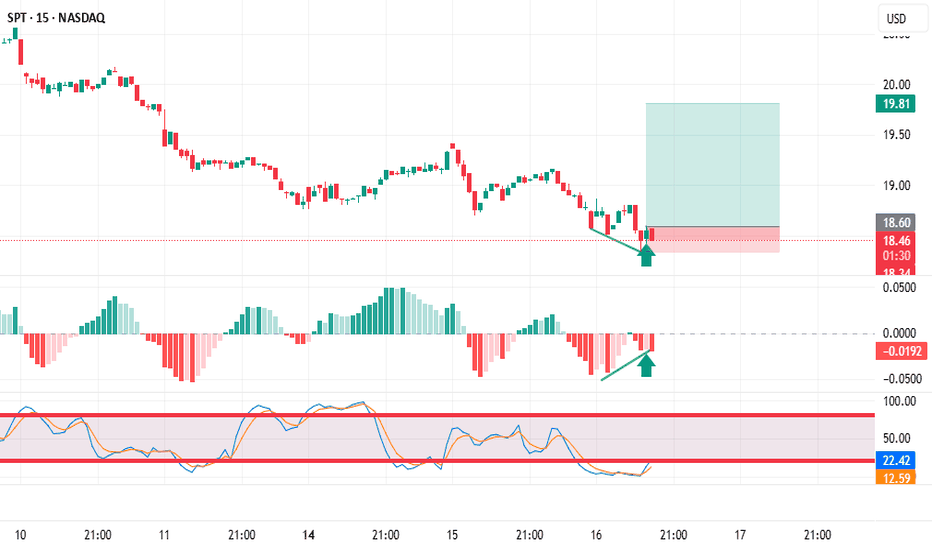

Trading stocks using Dr. Elder's "Three Screens" methodI found a great divergence on the weekly chart

Then I looked at the daily chart of this stock, and here I also found divergence.

Then I looked at the hourly chart of this stock, and here I also found divergence.

And even on the 15-minute chart I saw price divergence towards the indic

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1.04 USD

−61.97 M USD

405.91 M USD

50.03 M

About Sprout Social, Inc

Sector

Industry

CEO

Ryan Barretto

Website

Headquarters

Chicago

Founded

2010

FIGI

BBG001K1CT23

Sprout Social, Inc. engages in the provision of online social media management tools for businesses. It offers communication tools, contact management, lead generation, and analytics services. The firm also offers solutions for enterprises, agencies, small businesses, customer service, social media marketing, and employee advocacy sectors. The company was founded by Justyn Howard, Aaron Rankin, Gilbert Lara, and Peter Soung on April 21, 2010 and is headquartered in Chicago, IL.

Related stocks

Sprout Oversold and will go up againIm back again friends. Nowadays im more focused on stock market and i trade mostly stock markets. As you can see Sprout has reached oversold territory and last support line. I believe it will go up very very soon.

It can go up to 22%/44%. So i BOUGHT Sprout (0% Leverage)

NASDAQ:SPT

SPT possible BUY setup Though this might be a risky play, since SPT is posting results in couple of days, I love what the charts are telling me at the moment.

This Chicago based firm provides social media management software for businesses.

Sprout Social has recently targeted larger companies for partnering, establishin

SPT long to $158Sprout has made a nice run of late. Warranted? Maybe maybe not but that's what we deal with these days. SPT broke out recently from a wedge and has retraced back to the trendline. Only reason I would be long is this ridiculous market. Short may be an option too. I think the safest way to make

SPT - PEG consolidation on lower volume (8/16/2021)Strong PEG with selling on low volume. This chart may take some more time to develop and base over a lower period of time. Ideally would like to see volume dry up more and price to contract to confirm the buyers are in control.

Cannot determine good entries and stops until we get more data on a lo

WATCHING $SPT for ENTRY TARGET @ 76.71WATCHING $SPT for ENTRY TARGET @ 76.71

I’m practicing to nail my entries even better… if target hits I will take a position.

As many times as I've swung this I still have no idea what Spout Social is. 😅 Maybe later today I'll look into it. Looking for pullback for entry.

If there's any ticker

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of SPT is 18.93 USD — it has decreased by −0.73% in the past 24 hours. Watch Sprout Social, Inc stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Sprout Social, Inc stocks are traded under the ticker SPT.

SPT stock has fallen by −1.66% compared to the previous week, the month change is a −8.06% fall, over the last year Sprout Social, Inc has showed a −48.88% decrease.

We've gathered analysts' opinions on Sprout Social, Inc future price: according to them, SPT price has a max estimate of 32.00 USD and a min estimate of 18.00 USD. Watch SPT chart and read a more detailed Sprout Social, Inc stock forecast: see what analysts think of Sprout Social, Inc and suggest that you do with its stocks.

SPT stock is 1.66% volatile and has beta coefficient of 1.20. Track Sprout Social, Inc stock price on the chart and check out the list of the most volatile stocks — is Sprout Social, Inc there?

Today Sprout Social, Inc has the market capitalization of 1.10 B, it has decreased by −5.67% over the last week.

Yes, you can track Sprout Social, Inc financials in yearly and quarterly reports right on TradingView.

Sprout Social, Inc is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

SPT earnings for the last quarter are 0.22 USD per share, whereas the estimation was 0.15 USD resulting in a 46.04% surprise. The estimated earnings for the next quarter are 0.15 USD per share. See more details about Sprout Social, Inc earnings.

Sprout Social, Inc revenue for the last quarter amounts to 109.29 M USD, despite the estimated figure of 107.85 M USD. In the next quarter, revenue is expected to reach 110.94 M USD.

SPT net income for the last quarter is −11.22 M USD, while the quarter before that showed −14.42 M USD of net income which accounts for 22.18% change. Track more Sprout Social, Inc financial stats to get the full picture.

No, SPT doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 27, 2025, the company has 1.32 K employees. See our rating of the largest employees — is Sprout Social, Inc on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Sprout Social, Inc EBITDA is −39.43 M USD, and current EBITDA margin is −10.89%. See more stats in Sprout Social, Inc financial statements.

Like other stocks, SPT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Sprout Social, Inc stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Sprout Social, Inc technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Sprout Social, Inc stock shows the sell signal. See more of Sprout Social, Inc technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.