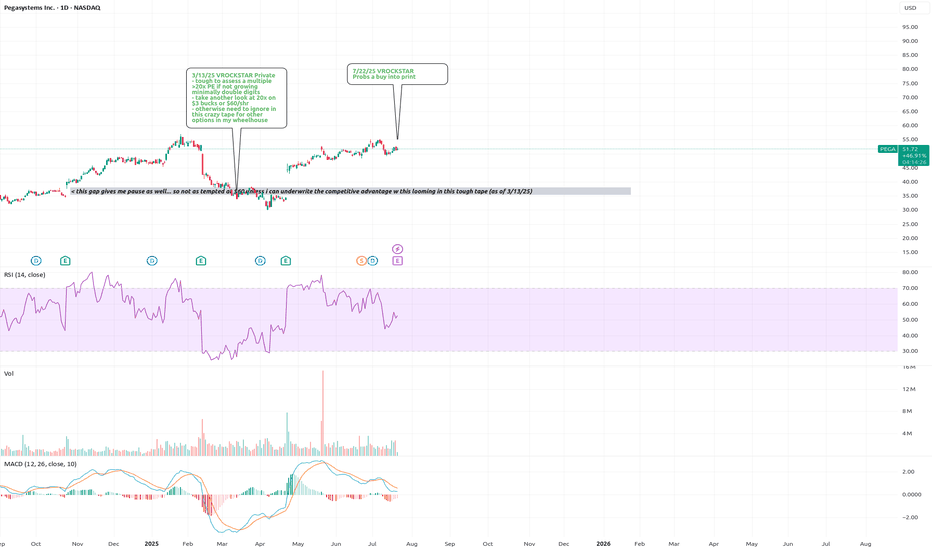

7/22/25 - $pega - Probs a buy into print7/22/25 :: VROCKSTAR :: NASDAQ:PEGA

Probs a buy into print

- not expensive

- great growth

- expanding margins

- good early barometer for consumer/ journey stuff

- insane beat last result... hard to extrapolate these things w/o digging in more... but setup is solid into results on a quick look.

-

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.28 USD

99.19 M USD

1.50 B USD

88.10 M

About Pegasystems Inc.

Sector

Industry

CEO

Alan Trefler

Website

Headquarters

Waltham

Founded

1983

FIGI

BBG000H1RYG7

Pegasystems, Inc. engages in the development, market, license, and support of software, which allows organizations to build, deploy, and change enterprise applications. Its product, Pega Infinity, helps connect enterprises to their customers in real-time across channels, streamline business operations, and adapt to meet changing requirements. The company was founded by Alan Trefler in 1983 and is headquartered in Waltham, MA.

Related stocks

Pegasystems Inc. (PEGA) Powers AI Business WorkflowPegasystems Inc. (PEGA) is a software company that delivers AI-powered workflow automation and customer engagement solutions for large enterprises. Its platform helps businesses streamline operations, improve customer experiences, and adapt quickly to changing needs. Pegasystems’ growth is driven by

Pegasystems (PEGA) AnalysisCompany Overview: Pegasystems NASDAQ:PEGA is strategically positioned to leverage the increasing demand for AI-powered customer service solutions. By incorporating advanced technologies such as natural language processing and chatbots, PEGA is enhancing user experiences and streamlining customer i

$PEGA, AI Stock Set to Rip Apart The BearsIn the rapidly evolving landscape of artificial intelligence (AI), few companies have made as significant a mark as Pegasystems Inc. (NASDAQ: PEGA). Known for its cutting-edge software solutions, PEGA stands out for its robust AI capabilities, making it a compelling choice for investors looking to c

PEGA - JULY 24 MATrend Unsustainable Momentum- D1 is top of the range

- H1 setup showed a previous downtrend followed by a spike up today

- Slight price rejection in H1 with the opening candle

- Huge price rejection in H1 with the 22:30 candle

MATrend Unsustainable Momentum (Systematic) ⏪

The strategy identifies stocks (Tech sector ) that fo

PEGA - JULY 24 MATrend Unsustainable Momentum- D1 is top of the range

- H1 setup showed a previous downtrend followed by a spike up today

- Slight price rejection in H1 with the opening candle

- Huge price rejection in H1 with the 22:30 candle

MATrend Unsustainable Momentum (Systematic) ⏪

The strategy identifies stocks (Tech sector ) that fo

A Cup and Handle on Pegasystems! Potential of +50%NASDAQ:PEGA

Pegasystems Inc. is a leading provider of Customer Relationship Management software that enables transaction-intensive organizations to manage a broad array of customer interactions. Their software enables organizations to deliver high-quality, consistent customer service across today's

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

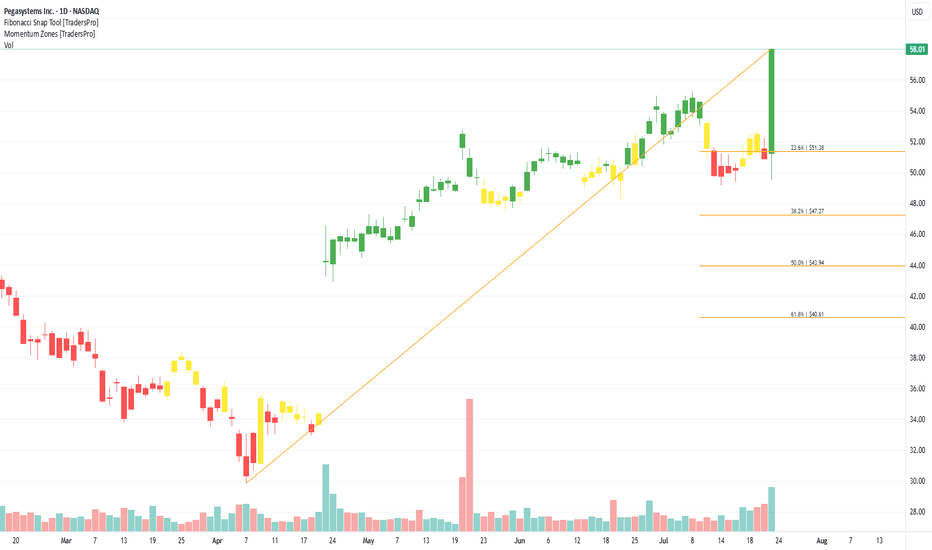

The current price of PEGA is 57.40 USD — it has decreased by −2.23% in the past 24 hours. Watch Pegasystems Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Pegasystems Inc. stocks are traded under the ticker PEGA.

PEGA stock has fallen by −1.03% compared to the previous week, the month change is a 9.33% rise, over the last year Pegasystems Inc. has showed a 62.65% increase.

We've gathered analysts' opinions on Pegasystems Inc. future price: according to them, PEGA price has a max estimate of 78.00 USD and a min estimate of 58.00 USD. Watch PEGA chart and read a more detailed Pegasystems Inc. stock forecast: see what analysts think of Pegasystems Inc. and suggest that you do with its stocks.

PEGA reached its all-time high on Feb 22, 2021 with the price of 74.40 USD, and its all-time low was 0.45 USD and was reached on Dec 19, 2000. View more price dynamics on PEGA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PEGA stock is 3.36% volatile and has beta coefficient of 1.43. Track Pegasystems Inc. stock price on the chart and check out the list of the most volatile stocks — is Pegasystems Inc. there?

Today Pegasystems Inc. has the market capitalization of 10.04 B, it has decreased by −2.52% over the last week.

Yes, you can track Pegasystems Inc. financials in yearly and quarterly reports right on TradingView.

Pegasystems Inc. is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

PEGA earnings for the last quarter are 0.28 USD per share, whereas the estimation was 0.24 USD resulting in a 14.71% surprise. The estimated earnings for the next quarter are 0.20 USD per share. See more details about Pegasystems Inc. earnings.

Pegasystems Inc. revenue for the last quarter amounts to 384.51 M USD, despite the estimated figure of 361.88 M USD. In the next quarter, revenue is expected to reach 351.54 M USD.

PEGA net income for the last quarter is 30.08 M USD, while the quarter before that showed 85.42 M USD of net income which accounts for −64.79% change. Track more Pegasystems Inc. financial stats to get the full picture.

Yes, PEGA dividends are paid quarterly. The last dividend per share was 0.03 USD. As of today, Dividend Yield (TTM)% is 0.13%. Tracking Pegasystems Inc. dividends might help you take more informed decisions.

Pegasystems Inc. dividend yield was 0.13% in 2024, and payout ratio reached 10.84%. The year before the numbers were 0.25% and 15.03% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 5.44 K employees. See our rating of the largest employees — is Pegasystems Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Pegasystems Inc. EBITDA is 297.36 M USD, and current EBITDA margin is 11.92%. See more stats in Pegasystems Inc. financial statements.

Like other stocks, PEGA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Pegasystems Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Pegasystems Inc. technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Pegasystems Inc. stock shows the buy signal. See more of Pegasystems Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.