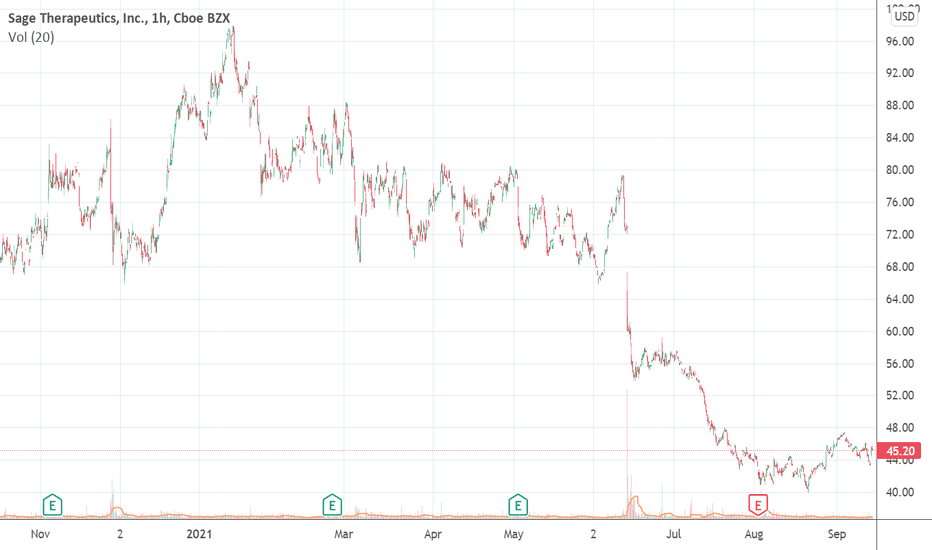

Trade Review - SAGEWhen SAGE showed up in screener there was a bullish continuation pattern on the daily timeframe and a potential overextension on the higher timeframe downtrend.

The higher timeframe is in a downtrend, have made a measured move down (volatility projection) and is extended from the mean, thus we observe for potential reversion.

The lower timeframe provides a bullish continuation setup, which allows us to enter with a more structured approach. There was a failure test entry earlier, but since this was missed we look for a more clear range expansion as a confirmation. The target is a measured move up, as this is a projection of the current volatility.

In this chart you can observe the actual expansion / breakout, since there was a noticeable contraction 2 bars prior the move could be entered quicker. The stop is located 1-2 ATR from the entry point, which allows for a 1.5 to 2 R trade.

SAGE trade ideas

$SAGE: strong base, upcoming catalysts$SAGE is an interesting stock here, has pending catalysts for mid 2023, which fit the expectations from the Time@Mode technical pattern at hand here.

Consider the volatility of these biotech names when entering, stock could move huge after data comes out (up or down) but odds are good that it breaks to the upside given the technical pattern suggesting the smart money has been accumulating stock.

Upcoming catalysts:

SAGE-217 - (SHORELINE)

Major Depressive Disorder (MDD)

Phase 3 additional data due in mid-2023.

Zuranolone (SAGE-217)

Major depressive disorder (MDD) and Postpartum Depression

PDUFA priority review date of August 5, 2023.

Best of luck!

Cheers,

Ivan Labrie.

SAGE 62% PoP Bearish Iron Condor after event

My favorite bearish neutral trade for today.

Losing only upside, I like the extreme high IVR values to play.

Reasons to play this:

1/ After event, big selloff, high implied volatility.

2/ Extreme High Implied Volatility, good for credit strategies

3/ I can boost my original bearish vertical spread with 2 bottom legs at fib 0.786 to boosting my reward almost zero risk to the downside (max loss below strike 35 is $17 ...)

4/ Secure zones are 88$ and the 40$

So the winner is the negative delta Iron Condor Strategy.

Max profit: $483

Probability of Profit: %62

Profit Target relative to my Buying Power: 42%

Max loss with my risk management: ~$250

Req. Buy Power: $1050 (max loss without management at expiry, no way to let this happen!)

Tasty IVR: 92 (ultra high)

Expiry: 45 days

Buy 1 SAGE Jun18' 35 Put

Sell 1 SAGE Jun18' 40 Put

Sell 1 SAGE Jun18' 90 Call

Buy 1 SAGE Jun18' 105 Call

IRON CONDOR for 4.83cr with negative -8.3 delta, because IVR is very high and I'm bearish.

Stop/my risk management : Closing immediately if daily candle is closing ABOVE $90, max loss in my calculations in this case could be 250$. Probability of loss in this way: ~20% .

Take profit strategy: 60% of max.profit in this case with auto sell order at 1.69db. Probability of profit this way: ~80%.

Of course I'll not wait until expiry in any case!

If you liked this article, check my other ideas.

Anyway: HIT THE LIKE BUTTON BELOW , and for fresh option ideas FOLLOW ME( @mrAnonymCrypto ) on tradingview !

$SAGE - LONGSept 2

I missed the initial trade back at $40.00, but looking to enter into this tomorrow. You can use a more aggressive stop loss if you want, but this is still in a momentum trade and the open range for the next two weeks suggests a bullish overall market.

Quick analysis of SAGE shows a massive drop in December when phase 3 of the trial did not meet the threshold to continue to the next stage even though it shows some promise. Then CEO increased his share position adding 16% $500,000 insider buying.

Stock crashed with the the market down to $25 dollars. A flag pattern breakout happened June 18th and hit its target by August 10th.

A new flag pattern formed and the break-out confirmation of the flag happened today after it had bounced of the 50 day MA. Today we closed above recent highs and tomorrow continuation could confirm breakout. Next resistance is 200 day MA at $55.48. Break above would confirm breakout to following targets:

Target 1: $62.58

Target 2: $70.50

Target 3: Momentum

Stop Loss: $47.13 (50 day MA)

R/R: 2.51

$SAGE can rise in the next daysContextual immersion trading strategy idea.

Sage Therapeutics, Inc., a biopharmaceutical company, develops and commercializes novel medicines to treat central nervous system (CNS) disorders.

The demand for shares of the company looks higher than the supply.

This and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $64,12;

stop-loss — $60,51.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

SAGE - ON WATCH for a Short - Fundamental play #COVID19Watch this BioTech - Selling #COVID19 Hype, squeezing a small percent (19%) for shorts in the market. I am not looking to buy the hype train. Instead wait for a peak, then go Puts. (if VIX is normal by then, Buy the Puts, otherwise spread)

This play will materialize in two weeks - Otherwise Expires. Visit back.

This is a biotech - we wont have any cash flow. But they do not have cash either to cover this year expense.

WAIT, WAIT, WAIT and then Fire.

Sage Therapeutics Jumps on drug plan.$sageSage Therapeutics (NASDAQ:SAGE) announces next steps in the Landscape Program, the clinical program evaluating zuranolone (SAGE-217) for the treatment of postpartum depression (PPD) and major depressive disorder (MDD), following a Breakthrough Therapy guidance meeting with the FDA.

Following discussions with the FDA, Sage plans to initiate three new short-term clinical studies in 2020, if successful, for three distinct indications: PPD, acute rapid response therapy in MDD when co-initiated with a new standard antidepressant, and episodic treatment of MDD. These planned studies include:

For use as an oral therapy in women with PPD; for use as an acute rapid response therapy (RRT) in patients with MDD when co-initiated with new standard antidepressant therapy and for use as an episodic therapy in patients with MDD.

Topline data from all the three studies evaluating a two-week course of zuranolone 50 mg is anticipated in 2021.

The Company is on track to report topline data from Shoreline Study (MDD-303) in 2020 from patients with MDD who received zuranolone 30 mg.

Sage has paused enrollment in the Redwood and Rainforest study in Q4 2019.

Shares are up 12% premarket.

Sage Therapeutics Gets a Buy From Citi $sagePossible gap fill above $54 with $62 as a upside target

Imitated afterhours by Citi to buy

Average analysts price target $95.42 | Overweight

Short interest high at 13.09%

Stifel analyst Paul Matteis says Sage Therapeutics shares below $50 represent one of the best opportunities in Stifel's coverage universe. The bear case is the uncertain path forward for SAGE-217 and Zulresso looking commercially unviable while Sage's cash burn profile seeming "misaligned" with the post-MOUNTAIN trial market capitalization, Matteis tells investors in a research note. However, the analyst, who doesn't even completely disagree with the bear case, believes the stock "seems to heavily discount two major upside levers." SAGE-217 is a single positive acute major depressive disorder study away from being just as big of a drug as investors have always hoped, and SAGE-217's value in postpartum depression is underappreciated, even if another study is needed, contends the analyst. Matteis keeps a Buy rating on Sage Therapeutics with a $143 price target. The stock closed Friday down 10%, or $5.01, to $47.00.