Rigetti: Quantum Mirage or Computing's Next Frontier?Rigetti Computing, a pioneer in quantum computing, recently commanded market attention with a significant 41% surge in its stock. This jump followed a critical technological breakthrough: achieving 99.5% median 2-qubit gate fidelity on its modular 36-qubit system. This represents a twofold reduction

Key facts today

Rigetti Computing's shares increased by 2.6% following Marco Pistoia's appointment as senior vice president of industry relations at IonQ, amid mixed results in the quantum computing sector.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.68 USD

−200.99 M USD

10.79 M USD

314.51 M

About Rigetti Computing, Inc.

Sector

Industry

CEO

Subodh K. Kulkarni

Website

Headquarters

Berkeley

Founded

2013

FIGI

BBG00Z911S16

Rigetti Computing, Inc. provides full-stack quantum computing services. It serves global enterprise, government, and research clients through its Rigetti Quantum Cloud Services platform. The company was founded by Chad Rigetti in 2013 and is headquartered in Berkeley, CA.

Related stocks

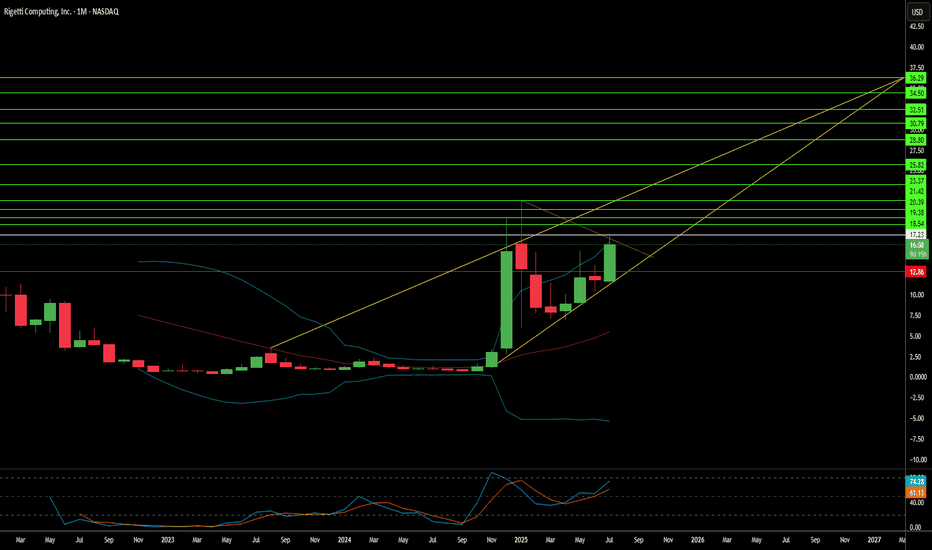

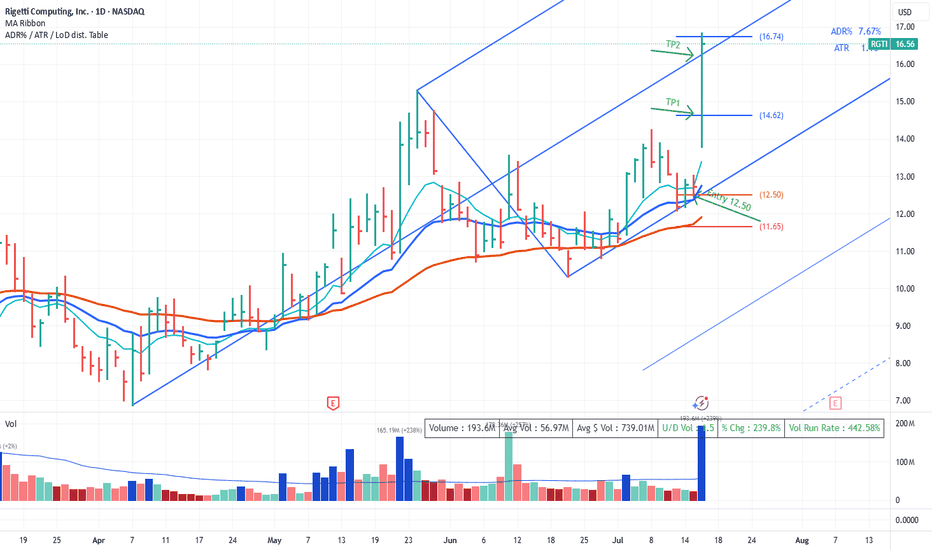

Median Line Trade RGTIPrice tests the LMH and rejects it. Look for a long at the retest. We get set at 12.50.

TP1 is logical at 2.5R and just before the prior top in case we fail to follow through

TP2 is at the median line. As Dr Andrews says "Price makes it to the Median Line 80% of the time".

Ok 'we got lucky' on som

Chapter 3: The Big Gap Fill (RGTI) Chapter 3: The Big Gap Fill

After the luminous victory of the Alienoid Bulls in Chapter 1, the quantum lattice began to warp. Unbeknownst to them, the Mech Bears had not been defeated—only waiting, recalibrating, and evolving.

Hidden in the deep recesses of the 7D stackspace, a new war protocol ha

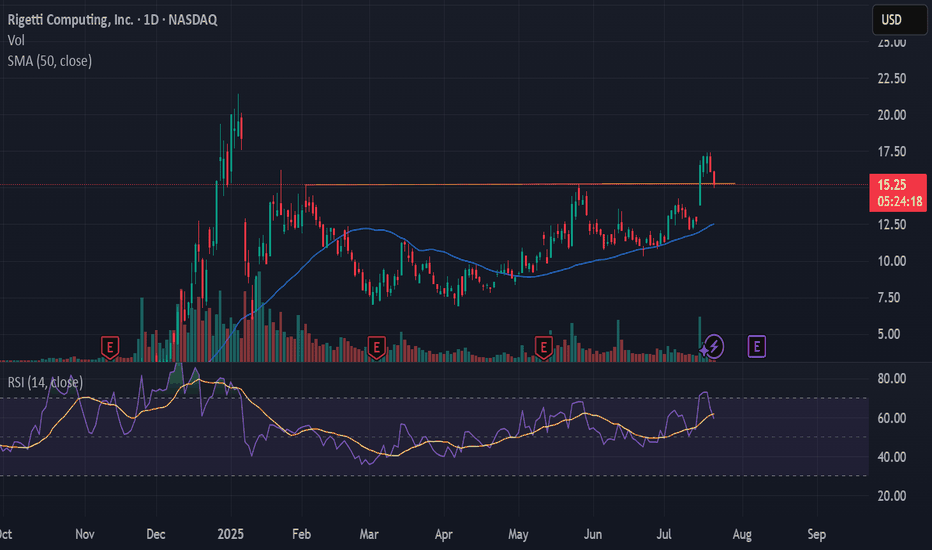

RGTI Heading to $17+ Good evening trading family

So currently due to price action it appears we are on our way to 17 dollar target however we expect a little bit of a correction at the 15 range.

However worst scenario if we go below 11 dollars be prepared for a sinker down to 8.

Trade Smarter Live Better

Kris/ M

RGTI - Another Quatum Stock . Should i buy?Hello Everyone,

So last Quantum stock that i try to analyse today is RGTI - Rigetti Computing

First of all some figures for RGTI:

Revenue: $1.47 M — down 52% YoY and 36% QoQ

Operating Expenses: $22.1 M — up 22% YoY

Operating Loss: $21.6 M .

Net Income: +$42.6 M (+$0.15 eps) — driven by ~$62 M o

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of RGTI is 15.08 USD — it has increased by 0.37% in the past 24 hours. Watch Rigetti Computing, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Rigetti Computing, Inc. stocks are traded under the ticker RGTI.

RGTI stock has fallen by −9.64% compared to the previous week, the month change is a 36.89% rise, over the last year Rigetti Computing, Inc. has showed a 1.31 K% increase.

We've gathered analysts' opinions on Rigetti Computing, Inc. future price: according to them, RGTI price has a max estimate of 20.00 USD and a min estimate of 14.00 USD. Watch RGTI chart and read a more detailed Rigetti Computing, Inc. stock forecast: see what analysts think of Rigetti Computing, Inc. and suggest that you do with its stocks.

RGTI reached its all-time high on Jan 6, 2025 with the price of 21.42 USD, and its all-time low was 0.36 USD and was reached on May 4, 2023. View more price dynamics on RGTI chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

RGTI stock is 6.64% volatile and has beta coefficient of 2.83. Track Rigetti Computing, Inc. stock price on the chart and check out the list of the most volatile stocks — is Rigetti Computing, Inc. there?

Today Rigetti Computing, Inc. has the market capitalization of 5.03 B, it has increased by 27.09% over the last week.

Yes, you can track Rigetti Computing, Inc. financials in yearly and quarterly reports right on TradingView.

Rigetti Computing, Inc. is going to release the next earnings report on Aug 12, 2025. Keep track of upcoming events with our Earnings Calendar.

RGTI earnings for the last quarter are −0.08 USD per share, whereas the estimation was −0.05 USD resulting in a −51.81% surprise. The estimated earnings for the next quarter are −0.05 USD per share. See more details about Rigetti Computing, Inc. earnings.

Rigetti Computing, Inc. revenue for the last quarter amounts to 1.47 M USD, despite the estimated figure of 2.55 M USD. In the next quarter, revenue is expected to reach 1.87 M USD.

RGTI net income for the last quarter is 42.62 M USD, while the quarter before that showed −152.96 M USD of net income which accounts for 127.86% change. Track more Rigetti Computing, Inc. financial stats to get the full picture.

No, RGTI doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 29, 2025, the company has 140 employees. See our rating of the largest employees — is Rigetti Computing, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Rigetti Computing, Inc. EBITDA is −66.61 M USD, and current EBITDA margin is −570.94%. See more stats in Rigetti Computing, Inc. financial statements.

Like other stocks, RGTI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Rigetti Computing, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Rigetti Computing, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Rigetti Computing, Inc. stock shows the strong buy signal. See more of Rigetti Computing, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.