Takeda Secures Global Rights from Ovid TherapeuticsTakeda Secures Global Rights from Ovid Therapeutics to Develop and Commercialize Soticlestat for the Treatment of Children and Adults with Dravet Syndrome and Lennox-Gastaut Syndrome.

Ovid eligible to receive up to $856M in payments, including a $196M upfront payment, regulatory and commercial milestone payments and tiered double-digit royalties on product sales

− Original 2017 collaboration between Ovid and Takeda to conclude; Ovid will have no further development or milestone obligations.

In addition, Ovid will receive tiered royalties beginning in the low double-digits and up to 20 percent on sales of soticlestat, if approved and commercialized.

Takeda intends to initiate Phase 3 studies of soticlestat in children and young adults with DS and LGS in calendar year Q2 2021.

finance.yahoo.com

OVID trade ideas

OVID Could Potentially Bounce Back After losing most of its value, OVID sort of did nothing for the past month. However, recently it showed strong upside which makes me think it could bounce back eventually. If you like this idea, take a look at my idea on APRE and also look at UBX and how they bounced back. Target the $6 zone.

buy rating and FDA Rare Pediatric Disease DesignationShares of Ovid Therapeutics were up by 29.1%, despite the company not reporting any news. The market is probably reacting to Ovid getting a buy rating from an analyst.

---------------------------------------------------------

Michael Higgins, an analyst with Ladenburg Thalmann, reiterated a buy rating on Ovid's stock today. What's more, Higgins gave Ovid a price target of $20, which represents a significant upside from the company's previous close of $5.43. So it isn't surprising that investors rushed to purchase Ovid's stock, sending shares significantly higher.

-------------------------------------------------------

Ovid currently has no products on the market and doesn't generate any revenue. The company does have several interesting pipeline candidates, however.

-------------------------------------------------------

Ovid's OV101 is an investigational treatment for a rare disorder called Angelman syndrome.

www.fool.com

Ovid Therapeutics Receives FDA Rare Pediatric Disease Designation for OV101 for the Treatment of Angelman Syndrome

and is currently being evaluated in the Company’s pivotal Phase 3 NEPTUNE trial in Angelman syndrome, with topline results expected in the fourth quarter of 2020 . The FDA has previously granted Orphan Drug and Fast Track designations for OV101 for the treatment of Angelman syndrome.

Ovid may be eligible to receive a priority review voucher from the FDA, which can be redeemed to obtain priority review for any subsequent marketing application or may be transferred and/or sold to other companies for their programs, such as has recently been done by other voucher recipients.

“OV101 has the potential to become the first FDA-approved therapy for individuals living with Angelman syndrome. Receiving Rare Pediatric Disease Designation from the FDA is a significant milestone for this program and underscores the critical value of our work,”

finance.yahoo.com

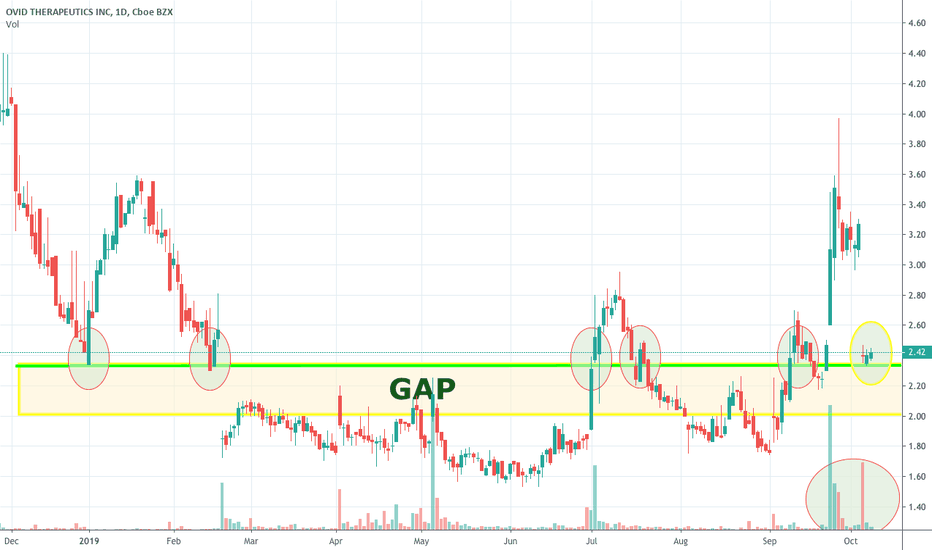

$OVID Holding The Gap But Can it Sustain?One thing to look at especially when it comes to penny stocks is volume. If you look at this chart, OVID stock is holding above the previous gap zone. However, volume has consistently deteriorated. My question is can this sustain levels above the gap zone or are we looking at a further pullback?

" Since June, shares of this biotechnology penny stock rallied from lows of $1.53 to highs of $3.97 late last month. However, on Friday, the stock tanked 27% after announcing a public offering to raise money for the company.Even so, the proceeds of the gross $32.5 million will be put to immediate use. Proceeds from the Offerings will be used “primarily to advance the clinical development of its OV101 and OV935 programs.” The remainder will be for working capital and general corporate purposes. " *

About OVID

Ovid Therapeutics Inc is a US based biopharmaceutical company. The firm is engaged primarily in developing impactful medicines for patients and families living who are suffering with rare neurological disorders. It is targeting disorders such as intellectual disability, severe speech impairment, problems with movement and balance, sleep disorders and anxiety to transform the patient's life.

* Quote Source: 3 Penny Stocks To Watch After Latest Biotech News

OVID - Going For A Run - Did You Catch It?Ovid Therapeutics, Inc. focuses on developing medicines for patients and families living with rare neurological disorders. The company was founded by Matthew During in April 2014 and is headquartered in New York, NY.

SHORT INTEREST

272.51K 08/30/19.

P/E Current

-1.17

P/E Ratio (with extraordinary items)

-1.81

Average Recommendation: BUY

Average Target Price: 12.33

OVID - Bullish Momentum. Pullback Possible FirstOvid Therapeutics, Inc. focuses on developing medicines for patients and families living with rare neurological disorders. The company was founded by Matthew During in April 2014 and is headquartered in New York, NY.

SHORT INTEREST

426.41K 08/15/19

P/E Current

-1.03

P/E Ratio (with extraordinary items)

-1.59

Average Recommendation: BUY Average Target Price: 12.00