PACB trade ideas

PACB: Early Markup Phase – Bulls in Control, Box Breakout, Next Candlestick Analysis

The last 3 daily candles form a bullish continuation sequence:

Strong green candles with expanding bodies, closing near their highs. No significant upper wicks—this is a hallmark of sustained buying. Volume is not tapering; instead, it's growing, confirming conviction behind the move.

Earlier, around mid-June, there was a small consolidation followed by a bullish Marubozu candle (open near low, close near high). This often acts as a breakout candle per Nison.

No major reversal signals (no shooting star, bearish engulfing, or doji clusters at the highs yet).

This suggests momentum bulls are in control.

Trend & Momentum

Trend health: A fresh higher high and higher low sequence is emerging after months of compression. Price is starting to look parabolic, though still early.

Momentum:

RSI is now at 72.4 (overbought territory). This often precedes pullbacks, but in strong trends it can stay overbought for weeks.

MACD is strongly positive and widening—classic early stage trend acceleration.

This feels like a sentiment shift from apathy to FOMO. Watch for “emotional” moves if volume spikes further.

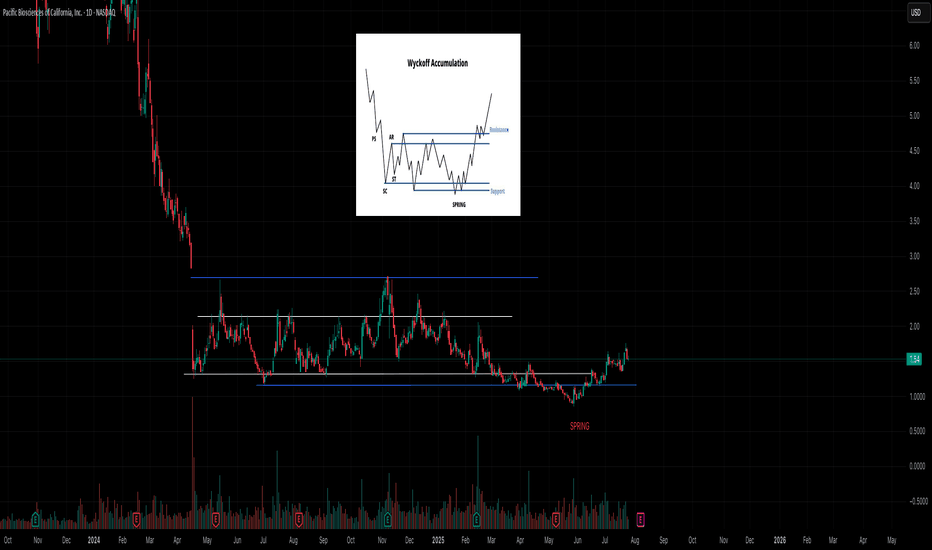

Range Box

The prior range formed a box.

The recent breakout above ~$1.30 is a clean box breakout with expanding volume—this confirms the breakout is likely genuine, not a false trap.

A new box may form $1.30–$1.64 if price stalls here.

The Tactical Play

This chart is flashing early markup phase (accumulation → breakout → markup). But the crowd is waking up now, so you have to manage emotion and probabilities like a tactician:

If You’re Long / Thinking Long

Stay in (but tighten control):

It just broke out of the $1.30 box with conviction (volume + body expansion). That breakout level $1.30–$1.37 is now support. Pullbacks into this zone are buy-the-dip territory as long as volume doesn’t surge on red days.

RSI > 70 means “momentum zone” (strong trends can stay overbought for weeks), but be ready for shallow pullbacks (to 23.6%-38.2% Fib: $1.47–$1.37).

Upside Targets:

$1.84 (127.2%) – first likely stall.

$2.09 (161.8%) – next leg if sentiment heats up.

$2.37 (200%) – euphoria zone. Don’t expect it without a healthy base first.

Tactical move: Trail stops below $1.37 (38.2% Fib) if you want to stay aggressive, or tighter at $1.47 for a swing. If $1.37 fails on heavy volume, it’s probably a failed breakout.

If You’re Flat (No Position)

Two options:

Breakout pullback entry:

Wait for a dip into $1.47–$1.37. Buy there only if it holds with low selling volume. That’s the classic “backtest of breakout box.”

Momentum entry:

Chase only if price closes cleanly above $1.64 with volume acceleration. Target $1.84–$2.09. Use tight stops because of overextension risk.

If You’re Short or Considering Short

Don’t fade this yet. MACD, volume, and structure all say bulls are in charge. Shorts will likely get steamrolled unless you catch a blow-off top (look for a long upper wick + huge volume spike near $1.84 or $2.09).

Big Picture

This is transitioning from apathy to hope. Early longs (smart money) are in profit and likely to ride it higher. If it rips fast into $1.84-$2.09, that’s where emotions (FOMO) can set in—and where you start hunting for signs of exhaustion.

Not Financial Advice

Pacific Biosciences of California, Inc. (NASDAQ: PACB) 1. Company Overview

About: Pacific Biosciences, also known as PacBio, is a life sciences technology firm specializing in sequencing solutions for complex genomic applications. Its core products include HiFi long-read sequencing and Single Molecule, Real-Time (SMRT) sequencing technologies. These products are widely used in fields like human genome research, oncology, and infectious disease studies.

2. Technological Advances

SPRQ Chemistry Release: PacBio recently launched the SPRQ chemistry for its Revio sequencing systems, a breakthrough expected to cut the cost of sequencing a human genome to under $500. This upgrade also enhances sequencing yield by 33% and reduces DNA input needs by fourfold. This innovation is anticipated to drive broader adoption in clinical and population sequencing due to its lower cost and high throughput.

Enhanced Multiomics Capabilities: The company’s recent software updates, paired with the SPRQ chemistry, allow for DNA methylation analysis and improved multiomics functions. These capabilities open PacBio’s technology for deeper genomic and epigenomic studies, which could appeal to a larger user base in research and clinical settings.

3. Q3 2024 Earnings Summary

Financial Performance: In Q3 2024, PacBio reported revenues of approximately $41.95 million, reflecting modest growth compared to previous quarters. However, the company remains unprofitable, with net losses due to substantial R&D investments aimed at supporting its new technology initiatives. Analysts are watching for improvements in profitability as the firm scales its new offerings.

Growth Outlook: Revenue projections for 2025 indicate a potential 27% growth, driven by increased adoption of the Revio systems and applications across various scientific fields. However, analysts caution that maintaining strong growth amid significant industry competition could be challenging.

4. Stock Performance and Analyst Sentiment

Current Price and Volatility: As of November 8, 2024, PACB stock closed at $2.30, down slightly from recent highs. The stock has exhibited volatility over the past year, trading within a wide range from $1.16 to $10.65. High short interest of over 20% indicates some market skepticism about its near-term performance, although it also points to a potential for price fluctuations.

Analyst Ratings: The stock holds a "Moderate Buy" consensus among analysts, with an average 12-month price target of $4.50, reflecting a potential upside of about 96%. Most analysts remain cautiously optimistic due to PacBio’s technological advances, though some suggest that its path to profitability may still be uncertain.

5. Future Outlook and Risks

Growth Drivers: PacBio’s advances in low-cost, high-throughput genome sequencing are likely to expand its market reach, especially as more institutions adopt its technology for both research and clinical purposes.

Risks: The company faces competition from other sequencing firms, which may pressure profit margins. Additionally, its reliance on high R&D expenses poses a risk if revenue growth fails to offset operational costs.

Summary

PacBio’s focus on making high-quality genome sequencing affordable and accessible could position it as a leader in genomic research. While current financial losses and competitive pressures pose challenges, the company’s cutting-edge technology offers significant growth potential. Analysts remain cautiously optimistic, and the coming quarters will be crucial for demonstrating sustained revenue growth and moving toward profitability.

Pacific Biosciences of California, Inc. - positive divergenceOn the 5 day chart price action has corrected 90% since closing the previous idea (below) on June 21st 2023 after a 200% rally. A number of reasons now exist to consider a new long position now that the short is closed.

1) RSI resistance breakout and backtest confirmation.

2) Strong regular bullish divergence. Look left.

3) Monthly support. See below.

4) No shares splits since last publication when trading at $14

5) Percentage of Shares Shorted 20.04%. That comes after a 98% correction. My goodness.

Is it possible price action continues correcting after a 90% correction? Sure, sellers and short sellers alike know what their doing.

Is it probable? No.

Ww

Type: Trade

Risk: <= 6%

Timeframe for long: this month

Return: For elsewhere

Stop loss: For elsewhere

Previous long idea

Monthly chart support

PACB - Flushed Out - Potential 20 bagger hereOk so we are all looking for that next 20 bagger right? Biotechs and moreover disrupter Biotechs are so hated right now they are IMO a deal.

Now not all Biotechs will be big winners, some will go to zero, but if the potential to go to zero is there, it is best to buy near zero ;)......

So I am going to be adding some PACB and a couple others (stay tuned) to my moon shot portfolio. Yes this is money I do not mind losing. I know nobody likes to lose money, but this is not my IRA or what I am depending on for retirement, this is "I want a new Harley" type money.

If you are looking to throw a few bones into a few stocks that have the potential to win big, but also the potential to go to zero, stay tuned.

I will be buying 500 shares of PACB. Ever gets back to 40 that turns 1000 into 20k, and that is a 20 bagger for my next bagger ;). If you own a bike you would understand that ;)

PACB - LONGAt the upcoming TD Cowen 44th Annual Health Care Conference and Barclays 26th Annual Global Healthcare Conference, PacBio is expected to present corporate updates, including recent achievements and product advancements, financial performance, and strategic outlook. The company may also discuss industry trends, how its sequencing solutions are positioned within the genomics market, and plans for addressing future demands. These presentations aim to reinforce investor confidence by highlighting PacBio's strengths, strategic directions, and potential in the rapidly evolving genomics industry, complemented by opportunities for direct engagement with investors and industry stakeholders through Q&A sessions and networking.

Macro support here, Nice uptick in Volume.

Good luck traders.

Pacific Biosciences of California, Inc.On the above 6-day chart price action has corrected 90% since the sell signal back in February 2021. A number of reasons now exist to be long, including:

1) The ‘buy signal’ prints. Look left, not to be ignored on this time frame.

2) Price action and RSI resistance breakouts.

3) Price action prints a strong DOJI candle on the 0.786 Fibonacci level

4) Despite the correction, price action is in an uptrend. This is clearly visible on the monthly chart below.

Is it possible price action falls further? Sure.

Is it probable? No.

Ww

Type: trade

Risk: 6% of portfolio

Timeframe: 5 to 8 months

Return: 400% minimum

1-month chart

Finishing wave 3 - target 140 dollar regionPACB is finishing wave 3 and is on its last leg (wave 5 in this wave 3). Wave 3 is generally 1.618 the length of wave 1, which puts the target at around 140 dollars over the next several months. This is a great investment for the long term as well since it will likely have more upside in the years to come in the form of wave 5 and has tailwinds from gene editing breakthroughs.

PACB, More than 100% profit for Mid term investment!PACB is a real chance for mid and long term investment. Follow the analysis if you want to find out the details.

Stock's trend is clearly up. There are still two large up going waves to complete the whole Elliott wave cycle.Wave count labels have been shown on the chart. Correction (wave 4 ) of labeled up going wave 3 ( from 2.2 to 53.69 !) has more than likely been completed at 0.618 golden ratio retracement around 21 USD.

It seems the stock has started the new rally (wave 5 of (3) ) after correction and completed wave i and now is completing wave ii of 5 of (3). Good entry point may be around 23 USD which corresponds to 0.786 retracement of wave i .

Our first target is a new All Time High around 61 USD which is a strong resistance to form by 1.272 extension of wave 4 and 0.786 projection of wave 1-3.

After completion of wave (3), We probably see a retracement down to 31 or 24 USD corresponding to 0.5 and 0.618 Fibonacci levels. Then we will have a new and final up going wave (5) before the BIG SHORT !

In terms of timing , Chart is just a schematic drawing So, I kindly ask you to disregard the dates on the chart.

I hope this analysis to be helpful and wish you huge profits.

PACB setting up nicelyPACB is continuing to make higher highs and higher lows. 50 MA acting as resistance. A clean break above the 50 will be my entry point. Looking for PACB to make an explosive move as we get closer to the apex of the triangle. PT $35-$38 in 4-5 weeks. Using trendline as stop loss.