Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.25 USD

462.19 M USD

2.87 B USD

2.14 B

About Palantir Technologies Inc.

Sector

Industry

CEO

Alexander Caedmon Karp

Website

Headquarters

Denver

Founded

2003

FIGI

BBG000N7QR55

Palantir Technologies, Inc. engages in the business of building and deploying software platforms that serve as the central operating systems for its customers. It operates through the Commercial and Government segments. The Commercial segment focuses on customers working in non-government industries. The Government segment is involved in providing services to customers that are the United States government and non-United States government agencies. The company was founded by Alexander Ceadmon Karp, Peter Andreas Thiel, Stephen Cohen, Joseph Lonsdale, and Nathan Dale Gettings in 2003 and is headquartered in Denver, CO.

Related stocks

Palantir Technologies: Long Opportunity Amid AI MomentumCurrent Price: $153.52

Direction: LONG

Targets:

- T1 = $159.20

- T2 = $165.80

Stop Levels:

- S1 = $150.70

- S2 = $147.30

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ide

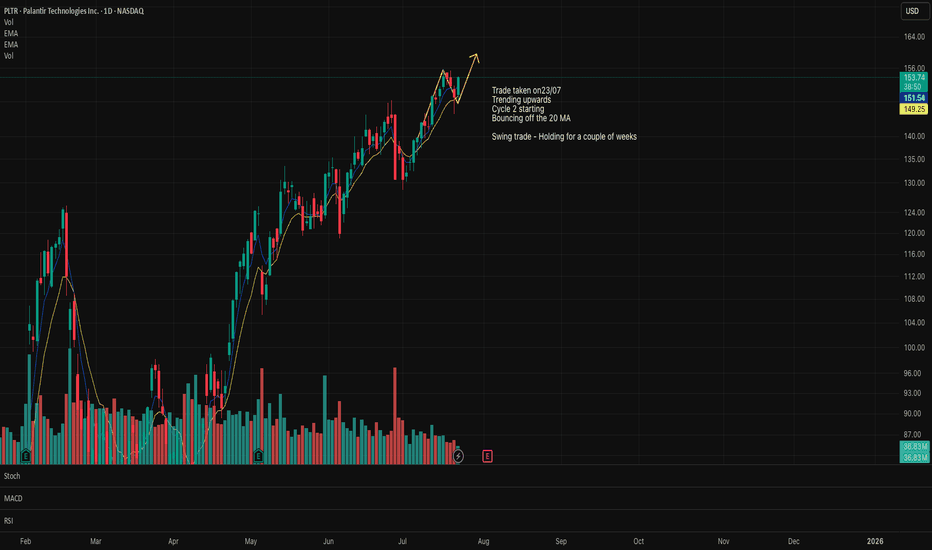

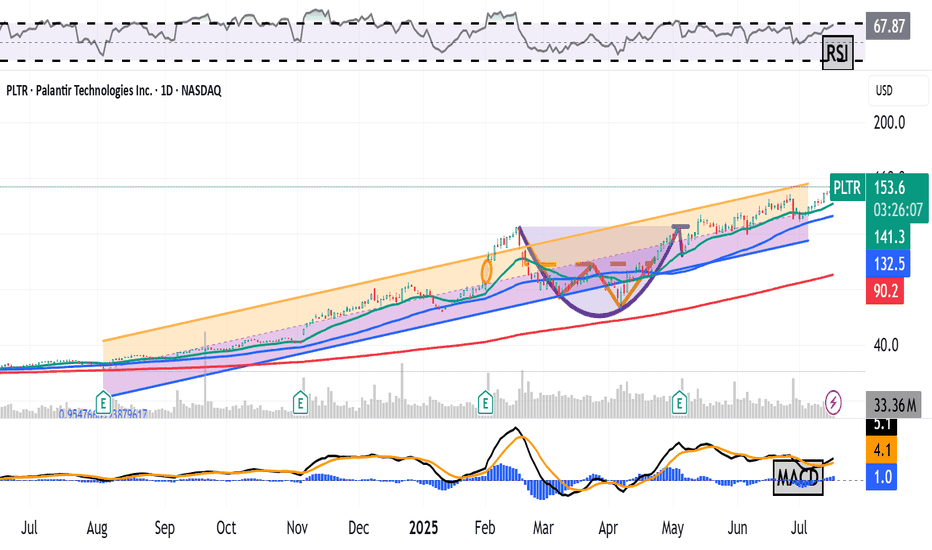

PLTR moving higherPLTR expected to move higher.

The price is bouncing off the 20MA and respecting it.

Making new higher/highs and higher lows.

Earnings is due shortly, which could have a negative impact to the price.

However, the long term outlook for the company is still strong.

Anyone else have thoughts on this

Jade Lizard on PLTR - My 53DTE Summer Theta PlayMany of you — and yes, I see you in my DMs 😄 — are trading PLTR, whether using LEAPS, wheeling, or covered calls.

I took a closer look. And guess what?

📈 After a strong move higher, PLTR was rejected right at the $143 call wall — pretty much all cumulative expiries cluster resistance there

Usin

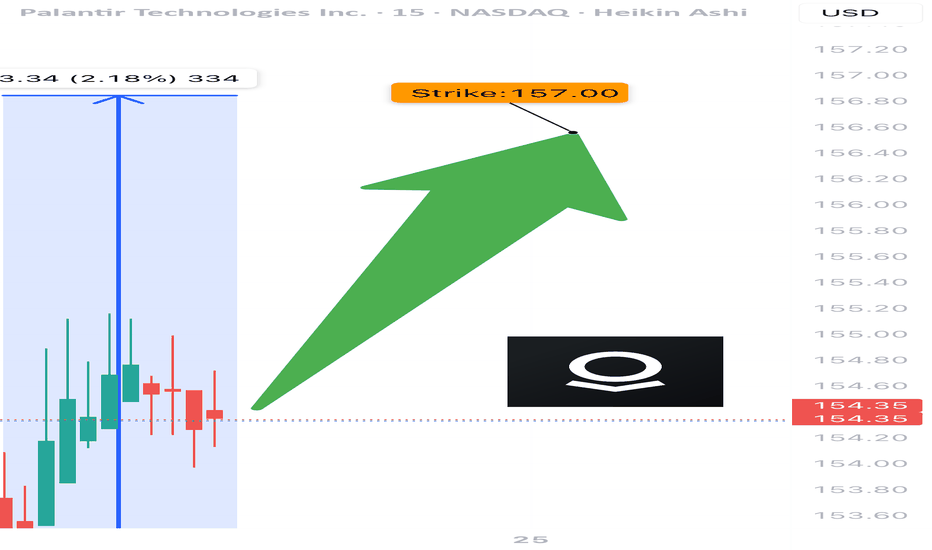

PLTR TRADE SIGNAL (07/24)

🚨 PLTR TRADE SIGNAL (07/24) 🚨

💥 Expiry in 1 day = HIGH GAMMA risk = BIG MOVES coming

🧠 Key Highlights:

• Call/Put Ratio: 1.40 → bullish options flow

• Strong institutional positioning 📈

• RSI cooling off = ⚠️ watch momentum

• Volume concerns → cautiously bullish

💥 TRADE SETUP

🟢 Buy PLTR $157.50 C

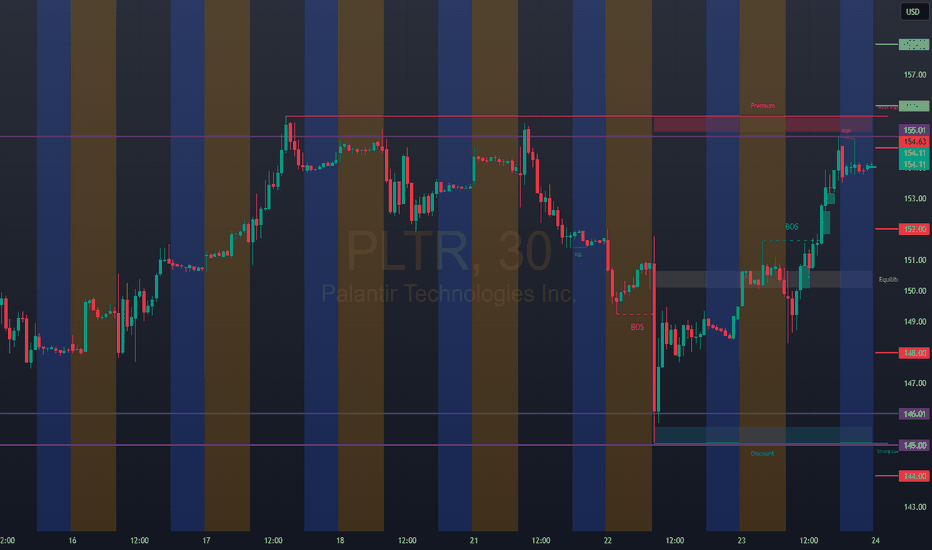

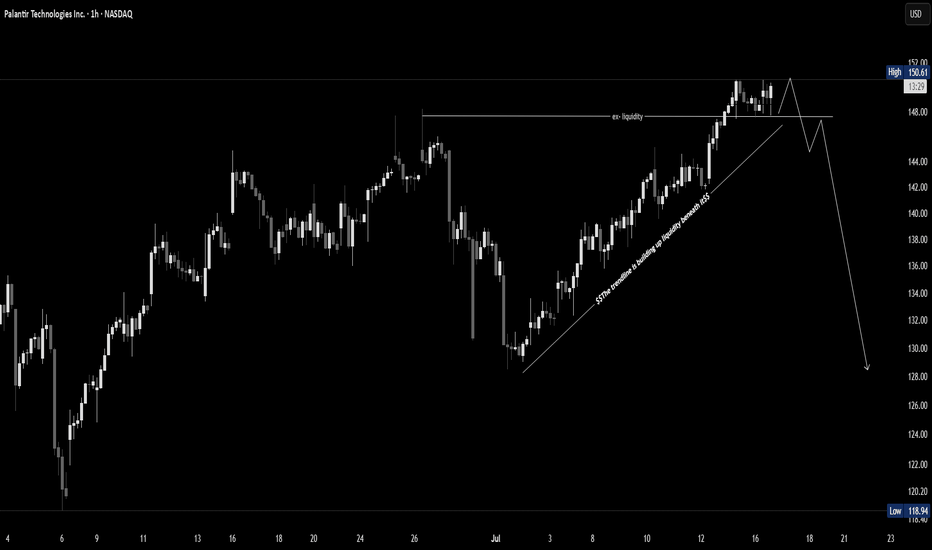

PLTR Sitting on the Edge! Will $147 Hold or Break? July 16Technical Overview:

PLTR is showing signs of a distribution top after a strong rally. The most recent 1H structure shows a Change of Character (CHoCH) just under $149 with lower highs forming and weak bullish reaction.

* CHoCH confirmed under $148.50

* Price struggling inside supply zone: $148.50–$1

PLTR is doing it... pullback honeyThis video has my thoughts about PLTR and a trading view tip... the data window!!! Who knew?

Hope the talk inspires you as you decide on future investments; especially when it's stalling or pulling back.

My short term bias is bearish for a pullback on PLTR. Not sure when it will happen, but <155 i

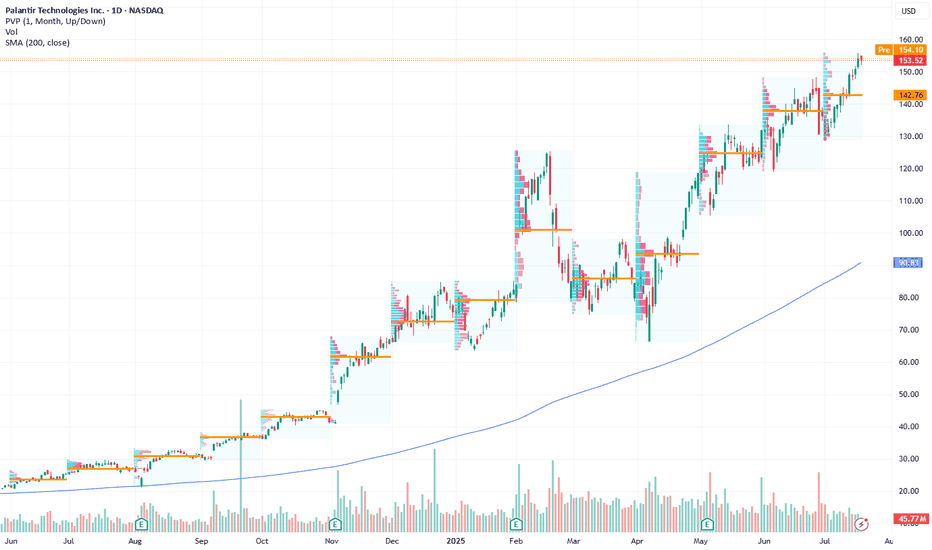

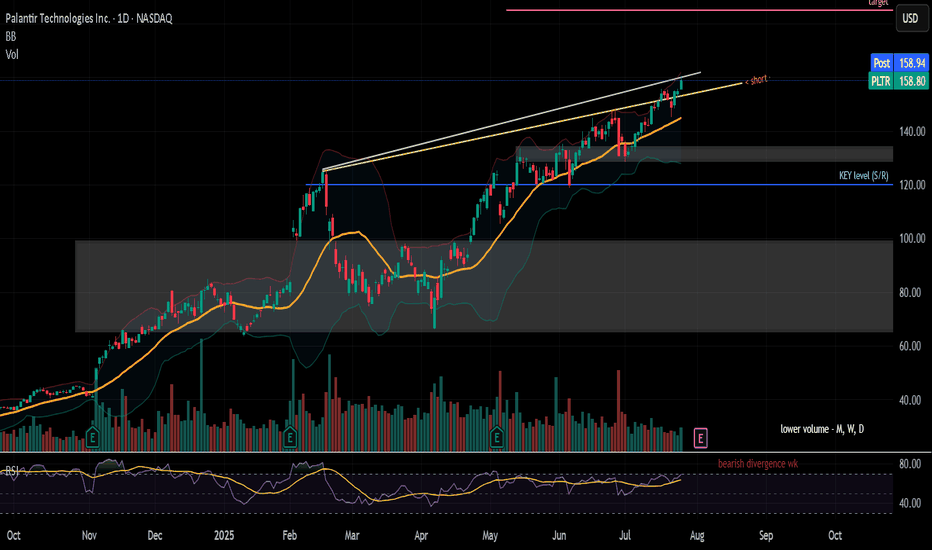

Palantir Is Up 600%+ Since August. What Do Its Charts Say?National-security software firm Palantir Technologies NASDAQ:PLTR hit a new all-time high this week and has gained more than 600% since hitting a 52-week low last August. What does technical and fundamental analysis say could happen next?

Let's look:

Palantir's Fundamental Analysis

PLTR has b

PLTR Just Broke the High - But Don't Get Trapped Palantir just broke its recent high, sparking breakout excitement. But this could be a classic liquidity grab — not a genuine breakout. If price fails to hold and shifts structure, a sharp reversal could follow.

🧠 Wait for confirmation — don’t chase green candles.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of PLTR is 158.80 USD — it has increased by 2.63% in the past 24 hours. Watch Palantir Technologies Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Palantir Technologies Inc. stocks are traded under the ticker PLTR.

PLTR stock has risen by 2.63% compared to the previous week, the month change is a 9.99% rise, over the last year Palantir Technologies Inc. has showed a 509.83% increase.

We've gathered analysts' opinions on Palantir Technologies Inc. future price: according to them, PLTR price has a max estimate of 170.00 USD and a min estimate of 40.00 USD. Watch PLTR chart and read a more detailed Palantir Technologies Inc. stock forecast: see what analysts think of Palantir Technologies Inc. and suggest that you do with its stocks.

PLTR reached its all-time high on Jul 17, 2025 with the price of 155.68 USD, and its all-time low was 5.92 USD and was reached on Dec 27, 2022. View more price dynamics on PLTR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PLTR stock is 3.55% volatile and has beta coefficient of 2.32. Track Palantir Technologies Inc. stock price on the chart and check out the list of the most volatile stocks — is Palantir Technologies Inc. there?

Today Palantir Technologies Inc. has the market capitalization of 374.75 B, it has increased by 5.90% over the last week.

Yes, you can track Palantir Technologies Inc. financials in yearly and quarterly reports right on TradingView.

Palantir Technologies Inc. is going to release the next earnings report on Aug 4, 2025. Keep track of upcoming events with our Earnings Calendar.

PLTR earnings for the last quarter are 0.13 USD per share, whereas the estimation was 0.13 USD resulting in a 1.05% surprise. The estimated earnings for the next quarter are 0.14 USD per share. See more details about Palantir Technologies Inc. earnings.

Palantir Technologies Inc. revenue for the last quarter amounts to 883.86 M USD, despite the estimated figure of 862.17 M USD. In the next quarter, revenue is expected to reach 939.12 M USD.

PLTR net income for the last quarter is 214.03 M USD, while the quarter before that showed 79.01 M USD of net income which accounts for 170.89% change. Track more Palantir Technologies Inc. financial stats to get the full picture.

No, PLTR doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 3.94 K employees. See our rating of the largest employees — is Palantir Technologies Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Palantir Technologies Inc. EBITDA is 435.34 M USD, and current EBITDA margin is 11.93%. See more stats in Palantir Technologies Inc. financial statements.

Like other stocks, PLTR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Palantir Technologies Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Palantir Technologies Inc. technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Palantir Technologies Inc. stock shows the strong buy signal. See more of Palantir Technologies Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.