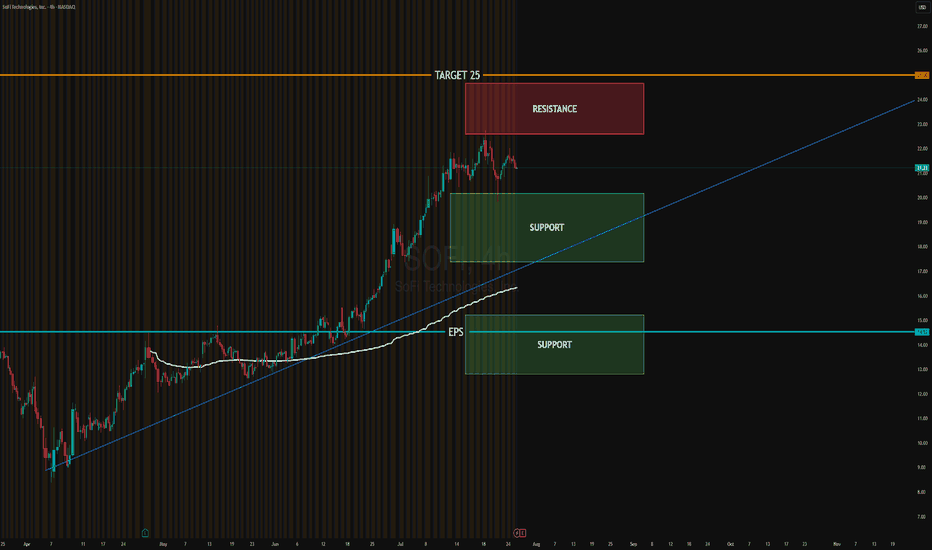

Scared? Become a BuyerHello I am the Cafe Trader.

With heightened interest in SOFI, I am seeing many worried posts, and skepticism. Before taking profits early, consider these levels fist.

Years Old Supply.

This Supply zone (marked in the red box) has been sitting here for years. It is no suprise that we get a dynami

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.52 USD

498.67 M USD

3.77 B USD

1.16 B

About SoFi Technologies, Inc.

Sector

Industry

CEO

Anthony J. Noto

Website

Headquarters

San Francisco

Founded

2011

FIGI

BBG00YB1ZD58

SoFi Technologies, Inc. is a financial service platform, which engages in the provision of student loan refinancing options to the private student loan market. It operates through the following segments: Lending, Technology Platform, and Financial Services. The Lending segment offers personal loans, student loans, home loan products, and related servicing activities. The Technology Platform segment focuses on technology products and solutions revenue. The Financial Services segment includes the SoFi Money product, SoFi Invest product, SoFi Credit Card product, SoFi Relay personal finance management product, and other financial services such as lead generation and content for other financial services institutions. The company was founded in 2011 and is headquartered in San Francisco, CA.

Related stocks

SoFi: On the Road to ATH ResistanceAfter clearing over 100 lines off my chart, I wanted to take a clean, fresh look at SoFi heading into the upcoming earnings report — just to gain a new perspective on where we stand.

Weekly chart. As simple as it gets.

What I’m seeing: a breakout from a classic cup-and-handle formation, with the b

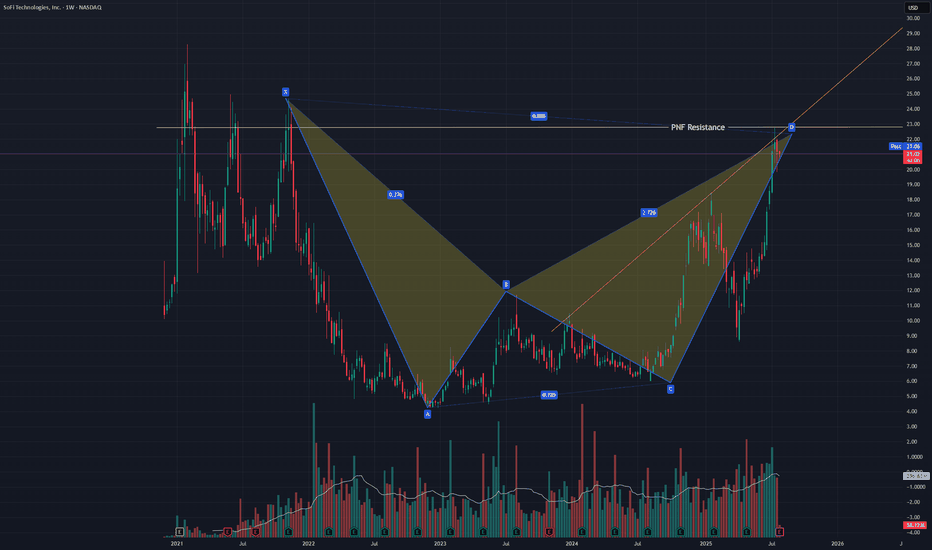

SOFI Pullback most likely comingNASDAQ:SOFI just finished a bearish bat harmonic and failed to break a resistance line I have from a PNF chart. It also failed a back test of a trendline of resistance in this uptrend. A pullback is likely but in this irrational market any thing could happen. I did a strangle +-5% just in case.

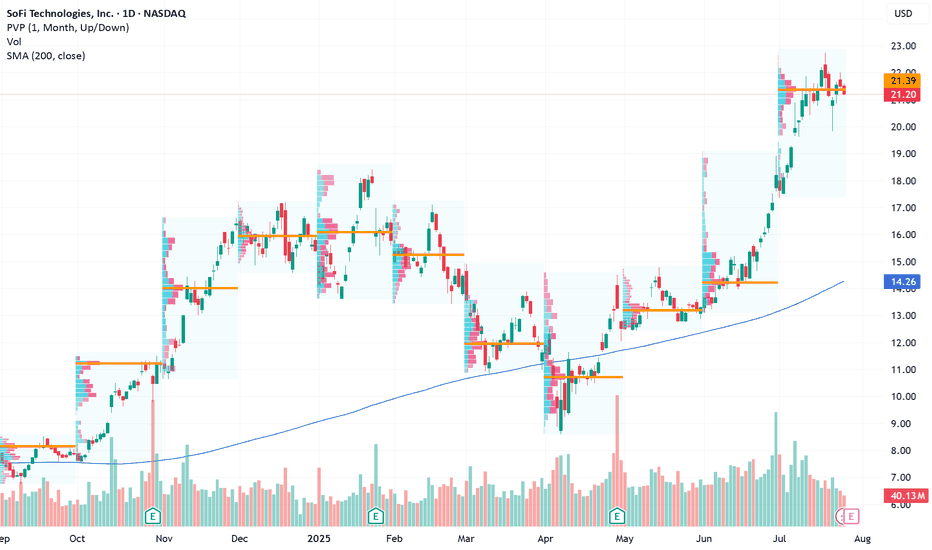

Positioned for an Earnings-Driven Upside Opportunity Current Price: $21.20

Direction: LONG

Targets:

- T1 = $22.80

- T2 = $23.60

Stop Levels:

- S1 = $20.60

- S2 = $19.90

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to i

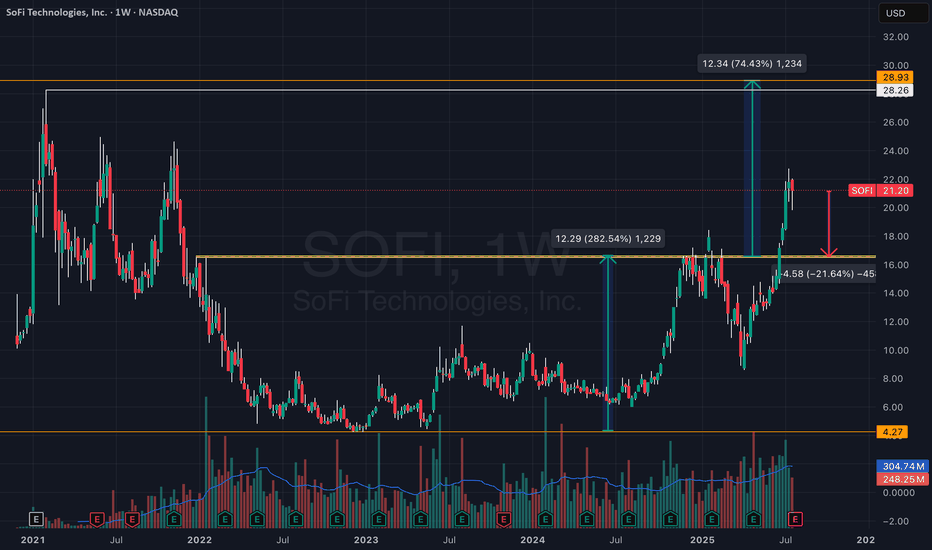

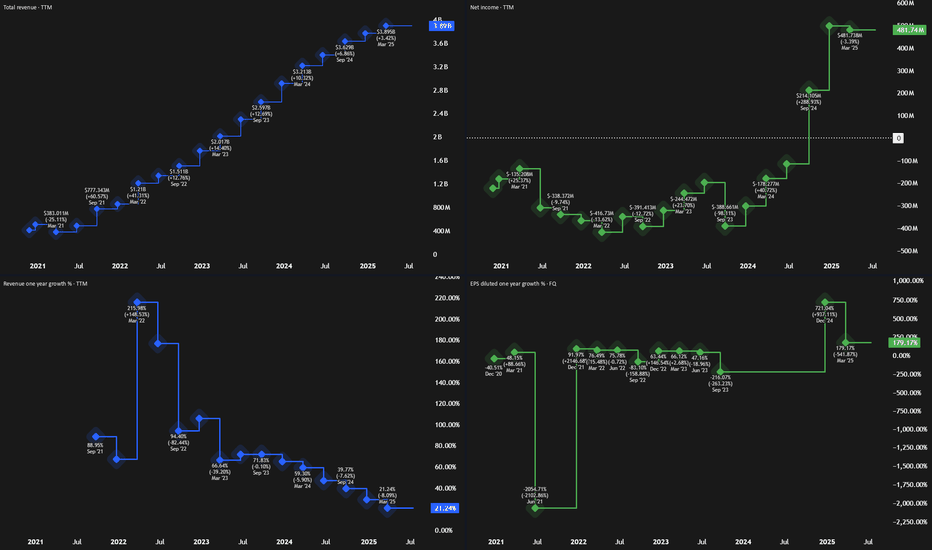

Why We See 100%+ Upside In SoFi Over The Next 3 YearsAfter soaring to nearly $28 per share during the SPAC-fueled fintech boom in 2021, SoFi Technologies (SOFI) crashed back to earth, trading under $5 as rising interest rates, regulatory headwinds, and lack of profitability dimmed investor optimism. But the tide has turned.

Over the past year, SoFi h

SOFI Breakout to 30$SoFi Technologies is primed for a major rally. The weekly chart is displaying a classic cup and handle formation, which is one of the most reliable bullish patterns in technical analysis. With the handle nearing completion, the stage is set for a breakout—often marking the start of strong upward mov

My thoughts for the coming weeksWe are at a tough patch now unfortunately looking at the charts, and so I think it's safe to assume we will see some selling and slowing down in upward price action, until we find more momentum to carry us into price discovery.

As you can see, we're heading towards some very important areas. One be

SoFi's Surge: Unveiling 2023 and What Lies Ahead in 2024Technical Analysis Overview

Current Price : $10.34, a 3.77% increase.

Weekly Trend : Showing a positive trend with a 5.35% increase over the last five days.

1-Month Trend : A significant increase of 51.96%, indicating strong bullish sentiment.

6-Month and Yearly Trends : A 17.04% increase ov

SOFI meets 25 out of 28 technical & fundamental criteria – SwingEntered at $22.55 after full validation through our 28-criteria system.

✅ Strong earnings (positive revenue growth & stable forward guidance)

✅ Dilution concerns cleared (no new share offering)

✅ Breakout confirmed above VWAP with clean pullback

✅ Accelerated momentum and rising premarket volume

✅

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US83406FAA0

SOFI TECH. 21/26 ZO CVYield to maturity

−14.11%

Maturity date

Oct 15, 2026

US83406FAC6

SOFI TECH. 24/29 CV 144Yield to maturity

−15.91%

Maturity date

Mar 15, 2029

See all SOFI bonds

Curated watchlists where SOFI is featured.

Frequently Asked Questions

The current price of SOFI is 21.23 USD — it has decreased by −5.98% in the past 24 hours. Watch SoFi Technologies, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange SoFi Technologies, Inc. stocks are traded under the ticker SOFI.

SOFI stock has fallen by −1.35% compared to the previous week, the month change is a 21.14% rise, over the last year SoFi Technologies, Inc. has showed a 180.45% increase.

We've gathered analysts' opinions on SoFi Technologies, Inc. future price: according to them, SOFI price has a max estimate of 30.00 USD and a min estimate of 6.00 USD. Watch SOFI chart and read a more detailed SoFi Technologies, Inc. stock forecast: see what analysts think of SoFi Technologies, Inc. and suggest that you do with its stocks.

SOFI reached its all-time high on Feb 1, 2021 with the price of 28.26 USD, and its all-time low was 4.24 USD and was reached on Dec 7, 2022. View more price dynamics on SOFI chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SOFI stock is 9.61% volatile and has beta coefficient of 2.46. Track SoFi Technologies, Inc. stock price on the chart and check out the list of the most volatile stocks — is SoFi Technologies, Inc. there?

Today SoFi Technologies, Inc. has the market capitalization of 25.17 B, it has increased by 2.00% over the last week.

Yes, you can track SoFi Technologies, Inc. financials in yearly and quarterly reports right on TradingView.

SoFi Technologies, Inc. is going to release the next earnings report on Nov 4, 2025. Keep track of upcoming events with our Earnings Calendar.

SOFI earnings for the last quarter are 0.08 USD per share, whereas the estimation was 0.06 USD resulting in a 30.25% surprise. The estimated earnings for the next quarter are 0.08 USD per share. See more details about SoFi Technologies, Inc. earnings.

SoFi Technologies, Inc. revenue for the last quarter amounts to 858.23 M USD, despite the estimated figure of 804.25 M USD. In the next quarter, revenue is expected to reach 862.63 M USD.

SOFI net income for the last quarter is 97.26 M USD, while the quarter before that showed 71.12 M USD of net income which accounts for 36.77% change. Track more SoFi Technologies, Inc. financial stats to get the full picture.

No, SOFI doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 5 K employees. See our rating of the largest employees — is SoFi Technologies, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SoFi Technologies, Inc. EBITDA is 926.61 M USD, and current EBITDA margin is 16.72%. See more stats in SoFi Technologies, Inc. financial statements.

Like other stocks, SOFI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SoFi Technologies, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SoFi Technologies, Inc. technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SoFi Technologies, Inc. stock shows the buy signal. See more of SoFi Technologies, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.