PDD trade ideas

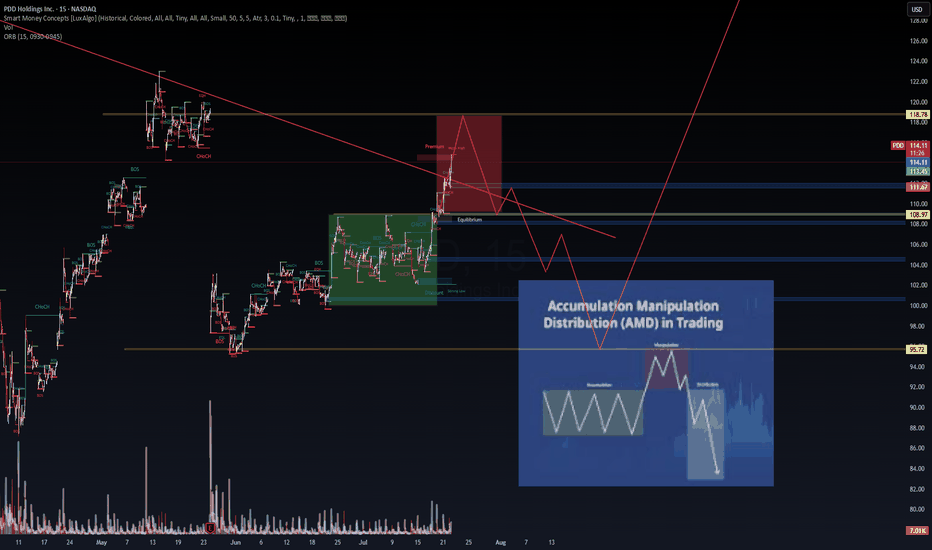

$PDD Breakdown Alert | AMD x SMC Framework (15m)📉 NASDAQ:PDD Breakdown Alert | AMD x SMC Framework (15m)

🔻 Smart Money Distribution may be underway

We're entering the manipulation phase after a textbook accumulation block and liquidity sweep above premium levels. The recent move above equilibrium aligns with potential exit liquidity engineering. Key elements:

🧠 Smart Money Flow

CHoCH & BOS sequence confirmed

Strong imbalance and premium rejection

Red box: Potential distribution zone

Break of structure expected beneath 111.67 and 108.97

Targeting demand imbalance zones around 102–96

📊 VolanX Protocol View

This is a classic AMD model unfolding in real-time:

Accumulation →

Manipulation →

Distribution & sell-off below key demand

🎯 Execution Plan

📍Entry Zone: 114–115 rejection

🎯TP1: 110

🎯TP2: 104.6

🛑SL: Close above 118.78

🔍 Watch for:

Order block reaction near 111.67

Confirmed displacement below 108.97 for continuation

Reaccumulation invalidation if 118.78 breaks

🧠 VolanX AI monitors AMD phases across tickers—de-risk, reposition, and trade what institutions are trading.

📌 This post is for educational purposes only. Not financial advice.

#VolanX #PDD #SMC #SmartMoney #AMD #LiquidityHunt #TradingView #WaverVanir #PriceAction #InstitutionalOrderFlow #AlgoTrading #MarketStructure

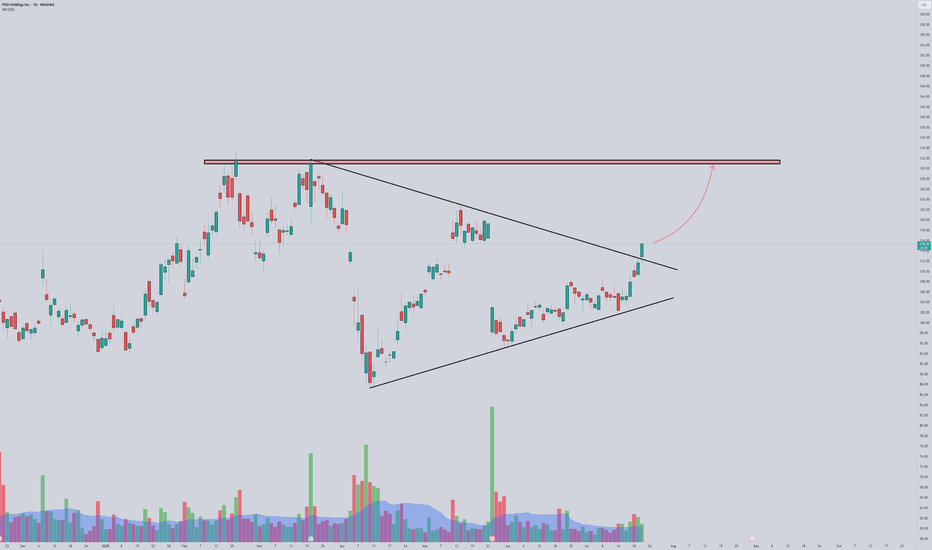

$PDD – Breakout Confirmed | Bullish Continuation Play📈 NASDAQ:PDD – Breakout Confirmed | Bullish Continuation Play

After months of compression beneath a well-respected descending trendline, PDD has just broken out with strength—clearing the $112 level and challenging multi-month resistance. This is not just a technical breakout—this is a volatility expansion event backed by institutional flow and price structure alignment.

🔺 Key Technicals:

✅ Downtrend resistance broken with volume thrust

🔺 Horizontal breakout zone around $114–$116 acting as the next battleground

🎯 Probabilistic projection: move toward $140–$164 if bulls maintain control

📊 VolanX DSS Signal:

✅ Momentum: Bullish (Breakout + Higher Lows)

📏 Fibonacci: 0.618–1.618 extension zone projects to $160+

🧠 SMC Alignment: Liquidity sweep likely occurred below $92, fueling current drive

🛰️ Macro: China’s fiscal stimulus narrative + re-rotation into Chinese tech could amplify upside

💡 VolanX Execution Bias:

📅 Short-term: Expect retest of $110–112 as a potential re-entry zone

🎯 Medium-term: Target zone = $140–$164 (converging with prior ATH structure)

🛡️ Risk Management: Break below $108 invalidates bullish thesis

🧪 Strategic Options Overlay:

Aug 29 $117 Calls seen in $1.5M sweep = institutional confidence

Consider:

✅ Bull Call Spread (115/135 or 120/140)

🧬 Diagonal Call Spread (Aug/Sept) for theta capture

💥 Long Synthetic for aggressive directional play

🔁 Narrative Shift in Play

VolanX assigns a 72% directional confidence for bullish continuation over the next 2–4 weeks. This setup transitions PDD into a high-beta breakout structure—ideal for momentum traders and rotational capital.

📌 Follow for real-time updates and execution paths.

— WaverVanir | VolanX Protocol

PDD Stock Trading Plan (2025-07-12)PDD Stock Trading Plan (2025-07-12)

Final Trading Decision

1. Comprehensive Summary of Each Model's Key Points

DS Report

Technical Analysis: Price: Currently at $104.91, facing short-term bearish pressures with significant support at $104.83. Indicators: Short-term indicators (30-min) show bearish signals, while daily indicators hint at a potential bullish reversal (e.g., MACD bullish divergence). Sentiment: Mixed headlines with a stable VIX suggest a favorable but cautious entry environment. Trade Strategy: Long with a target of $108.70 and stop loss at $104.10 based on recent support levels.

LM Report

Technical Analysis: Price: Above the long-term bullish trend but facing near-term resistance. Indicators: Neutral RSI levels do not suggest a clear direction. MACD shows some signs of hesitance. Sentiment: Slightly bullish due to institutional flows and a falling VIX but lacks strong conviction. Trade Strategy: Suggests a long position at $105.50, with a profit target of $113.64.

GK Report

Technical Analysis: Describes a neutral situation with prices around key EMAs and exhibiting consolidation. Weak momentum signals indicate uncertainty regarding outright positions. Sentiment: Highlights mixed news with both bullish and bearish implications. Trade Strategy: Recommends not to trade due to the unclear directional bias.

CD Report

Technical Analysis: Confirms short-term bearish momentum with price below moving averages and mixed momentum indicators. Suggests a moderately bearish sentiment based on resistance levels. Sentiment: Slightly positive VIX implies stability; however, recent call volumes show mixed institutional sentiment. Trade Strategy: Strong short position recommended to profit from resistance at $105.70.

2. Areas of Agreement and Disagreement

Agreement:

Most models agree on near-term bearish indicators (e.g., weak momentum, mixed MACD signals across timeframes). Multiple reports note the importance of the $104.30-$106.20 price range as critical support/resistance.

Disagreement:

Long vs. Short Positions: DS and LM suggest potential long positions based on technical rebounds, while CD firmly recommends a short position anticipating downward movement. Market Sentiment: Some models see potential bullish opportunities in VIX stability and call volume, while others express caution due to mixed signals.

3. Conclusion and Recommendations

Overall Market Direction Consensus

The market is in a neutral to moderately bearish state based on the conflicting signals from the models. The current indicators do not suggest a strong bullish trend, while technical analysis indicates possible downward momentum.

Recommended Trade

Direction: Short Position Entry Price: $104.90 at market open. Stop Loss: $106.20 (1.2% loss). Take Profit: $102.50 (2.3% gain). Position Sizing: Based on a $10,000 account with a 2-3% risk tolerance, risking approximately $100-$120 total. Holding Period: 3-4 weeks maximum. Confidence Level: 65% based on resistance rejection and mixed sentiment.

Key Risks and Considerations

Risk of a market reversal if bullish news arrives or a strong institutional buying momentum occurs. Close monitoring of technical indicators is required, particularly the MACD and RSI, as conditions shift either direction could warrant position adjustments.

TRADE_DETAILS (JSON Format)

{ "instrument": "PDD", "direction": "short", "entry_price": 104.90, "stop_loss": 106.20, "take_profit": 102.50, "size": 200, "confidence": 0.65, "entry_timing": "open" }

📊 TRADE DETAILS 📊 🎯 Instrument: PDD 📉 Direction: SHORT 💰 Entry Price: 104.9 🛑 Stop Loss: 106.2 🎯 Take Profit: 102.5 📊 Size: 200 💪 Confidence: 65% ⏰ Entry Timing: open

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

$PDD Set To flip bearishSignificant downside risk based on a combination of fundamental, macroeconomic, and geopolitical factors. One major reason for this pessimistic outlook could be valuation concerns; the current stock price may appear overvalued relative to key metrics like earnings, revenue growth, or free cash flow. Additionally, regulatory risks play a large role, especially given PDD’s operations in China. Increased government scrutiny, the threat of tighter tech regulations, and the ongoing risk of U.S. delisting due to geopolitical tensions may all contribute to the bearish sentiment.

Slowing growth is another common concern. If analysts see evidence that user growth, spending per user, or revenue momentum is tapering off—particularly as competition from giants like Alibaba or JD intensifies—that could justify a lower target. On top of that, macroeconomic headwinds in China, such as sluggish consumer spending, youth unemployment, or a weakening property market, may further dampen expectations for PDD’s performance. Some bears may also point to transparency or accounting concerns, especially with the limited visibility U.S. regulators have into Chinese financial audits. If insider selling is also occurring, that may reinforce concerns that even company leadership lacks confidence in future prospects. Altogether, these factors can easily justify a sharply lower price target like $50 per share.

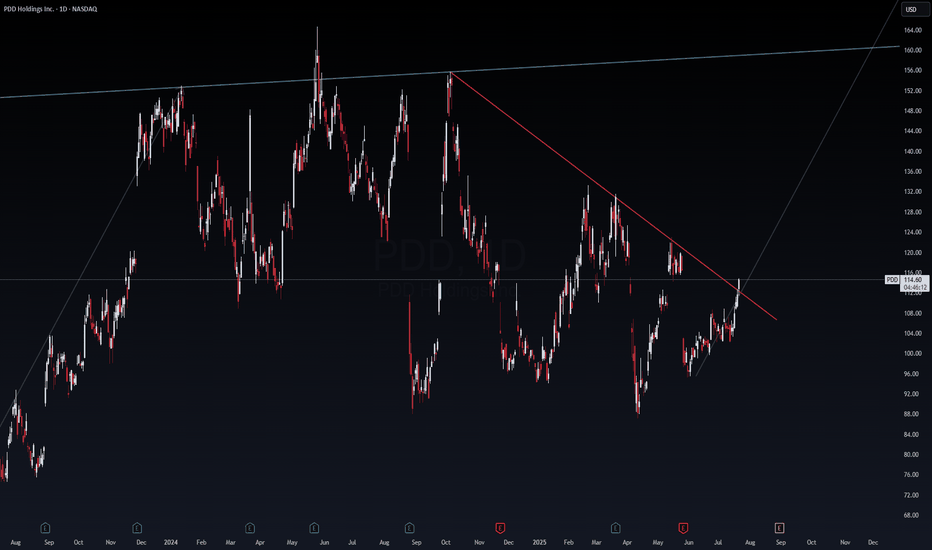

PINDUODUO Stock Chart Fibonacci Analysis 042525Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 94/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Temu's Price Magic: Shattered by Tariffs?PDD Holdings, the parent entity behind the popular e-commerce platform Temu, confronts a severe operational challenge following the recent imposition of stringent US tariffs targeting Chinese goods. These trade measures, particularly the dismantling of the "de minimis" rule for Chinese shipments, directly threaten the ultra-low-cost business model that fueled Temu's rapid expansion in the US market. The elimination of the previous $800 duty-free threshold for individual packages strikes at the core of Temu's logistical and pricing strategy.

The impact stems from newly enacted, exceptionally high tariffs on these formerly exempt low-value parcels. Reports indicate rates escalating to 90% of the item's value or a significant flat fee, effectively nullifying the cost advantages Temu leveraged by shipping directly from manufacturers in China. This fundamental shift disrupts the financial viability of Temu's model, which relied heavily on tariff-free access to deliver goods at minimal prices to American consumers.

Consequently, significant price increases for products sold on Temu appear almost inevitable as PDD Holdings grapples with these substantial new costs. While the company's official response is pending, economic pressures suggest consumers will likely absorb these charges, potentially eroding Temu's primary competitive advantage and slowing its growth momentum. PDD Holdings now faces the critical task of navigating this disrupted trade landscape and adapting its strategy to maintain its market position amidst heightened protectionism and geopolitical tension.

Pinduoduo $220PDD has a lot of potential to rise to $220 and above. China has been battered and this stock trades with a 12 PE ratio. That's about as cheap of a stock with revenue growth like this you're going to find.

The CSI 300 index has finished it's 2022 correction and is in a uptrend likely supporting PDD rising.

Good luck!

Campaign Trading this company to $175Technical Indicators and Analyst Ratings

Overall Recommendation: Neutral, with some leaning towards a "Strong Buy."

1-Year Price Target: $146.22, a potential increase of 27.96%.

Company Profile

Founded: 2015 by Hua Lin Cai and Zheng Huang.

Headquarters: Dublin, Ireland.

Business Model: A multinational commerce group focusing on digital economy inclusion for local communities and small businesses.

Heavy Volume Build Up! Little Double Dip?Seen in the volume profile levels to the left, there is a large volume displacements and price looks like it wants $110 this week.

High amounts of calls at the $110 strike expiring 1/10. Its only right lol.

Large volume on the $130 & $150 strikes expiring 1/17

Price targets:

#1

$110 by end of week

#2

$120

#3

$140

PDD Going Up! ✅ Breakout Potential – PDD has been consolidating near key resistance levels, and a breakout above $108 could trigger the next leg up. If it holds above this level, I see a possible huge upward directional move.

✅ Volume Expansion – Recent trading sessions have seen higher-than-average volume, which is often a sign that institutions are accumulating shares.

PDD is not just another e-commerce stock—it’s a growth powerhouse with strong fundamentals and a compelling technical setup. If the stock maintains its bullish trajectory, we could see new all-time highs soon.

What are your thoughts on PDD? Bullish or bearish? Drop your insights in the comments! 📢📊

$PDD has 50-60% upside from $100- NASDAQ:PDD has solid growth and temu is currently launching into new regions with TAM increasing with each entered zone.

- Chinese equities are dirt cheap and have performed badly in last 4 years. Trump was seen as detrimental for chinese equities. However, I will play the devil's advocate here and say Trump will be good for China. If US wants to prosper then it's better to sort deals and grow together vs making china as enemy economically.

- Lot of companies of US have manufacturing in China and Chinese consumers especially middle class is getting stronger thus offering selling opportunities for US companies.

- China will ease monetary policy to revive the demand and consumption which should boost economy

11/23/24 - $pdd - Close to buying again... ~$10011/23/24 :: VROCKSTAR :: NASDAQ:PDD

Close to buying again... ~$100

- have traded this one around quite extensively, but it's always been a rental, because I'm never quite confident to own chinese stonks after getting the Brandon treatment on my Yandex shares (which eventually turned to NASDAQ:NBIS and i got to dump for btc)

- the VIE structures in china remain a concern, to be sure. but ironically i feel much more confident w Trumpo in whitehouse and this setup vs. Kamelo. his first term did similar to chinese stonks, sending them back "home" before there was less concern over time. to be sure China needs the US "less" than 4-8 years ago, but it remains important. also it's all one big club as my friend george carlin says and you and i r not in it (or if you are... godspeed). which is to say, it's all theater they r all friends and ultimately there are no real wars anymore (but i digress...)

- so back to $pdd. conf call yielded what sounded like a sequel to the last result "growth moderating so we'll spend more"

- but when you look at google trends, a consumer still spending, and a cash strapped consumer... and i realize that google trends aren't the be-all-end-all but they help in the case of gauging brand/ retail interest. TEMU looks pretty legit (that's the marginal grower in the portfolio)

trends.google.com

- so what's the right price for a chinese stock? always impossible to know short-term. but let's consider amazon is the gold standard. you get half the growth (conservatively bc it's probably 1/3) for 4-5x the PE multiple (of pdd) and you get 20% fcf yield on PDD (on their EV) vs. amzn at 3%.

- what about other chinese stocks i follow (typically only the top 3 at this stage b/c the others are exposed to the same risks and with more downside - bc they r not as passively owned) but probably w similar upside. so let's see about another big one, $baba. multiple slightly higher on PE and fcf yield (which i'd point to as the guiding light when valuation metrics are already v low) as 11%. JD closer to 13% fcf yield. a smaller one... NYSE:VIPS (low to now growth) at closer to 30%. so NASDAQ:PDD 's ~20% yield looks pretty attractive for a co that should all-things-equal be the larger enterprise value company (vs. baba).

- what's the right way to play it? the million dollar question. into year-end, the stock might see a lot of vol to be sure. i'd hardly see US funds necking into this with size esp when they can take "china risk" with NYSE:TSM which is probably my favorite single name at the moment - i might write that up again. furthermore, tax loss season is upon us, so weak action on recent AMEX:KWEB and all corresponding chinese stonks is going to force some rearranging by passive funds into year end as well. ultimately a bottom could be soon (could already be in), but given i see little reason for the stonk to retrace it's big (again) down move without additional sellers repositioning... the risk/reward looks balanced. as mentioned i am not a "must own china" exposure guy. and my NYSE:TSM position (using leverage) at nearly 25% is big enough.

- so the way i'm personally playing it in my PA is further waiting. if it rips/ big catalyst, trump sucks the chinese star... i can hop back in. i'll add it to the top of my watchlist (at this pt i generally will be watching NASDAQ:PDD > NYSE:BABA > NASDAQ:JD as canaries.. the others i'll look again with detail if/when the bellwethers run).

- keep an eye on the gap from late '24 as well. market makers have a funny way of dotting these i's and crossing these t's. low $80s would be a good entry.

- one more thing. i'm probably going to use medium-term leverage if we go lower. why? because i don't want to tie up a ton of notional cash in chinese names that could take time for catalyst to play out, but are explosive to the upside if/when. furthermore, if something whacky happens, i'd rather take the smaller L then have to cut or be cut off in my account with a zero. i ascribe a small scenario of the "yandex" style event, but would want to build some optionality for myself if/does happen, including ability to size up the calls with a longer dated exposure. remember - the main objective is to not lose money and to set ourselves up in the way where we can maximize upside to downside. i like calls on the chinese names when duty calls.

- if you've stuck with me on this long one. i appreciate you (i always do). have been traveling the last week and missed some action, so i'm here on a Saturday reviewing some buckets of names that i've been meaning to check in on (like China).

be blessed,

V

$PDD reversal finally coming for China stocks?PDD set to make a bullish move. Price at trendline going back to May and also at the demand zone from September before October’s parabolic move. RSI, MACD, and STOCH are all curling up and oversold. A break above 102.50 and this will explode higher. Initial PT at 110 and followed by gapfill PT at 114. SL at break and close of bottom trendline.

$PDD Long to $106-$108I entered into a long on NASDAQ:PDD at $97.50 and am moving my stop loss up to $97.5 from $95. Either PDD breaks $100 and we reach downtrend resistance around $106-$108, or it gets rejected here and goes down further. I'm positioning myself in case this happens, potentially losing current profit but leaving the trade open for an additional 7-9%.

PDD (TEMU) is the new WISHPinduoduo, once a rising star in China's e-commerce market, has recently reported earnings below expectations, marking a significant turning point for its stock. This paper analyzes the technical and fundamental reasons why PDD Holdings' stock could experience a dramatic drop, similar to Wish.com, a platform that lost most of its market value due to strategic missteps, intense competition, and declining investor confidence.

1. Fundamental Analysis

1.1. Disappointing Earnings

For the first time, Pinduoduo has posted earnings below market expectations. This is a red flag for several reasons:

Decelerating Growth: A mismatch between analysts' projections and actual performance suggests Pinduoduo's rapid growth model may be unsustainable.

Margin Pressures: Declining profit margins indicate rising competition or operational inefficiencies, reminiscent of Wish.com.

1.2. Vulnerable Business Model

Like Wish, Pinduoduo operates on a low-margin, high-volume group-buying model that is inherently fragile:

Low-Value Customers: A customer base driven primarily by extreme discounts tends to lack loyalty and is highly price-sensitive.

Perceived Low Quality: Offering low-quality products risks damaging the brand's reputation over time.

1.3. Slowing Chinese Market

China's e-commerce sector is becoming saturated, with fierce competition from established players like Alibaba and JD.com. This market saturation could further hinder Pinduoduo's ability to grow and retain market share.

2. Technical Analysis

2.1. Downward Trend in Stock Price

Pinduoduo's stock has recently declined significantly, reflecting bearish investor sentiment. Key technical indicators show:

Bearish Breakout: The stock price has broken key support levels at $80 and is heading toward lower thresholds.

Price Target of $20: Based on Fibonacci retracements and Elliott Wave Theory, the next significant support level is around $20.

2.2. Increased Volatility

Recent trading sessions have seen a surge in volume, a classic indicator of institutional selling. This signals aggressive selling pressure, which could accelerate the stock's decline.

3. Parallels with Wish.com

3.1. Wish.com's Decline

Wish.com saw its stock collapse from $32 during its IPO to less than $1 due to:

Disappointing Financial Results: Consistent earnings misses eroded investor trust.

Intense Competition: Other platforms like Amazon and Shopee captured market share.

Loss of Active Users: An unsustainable business model led to a shrinking customer base.

3.2. Similarities with Pinduoduo

Pinduoduo exhibits similar vulnerabilities, including:

Low Margins and High Competition: Like Wish, Pinduoduo faces a highly competitive environment that puts downward pressure on margins.

Brand Weakness: A growing perception of low-quality products could erode customer trust and loyalty.

4. Current Developments and Risks

Earnings Miss: PDD reported third-quarter revenue growth of 44%, reaching 99.35 billion yuan ($13.7 billion), falling short of the 102.43 billion yuan expected by analysts.

Stock Performance: Following the earnings miss, PDD shares dropped 8% in pre-market trading, reflecting growing concerns over its growth trajectory.

PDD eyes on $110.45: Golden Genesis fib to start the next move PDD and all Chinese stocks has been whipsawed.

Now approaching well proven Golden Genesis fib.

Even the Fib-Blind are keenly aware of this level.

$110.45 is the Golden Genesis to hold.

$101.98 then 96.75 are support fibs below.

$124.15 above will the first target/resistance.

===========================================

.

PDD - hyper growth gem Rising wedge was always going to break down. This company has high exposure to the Chinese consumer, which continues to struggle with no end in sight. That is reflected in the stock price of companies like Alibaba which trade at very low valuations. But unlike Alibaba, PDD is a hyper growth stock and has taken a lot of their market share.

Looking at the technicals, there is a gap fill between $80-90. I did start with a small buy at $97 but I’m looking to start a sizeable position at the gap fill. We have all sorts of confluence on the chart, I tend to favour Fibonacci retracement and Fibonacci time based trend, along with the Speedfan.

I like what I see for a long term investment, not looking to trade this. I do believe the Chinese economy will rebound, and when it does PDD will have a violent rebound.

Not financial advice, just my thoughts. I will continue to monitor this and keep you updated. Happy trading!