Am I seeing this right!!! 22% short interest.

Serve Robotics Inc. stock forum

tradingview.com/x/CFxMkkhh/

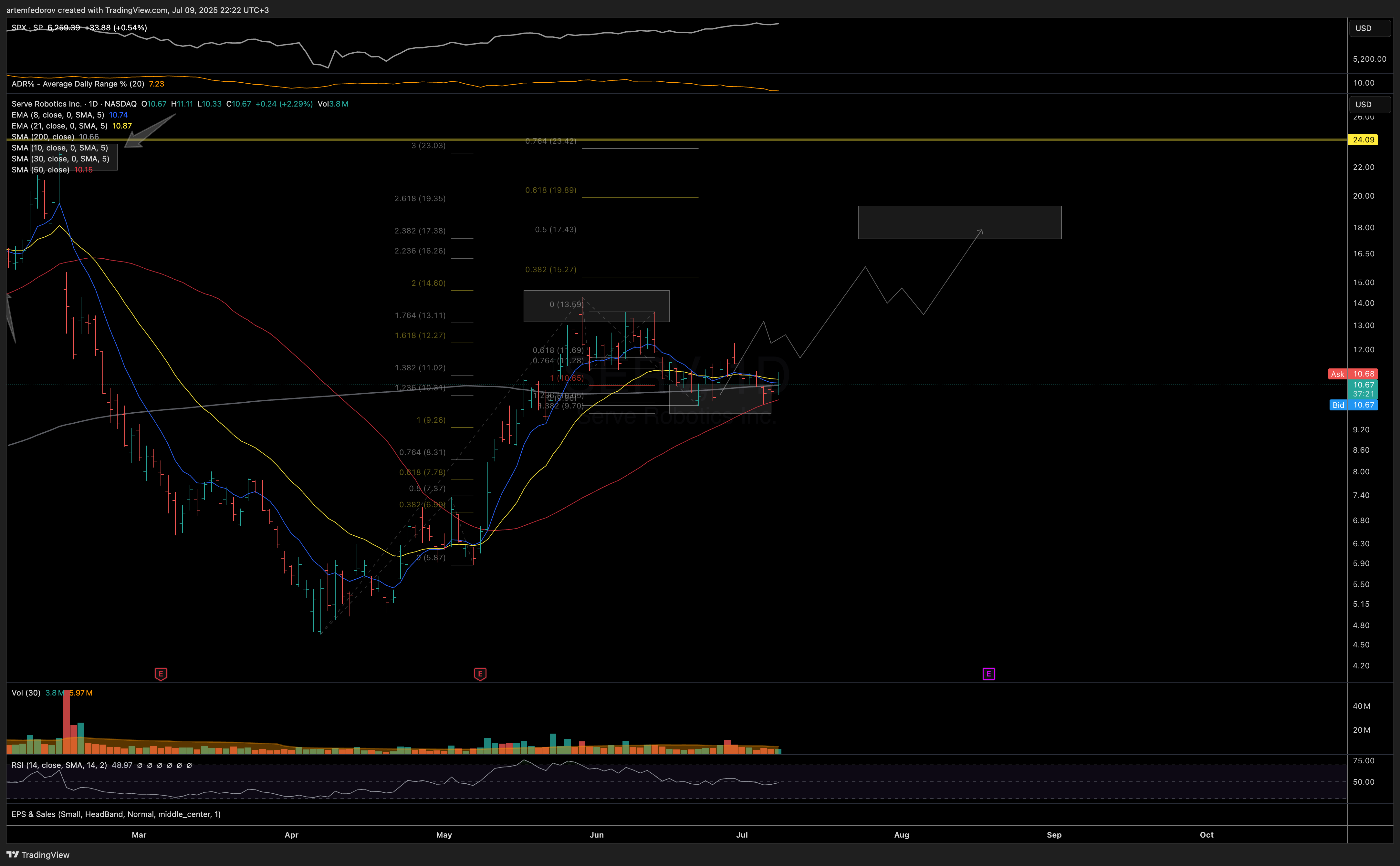

Preferably, price holds today’s low and follows through in the coming weeks toward May highs and beyond.

Previously on breakout potential:

tradingview.com/symbols/NASDAQ-SERV/minds/?mind=67Wwxv1kRWSNdGgNfW7gHg

- Backed by

- Part of the hyped #Robotics theme with aggressive fleet expansion

- Growing institutional accumulation

- Strong price/volume action with price basing at 2024 break-out level

As long as price holds above $9.70 support, odds favor upside toward $17–20 macro resistance

Previously:

tradingview.com/symbols/NASDAQ-SERV/minds/?mind=kjkAPHWnREW3GmA9i3lzOA

If  SERV exceeds the 13.8 USD barrier, we will surge to 15-16 USD.

SERV exceeds the 13.8 USD barrier, we will surge to 15-16 USD.