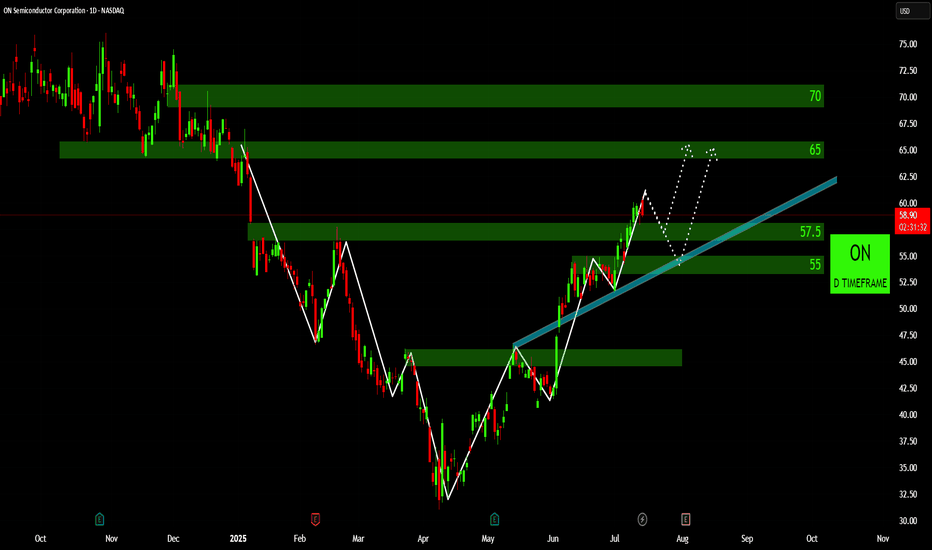

A Technical Review of ON: Trendlines and Potential TargetsBullish Trendline in Play : The price action since late April/early May clearly demonstrates an upward-sloping trendline (highlighted in light blue), indicating a sustained bullish momentum. The price has respected this trendline on multiple occasions, suggesting its significance as dynamic support.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.47 USD

1.57 B USD

7.08 B USD

415.43 M

About ON Semiconductor Corporation

Sector

Industry

CEO

Hassane El-Khoury

Website

Headquarters

Scottsdale

Founded

1999

FIGI

BBG000DV7MX4

ON Semiconductor Corp. engages in the provision of intelligent power and sensing solutions with a primary focus on automotive and industrial markets. It operates through the following segments: Power Solutions Group (PSG), Analog and Mixed-Signal Group (AMG), and Intelligent Sensing Group (ISG). The PSG segment offers discrete, module, and integrated semiconductor products that perform multiple application functions, including power switching, signal conditioning, and circuit protection. The AMG segment designs and develops analog, mixed-signal, power management integrated circuits, sensor interface devices, power conversion, signal chain, and voltage regulation devices. The ISG focuses on the design and development of complementary metal oxide semiconductor image sensors, image signal processors, single photon detectors, including silicon photomultipliers, single photon avalanche diode arrays, and short-wavelength infrared products, as well as actuator drivers for autofocus and image stabilization. The company was founded on July 4, 1999 and is headquartered in Scottsdale, AZ.

Related stocks

Trade Plan (Short-Term Swing) for $ON🔍 Chart Setup & Trend

Timeframe: Daily chart

Trend: After a prolonged downtrend, NASDAQ:ON appears to be forming a base and attempting a short-term reversal.

It is testing resistance around $57, and a breakout could trigger bullish continuation.

Price is approaching the 50-day EMA, which is a k

ON Semiconductor – Reaction at 78.6% Fib, Decision Time at $49.7NASDAQ:ON just reacted to a key 78.6% Fibonacci retracement from the April 2020 low to its all-time high.

After a make-or-break earnings on May 5, price has pushed into a major resistance zone at $49.75. Interestingly, analysts are averaging a price target of $47, slightly below current levels.

💡

Short Trade Setup – ON Semiconductor (ON)!🔻

Timeframe: 30-Minute Chart

Pattern: Rising Wedge Breakdown (Bearish Reversal)

📝 Trade Plan (Short Position)

📌 Entry: ~$45.22 (Breakdown confirmation below wedge)

🛑 Stop-Loss (SL): $47.26 (Above wedge resistance / structure invalidation)

🎯 Take Profit Targets:

TP1: $43.06 (First support level

ON | Long Setup | Bullish Recovery Flow | (May 2025)ON | Long Setup | Breakout from Downtrend Channel + Bullish Recovery Flow | (May 2025)

1️⃣ Short Insight Summary:

ON Semiconductor (ON) is breaking out of its long-term downtrend channel, showing strong price action and renewed momentum. A recovery seems to be gaining speed, and May could be a key

ON – ON Semiconductor Corporation – 30-Min Short Trade Setup !📉 🔻

🔹 Asset: ON (NASDAQ)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Breakdown from Symmetrical Triangle + Trendline Breach

📊 Trade Plan (Short Position)

✅ Entry Zone: Below $45.20 (breakdown from triangle and support zone)

✅ Stop-Loss (SL): Above $45.98 (failed breakout / pattern invalidation)

🎯 Take

ON Semiconductor Corporation (ON) – 30-Min Long Trade Setup!### 📌 ** 🚀**

🔹 **Asset:** ON Semiconductor Corp (**ON** – NASDAQ)

🔹 **Timeframe:** 30-Min Chart

🔹 **Setup Type:** **Symmetrical Triangle Breakout**

---

### **📊 Trade Plan (Long Position)**

✅ **Entry Zone:** Above **$43.24** (Breakout Confirmation)

✅ **Stop-Loss (SL):** Below **$42.11**

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ONNN5032395

ON Semiconductor Corporation 3.875% 01-SEP-2028Yield to maturity

5.31%

Maturity date

Sep 1, 2028

ONNN5763928

ON Semiconductor Corporation 0.5% 01-MAR-2029Yield to maturity

1.92%

Maturity date

Mar 1, 2029

ONNN5416950

ON Semiconductor Corporation 0.0% 01-MAY-2027Yield to maturity

−10.51%

Maturity date

May 1, 2027

See all ON bonds

Frequently Asked Questions

The current price of ON is 58.28 USD — it has increased by 2.67% in the past 24 hours. Watch ON Semiconductor Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange ON Semiconductor Corporation stocks are traded under the ticker ON.

ON stock has fallen by −4.71% compared to the previous week, the month change is a 5.10% rise, over the last year ON Semiconductor Corporation has showed a −15.68% decrease.

We've gathered analysts' opinions on ON Semiconductor Corporation future price: according to them, ON price has a max estimate of 75.00 USD and a min estimate of 33.00 USD. Watch ON chart and read a more detailed ON Semiconductor Corporation stock forecast: see what analysts think of ON Semiconductor Corporation and suggest that you do with its stocks.

ON stock is 2.63% volatile and has beta coefficient of 1.73. Track ON Semiconductor Corporation stock price on the chart and check out the list of the most volatile stocks — is ON Semiconductor Corporation there?

Today ON Semiconductor Corporation has the market capitalization of 23.79 B, it has decreased by −0.54% over the last week.

Yes, you can track ON Semiconductor Corporation financials in yearly and quarterly reports right on TradingView.

ON Semiconductor Corporation is going to release the next earnings report on Aug 4, 2025. Keep track of upcoming events with our Earnings Calendar.

ON earnings for the last quarter are 0.55 USD per share, whereas the estimation was 0.50 USD resulting in a 9.49% surprise. The estimated earnings for the next quarter are 0.53 USD per share. See more details about ON Semiconductor Corporation earnings.

ON Semiconductor Corporation revenue for the last quarter amounts to 1.45 B USD, despite the estimated figure of 1.40 B USD. In the next quarter, revenue is expected to reach 1.45 B USD.

ON net income for the last quarter is −486.10 M USD, while the quarter before that showed 379.90 M USD of net income which accounts for −227.95% change. Track more ON Semiconductor Corporation financial stats to get the full picture.

No, ON doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 28, 2025, the company has 26.49 K employees. See our rating of the largest employees — is ON Semiconductor Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ON Semiconductor Corporation EBITDA is 2.00 B USD, and current EBITDA margin is 36.07%. See more stats in ON Semiconductor Corporation financial statements.

Like other stocks, ON shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ON Semiconductor Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ON Semiconductor Corporation technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ON Semiconductor Corporation stock shows the neutral signal. See more of ON Semiconductor Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.