Key facts today

PACCAR Inc (PCAR) raised its quarterly dividend by 10% to 33 cents per share and declared an extra dividend of $3, with a free-cash-flow yield of 6%.

PACCAR Inc's Parts division reported record quarterly revenues, driven by investments in distribution capacity and customer support programs, despite a flat aftermarket parts market.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.85 USD

4.16 B USD

33.65 B USD

515.15 M

About PACCAR Inc.

Sector

CEO

Preston R. Feight

Website

Headquarters

Bellevue

Founded

1905

FIGI

BBG000BQVTF5

PACCAR, Inc. is a global technology company, which engages in the design and manufacture of light, medium, and heavy-duty trucks. It operates through the following segments: Truck, Parts, and Financial Services. The Truck segment designs and manufactures heavy, medium, and light duty diesel trucks which are marketed under the Kenworth, Peterbilt, and DAF brands. The Parts segment distributes aftermarket parts for trucks and related commercial vehicles. The Financial Services segment provides finance and leasing products and services provided to truck customers and dealers. The company was founded by William Pigott Sr. in 1905 and is headquartered in Bellevue, WA.

Related stocks

Paccar Stock Chart Fibonacci Analysis 050925Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 92/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E

PCAR Open GapsI've been watching this thing through the tank, PCAR has always filled open gaps before, and there's a bunch of them now.

I don't expect earnings to be that great, so hopefully they all fill before then.

ANyways, it's back to my favorite play. I've made so much money off this stock, I was willin

Strength on PCAR stock Paccar Inc. stock looks strong. We can see that since October 2024, the largest volume occurred after publishing earnings reports or on ex-dividend dates. Please note that:

- All bars on those days are down with the closing price in the middle of the bar which in Volume Spread Analysis (VSA) indicat

PACCAR ... buy opportunity Uptrend

Based on my strategy, a new trend will be formed after breaking a trend line and then passing out of a price level. This chart has both conditions and if chart does not form a high shadow above today's candle, I will get a buying position by setting a SL at about 100.

Next targets could be a

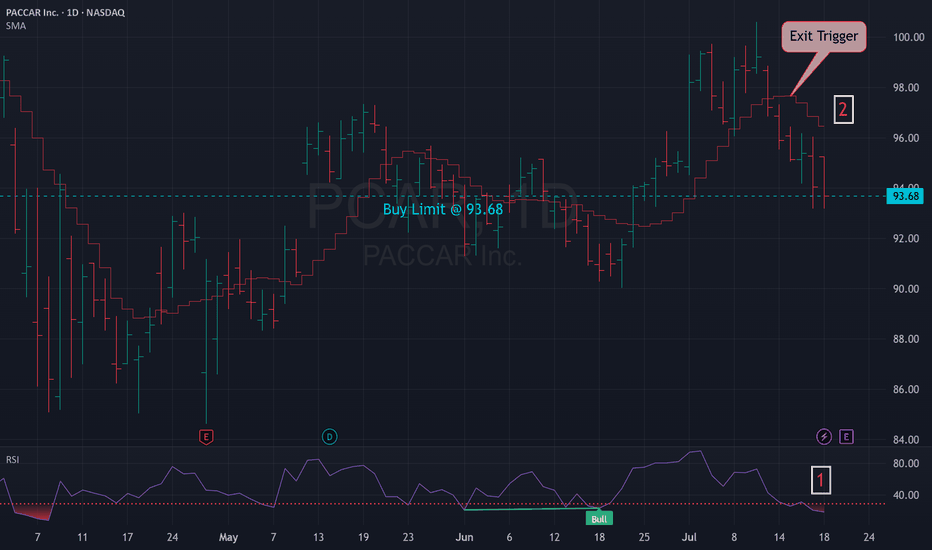

PCAR is BullishPrice was in a strong down trend, however a matured bullish divergence signals that bulls are trying to win control of the price action, and if they succeed in doing so, we can expect a bullish rally from here, after the break of previous lower high. Targets are mentioned on the chart.

PCAR UpdateOversold on the daily but no traction on a big up day for the market. Quit frankly higher unemployment is bad news, not good news. PCAR typically trades with the news, unlike the rest of the market, lol.

But regardless, I'm beginning to think it loses the support next week and has yet another leg

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PCAR5482810

PACCAR Financial Corp. 4.95% 03-OCT-2025Yield to maturity

4.76%

Maturity date

Oct 3, 2025

PCAR5775605

PACCAR Financial Corp. 5.0% 22-MAR-2034Yield to maturity

4.76%

Maturity date

Mar 22, 2034

PCAR5457380

PACCAR Financial Corp. 3.55% 11-AUG-2025Yield to maturity

4.75%

Maturity date

Aug 11, 2025

PCAR5562953

PACCAR Financial Corp. 4.45% 30-MAR-2026Yield to maturity

4.35%

Maturity date

Mar 30, 2026

PCAR6070099

PACCAR Financial Corp. 4.55% 08-MAY-2030Yield to maturity

4.30%

Maturity date

May 8, 2030

PCAR5179395

PACCAR Financial Corp. 1.1% 11-MAY-2026Yield to maturity

4.22%

Maturity date

May 11, 2026

PCAR5900464

PACCAR Financial Corp. 4.0% 26-SEP-2029Yield to maturity

4.22%

Maturity date

Sep 26, 2029

PCAR5629208

PACCAR Financial Corp. 5.05% 10-AUG-2026Yield to maturity

4.21%

Maturity date

Aug 10, 2026

PCAR5740354

PACCAR Financial Corp. 4.6% 31-JAN-2029Yield to maturity

4.20%

Maturity date

Jan 31, 2029

PCAR5353297

PACCAR Financial Corp. 2.0% 04-FEB-2027Yield to maturity

4.19%

Maturity date

Feb 4, 2027

PCAR5942864

PACCAR Financial Corp. 4.5% 25-NOV-2026Yield to maturity

4.14%

Maturity date

Nov 25, 2026

See all PCAR bonds

Curated watchlists where PCAR is featured.

Frequently Asked Questions

The current price of PCAR is 101.57 USD — it has increased by 0.14% in the past 24 hours. Watch PACCAR Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange PACCAR Inc. stocks are traded under the ticker PCAR.

PCAR stock has risen by 6.64% compared to the previous week, the month change is a 7.97% rise, over the last year PACCAR Inc. has showed a 1.73% increase.

We've gathered analysts' opinions on PACCAR Inc. future price: according to them, PCAR price has a max estimate of 121.00 USD and a min estimate of 86.00 USD. Watch PCAR chart and read a more detailed PACCAR Inc. stock forecast: see what analysts think of PACCAR Inc. and suggest that you do with its stocks.

PCAR reached its all-time high on Mar 28, 2024 with the price of 125.50 USD, and its all-time low was 0.20 USD and was reached on Dec 31, 1974. View more price dynamics on PCAR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PCAR stock is 1.90% volatile and has beta coefficient of 0.88. Track PACCAR Inc. stock price on the chart and check out the list of the most volatile stocks — is PACCAR Inc. there?

Today PACCAR Inc. has the market capitalization of 53.25 B, it has decreased by −3.25% over the last week.

Yes, you can track PACCAR Inc. financials in yearly and quarterly reports right on TradingView.

PACCAR Inc. is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

PCAR earnings for the last quarter are 1.37 USD per share, whereas the estimation was 1.29 USD resulting in a 6.29% surprise. The estimated earnings for the next quarter are 1.22 USD per share. See more details about PACCAR Inc. earnings.

PACCAR Inc. revenue for the last quarter amounts to 6.96 B USD, despite the estimated figure of 6.99 B USD. In the next quarter, revenue is expected to reach 6.37 B USD.

PCAR net income for the last quarter is 723.80 M USD, while the quarter before that showed 505.10 M USD of net income which accounts for 43.30% change. Track more PACCAR Inc. financial stats to get the full picture.

Yes, PCAR dividends are paid quarterly. The last dividend per share was 0.33 USD. As of today, Dividend Yield (TTM)% is 1.24%. Tracking PACCAR Inc. dividends might help you take more informed decisions.

PACCAR Inc. dividend yield was 1.18% in 2024, and payout ratio reached 15.56%. The year before the numbers were 1.09% and 12.10% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 30.1 K employees. See our rating of the largest employees — is PACCAR Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PACCAR Inc. EBITDA is 5.06 B USD, and current EBITDA margin is 17.89%. See more stats in PACCAR Inc. financial statements.

Like other stocks, PCAR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PACCAR Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PACCAR Inc. technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PACCAR Inc. stock shows the buy signal. See more of PACCAR Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.