Rigetti Computing (RGTI): Explosive Momentum—What’s Next?🔥 LucanInvestor’s Commands:

🩸 Resistance: $18.00. A breakout targets $19.50 and $21.00.

🩸 Support: $16.50. A breakdown exposes $15.00 and $13.50 as potential retracement levels.

🔥 LucanInvestor’s Strategy:

🩸 Long: Above $18.00, aiming for $19.50 and $21.00. Sustained high volume is essential to maintain the rally.

🩸 Short: Below $16.50, targeting $15.00 and $13.50. A loss of momentum could trigger profit-taking.

🩸 Rigetti is up an astounding 597% over the past month, showing parabolic growth. MACD remains positive but signals caution with reduced momentum. The stock is heavily overextended, making these levels critical for direction. Traders should watch volume spikes for confirmation at resistance and support levels.

👑 "In the chaos of volatility lies the chance for extraordinary rewards. Will you seize it?" — LucanInvestor

RGTI trade ideas

RGTI | Next Leg Higher Incoming | LONGRigetti Computing, Inc. provides full-stack quantum computing services. It serves global enterprise, government, and research clients through its Rigetti Quantum Cloud Services platform. The company was founded by Chad Rigetti in 2013 and is headquartered in Berkeley, CA.

$NASDAQ:RGTI breaking out of a bullish flagNASDAQ:RGTI appears to be breaking out of a bullish flag with ~$14 Price Target (PT).

Awaiting confirmation on volume, but 100M shares have traded 2 hours into the trading day, which matches recent daily volume. Long story short... looks like there's going to be a lot of volume today.

As I get closer to the PT, I'll set up a trailing stop to help maximize profits/minimize loss.

Good luck!

12/26/24 - $rgti - FAFO $15. 200x sales. Short. 12/26/24 :: VROCKSTAR :: NASDAQ:RGTI

FAFO $15. 200x sales. Short.

- you guys know my thoughts on quantum per a few recent posts on NASDAQ:QUBT (lol) and OTC:BTQQF (long, but measured).

- but C-tier garbage like NASDAQ:RGTI at 200x next year's sales and having missed missed missed (they do deliver pressers though!) might take a dump in your new year's stocking if mgmt r smart. they burn cash for as long as the eye can see... so dilution is par for the FAFO course.

- could it meme higher? obviously. y'all don't even own it, renting the C's and driving gamma in an illiquid tape.

- i'm short the next week P's at 13 strike will adjust accordingly, but one bad wick lower will drain the pond.

- as always, may the luckiest balls win. all the best if you're long, and in earnest, congrats. but if u don't pay urself here, i hope the logic is more nuanced than "quantum iz future".

- math matters

V

BEARISH on $RGTI and all Quantum, $QUBT $QBTS, $QMCO, $ARQQListen guys and gals, I found NASDAQ:RGTI when it was in the SET:2S and I was super excited about it. It ran 1500% in 2 months, but let's do some math about how much money quantum computer manufacturers can actually make...

I may be wrong, but do you need a quantum computer? Because I do not. Nor does anyone I know. I read an article on tradingview here that said one company forecasted Quantum sales to total $8.9B by 2028. This seems far less lucrative than AI at least for now.

Example... NASDAQ:RGTI has a market cap of $2.6B...now. They are seemingly digging deeper into a hole, bringing in GETTEX:13M per year revenue and reporting a loss of $75M. Net margin growing in the wrong direction. Where is the value coming from? It will wear off in my opinion.

Just saying, might be a little early to be holding these. Buy when they are $1 again and sit there for 2-3 years. You're welcome...maybe.

The Next Bubble: Hunting for Sci-Fi Hype in Emerging MarketsExploring potential emerging market bubbles with a focus on futuristic and lesser-known technologies.

In the ever-evolving landscape of investment opportunities, savvy investors are always looking for the next big wave. This potential market bubble could transform obscure technologies into astronomical valuations. While traditional industries like banking and oil remain predictable, the most exciting investment frontiers lie in science fiction-adjacent technologies that most people can barely comprehend.

Quantum Computing: The Invisible Revolution

Quantum computing represents a prime candidate for a potential market bubble. Most people struggle to understand how quantum computers work, which makes them perfect for speculative investment. Companies like IBM, Google, and several stealth startups are developing quantum technologies that seem more like science fiction than reality.

The allure is simple: quantum computers promise to solve complex problems that classical computers can't handle. From cryptography to drug discovery, the potential applications are mind-bending. As public understanding remains limited, this knowledge gap creates fertile ground for massive hype and potentially inflated valuations.

Synthetic Biology: Programming Life Itself

Another frontier that screams "future bubble" is synthetic biology. Imagine companies that can program biological systems, design custom organisms, or create entirely new forms of life. Startups in this space are working on everything from lab-grown meat to engineered microorganisms that can clean up environmental pollution.

The complexity of synthetic biology means most investors won't understand the underlying technology, creating perfect conditions for a speculative frenzy. Companies like Ginkgo Bioworks are already pushing the boundaries of what seems possible, blurring the lines between engineering and biology.

Space Resource Extraction: The Final Economic Frontier

While space tourism gets most of the headlines, the real potential bubble might be in space resource extraction. Companies are developing technologies to mine asteroids, harvest helium-3 from the moon, or extract rare minerals from extraterrestrial sources. These ventures sound like plot points from a science fiction novel but are becoming serious investment considerations.

The total addressable market is astronomical, and the technological challenges are so complex that they create a perfect environment for speculative investment. Most people can't comprehend the engineering required, which means wild narratives can drive market sentiment.

Neuromorphic Computing: Brains in Silicon

Neuromorphic computing represents another potential bubble zone. These are computer systems designed to mimic the human brain's neural structures, promising revolutionary approaches to artificial intelligence and machine learning. Companies developing neuromorphic chips and systems are creating technologies that seem more like sentient machines from a William Gibson novel than traditional computing.

The mystique of creating "brain-like" computers that can learn and adapt independently is a powerful narrative for investors seeking the next transformative technology.

Key Bubble Indicators

When hunting for potential market bubbles in sci-fi-adjacent technologies, look for these red flags:

- Technological complexity that defies easy explanation

- Massive potential market size with minimal current revenue

- High-profile founders with grandiose visions

- Media coverage that sounds more like science fiction than economic analysis

- Significant venture capital interest despite unclear monetization paths

Investor Caution: The Thin Line Between Innovation and Illusion

While these technologies represent exciting investment frontiers, they also embody significant risks. Not every sci-fi-like technology will become the next big bubble. Careful research, understanding technological feasibility, and avoiding pure hype is crucial.

The most successful investors will be those who can distinguish between genuine technological breakthroughs and elaborate narratives designed to attract speculative capital.

Remember: Today's impossible dream could be tomorrow's trillion-dollar market—or next year's cautionary tale.

#RGTI: is up +650% in less than 2 months since I published the analysis!

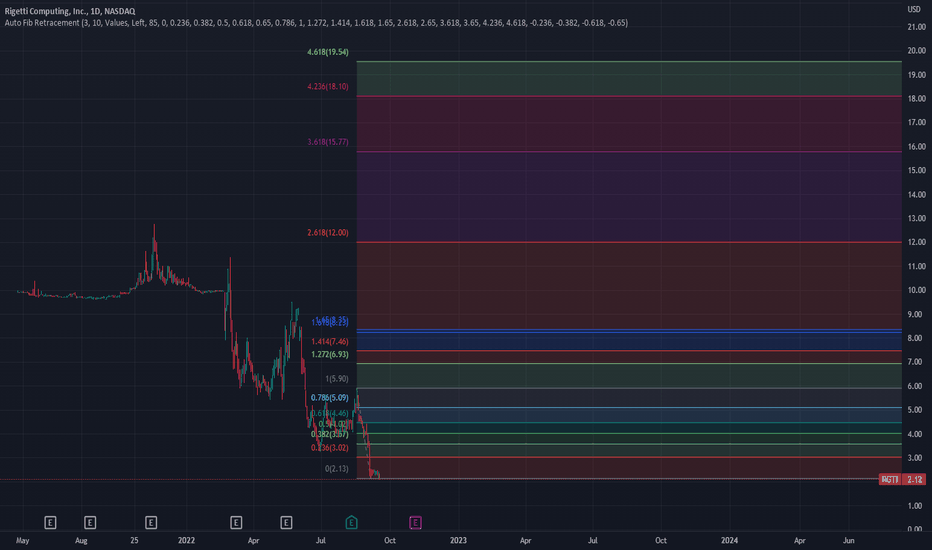

A Possible 10 Bagger..!The image shows a stock chart for Rigetti Computing, Inc. (RGTI), a company listed on NASDAQ. Here's a technical and fundamental analysis based on the information provided:

Technical Analysis:

1. Price trend: The stock has experienced a significant downtrend since its peak in 2021/2022, falling from over $12 to current levels around $1.29.

2. Recent price action: There's a potential bottoming pattern forming, with the price stabilizing and showing some upward momentum recently.

3. Chart pattern: The chart displays what appears to be an inverted head and shoulders pattern (marked with A, B, C, D points), which is typically a bullish reversal signal.

4. Volume: Recent volume spikes coincide with price increases, potentially indicating growing investor interest.

5. Moving averages: The price has crossed above some short-term moving averages, which could be a bullish sign.

6. Resistance level: There's a potential resistance level around $2.50-$3.00 based on previous price action.

Fundamental Analysis:

1. Performance metrics: The chart shows positive performance over various timeframes:

- 1 week: 53.17%

- 1 month: 62.49%

- 3 months: 15.14%

- 6 months: 14.16%

- Year-to-date: 30.98%

- 1 year: 7.5%

2. Market cap: With the current price at $1.29 and assuming the volume of 14.502M represents shares outstanding, the market cap is approximately $18.7 million.

3. Industry context: Rigetti Computing is in the quantum computing sector, which is an emerging and potentially disruptive technology field.

4. Volatility: The stock shows high volatility, typical of early-stage tech companies in emerging sectors.

5. Investor sentiment: The "This could be a ten-bagger" comment suggests some speculative interest in the stock's potential for significant growth.

Cautions:

- The stock is highly volatile and speculative.

- Past performance doesn't guarantee future results.

- Further fundamental research on Rigetti's financials, competitive position, and growth prospects would be necessary for a comprehensive analysis.

This analysis is based solely on the chart provided and should not be considered investment advice. Investors should conduct their own thorough research before making any investment decisions.

RGTI LongWeekly, Wedge breakout

Long 1.35

Stop 1

Target 3.3

Risk management is much more important than a good entry point.

I am not a PRO trader.

In my trading plan, the Max Risk of each short term trade should be less than 1% of an account.

For non-Pro option traders, better begin from buying ITM options and keep 90+ days, Selling OTM and less than 60 days.

I will try some samples to test my chart reading and OP strategy:

"Buy in the money (ITM) calls in daily/weekly uptrend, and keep 400 days. "

Related trades:

CAN price 1.6 11/19/2024

BuyToOpen Jan2026 Call C1 Limit 1.0 ( Delta 0.87 , 422 days )

ITM C1 has 0.6 value.

OPK price 1.6 11/20/2024

BuyToOpen Jan2026 Call C1 Limit 0.65 x2 ( Delta 0.85 , 421 days )

ITM C1 has 0.6 value.

POET price 3.9 11/20/2024

BuyToOpen Jan2026 Call C3 Limit 1.05 ( Delta 0.85 , 421 days )

ITM C3 has 0.9 value.

ACHR price 5.06 11/20/2024

BuyToOpen Jan2026 Call spread C3.5/10 Limit 1.6 (C3.5 Delta 0.82 , 421 days )

ITM C3.5 has 1.56 value.

$RGTI landing on 50 EMA on hourly After a strong surge pulling away from 8 EMA on daily. The magnetic pulling effect brought down the price however still far from it's 8 EMA. Looking at hourly chart, it appears to have landed on 50 EMA in yellow. However, RSI still weak. Hasn't cross its MA. More room to fall?

Rigetti here we go. Please note that there is a substantial amount of risk involved in this opportunity. Please consider this before proceeding.

Rigetti Computing is an integrated systems company that builds quantum computers and the superconducting quantum processors that power them. Through their Quantum Cloud Services (QCS) platform, their machines can be integrated into any public, private, or hybrid cloud. The company designs and manufactures integrated circuits for quantum computers and develops software for building algorithms for these chips.

Good luck!

All the best.

Rigetti: long term gem! Investing in Rigetti at present bears resemblance to investing in Microsoft during the 1990s. Quantum computing is poised to exert a profound influence on the technology sector, underscoring the rationale for acquiring shares in a company at the forefront of quantum computer development. The current market indicators suggest an impending surge in Rigetti's stock value over the ensuing months, presenting a favorable opportunity to augment our portfolio's overall worth.

RGTI Rigetti Computing Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RGTI Rigetti Computing prior to the earnings report this week,

I would consider purchasing the 2.50usd strike price Calls with

an expiration date of 2023-8-18,

for a premium of approximately $0.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Quantum computing stocks to buyRigetti Computing - pure-play quantum computing business that went public in October 2021 through a SPAC deal.

RGTI has partnered with several leading companies and institutions, such as Ampere Computing, Deloitte, NASA, and the U.S. Department of Energy.

Rigetti Computing’s financials show robust growth potential, as the company generated $13 million in revenue in 2022, up 46% year-over-year. The quantum computing firm expects increased growth as its quantum projects continue to scale.

RGTI Long Currently at 'oversold' due to an end of the lock-up period. Rigetti Computing is a Berkeley, California-based developer of superconducting quantum computers. Partnership with Nasdaq, Standard Chartered Bank, United States Department of Energy, Ampere Computing and etc. Rigetti's 80-qubit Aspen-M machine available on Amazon AWS and Microsoft Azure cloud. Huge potential.

Rigetti Computing (RGTI) at the bottom?Rigetti Computing (Ticker: RGTI) had been soldoff all the way down to below $2 level with over -80% in 6 months. Now, it is trading at near the balance sheet cash position. Meanwhile, other quantum computing stocks are still trading at 2x ~ 10x their balance sheet cash position. In my opinion, we are at the bottom now. DYOR.