Rambus, Inc. (RMBS) Expands AI and Cloud SolutionsRambus, Inc. (RMBS) is a leading semiconductor and technology solutions company focused on high-speed memory interfaces, security IP, and advanced chips that power data centers, AI, and cloud computing. Known for innovation in high-performance computing, Rambus helps meet the growing demand for fast

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.14 USD

179.82 M USD

556.62 M USD

106.78 M

About Rambus, Inc.

Sector

Industry

CEO

Luc Seraphin

Website

Headquarters

San Jose

Founded

1990

FIGI

BBG000BR32C6

Rambus, Inc. engages in the provision of cutting-edge semiconductor and Internet Protocol products, spanning memory and interfaces to security, smart sensors and lighting. Its products include Memory Interface Chips, Interface IP, and Security IP. The company was founded by P. Michael Farmwald and Mark A. Horowitz in March 1990 and is headquartered in Sunnyvale, CA.

Related stocks

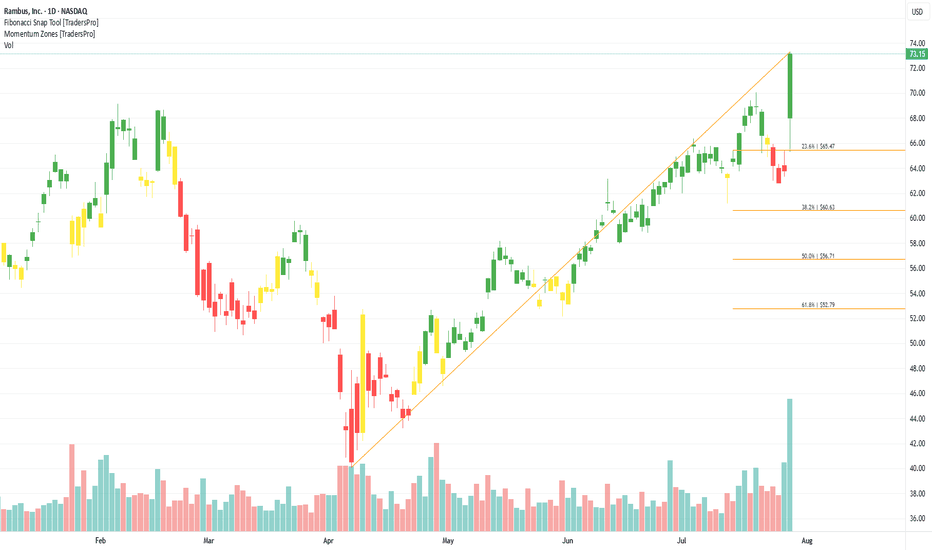

RMBS - Sep 24 Opening Sustainable Momentum- Down trend continuation after pull back

- Lower highs

- Price opened with momentum and closed below support

- RUT and SPX had a broad market drop that ignited this move

Opening Sustainable Momentum 🚀

Strategy

Signals identify market opening H2 candles through momentum and behaviour change that p

RMBS - Aug 24 MATrend Sustainable MomentumGood Risk & Reward 3.71R, price also has just broken above H1 SMA100 (Mid Cap)

MATrend Sustainable Momentum (Systematic) 🚀

This is a variant of the Unsustainable strategy. System identifies stocks (Tech sector) that follows the larger market regime's momentum of the day.

RMBS - Short OpportunityGood morning everyone,

The sellers are taking over control and for the time being RMBS is looking good for a short. I am currently still waiting to get filled on a good limit order. The spread between bid and ask was a bit wide on the option chain so ill be going for a mid price. Hopefully Ill get

Rambus Gains on Wells Fargo CommentsFundamental Analysis

Wells Fargo cast a favorable light on Rambus (NASDAQ: NASDAQ:RMBS ), following encouraging developments from Micron Technology (NASDAQ: NASDAQ:MU ). As a result, Rambus shares surged more than 6% intra-day today.

The focus was on NASDAQ:RMBS 's potential gains from MU's shi

🚀 Rambus Inc. (RMBS): Navigating the Semiconductor Horizon! 💻Rambus Inc. (RMBS:NASDAQ), a leading semiconductor company specializing in DDR memory interface chips, is strategically positioning itself to capitalize on the escalating demand for data-center memory performance. This surge is primarily propelled by the widespread adoption of artificial intelligenc

Rambus (RMBS) Is it Worth The Risk?

Price Momentum

RMBS is trading in the middle of its 52-week range and below its 200-day simple moving average. The stock still appears to have some downward momentum which will subsequently precede with an upward trend

Price change

The price of RMBS shares has increased $3.38 since the market la

Rambus (RMBS) Is it Worth Placing A Bet On?Rambus currently has an average brokerage recommendation (ABR) of 1.00, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by five brokerage firms. An ABR of 1.00 indicates Strong Buy.

While the ABR calls for buying Rambus,

Double Tops on RMBSUptrend reversed after one large double top and two small double tops. RMBS is forming a small double top and holding support of 200 EMA. If the price falls below 48.5, it may go all the way down to 44, which is a strong support level. By this time RSI would also be in oversold category. RMBS may th

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of RMBS is 72.41 USD — it has decreased by −2.06% in the past 24 hours. Watch Rambus, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Rambus, Inc. stocks are traded under the ticker RMBS.

RMBS stock has risen by 13.11% compared to the previous week, the month change is a 13.69% rise, over the last year Rambus, Inc. has showed a 42.32% increase.

We've gathered analysts' opinions on Rambus, Inc. future price: according to them, RMBS price has a max estimate of 90.00 USD and a min estimate of 62.00 USD. Watch RMBS chart and read a more detailed Rambus, Inc. stock forecast: see what analysts think of Rambus, Inc. and suggest that you do with its stocks.

RMBS reached its all-time high on Jun 23, 2000 with the price of 127.00 USD, and its all-time low was 3.08 USD and was reached on Jun 26, 2002. View more price dynamics on RMBS chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

RMBS stock is 6.36% volatile and has beta coefficient of 2.18. Track Rambus, Inc. stock price on the chart and check out the list of the most volatile stocks — is Rambus, Inc. there?

Today Rambus, Inc. has the market capitalization of 7.79 B, it has increased by 3.39% over the last week.

Yes, you can track Rambus, Inc. financials in yearly and quarterly reports right on TradingView.

Rambus, Inc. is going to release the next earnings report on Nov 3, 2025. Keep track of upcoming events with our Earnings Calendar.

RMBS earnings for the last quarter are 0.66 USD per share, whereas the estimation was 0.58 USD resulting in a 12.96% surprise. The estimated earnings for the next quarter are 0.63 USD per share. See more details about Rambus, Inc. earnings.

Rambus, Inc. revenue for the last quarter amounts to 170.00 M USD, despite the estimated figure of 166.97 M USD. In the next quarter, revenue is expected to reach 176.00 M USD.

RMBS net income for the last quarter is 57.94 M USD, while the quarter before that showed 60.30 M USD of net income which accounts for −3.93% change. Track more Rambus, Inc. financial stats to get the full picture.

No, RMBS doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 712 employees. See our rating of the largest employees — is Rambus, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Rambus, Inc. EBITDA is 270.27 M USD, and current EBITDA margin is 38.96%. See more stats in Rambus, Inc. financial statements.

Like other stocks, RMBS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Rambus, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Rambus, Inc. technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Rambus, Inc. stock shows the buy signal. See more of Rambus, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.