Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.37 USD

2.09 B USD

21.13 B USD

319.85 M

About Ross Stores, Inc.

Sector

Industry

CEO

James Grant Conroy

Website

Headquarters

Dublin

Founded

1957

FIGI

BBG000BSBZH7

Ross Stores, Inc. engages in the operation of off-price retail apparel and home accessories stores. Its products include branded and designer apparel, accessories, footwear, and home fashions through the Dress for Less and dd's DISCOUNTS brands. The company was founded by Stuart G. Moldaw in 1957 and is headquartered in Dublin, CA.

Related stocks

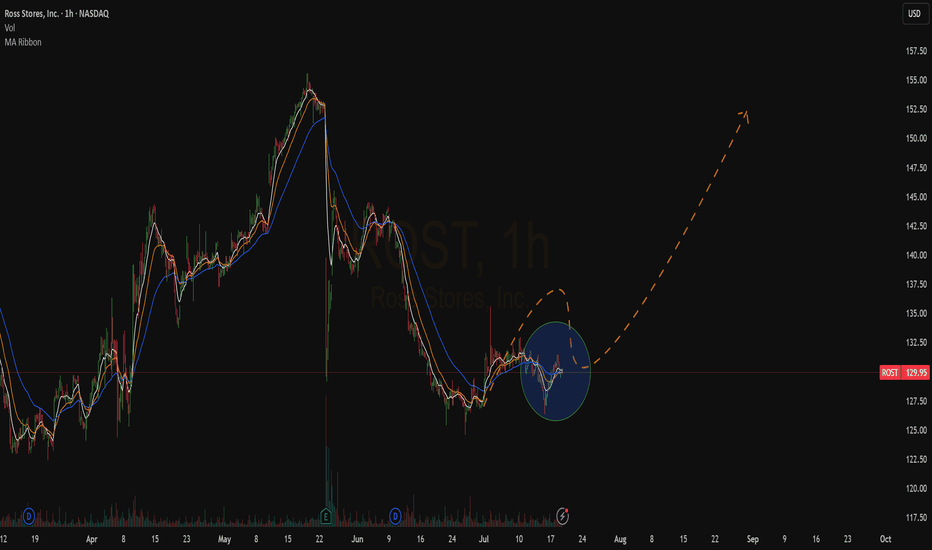

ROST is correcting and that's OK - Long at 141.28People get panicky during corrections. Understandably, it can be nerve-wracking watching that stock you were sure was going up, going down. With the short term nature of the trading I'm doing, I don't worry that much, and especially when the corrections are garden variety ones.

ROST is down alm

Second $ROST entry on bullish confirmation!Key Stats:

Market Cap: $51.9B

P/E Ratio: 24.65 (sector average ~22.5)

Free Cash Flow: $1.6B TTM

Next Earnings Date: March 4, 2025

Technical Reasons Supporting an Increase:

Ascending Channel Formation: ROST continues to trend upward within a well-defined ascending channel, target

You need $ROST to spell PROFITSKey Stats

Current Price: $154.87

52-Week Range: $113.77 - $159.16

P/E Ratio: 24.38 (moderate valuation for retail)

Market Cap: $51.38B

Revenue Growth: +5.8% forecasted YoY for FY 2025

Next Earnings Date: March 4 2025

Top 3 Technical Reasons ROST Will Increase:

Breakout Setup: The s

Ross Stores: Pullback Near HighsRoss Stores rallied in the winter. Now, after a period of consolidation, some traders may see potential for further upside.

The first pattern on today’s chart is the pair of bullish gaps after the last two earnings reports. The first gap sent the retailer to new highs above its 2021 peak. The secon

Ross Stores Stock Jumps 8.34% on Earnings BeatRoss Stores ( NASDAQ:ROST ) has reported better-than-anticipated results and raised its guidance as it reduced costs. The off-price apparel and home goods retailer beat profit and sales forecasts, despite facing macroeconomic headwinds that squeezed its lower-income customers. CEO Barbara Rentler sa

5/23/24 - $rost - a +ve EPS setup, but watching from parking lot5/23/24 - vrockstar - NASDAQ:ROST - a good play on affordability like NASDAQ:COST NYSE:BJ (which reported good #s in this AM) and then we even see semi-discretionary stuff that's still discretionary makeup ( NYSE:ELF ) doing fine. it's the pricey and let's wait category (or let's finance it ca

Intuition stock short ROST tgt $95I never had time this weekend to meditate and fish through time and space for a ticker, so while lying in bed I had the thought I should try to get something. Pretty immediately I "heard", "Ross dress for less." I'm assuming it's the stock and not a recommendation to shop cuz I actually hate my loca

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ROST4973627

Ross Stores, Inc. 5.45% 15-APR-2050Yield to maturity

6.21%

Maturity date

Apr 15, 2050

US778296AD5

ROSS STORES 20/30Yield to maturity

5.24%

Maturity date

Apr 15, 2030

ROST5064464

Ross Stores, Inc. 1.875% 15-APR-2031Yield to maturity

5.10%

Maturity date

Apr 15, 2031

ROST4973625

Ross Stores, Inc. 4.7% 15-APR-2027Yield to maturity

4.57%

Maturity date

Apr 15, 2027

ROST5064463

Ross Stores, Inc. 0.875% 15-APR-2026Yield to maturity

4.47%

Maturity date

Apr 15, 2026

See all ROST bonds

Curated watchlists where ROST is featured.

Female-led stocks: Who rules the world?

34 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of ROST is 138.33 USD — it has increased by 1.39% in the past 24 hours. Watch Ross Stores, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Ross Stores, Inc. stocks are traded under the ticker ROST.

ROST stock has risen by 5.27% compared to the previous week, the month change is a 7.63% rise, over the last year Ross Stores, Inc. has showed a −2.65% decrease.

We've gathered analysts' opinions on Ross Stores, Inc. future price: according to them, ROST price has a max estimate of 175.00 USD and a min estimate of 126.00 USD. Watch ROST chart and read a more detailed Ross Stores, Inc. stock forecast: see what analysts think of Ross Stores, Inc. and suggest that you do with its stocks.

ROST reached its all-time high on Aug 23, 2024 with the price of 163.60 USD, and its all-time low was 0.11 USD and was reached on Oct 26, 1987. View more price dynamics on ROST chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ROST stock is 1.52% volatile and has beta coefficient of 0.64. Track Ross Stores, Inc. stock price on the chart and check out the list of the most volatile stocks — is Ross Stores, Inc. there?

Today Ross Stores, Inc. has the market capitalization of 45.24 B, it has decreased by −1.34% over the last week.

Yes, you can track Ross Stores, Inc. financials in yearly and quarterly reports right on TradingView.

Ross Stores, Inc. is going to release the next earnings report on Aug 14, 2025. Keep track of upcoming events with our Earnings Calendar.

ROST earnings for the last quarter are 1.47 USD per share, whereas the estimation was 1.44 USD resulting in a 1.83% surprise. The estimated earnings for the next quarter are 1.54 USD per share. See more details about Ross Stores, Inc. earnings.

Ross Stores, Inc. revenue for the last quarter amounts to 4.98 B USD, despite the estimated figure of 4.96 B USD. In the next quarter, revenue is expected to reach 5.55 B USD.

ROST net income for the last quarter is 479.25 M USD, while the quarter before that showed 586.78 M USD of net income which accounts for −18.33% change. Track more Ross Stores, Inc. financial stats to get the full picture.

Yes, ROST dividends are paid quarterly. The last dividend per share was 0.41 USD. As of today, Dividend Yield (TTM)% is 1.12%. Tracking Ross Stores, Inc. dividends might help you take more informed decisions.

Ross Stores, Inc. dividend yield was 1.00% in 2024, and payout ratio reached 23.27%. The year before the numbers were 0.93% and 24.12% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 107 K employees. See our rating of the largest employees — is Ross Stores, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Ross Stores, Inc. EBITDA is 3.05 B USD, and current EBITDA margin is 14.35%. See more stats in Ross Stores, Inc. financial statements.

Like other stocks, ROST shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Ross Stores, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Ross Stores, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Ross Stores, Inc. stock shows the buy signal. See more of Ross Stores, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.