SERV trade ideas

Safe Entry Zones SERVStock Movement Ranging.

Stock between strong resistance and support level of 4h zones both are significate selling and buying zones. in case breaking-down it will Down-Movement Stock and vice versa.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock:

On 15M TF when Marubozu Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu Candle, because price will always and always re-test the imbalance.

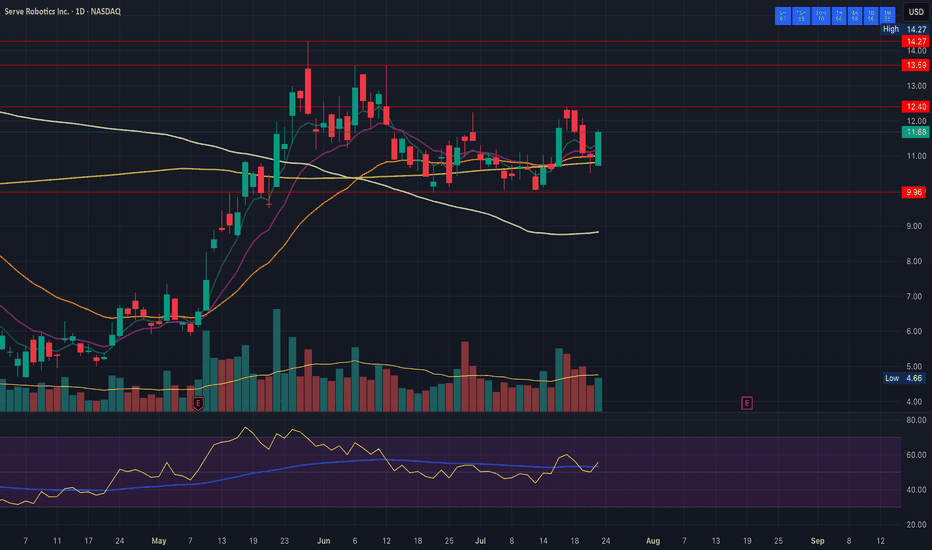

SERV Breakout Trade Idea – 3.8x R:R Setup📢

🚨 Trade Setup Alert – Serve Robotics Inc. (NASDAQ: NASDAQ:SERV )

A clean ascending triangle is forming on the 30-min chart — price is squeezing toward the apex. A breakout above resistance could trigger a strong move.

📍 Entry: $12.65

🎯 Target: $14.46

🛑 Stop Loss: $12.18

📊 Risk-Reward Ratio: 3.8x

🧠 Pattern: Ascending Triangle 🔺

📈 If volume confirms the breakout, this trade has momentum potential.

📉 Risk is defined, and the setup looks strong — let’s trade smart, not emotional.

💬 Drop your thoughts below or share your setups 👇

#SERV #SwingTrade #Breakout #ProfittoPath #StockMarket #TechnicalAnalysis #TradingView #OptionsTrading #SmartMoneyMoves

The pattern is true!This pattern is true, but only reflects a return to previously visited high just before the big drop. Primarily visits the initial area of imbalance for mitigation purposes. Price movement experienced after that mitigation is solely dependant on the frequency and location of imbalances created and mitigated on the trip.

Strong Buy ZoneThe Green 1h Zone Acts as Zone buying Zone.

The 1h Red Zone Acts as Resistance.

Scenarios Two: the 1h/4h Green Zone Act as the strongest support level.

Also there is strong Bullish Pattern "M pattern forming triple bottoms"

We have two Scenarios indicating Buyers step in Strongly Within 1h Green Buying Zone:

Scenarios One: strong buying volume reversal Candle.

Scenarios Two: Fake Break-Out of green Buying Zone.

Both indicate Buyers Stepping in strongly.

Once One Showed Up a safe entry would be 50% Fibo from the buying Candle at 1h TF.

The "Profit Take" are area's where you may reduce or sell all position to secure profit which act as Resistances. as for Previous Low Pink Line (P. Low)

Earnings soon, what will the movement be?All depends on movement prior to earnings, I drew my two different outlooks depending on if we rise prior to or decline prior to earnings.

With market tide shifting to bullish in the next month, I think we may pop to $12-$13.

Even if we drop after earnings, it will be a buying opportunity for the next year.

I have $12 calls expiring 3/28, wish me luck :)

Nvidia $SERV'd this one! Massive move still on the table!NASDAQ:SERV

NASDAQ:NVDA selling out of this one crushed this name but...

- The CupnHandle is still intact IF this is indeed bottom.

- Volume Shelf and S/R Zone here

- Right at smoothing line which has historically held pretty well.

Only time will tell but if we come back up and break out of this CupnHandle at $24.32 we are going to...

🎯 $42

Not financial advice

Confessions from the Desk: Nvidia is Up, I Am NotIt’s Friday, the sun is shining, and Nvidia is up. Unfortunately, I am not.

Nvidia sits smugly at $137.19, while my $140 call is officially DOA—dead on arrival, with no chance of resuscitation. I’d like to say I’m surprised, but at this point, it feels like the market is just personally messing with me.

To add insult to injury, my carefully curated basket of stocks has been bouncing around like a drunk day trader on margin. One minute, I think I’m up; the next, I’m refreshing my portfolio like a gambler waiting for a miracle. Spoiler alert: the miracle never comes.

Meanwhile, Nvidia has been making big boy moves—cutting its stake in Arm Holdings, taking a bite out of China’s WeRide, and ghosting Serve Robotics and SoundHound AI like a bad Tinder date. The result? Stocks are moving, headlines are flashing, and somewhere in a penthouse office, a hedge fund manager is smirking at my pain.

Let’s break it down:

Nvidia dumps 44% of Arm Holdings – Apparently, even they have commitment issues.

Exited Serve Robotics & SoundHound AI – Serve was rolling along nicely until, well... it wasn’t. SoundHound AI got the boot, too, and its shares fell 25%. Ouch.

Pumped 1.7 million shares into WeRide – WeRide stock shot up 76%. That’s cool, but guess who doesn’t own WeRide? This guy.

Also bet on AI cloud firm Nebius – Stock rose 8%. Lovely. Again, not in my portfolio.

Now, as Nvidia makes its AI master moves, I sit here staring at my screen, watching Serve Robotics—one of my few February winners—go completely sideways. That’s right, folks. Nvidia’s got a plan, but my portfolio? It’s just vibing.

But hey, it’s Friday, the sun is out, and at least I don’t own SoundHound AI. Small wins, right?

Happy Friday

Long Trade Setup Breakdown for Serve Robotics Inc. (SERV) - 30-M📊

🔹 Asset: Serve Robotics Inc. (SERV)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Ascending Triangle Breakout

🚀 Trade Plan (Long Position):

✅ Entry Zone: $22.92 (Breakout Confirmation)

✅ Stop-Loss (SL): $20.88 (Below Support)

🎯 Take Profit Targets (Long Trade):

📌 TP1: $25.22 (First Resistance)

📌 TP2: $28.07 (Extended Bullish Target)

📊 Risk-Reward Ratio Calculation:

📈 Risk (Stop-Loss Distance):

$22.92 - $20.88 = $2.04

📈 Reward to TP1:

$25.22 - $22.92 = $2.30

💰 Risk-Reward Ratio to TP1: 1:1.13

📈 Reward to TP2:

$28.07 - $22.92 = $5.15

💰 Risk-Reward Ratio to TP2: 1:2.52

🔍 Technical Analysis & Strategy:

📌 Breakout Confirmation: Strong buying momentum above $22.92 signals continuation.

📌 Pattern Formation: Ascending Triangle Breakout, indicating a bullish move.

📊 Key Support & Resistance Levels:

🟢 $20.88 (Strong Support / SL Level)

🟡 $22.92 (Breakout Zone / Entry)

🔴 $25.22 (First Profit Target / Resistance)

🟢 $28.07 (Final Target for Momentum Extension)

🚀 Momentum Shift Expected:

If price stays above $22.92, it could push towards $25.22 and $28.07.

A higher volume breakout would confirm strength in the trend.

🔥 Trade Execution & Risk Management:

📊 Volume Confirmation: Ensure buying volume remains strong after breakout.

📈 Trailing Stop Strategy: If price reaches TP1 ($25.22), move SL to entry ($22.92) to lock in profits.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $25.22, let the rest run to $28.07.

✔ Adjust Stop-Loss to Break-even ($22.92) after TP1 is hit.

⚠️ Fake Breakout Risk:

If price drops below $22.92, be cautious and watch for a retest before re-entering.

🚀 Final Thoughts:

✔ Bullish Setup – If price holds above $22.92, higher targets are expected.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.13 to TP1, 1:2.52 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀🏆

🔗 #StockTrading #SERV #BreakoutTrade #TechnicalAnalysis #MarketTrends #ProfittoPath

Launch on Serve Robotics. SERVWe are really liking the amalgamation of factors in this picture. Just have a look at that bullish candle just smashing through the MIDAS curve in green. US and vWAP offer resistance in tandem. Bollinger Band %PCT crossed to bullish and the other two oscillators below also threw of signs in tandem. High probability situation here if you are going long.

Serve Robotics (SERV): Autonomous Delivery Gains StrengthServe Robotics Inc. (SERV) is a robotics company focused on revolutionizing last-mile delivery with autonomous sidewalk robots. These robots are designed to navigate urban environments, delivering food and other goods quickly and efficiently. As demand for contactless delivery grows, Serve Robotics is expanding its fleet and forming partnerships with major food and retail brands, driving its growth in the fast-evolving delivery industry.

On the stock chart, SERV recently showed a confirmation bar with increasing volume and is finding demand at the Fibonacci 0.50 level inside the corrective zone (0.382-0.618). This is a strong support area in uptrends, signaling increased buying interest and a potential move higher. A trailing stop can be set using Fibonacci levels, allowing traders to manage risk while keeping upside potential open.

Serve Robotics (SERV) Analysis Company Overview:

Serve Robotics NASDAQ:SERV is a pioneer in autonomous last-mile delivery, leveraging AI-driven electric robots to reduce costs and emissions. With strong partnerships and financial backing, SERV is positioned to disrupt traditional delivery models.

Key Catalysts:

$450 Billion Market Potential by 2030 🌎

Serve’s $1-per-trip model could revolutionize delivery economics.

Strategic Partnerships – Uber & 7-Eleven 📦

Uber’s $11.5M investment and integration with Uber Eats enhance scale.

7-Eleven partnership strengthens Serve’s retail delivery presence.

Strong Financial Backing – Secured Through 2026 💰

$166M raised since December 2024, ensuring funding stability.

NVIDIA and Delivery Hero investments validate AI-driven robotics.

Investment Outlook:

Bullish Case: We are bullish on SERV above $14.00-$14.50, supported by disruptive potential, strategic partnerships, and financial strength.

Upside Potential: Our price target is $31.00-$32.00, reflecting market expansion, AI adoption, and industry transformation.

📢 Serve Robotics—Redefining Last-Mile Delivery. #AI #Robotics #AutonomousDelivery #SERV

Serve Robotics Incwitnessed a strong rebound in yesterday's session after attempting to test the support level at 12.84, to close at the last peak 15$, which is the level that needs to be violated, to confirm the current uptrend, triggering further rises near 17.79 - 19.61 - 21.62 - 24.09, where the historical peak lies.

The stop-loss lies below 12.70$.

the indicators are heading toward the positive side, which confirms the mentioned positive scenario.

Disclaimer: This analysis is for informational purposes only and does not constitute financial, investment, or trading advice.

Serve Robotics Inc. (SERV): Recent Price Surge and Strategic DevAs of December 13, 2024, Serve Robotics Inc. (NASDAQ: SERV) closed at $13.08 per share, reflecting a 15.34% increase from its previous closing price. The stock experienced a day range between $10.80 and $13.12, with a trading volume of 8.59 million shares. It has been showing strong momentum, with a 56.46% increase over the past month and a remarkable 478.76% growth over the last six months

Recent Events:

Corporate Expansion: Serve Robotics is scaling operations with a focus on autonomous sidewalk delivery, including a partnership with Uber and new market expansion plans.

Strategic Appointments: Recently, Lily Sarafan joined the company's Board of Directors, and Anthony Armenta became Chief Software and Data Officer

Acquisition: The company has acquired Vebu to diversify its offerings, including automation solutions for the restaurant industry

These developments have fueled investor confidence, contributing to SERV's recent stock performance.

Disclaimer: Not Financial Advice, Only for Research Purposes.

Serve it Up to $18Liking the volume and the new price action in the last week as SERV is bouncing off the lower linear red trend line. would like to see $18 in the next month.

This is a technical play not a fundamental one; however, Nvidia and Uber investments provide some cushion to the lofty valuation.

Serve Robotics, a $500 million company developing autonomous delivery robots, has attracted investments from Uber and Nvidia, both holding over 20% of the company's shares. Their robots, offering cost-effective solutions for last-mile deliveries, are seen as more efficient than human drivers. Despite high growth, Serve has limited revenue and is currently unprofitable, with losses mounting. The company aims to deploy 2,000 robots by 2025 and expects a huge opportunity in the robot delivery sector, potentially worth $450 billion by 2030. However, its high valuation raises concerns for potential investors.

Title: "SERV Reversal: Entry $11.39, Targets $13.65 & $15.33!SERV is showing a bullish reversal from a falling wedge pattern. Entry at $11.39, with targets at $13.65 and $15.33, supported by strong technical indicators. A well-placed stop loss at $10.27 ensures a favorable risk-reward setup. Watching for confirmation of upward momentum.

SERV Ascending Triangle Breakout | Targeting $15.39 .

"SERV has formed a strong ascending triangle pattern on the 30-minute chart, breaking out with a significant 42% price surge. The breakout above resistance at $13.65 indicates bullish momentum, with the next key target at $15.39.

Key levels:

- **Support:** $11.15

- **Resistance:** $13.65 (broken)

- **Target:** $15.39

This setup highlights a potential continuation of the upward trend. Watching volume closely to confirm the breakout. Share your thoughts or analysis below!"