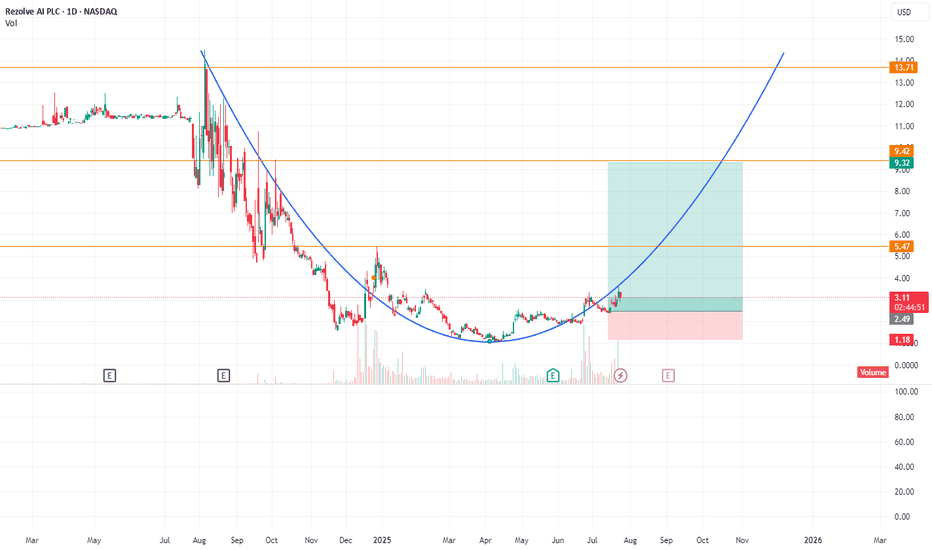

RZLV formed round bottomBusiness Model: AI SaaS for retail—mobile-first, gen‑AI conversational commerce and checkout.

Financials: Very low revenue base, heavily loss-making, but building enterprise footprint and usage.

Balance Sheet: Strengthened via equity conversions, debt facility, and capital raises; dilution risk remains.

Traction: Growing client deployments across major brands; usage and GMV accelerating in 2025.

Leadership: Experienced team, led by a founder-CEO and a seasoned global CTO/product head drawn from tech‑commerce backgrounds.

Despite minimal current revenue, Rezolve AI is betting on rapid scaling through partnerships with Microsoft, Google, and enterprise clients. Execution and monetization in 2025 will be pivotal to its valuation trajectory.

RZLV trade ideas

Woah This One is InterestingI couldn't seem to find a single trend or pattern in this until I scaled back my time frame and zoomed out.

There is a massive volume profile gap that I labeled in my green lines that I believe price is now targeting long term.

One single tiny piece of news will make this thing sky rocket.

Watch for a nothing burger or spike down to grab liquidity one final time. With time, this will rocket.

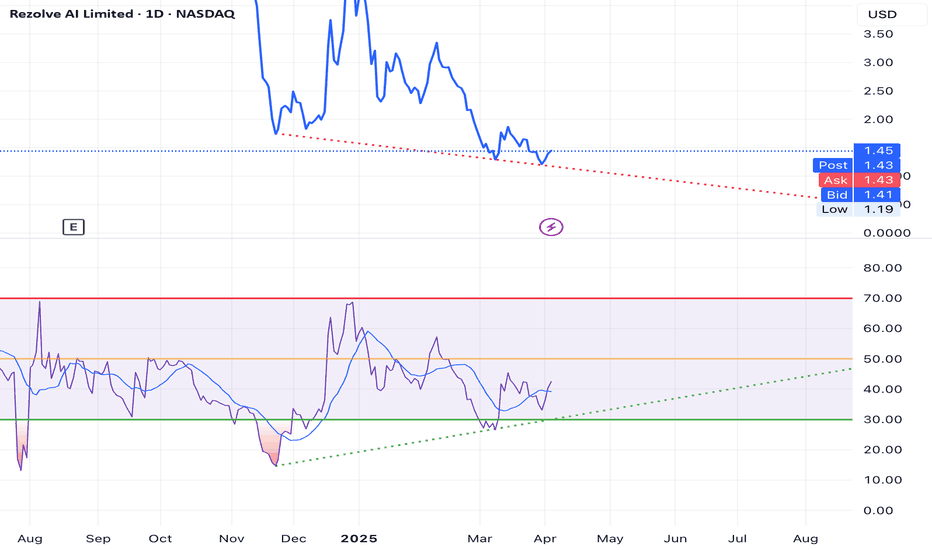

BULLISH RSI DIVERGENCE ON REZOLVE AI (RZLV) 1D CHARTA bullish RSI divergence appeared to gather more strength on the 1 hour chart today. This could possibly signal a bullish up trend. The London based company provides AI solutions for commerce. Rezolve recently closed an acquisition of GroupBy, an ECommerce company, and has recently been featured favorably in articles by Nasdaq and others.

12/26/24 - $rzlv - Need more developments.12/26/24 :: VROCKSTAR :: NASDAQ:RZLV

Need more developments.

- ai chatbot co for e-commerce

- reminds a bit of NASDAQ:LPSN 's attempt (too bad they never figured it out)

- i'm skeptical this product can't easily be built in house (and already is) by names like NASDAQ:AMZN , NYSE:SHOP , etc. so today it seems more like a "feature" than a moat-style AI business

- don't love the founder, seems a bit dry. but honestly never met the guy and wish him the best

- no revenues, a bunch of announcements coming in '25 and apparently some initial biz in 4Q. but seems more like a build hype/ announcement excitement situation

- in this tape weird stuff is ripping. if AI software names rip, this could well double off it's lows, but I think at nearly 700 mm+ valuation, that's just too much to ask from me and i have a bunch of other stuff i'd rather own and can more easily scale up (b/c this would be a 25-50 bps position at max size... so "legging" in at 5-10 bps is just a distraction on my PnL)

- set target to re-look if/when we retest the $2 handle

V