PAX trade ideas

Patria Investments Limited Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# Patria Investments Limited Quote

- Double Formation

* # (1st. Reference)) At 23.00 USD| Subdivision 1

* (A+)) - *Crossing | Completed Survey

* 41 bars, 1.247d | Date Range Method - *(Downtrend Argument))

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* Monthly Time Frame | Trend Settings Condition | Subdivision 3

- (Hypothesis On Entry Bias)) | Regular Settings

* Stop Loss Feature Varies Regarding To Main Entry And Can Occur Unevenly

- Position On A 1.5RR

* Stop Loss At 15.00 USD

* Entry At 13.00 USD

* Take Profit At 10.00 USD

* (Downtrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

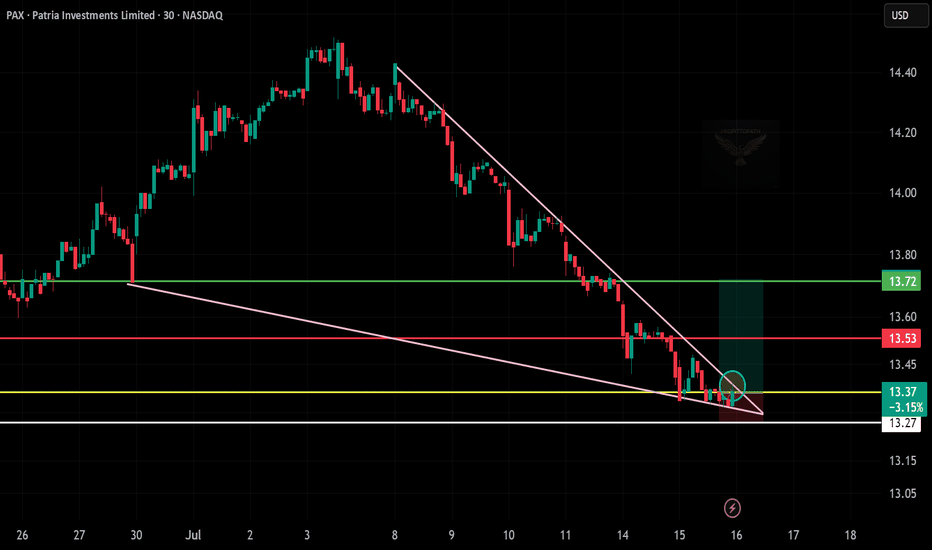

PAX Falling Wedge Breakout – Long Trade Setup

🧠 Chart Analysis Summary:

Pattern: Falling wedge breakout spotted — a classic bullish reversal pattern.

Current Price: $13.37

Support Zone:

$13.27 (white line, holding support)

Breakout Confirmation: Price is pushing out of the wedge with a small green move (circle).

📊 Key Levels:

Entry Zone: $13.35–$13.40

Target 1: $13.53 (red line – short-term resistance)

Target 2: $13.72 (green line – wedge target zone)

Stop-Loss: Below $13.25

🎯 Trade Idea (Bullish Bias):

Entry: $13.35–13.40

Target: $13.72

Stop-Loss: $13.25