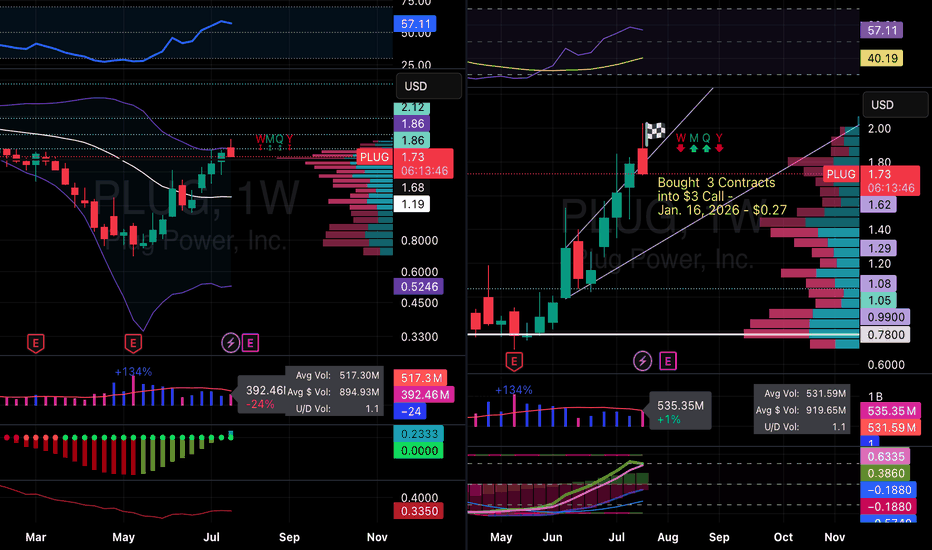

Plugged InIn looking at the money flow for NASDAQ:PLUG , I see the EMAs 8 day and 21 day crossing into a new uptrend. The RSI is still below the overbought territory. The weekly is down with volume pouring in to get ready for the next leg. Sellers are slowing with the MACD. Looking ahead the money in the past has flowed into PLUG in the winter, therefore winter contracts look well priced and primed for the future growth based upon today's information. Let's see where it goes.

Remember do your own due diligence and research. Past performance doesn't equal future performance.

PLUG trade ideas

Plug Power (PLUG): Recovery Play or Terminal Decline?Plug Power Inc. (PLUG) , a company focused on green hydrogen and fuel cell technologies, stands as one of the most emblematic examples of a boom and bust cycle in the speculative clean energy sector.

It reached an all-time high of USD 75.49 in January 2021 , driven by market enthusiasm over the energy transition. However, since then, the stock has collapsed by more than 99% , hitting a low of USD 0.69 on May 16, 2025 . It currently trades below USD 2, reflecting a massive loss in market capitalization and deep investor distrust.

🧮 Fundamental Analysis

1. Business Model

Plug Power develops integrated systems for the generation, storage, and distribution of green hydrogen, mainly targeting logistics, mobility, and high-energy industrial sectors.

2. Financial Issues

Persistent losses: the company has been unprofitable for years. In 2024, it posted a net loss of over USD 700 million.

High operating costs and poor efficiency in hydrogen project execution.

Accounting concerns: the SEC flagged accounting issues in 2021 and 2022, further damaging institutional confidence.

3. Capital Dilution

Plug has repeatedly financed its operations through equity offerings, significantly diluting shareholders. Recent rounds were issued at very low prices, worsening the drop in share value.

4. Cash Position

As of June 2025, the company requires new capital to continue operations, facing the risk of issuing more shares or convertible debt under unfavorable terms.

⚠️ Key Risks

Delisting risk if the stock doesn’t remain above USD 1.00 in the short term.

Bankruptcy risk (Chapter 11) if no strategic financing or partnerships are secured.

The green hydrogen sector is still not cost-competitive without subsidies, and competition is fierce (Air Liquide, Linde, Bloom Energy, etc.).

✅ Opportunities

Potential to secure strategic alliances with utilities, automakers, or industrial partners.

Ongoing green subsidies from the U.S. and EU may offer short-term support.

Much of the negative outlook seems already priced in: current market cap is around USD 1.8 billion, with physical assets and contracts still in place.

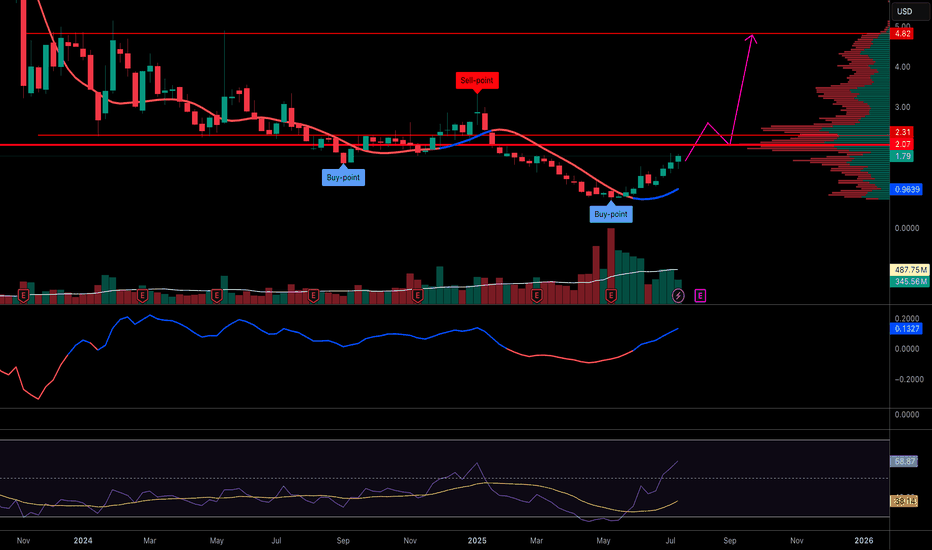

📉 Technical Analysis

From its all-time low of USD 0.69, PLUG staged a strong rebound, gaining +294% to reach USD 2.03 on July 21, 2025 . It now trades in a consolidation zone between the 23.6% (USD 1.71) and 38.2% (USD 1.52) Fibonacci retracements , which may act as short-term technical support.

This is a high-risk, high-volatility stock , capable of generating outsized returns — or total losses. Strict risk management is essential.

Repeated Rejections at the 200-EMA

The 200-day exponential moving average (EMA 200) has acted as a dynamic resistance throughout PLUG’s multi-year downtrend. Over the past three years, the stock has attempted to break above it on at least three occasions — in 2022, 2023, and 2025 — but failed each time.

The most recent attempt, in July 2025, ended with a reversal after reaching USD 2.10, which also coincides with the 23.6% Fibonacci retracement from the all-time high. Unless the stock breaks above the 200-EMA with strong volume and an ascending price structure, the bearish trend remains intact.

🧠 Speculative Position

We are currently positioned with a bullish options strategy targeting a speculative upside:

📈 Buy CALL USD 2.00 (exp. January 16, 2026)

🛡️ Sell CALL USD 5.00 (same expiration)

→ This forms a Bull Call Spread, limiting downside risk while maintaining a favorable risk/reward ratio.

🧾 Conclusion

Plug Power is no longer a fundamentally sound investment , but rather a high-risk speculative play , comparable to a synthetic long-term call option . If the company survives, restructures its balance sheet, and secures strategic partners, the upside could be substantial — but the risk of total capital loss remains very real .

🧭 Suitable only for experienced traders with speculative capital and disciplined technical execution.

Plug Power Inc. ( PLUG)The Stock formation between Cup and Handle pattern & Inverted Head and Shoulders pattern at the bottom of Handle side.

Any moment can trigger to 1.53$ , by breaking up this Level, the Target price on Chart.

Any positive news Any moment, will trigger UP.

Highly recommended for Buying.

Plug Power Inc. ( PLUG) .Eve-Adam Double Bottom Pattern

This pattern consists of a U-shaped bottom followed by a V-shaped bottom. It ranks third among four patterns according to Bulkowski, with an average gain of 37% after the breakout and before a correction of 20% or more.

Bulkowski Expected Target Price = 103$ in the middle way before reaching the Target price of Eve & Adam Double Bottom pattern.

Resistance level = 75$

Eve & Adam Double Bottom pattern Target price = 150$ .

Highly recommended for Buying this Stock 👌.

PLUG BUYBUY PLUG at .87 to .47, riding it back up to 3.20 to 13.00 as Profit Targets, Stop Loss is at .20!

If anyone likes mumbo jumbo long useless analysis, than this is NOT for you.

Also, if you are afraid of risk, failure, and want only a 100% sure thing, than

run as fast as you can from here and from the markets,

because it is definitely NOT for you.

WARNING: This is just my opinion of the market and its only for journaling purpose. This information and any publication here are NOT meant to be, and do NOT constitute, financial, investment, trading, or other types of advice or recommendations. Trading any market instrument is a risky business, so do your own due diligence, and trade at your own risk. You can loose all of your money and much more.

Plug Power: A Mirage or a Miracle?Plug Power (NASDAQ: PLUG), a key innovator in hydrogen energy solutions, recently experienced a significant surge in its stock value. This upturn is largely attributed to a strong vote of confidence from within the company: Chief Financial Officer Paul Middleton substantially increased his stake by acquiring an additional 650,000 shares. This decisive investment, following an earlier purchase, clearly signals robust conviction in Plug Power's future growth trajectory, despite prior market challenges. Analysts also reflect this cautious optimism, with an average one-year price target that suggests a significant upside potential from the current valuation.

A major catalyst for the renewed interest stems from Plug Power's expanded strategic collaboration with Allied Green Ammonia (AGA). This partnership includes a new 2-gigawatt (GW) electrolyzer project in Uzbekistan, part of a substantial $5.5 billion green chemical production facility. This facility will produce sustainable aviation fuel, green urea, and green diesel, positioning Plug Power's technology as foundational to large-scale decarbonization efforts. This initiative, backed by the Government of Uzbekistan, further solidifies a broader 5 GW partnership between Plug Power and AGA across two continents, highlighting the company's capability to deliver industrial-scale green hydrogen solutions.

While these strategic wins are promising, Plug Power continues to navigate financial headwinds. The company has faced recent revenue declines and currently reports significant annual losses and cash burn. To address capital needs, it is seeking shareholder approval to issue more shares. However, the substantial, multi-gigawatt contracts secured, particularly with Allied Green, underscore a strong future revenue pipeline. These projects affirm the critical demand for Plug Power's technology and its pivotal role in the evolving green hydrogen economy, emphasizing that the successful execution of these large-scale ventures will be key to long-term financial stability and sustained growth.

Potential ABCD patternStrong upside right now because of news that the CFO bought shares.

There is a potential ABCD pattern and fundamentally I think with the trump administration green hydrogen will have a few hard years, there are funding cuts for hydrogen project and more emphasis on oil and gas.

Plug Prints a Smile Face. Up 70%Plug Power - an Electrolyser Company has burnt Investors Capital to Date.

The initial idea was to use renewable Energy to convert pure water to Oxygen and Hydrogen using Electrolysis.

Initially the market got Sold on this Idea, and the stock was over bought.

But the market came back to reality in that you never get more out than you put in, and there was a TANK.

However, just IMO, the end use of H2 if made efficiently can be a viable use when generated by Solar or other means.

Whilst early for now, this one can still offer a further X3 from here but will remain speculative.

Only the Brave get Rewarded.

PLUG 1D Investment Long Aggressive Trend TradeAggressive Trend Trade

- short impulse

+ volumed TE / T1 level

+ support level

+ biggest volume 2Sp-

+ weak test

+ first buying bar close level

Calculated affordable stop limit

1 to 2 R/R take profit

Monthly Trend

"+ long impulse

+ support level

+ T2 level

+ biggest volume reaction bar

= below 1/2 correction"

Yearly CounterTrend

- short impulse

PLUG 1H Long Swing Conservative Trend TradeConservative Trend Trade

+ long impulse

+ 1/2 correction

+ volume zone

- strong approach

+ ICE level

+ support level

+ volumed Sp

Calculated affordable stop limit

1 to 2 R/R take profit

Daily Trend

"- short impulse

+ volumed TE / T1 level

+ support level

+ biggest volume 2Sp-

+ weak test"

Monthly Trend

"+ long impulse

+ support level

+ T2 level

+ biggest volume reaction bar

= below 1/2 correction"

Yearly CounterTrend

- short impulse

Will add more after successful test on 1H and / or after test completes on 1D.

PLUG alt energy looking to moonAlternative Energy demand is increasing. Plug after taking a heavy beating, leaving numerous gaps above its head, has a local Gap that could bring some excellent short-term gains. Hydrogen power. Lots of speculation around alternative energy this one just has the right fundamentals and the right technical analysis could send the Bots to that range you see there at the Gap and the 200 period 🤠

PLUG- book value is 2x higher- Asset PlayPLUG has a stated tangible book value 2x from current price.

Fundamentals:

Its still a cashflow negative, money loser.

Analysts expect the loss to be only -0.60 this year, down from -1.22 last year.

Analysts dont expect positive earnings until 2029.

Technicals:

Rsi is low, and possible bullish divergence, because momentum trend my be shifting neutral from its bearish trend.

Sentiment:

sentiment is low, meme stock players dont seem to care about PLUG like they used to, and TRUMP has definitely switched the energy narrative to pro oil vs alternatives.

TRADE-

long low rsi, and target tangible book value. 100% exit if target or partial met.

I wont be in this one for a decade like Celsius or other growth stocks, because this is an asset play.

I tend to avoid money losing businesses, unless they are deeply below tangible book value. Ive done this trade before on PLUG, it worked, so Im happy to try it again.

Im long options in the money, target tangible book value around 3.00 price.

PLUG power consolidation completed! Buy setupBuying now at discount levels near structural support. Expecting bullish thesis to be solidified once we recover above 1.9-2.2 levels.

Expecting fairly rapid progression to gap fill targets by 2026.

Strongly likely we see 6$ before summer 2025 & 10-12$ levels by end of yr

Planning to scale out of buy positions primarily at 10-12$ range. Will leave remainder for long term speculation for possible 14-20$ levels.

Plug long after the correction (Under Valued by 30%)Tgt: 4.90 based on technicals

partial take profit: 4.52 intrinsic Value

Wallstreet Tgt: $3.1

Reason --> News: The Treasury Department issued new rules on Friday for companies trying to get tax breaks for making clean hydrogen — a fuel that could make some of the world's dirtiest industries "green."

Competitor alternative stock PSE:BLOOM , did not trade Bloom due to overvaulation

Info:

In the heart of the green energy revolution, Plug Power Inc. has carved out a niche as a pioneer and leader in hydrogen fuel cell technology. Founded in 1997, the company initially faced skepticism about hydrogen’s viability but persisted in developing robust solutions that harness the power of this abundantly available element. Plug Power's primary focus is on producing fuel cells that replace conventional batteries in equipment and vehicles powered by electricity. These fuel cells use hydrogen in an electrochemical process to create energy, where hydrogen combines with oxygen to produce electricity, with water as the only byproduct. This innovation is a game-changer in the push towards sustainable industrial applications, offering a cleaner alternative to fossil fuels without sacrificing performance.

Fuel Cell Systems

Hydrogen Infrastructure

Energy Services

Electrolyzers

Stationary Power

Fundamentals:

Long term future: Hold/Sell

Bad deal with Amazon selling products in loss

Pontential Revenue increase till 2027 and improvement

Cashflow: Negative over the next 10year so bad future coming

Gross Profit: Negative -612m

Revenue Growth: Negative

Net Income: Negtive -1.4B

Solvency: Long-term 50/50 (short term no worries)

Technicals:

Stock down 90% Big Picture

A jump after News and short-term correction

Getting recjected by VAH and Fib and almost VWAP

Plug Power (PLUG): Early Signals of a Possible RecoveryPlug Power (PLUG) recently crossed above the EMA 200 and is now trading close to this key level. Furthermore, a long-term trendline, combined with supportive oscillator signals, suggests the potential formation of a bottom. The daily EMAs and SMAs indicate an even more compelling setup in the European XETRA trading sessions. This sets up an intriguing scenario where PLUG could experience a dynamic upward movement in the near future.