SOUN trade ideas

Soundhound Round 2 SoundHound Inc. is a voice AI and audio recognition company that specializes in technologies allowing humans to interact with devices through natural voice commands. Albiet not currently profitable, their business model does have some revolutionary potential for many service based industries as AI begins to take over our everyday life.

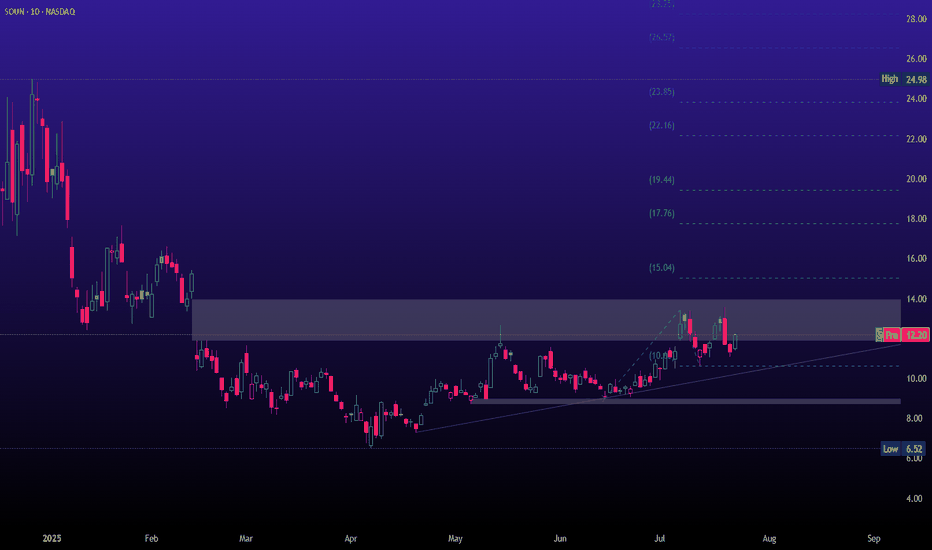

What im interested in here is the overall setup where we may be starting to see a rotation back to the highs after bouncing at some of my key levels based on the volume profile. These being the POC and VWAP from the low.

I think there is a decent chance we go to $16 perhaps, and then we can re-evaluate the market and if there is potential for us to hit new highs!

levels to manage $SOUN post-earningsStrategic Partnerships: SoundHound’s tie-ups with Acrelec (drive-thru AI) and AVANT communications signal longer-term enterprise growth plays, even as profitability lags.

TipRanks Consensus: 7 analysts average a Buy rating with an $11.00 12-month target (≈+1% upside), suggesting tempered enthusiasm into current weakness

SOUNSoundHound AI — Company Overview and Latest Developments (July 2025)

What Is SoundHound AI?

SoundHound AI, Inc. (Nasdaq: SOUN) is a leading voice artificial intelligence (AI) company headquartered in Santa Clara, California. Founded in 2005 by Stanford graduates, it has evolved from music recognition app Midomi (later rebranded SoundHound) to a global innovator in conversational voice AI.

What Does SoundHound Do?

The company develops an independent voice AI platform that powers conversational interfaces for businesses across automotive, TV, IoT, restaurant, customer service, healthcare, retail, finance, and more.

SoundHound's platform allows enterprises to create custom voice assistants, voice-enable products, deliver hands-free customer service, and gather valuable conversational analytics.

Key Products and Technologies

Product/Technology What It Does

Houndify Platform Suite of APIs, SDKs, and tools for building custom voice and conversational assistants for enterprise, auto, and consumer tech.

SoundHound Chat AI Advanced conversational assistant integrating generative AI and real-time data (weather, stocks, restaurants, etc.).

Smart Ordering AI-driven ordering for restaurants (drive-thru, kiosk, phone, and in-car).

Dynamic Drive Thru End-to-end voice interactions for fast-food and QSR environments.

Smart Answering Automated, always-available phone agent for customer calls.

Voice Commerce Ecosystem for ordering, payments, and pickup, notably powering new in-vehicle ordering.

Employee Assist AI agent to help staff with information, ordering, and support tasks.

Tech Stack Proprietary Speech-to-Meaning®, Deep Meaning Understanding®, Natural Language Understanding (NLU), ASR, TTS, Edge/Cloud.

Supports 25 languages and holds over 250 patents in conversational AI technologies.

Branded wake words, cloud/edge integration, and automatic content recognition are key differentiators.

Recent News & Major Highlights (2025)

CES 2025 Launch: Unveiled the industry’s first in-vehicle voice assistant enabling on-the-go food ordering—lets drivers order and pay for meals directly from car infotainment systems.

Restaurant Industry Expansion: Live demos at the National Restaurant Association Show showcased drive-thru, phone, kiosk, and in-car voice ordering, with AI now powering ordering in 10,000+ restaurant locations.

Acquisitions: Recently acquired Amelia (enterprise automation software) and Synq3 Restaurant Solutions, boosting its capabilities and reach in both enterprise and hospitality sectors.

Automotive & Enterprise Traction: Now in 20+ auto brands and sectors like healthcare, finance, and utilities, with strategic partnerships like OpenAI-powered voice AI in Stellantis vehicles.

Financial Growth: Company reports strong cash position ($200M, no debt), expects EBITDA positivity by year-end, and projects robust growth with expanding voice commerce opportunities.

Revenue Model and Growth

SoundHound's business relies on royalty licensing (hardware voice enablement), recurring subscriptions (for services like restaurant AI), and voice commerce (cut from voice-enabled orders), with growing adoption in cars, devices, and quick-service restaurants.

Summary:

SoundHound AI is a top player in the conversational AI space, voice-enabling products and services for enterprises worldwide, especially in automotive, retail, and hospitality. Its latest innovations—like in-car food ordering and expanded restaurant solutions—reflect aggressive growth and increasing real-world impact for AI-powered voice technology

$SOUN Breakout Setup – Clean Bullish Structure with Strong R/RSoundHound AI ( NASDAQ:SOUN ) is showing a strong technical setup as it pushes above the Ichimoku cloud on the daily chart. Price has been consolidating for over a month in a tight range between $9 and $10.30. Today’s breakout above the cloud with bullish MACD crossover signals potential trend continuation.

Key technicals:

Ichimoku Cloud: Price has closed above the Kumo with Tenkan-sen crossing above Kijun-sen—classic bullish signal.

MACD: Fresh bullish crossover with histogram flipping positive for the first time since mid-May.

Volume: Volume has been increasing on up days, suggesting accumulation.

Trade setup:

Entry: $10.30 (breakout candle)

Stop: $9.05 (below recent consolidation base and cloud)

Target: $13.41 (prior high and R1 pivot level)

Risk/Reward: 2.41

If price holds above $10 and consolidates, it could offer a low-risk add or re-entry zone. Momentum traders may wait for confirmation above $10.55 with volume before committing.

This setup offers both breakout potential and clean invalidation, making it attractive for swing traders and breakout traders alike.

SoundHound AI Inc (SOUN) Looks BullishShort‑Term & Mid‑Term Outlook

Near-term : Watch for a breakout above ~$11.30 on above-average volume. If that occurs, expect a swift move toward $13–14.

Mid-term : If momentum holds, the stock could reach $16–18 over the next 4–8 weeks.

Alternative (bearish) : A breakdown below the lower flag trendline (~$10

and the 50‑day MA (~

$10.05) could trigger a pullback toward the $9–10 region.

What to Do Now

Watch for breakout at ~$11.30–11.40. A clean break on strong volume could signal a run.

Conservative spec entry on breakout, with stops under ~$10.00.

Target: $17.80 measured move; $16 for more disciplined play.

SOUN | Long (Cautious) | AI Speculative Play | (June 30, 2025)SOUN | Long (Cautious) | AI Speculative Play with Technical Bounce Setup | (June 30, 2025)

1️⃣ Insight Summary:

SoundHound AI (SOUN) is showing potential for a short-term technical bounce, but fundamentals remain weak. This is more of a speculative, high-risk play for quick traders rather than a long-term investment.

2️⃣ Trade Parameters:

Bias: Long (speculative, small position)

Entry: ~$10.00 (Point of Control area)

Stop Loss: $8.43 (below recent structure)

TP1: $11.52

TP2: $13.60

TP3: $16.00

Final Target: $19.73

3️⃣ Key Notes:

✅ Revenue sits around $84 million, but net income is deeply negative at around -$350 million.

✅ Free cash flow is negative (~$100 million), but debt is low at ~$4 million and decreasing — a small positive sign.

✅ Recent filings show insider selling totaling ~$525 million over the last 5 days, which is concerning and signals caution.

✅ Most revenue comes from services and licensing in the U.S., South Korea, France, Japan, and Germany.

✅ Forecasts show revenue expected to grow slowly into 2026, but profitability remains uncertain.

✅ Technical setup suggests a possible bounce from $10 toward $11.52 and higher if momentum picks up, but fundamentally it lacks solid support.

❌ High volatility (beta ~3) and insider selling make this a risky, short-term speculative idea only.

4️⃣ Follow-up Note:

I will treat this as a very small position compared to stronger setups (e.g., YETI or ACIW). Will update if price action confirms above $11.52 or if insider sentiment changes.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

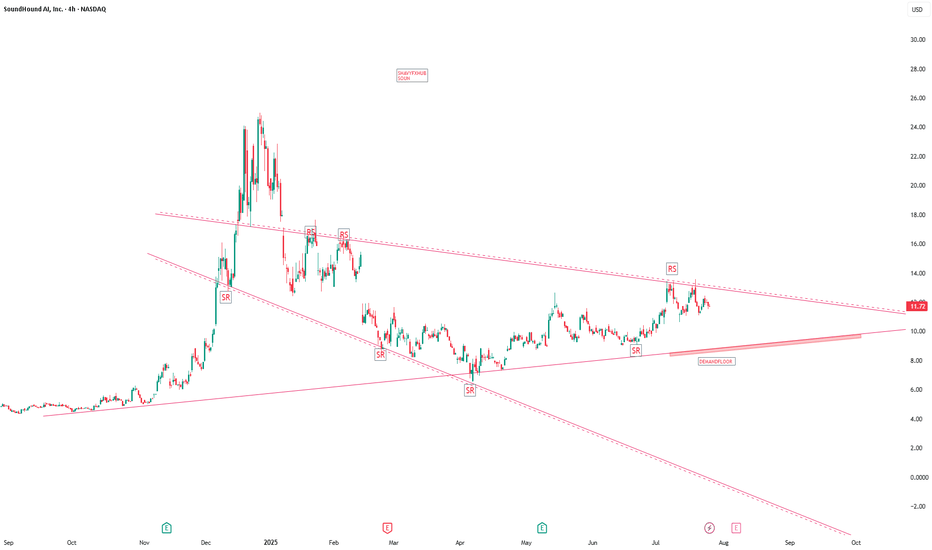

SOUNHOUND AI to 4x Yet Again The chart illustrates a recurring pattern of bullish triangle breakouts followed by explosive 399% price rallies, strongly supported by rising volume and breakout confirmations. Each breakout has occurred after extended consolidation phases forming ascending triangle patterns, a sign of institutional accumulation and bullish continuation.

Key points:

Breakout Zones have led to parabolic price action three times, each move gaining roughly 400%.

Current setup mirrors past behavior: breakout from a descending channel with reclaim of $9.50, the prior ATH and key support, indicating a bullish structural shift.

If the fractal repeats, a 399% move from the current $9.50 zone targets $47.37, aligning with the marked BullFlag target.

The presence of volume surges on breakouts confirms strong market participation, validating each rally.

Risks include failure to hold above the $9.50 breakout zone, or macroeconomic weakness affecting speculative tech.

However, from a pattern-recognition and momentum standpoint, SOUN offers asymmetric upside potential if the structure continues to play out.

Based on historical symmetry and breakout behavior, SoundHound AI appears poised for a continuation of its explosive uptrend, with technical indicators pointing toward a potential quadrupling in price if prior fractal patterns persist.

Big CUP & Handle .. 100+ for this AI stock

The chart displays a cup-and-handle pattern, a powerful bullish continuation setup. The "cup" formed from $3 to $11.07, followed by a "handle" consolidation near the $11.07 resistance (key level). The stock is poised for a breakout above this level, with the measured move of the pattern projecting a target of $125. This target is calculated by adding the cup's depth ($8, from $3 to $11) to the breakout point ($11.07), scaled on a logarithmic chart, suggesting a potential move to $125 if the breakout is confirmed with strong volume. The curved trendline (blue) provides robust support, reinforcing the bullish trend, while the breakout above the handle’s descending trendline signals momentum.

Fundamental Catalysts:

SoundHound AI is a leader in the conversational AI market, expected to grow to $49.9B by 2030 (CAGR 30.2%). Strategic acquisitions (Amelia, SYNQ3, Allset) have expanded its reach in restaurant and enterprise AI, adding clients like Chipotle and White Castle. Partnerships with Tencent, Stellantis, and Hyundai integrate its voice AI into global automotive markets, while a $1.2B revenue backlog ensures long-term growth. Q4 2024 revenue soared 101% to $34.5M, with 2025 projected at $157–$177M (97% growth). With 270+ patents, a $246M cash reserve (no debt), and a path to positive EBITDA by late 2025, SoundHound is primed for significant market share gains.

SOUN: Testing the 200-Day — Inflection Point AheadSOUN is back at its 200-day moving average — a key level that's held before, and now it’s under pressure again. No clean break yet, but the setup is looking vulnerable.

If it loses this level with conviction, downside momentum could accelerate fast. I’ve got eyes on $6.03 as the next major support zone.

This is where the bulls need to step in — or risk a deeper move. Watching closely. 👀

$SOUN Gearing Up For Blast OffNASDAQ:SOUN is looking ready to move back to its highs from several months ago after getting brutally sold off. The completed bullish harmonic pattern coupled with the potential bearish harmonics is a classic setup that can slingshot a stocks price rapidly. Additionally the stock has just finished an Elliot Wave cycle to the down side and is ready to retrace back to the upper Fibonacci levels. RSI on the daily has crossed over its EMA to confirm momentum in the upward direction. We could see $19 in one or two months.

SOUN: Updated Chart & Key Support LevelsSoundHound bounced perfectly off the SMA 200 ($8.28), confirming it as key support (S1). This remains a critical level to hold.

I’ve now added S2 ($7.94), S3 ($7.28), and S4 ($6.10) as additional downside levels to watch. If the SMA 200 fails, I’d anticipate further downside, especially in the current bearish market environment.

Keeping a close eye on price action at these levels. Stay tuned for updates.

Above $11.93 with Follow Through Above $12.50 Confirms a bottomIn lieu of such price action, we retain the ability to make one more low. In the very short term and observing the micro price action $11.79 could extend our black wave (iv) but above $11.93 with price action to get above $12.50 and I start to lean on the purple count.

Best to all,

Chris

SOUN: Key Support in FocusSoundHound has remained on a downward trajectory, and now all eyes are on the SMA 200 as the next key support level. With the stock approaching this level, how it reacts here will be critical in determining the next move.

A strong bounce here could indicate some stabilization, while a decisive break below would suggest continued downside pressure. Keeping a close watch to see if buyers step in or if this support fails to hold.

Stay tuned. 👀