8/1/25 - $qqq - How i'm positioned 8/1/25 :: VROCKSTAR :: NASDAQ:QQQ

How i'm positioned

- 2x leverage on the whole book. 75% at risk so 150% gross

- so 25% powder

47% obtc

30% nxt (12.5% leaps)

36% deck (ST and leaps for 6.5%)

27% lulu (ST gas for 1% lol!)

8% mstr (ST gas for 80 bps lol!)

5% gme (ST gas for 40 bps!)

5% ses (covered with calls at 1 strike already)

be well. let's attack monday.

if we dip monday i think >50% chance that's the low

if we don't, i think >30% chance we go higher

so i'm bidding this selectively w balance of ST gas and high conviction plays.

V

QQQ trade ideas

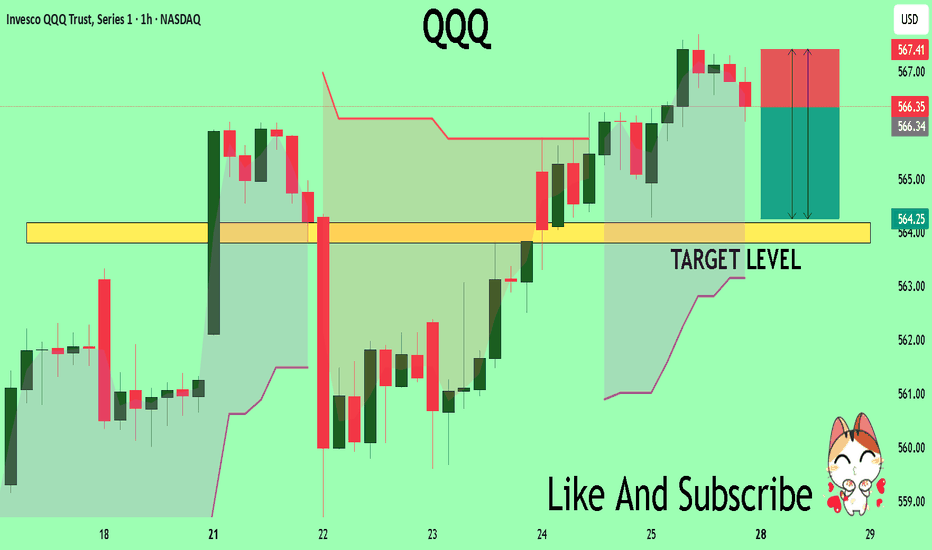

QQQ Massive Short! SELL!

My dear followers,

This is my opinion on the QQQ next move:

The asset is approaching an important pivot point 566.35

Bias - Bearish

Safe Stop Loss - 567.41

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 564.18

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

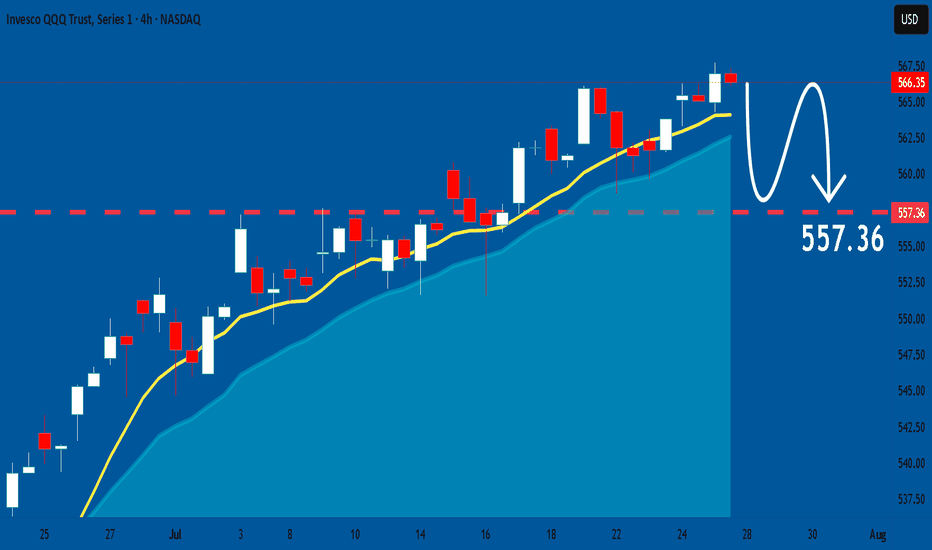

$QQQ August correction incoming?- August correction incoming? 🚨

- Greed is all time highs; People are complacent

- I believe a correction of 5-10% is healthy for the market to flush out excess and remove junk investments from the market.

- This involves people who are over-leveraged gets trapped.

- Personally, taking profits from risky bets, some profits from quality names and raising cash.

- Rotating money to defensive names.

- Not exiting the markets completely.

QQQ in a hot moment!Based on my analysis, the #QQQ got the reversal pattern candle, and we will have some consolidation starting this week until the end of September 2025.

My analysis becomes invalid in the daily candle close above the $572.11 (the high of today)

Do your diligence and study more; technical analysis is just the probabilities overview.

“Buy the rumor, sell the news”

---

### 🎯 **“Buy the Rumor, Sell the News” – A Trader’s Mind Game**

Imagine you’re not just following the market… you’re dancing ahead of it. This strategy flips traditional thinking on its head—and rewards those bold enough to act **before** the spotlight hits.

---

### 🕵️♂️ **Step One: Buy the Rumor**

- Traders catch whispers—like talk of a potential interest rate hike.

- The markets start to react *before* anything official is announced.

- Assets like gold might drop on the expectation alone… that’s your **entry point**.

You're not buying certainty. You're buying what the crowd *thinks* will happen.

---

### 🔊 **Step Two: Sell the News**

- Once the news breaks, it's already "old" to seasoned traders.

- That shocking headline? Already priced in.

- The market might reverse or surge unpredictably.

- This is when savvy traders exit, locking in profits from those who just arrived.

---

### 🧠 **Why It Works**

- Financial markets aren’t just driven by facts—they’re powered by **sentiment** and **anticipation**.

- By the time news goes public, smart money has already moved.

It’s like buying concert tickets before the band announces a tour—then selling them the moment fans go wild.

---

### 📉 **A Real Example**

- **Monday Rumor**: “The Fed will raise interest rates.”

- Gold begins to slide as traders prepare—this is your chance to act.

- **Thursday News**: The hike is confirmed.

- Instead of dropping further, gold might **rise** due to market overreaction or repositioning.

- You **sell** into that chaos—profit made.

---

Why NQ is probably tanking big timeIn this weekly chart, we see QQQ, which represents the Nasdaq.

As we can see, it had a hell of a run up.

Too far too fast IMO, and it reached the stretch level at the Upper Medianline Parallel.

The natural move is now to let go, take a breath and trade down to center again, which is the Centerline.

After all the most major and most important earnings results are over, and Funds have pumped up their gains through manipulative Options plays, it's time to reap what they have planted and book the gains.

It's all in line with, all moves are at the point, and everything is showing in a simple chart.

Unless price is opening and closing outside of the U-MLH, it's time to load the Boat and sail to the South.

#QQQ Weekly Chart – Technical Breakdown As of August 1, 2025QQQ Weekly Chart – Technical Breakdown

🧠 Key Observations

Bearish Weekly Rejection

A red candle at the recent high ($574.63) suggests buyers are taking profits.

Short-term reversal likely in play.

First Reaction Zone:

0.236 Fib at $533.87 is the first potential bounce zone.

Aligned with:

Fair Value Gap (FVG)

Upper range of the Weekly Order Block (OB)

Deeper Demand Zone:

If $533 fails, the Weekly Order Block becomes critical.

That zone stretches down toward $520–$508 (Fib 0.382).

Strong historical reaction area — may attract long setups if macro aligns.

RSI Divergence Risk:

RSI shows some signs of flattening.

Still above 59, so momentum is intact — but weakening.

📉 Pullback Path (Base Scenario):

Potential move to $533 → $520, consolidating inside the order block

From there, bullish continuation back toward $575+

Invalidated below $500, where structure breaks

📈 Mid-Term Bullish Bias Intact

Strong uptrend, higher lows still in place

Any dip into the OB + FVG zone = buy-the-dip opportunity.

Stock Allocation IdeasIf you're building a stock portfolio, how you allocate your money matters as much as what you buy. Here’s a practical, risk-aware approach for retail traders and investors:

1. Core and Satellite Approach

Core (60–70%): Stick with strong, stable companies—large-cap names with reliable earnings like AAPL, MSFT, or JNJ. These form the foundation of your portfolio.

Satellite (30–40%): Use this portion for high-potential ideas—growth stocks, emerging tech (like AI or EV), or small caps. Higher risk, but higher potential return.

2. Mix Between Defensive and Growth Stocks

In volatile markets, lean toward defensive sectors (healthcare, consumer staples, utilities).

In bull markets or improving conditions, increase exposure to growth sectors (tech, consumer discretionary).

3. Blend Growth and Value

Balance high-growth stocks with undervalued, stable companies.

When interest rates are high or inflation is rising, value stocks often perform better.

When rates fall or the economy picks up, growth stocks usually lead.

4. Don't Ignore International Exposure

While U.S. stocks are strong, consider adding 20–30% exposure to global markets (Europe, Japan, or select emerging markets).

5. Stay Disciplined with Rebalancing

Check your portfolio every 3 months.

Take profits where gains have outpaced, and reinvest in areas that are still fundamentally strong but lagging.

Final Tip: Focus on position sizing and risk management. You don’t need to hit every trade—preserving capital and staying in the game is the priority.

QQQ LEAP Trade Thesis – Aug 1, 2025

🧠 **QQQ LEAP Trade Thesis – Aug 1, 2025**

🎯 **Setup**: High-conviction LEAP PUT

📉 **Bias**: 🔻 *Moderate Bearish*

📆 Horizon: Long-Term (12+ months)

---

📊 **Multi-Model Intelligence Summary**

🧪 **Grok (xAI)**

• Monthly RSI = bearish 📉

• Trading near 52W highs = overvalued 💥

• Suggests: \$545 PUT

🧠 **Gemini (Google)**

• High conviction bearish

• Suggests: \$590 PUT (expensive premium)

🧬 **Claude (Anthropic)**

• RSI breakdown = confirmed weakness

• Recommends: \$530 PUT for max downside

🦾 **Meta (LLaMA)**

• Moving averages turning over

• Suggests: \$555 PUT – moderate confidence

🛰️ **DeepSeek**

• Long-term RSI confirms bearish drift

• Volatility ideal for LEAP entries

• Recommends: \$545 PUT

---

📍**MODEL CONSENSUS**

✅ Bearish trend across all models

✅ Favorable volatility (VIX ✅)

✅ Overvaluation = downside pressure

⚠️ Strike variance across models → we anchor at **\$545** for balance

---

💼 **TRADE SETUP (LEAP PUT)**

• 🔻 Direction: PUT (Short)

• 🎯 Strike: **\$545**

• 📆 Expiry: **2026-09-18** (413 days)

• 💰 Entry Price: **\$38.33**

• 🎯 Target: **\$76.66**

• 🛑 Stop: **\$24.91**

• ✅ Confidence: **75%**

• ⏰ Entry: Monday Open

• 📏 Size: 1 contract

---

📌 **Narrative**:

Every model says the same thing: RSI rollover, inflated price, and perfect LEAP conditions. Institutions are neutral → retail can front-run the decay. You don’t often get long-dated PUTs this clean.

🎯 Asymmetric risk/reward.

📉 Macro setup aligns.

🎯 Strong long-term positioning play.

---

🧠 Stay smart. Position early. Ride the macro shift.

🔔 Like + Follow for more AI-driven trade setups.

QQQ: Expecting Bullish Continuation! Here is Why:

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy QQQ.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

QQQ: Price Action & Swing Analysis

The analysis of the QQQ chart clearly shows us that the pair is finally about to tank due to the rising pressure from the sellers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

QQQ The Target Is UP! BUY!

My dear friends,

Please, find my technical outlook for QQQ below:

The instrument tests an important psychological level 553.86

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 562.88

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

QQQ daily bearish engulfing on Aug 1st. Where is the bottom?Top or temporary top signal spotted on August 1st tariff deadline marked by daily and weekly bearish engulfing candle on indexes.

Where is the bottom? Bullish reversal signal not yet spotted so here are potential scenarios as of now.

Scenario 1: Bull market still in play and reversal will happens to make a higher monthly low. Watch for a closed reversal candle.

Scenario 2: Monthly lower will be set. It's anyone guess where the temp bottom will happen. Here are potential bottom target to monitor:

2.1: Last year's high

2.2: QQQ 536-532 gap

2.3: Daily RSI 30

2.4: Daily RSI bullish divergence

Conclusion, set your alert levels and stay bearish till we see a closed reversal candle.

“QQQ Bounces Back — Trendline Still Holding”

📈 Trade Snapshot:

Despite a fakeout drop, QQQ holds the trendline. A break above $568.95 targets $570.64 short-term.

🎯 Setup Details:

→ Entry: $568.10

→ SL: ~$563.41

→ Target: $570.64

📌 Strong upward structure, with buyers defending key support.

📋 Hashtags:

#QQQ #BreakoutTrade #TrendlineSupport #ProfittoPath #ChartSetup #SwingTrade #PriceAction #SmartTrading

QQQ Forming Nice channelKey Observations:

Uptrend Channel:

QQQ has been trading within a rising channel.

The price respects both the support (lower red trendline) and resistance (upper red trendline) consistently.

Recent Price Action:

There was a sharp drop that briefly broke below the lower trendline support but quickly rebounded back inside the channel, indicating a false breakdown or buying strength at support.

A horizontal red line marks a previous resistance level, now potentially acting as a support.

Current Price:

The price is around $567.22, near the middle of the channel, but just below the recent local high/resistance.

Implication:

As long as the price stays within the channel, the uptrend remains intact.

A confirmed breakdown below the channel support would be bearish, while a breakout above the channel resistance would be bullish.

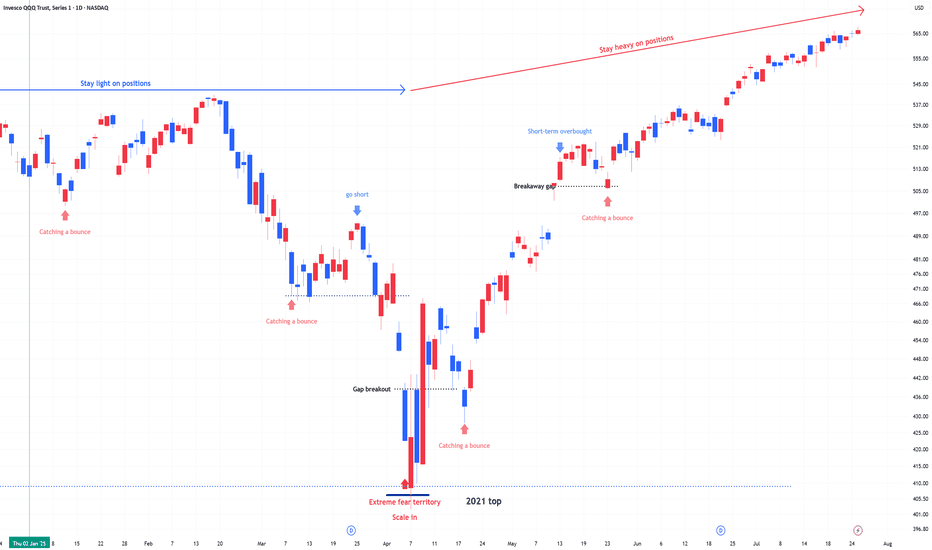

QQQ Technical Analysis: Bullish Trend Intact

From a technical perspective, the QQQ is in a powerful and well-defined uptrend. The price action since the April low has been contained within a sharp ascending channel, confirming strong and consistent buying pressure. The market is currently testing the upper boundary of this channel, which often acts as short-term resistance and can precede a minor pullback or consolidation phase.

A major bullish development was the recent breakout above the 535-540 price zone. This area had served as significant resistance from December through February, and its conversion into a new support floor is a textbook sign of strength. This level will now be a critical pivot point for the market.

Should a pullback occur, the chart lays out a clear hierarchy of support levels. The first line of defense is the intermediate support at 550. Below that lies the crucial 535-540 pivot zone, followed by another support area between 520 and 525. The most significant long-term support rests at the 500 level, which was a major resistance ceiling for much of the prior year.

The overall outlook remains bullish. As long as the price respects the ascending channel structure, particularly the lower trendline, the path of least resistance remains to the upside. Traders will likely view pullbacks toward these established support levels as potential opportunities to join the prevailing trend. A break below the channel and the 535 level would be the first signal of a potential momentum shift.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.