QQQ trade ideas

Consider Going Long on QQQ with Key Levels in Focus -Key InsightThe current market sentiment for QQQ demonstrates cautious optimism with a potential bullish

breakout on the horizon. Traders should focus on key resistance levels as

indicators of momentum, with 485 being a critical marker. Holding above this

level could lead to a continuation of the upward trend towards 492. Watch for

consolidation phases if unable to maintain above 485. -Price Targets: For the

coming week, look towards a long position. Targets (T1) are set at 490 and (T2)

at 492. Protect your position with stop levels at (S1) 478 and (S2) 475,

ensuring a measured approach to potential downside risks. -Recent Performance:

QQQ has shown slight bullish tendencies with higher highs within its trading

range, supported by the broader market's cautious optimism. Trading has been

between strategic support and resistance levels, indicating potential to breach

critical thresholds. However, market consolidation and volatility remain

prevalent. -Expert Analysis: Experts advise monitoring resistance breaks for QQQ

as it aligns with movements in SPY and major stocks like Tesla. This alignment

is crucial for understanding broader market trends, allowing traders to

anticipate market directions. The anticipated temporary bullish phase could be a

pivotal moment for traders in capturing short-term gains. -News Impact: Recent

reports highlight Tesla's synchronization with broader market trends, suggesting

that QQQ will likely continue mirroring macroeconomic conditions. The sideways

movement observed in the past week points to investor indecision, requiring

strategic positioning to navigate potential volatility and capitalize on

temporary price movements.

Outside the Channel the bears Roam (Week)The QQQ has been respecting the 50 EMA since 2023 and has been forming and upward parallel channel, but now the QQQ is testing hard the 50 EMA, the price is hovering right below the 50 EMA; however, price still closed inside the hypothetical upward parallel channel and in a flip zone with wick candles. Keep your eyes on price action and the channel and the flip zone and the key level below it. If we get a bullish candle moving upward inside the channel that is a good sign that we may have a price reversal. 483.34 the 50 EMA may be the deal or the deal breaker. Please be careful and remember outside the channel the bears roam.

Turning Point Good day Team:

The market has been moving quite mercurial lately.

On the daily on the triple Q we have consolidation that can determine price action upward for the buyers and downward for the sellers. However, we may have some confluences that may possibly favor the buyers.

✅ MACD (CM_Ult_MacD_MTF)

Histogram is turning positive, signal lines crossed bullish.

✅ MACD shows momentum reversal confirmed.

Ideal for a bullish breakout play if price follows through.

Williams VIX Fix (WVF)

Has a confirmed spike (11.97), with declining bars before and after.

WVF confirms a bottom is likely in or forming.

Let's hope for a clean break out, please see chart for key levels and indicators.

🧠 Final Trade Summary:

🔥 Most Lucrative Setup = LONG ABOVE $483.88

Backed by WVF, MACD, momentum, and structure

Only enter if 1H confirms breakout with strength

Stop under $480 (tight) or $468 (wide)

Target $489 → $491 → $500

Skip shorting unless price fails breakout and dumps on volume

Technicals for long term analysisMonthly technical indicators can help to assess long-term market direction with minimal noise. Monthly indicators are less sensitive to market fluctuations, providing smoother and more reliable signals for long-term analysis. The chart shows several monthly moving averages, adaptive trend flow, ultimate MACD, Williams %R, and momentum according to the TTM Squeeze indicator.

QQQ strong buy at $400 June of 2025QQQ looks very weak. There are a few issues that lead me to believe $400 in June 2025 if a reasonable target:

This area of the chat has very low volume and now structure - basically straight up on low volume.

The chart is trading very technically using Fib levels (outlined with yellow / green lines).

The market has a very high level of uncertainty, as do businesses and governments

April 2 will likely be close to a top for the current retrace.

Interestingly, the -1.618 just so happens to be the top reached in 2022.

This is also likely to intersect the lower trendline (white) AND the volume shelf established as part of the previous high and retrace at the $400 level.

What do you think?

“History Rhyming? A Deja Vu Moment in QQQ’s Price Action”Parabolic Run-Up Followed by a Sharp Decline

• Both patterns exhibit a strong rally leading into a rounded top formation before experiencing a steep decline.

• This suggests a classic distribution phase followed by a downtrend.

2. Top Formation & Reversal

• In both cases, the price reaches a peak and forms a lower high structure before starting its descent.

• This indicates potential selling pressure increasing at higher levels.

3. Volume Profile

• There is increased volume near the peak and during the decline, showing distribution and panic selling.

• This reflects a shift in sentiment, from bullish enthusiasm to risk-off behavior.

4. Downtrend Acceleration

• After breaking key support levels, the downtrend accelerates, leading to rapid sell-offs in both cases.

Key Differences:

• The first pattern (older) shows a more dramatic sell-off after the top, likely due to external macro factors.

• The second pattern, while following a similar structure, has not yet fully confirmed whether the decline will match the first in magnitude or find stronger support.

Implication:

If history repeats, price may continue declining after a brief consolidation. However, external conditions (macro factors, interest rates, liquidity) will influence whether the pattern fully plays out as before.

QQQ Going DownWe rejected from Resistance Zone now we going to support zone 4h (4 hours green zone) which i strongly believe we will bounce higher from there.

Note: bounce higher doesn't mean end of down going we still don't have confirmation but it means that we will get couple of sessions with decent profit to enjoy profit.

MASSIVE $QQQ BOUNCE INCOMING!MASSIVE NASDAQ:QQQ BOUNCE INCOMING!🚀

I believe we are setting up for a run to the 200DMA around $494ish🎯

- Wr% is uptrending after breaking out of Bearish WCB

- MACD is uptrending with the histogram rising

- RSI uptrending and broke out of bearish box

- Stochastic uptrending into the sweet spot after

breaking out of bearish box

We keep rejecting off the H5_S by wicking off it, which is bearish, but all other indicator show bullishness...

I could be wrong, but it's what the probabilities of everything and my GUT tell me.

Not financial advice

QQQuadruple witching tomorrowQuadruple witching is tomorrow 3/21/25. It refers to the simultaneous expiration of four types of derivative contracts: stock index futures, stock index options, stock options, and single-stock futures. The expiration of these contracts can lead to increased trading volume and market volatility, especially during the last hour of trading, known as the "witching hour".

QQQ is sitting at it's 2 year trend channel support level. Also, QQQ stochastic on the weekly chart is oversold. This is a high probability, low risk long setup. However, if this 2 year trend breaks down, then a new trend will take shape. To try to get the best entry, it would make sense to leg into the long position with 3 separate trades over the course of the next 3 days, 3/20, 3/21 & 3/24.

Long trade idea:

Long = 475

Stop = 465

Profit = 535

bull put spread 1 : 4 - risk : reward

4/17, 5/16 or 6/20 expiry

sell 535 put

buy 480 put

or

4/17, 5/16 or 6/20 expiry

buy 480 call

Options data:

3/21 expiry

Put Volume Total 225,663

Call Volume Total 253,501

Put/Call Volume Ratio 0.89

Put Open Interest Total 1,116,319

Call Open Interest Total 1,009,483

Put/Call Open Interest Ratio 1.11

4/17 expiry

Put Volume Total 51,129

Call Volume Total 58,065

Put/Call Volume Ratio 0.88

Put Open Interest Total 742,165

Call Open Interest Total 459,072

Put/Call Open Interest Ratio 1.62

5/16 expiry

Put Volume Total 30,172

Call Volume Total 26,170

Put/Call Volume Ratio 1.15

Put Open Interest Total 223,535

Call Open Interest Total 173,491

Put/Call Open Interest Ratio 1.29

6/20 expiry

Put Volume Total 21,202

Call Volume Total 10,509

Put/Call Volume Ratio 2.02

Put Open Interest Total 1,040,493

Call Open Interest Total 459,733

Put/Call Open Interest Ratio 2.26

QQQ - support & resistant areas for today March 19, 2025Above are the key support and resistance levels for QQQ today. We posted it before the action happened at 9.30am est. DM me to get them daily. Follow for Ideas.

These levels can indicate where the price might reverse or consolidate and may signal potential long (buy) or short (sell) positions for traders.

These levels are calculated using mathematical models and are relevant for today’s trading session. Please note that they may change in the future.

If you find this information helpful and would like to receive these insights every morning at 9:30 AM, please support me by boosting this post and following me @OnePunchMan91.

Your engagement is greatly appreciated! If this post does not receive more than 10 boosts, I may reconsider providing these daily updates. Thank you!

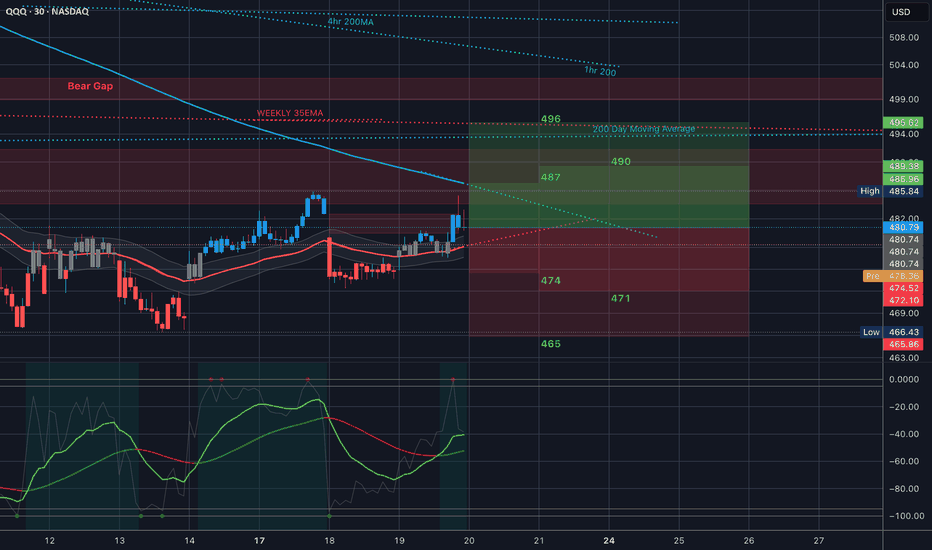

$QQQ - Trading Levels for March 19 2025

The only MA’s in today’s trading range is the 30min 35EMA which we opened right at, and the 30min 200 At the top.

Two Bear gaps at the top as well.

The 200DMA still has a little big of momentum in it and it’s facing slightly up.

The next support is 448 is we lose this area.

$QQQ Dead Cat to 10 WMA, then lower. Buy $496, Sell $514 What I see here is a double top on the weekly just like 2022. I can see our last 9 count in 2022 produced a 30% rally to the top. After the rally several months of sideways movement until we break trend. If we are Indeed Repeating the 2022 TOP. Then we have a harsh year ahead of us. As I said in previous posts, we should close February at the low of January. I have KRE falling out next week so I'm skeptical about what's going on. We've got DOGE checks and what not, who knows. I'm extremely bearish and I do believe we will bounce into a rejection this next week, then fall even further the week of 3/14. I will update day by day. For now, $496 will be my Buy. and $514 will be the Sell. Take Care Yall.

How to use ETFs instead of Indexes to know how to trade that dayMost Traders use the indexes to try to understand whether they should buy long or sell short. However, the ETFs impact the index components prices not the other way around. Most traders do not realize that they should be studying the ETF of an index rather than the index to determine how to trade the next day. Also ETF trading can be highly lucrative. Using the chart layouts that I have designed to trade Dark Pool activity, HFT and Hedge Fund activity and Sell Side activity helps you understand who is on control of price for the ETF and thus is created the value changes of the indexes.

When you study the ETF rather than the index, you will find you have far more information in the chart, indicators and price changes.

QQQ My Opinion! SELL!

My dear friends,

My technical analysis for QQQ is below:

The market is trading on 538.12 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 527.72

Recommended Stop Loss - 544.30

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

———————————

WISH YOU ALL LUCK

$QQQ - Trading Levels for March 18 2025

Not too much to write today because I’m on Spring Break and even though I am trading I’m not at my computer as much.

You can see the levels running through the chart. They are all labelled the bear gap is there just above the 35EMA and the 200DMA - that is big.

We are Neutral bearish here being above the 30min 25EMA but under the 30min 200MA

Green signal line still

Grab this chart and let's GO!!!

QQQ On The Rise! BUY!

My dear friends,

Please, find my technical outlook for QQQ below:

The price is coiling around a solid key level - 479.69

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 497.90

Safe Stop Loss - 469.89

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

———————————

WISH YOU ALL LUCK

QQQ at Crossroads! Big Move Incoming? Mar17 WeekQuick update on QQQ with a look at the 4-hour chart.

📈 Technical Analysis (TA):

* QQQ is at a critical resistance zone around $479-$480—key decision level here.

* Recent Change of Character (CHoCh) suggests bulls might take control if price breaks higher.

* Strong support formed at a Break of Structure (BOS) around $466; keep this level on radar if price pulls back.

* Watch closely the next resistance zones around $495 and a major overhead barrier at $502.

📊 GEX & Options Insights:

* High negative NET GEX at $466 marks critical PUT support—a strong floor area.

* CALL resistance appears clearly around $495-$510, with a significant gamma wall forming.

* IV Rank moderate at 42.8%, indicating reasonable premium—suitable for spreads or moderate premium selling strategies.

* PUT sentiment at 32.5% signals bearish bias, keeping bulls cautious.

💡 Trade Recommendations:

* Bullish Play: Wait for a confirmed breakout above $480 for a bullish run to $495 initially, and possibly higher towards $502. Set stops tight below $475.

* Bearish Play: Look for a clear rejection at $480 to enter puts targeting the support at $466.

* Neutral traders might explore credit spreads or Iron Condors between clear zones ($466–$495).

🛑 Risk Management: Ensure disciplined stop-loss placement, especially in this range-bound scenario.

Stay safe and trade wisely!

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

$QQQ WARNING! April Fool's Market a Joke this year at SUB $400Is this happening? I'm going to have to bet my money on yes. I have been doing this for a long time. Pattern Chart Trading . This has a high probability of happening imo. Is it absolute? Of course not. Is it better to be prepared? Absolutely. Now for the technicals of it.. I'm trying to do better with this...

If we take a bearish perspective on the fib from the previous high in December , and the most previous lower low mid January , we have ourselves at the 1.61 Golden Pocket below. I have a Bullish perspective if we hold here and move above the 1.00 Fib Level, mid January Lows at $499.70 . Last defense would be a 50% retracement to the .786 FIB at the $508 area. Currently, I expect a rally to the 50 day SMA for a retest, then a SLAM to $380s in April . This is the possibility. Take it with a Grain of Salt. The possibility is there. I have one Bullish outlook.. I will post after this...