Trading stocks using Dr. Elder's "Three Screens" methodI found a great divergence on the weekly chart

Then I looked at the daily chart of this stock, and here I also found divergence.

Then I looked at the hourly chart of this stock, and here I also found divergence.

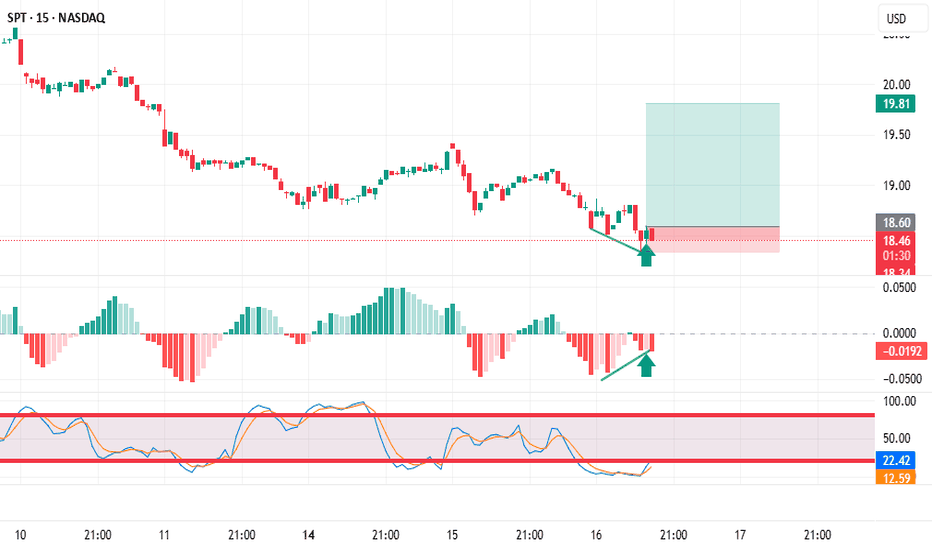

And even on the 15-minute chart I saw price divergence towards the indicators. This will be an excellent entry into a long position.

SPT trade ideas

Sprout Oversold and will go up againIm back again friends. Nowadays im more focused on stock market and i trade mostly stock markets. As you can see Sprout has reached oversold territory and last support line. I believe it will go up very very soon.

It can go up to 22%/44%. So i BOUGHT Sprout (0% Leverage)

NASDAQ:SPT

SPT possible BUY setup Though this might be a risky play, since SPT is posting results in couple of days, I love what the charts are telling me at the moment.

This Chicago based firm provides social media management software for businesses.

Sprout Social has recently targeted larger companies for partnering, establishing a nice contract with Salesforce.

What am I looking now:

1. Though I mentioned that this play is a risky one, due to upcoming earnings, SPT i currently trying to break from it's Daily Cup and Handle formation.

2. Today's try was not a god try of breaking the highest point of the Cup and Handle formation, sitting at around $66.70 price level. Price did break that point at one moment, but it quickly failed to maintain above it.

3. Selling pressure was high unfortunately, there were nearly 782k shares sold once it broke through the resistance level.

4. Since I am considering this a risky play, my initial entry will be small, with stop loss possibly larger than usual. Stop loss will be sitting at around $57.39 price level, which is just below the wick of the last candle which bounced from the 50EMA.

5. Once the earnings report are published, I will either close the trade or add to the position, depending on the results posted.

As always, please do your due diligence, this is just an opinion.

SPT long to $158Sprout has made a nice run of late. Warranted? Maybe maybe not but that's what we deal with these days. SPT broke out recently from a wedge and has retraced back to the trendline. Only reason I would be long is this ridiculous market. Short may be an option too. I think the safest way to make money on this is a long strangle

SPT - PEG consolidation on lower volume (8/16/2021)Strong PEG with selling on low volume. This chart may take some more time to develop and base over a lower period of time. Ideally would like to see volume dry up more and price to contract to confirm the buyers are in control.

Cannot determine good entries and stops until we get more data on a lower time frame. IMO will bounce a around a little more before a move higher or lower. Being patient and watching this.

WATCHING $SPT for ENTRY TARGET @ 76.71WATCHING $SPT for ENTRY TARGET @ 76.71

I’m practicing to nail my entries even better… if target hits I will take a position.

As many times as I've swung this I still have no idea what Spout Social is. 😅 Maybe later today I'll look into it. Looking for pullback for entry.

If there's any ticker symbol you'd like me to determine a good entry price just comment below and I'll do as many as time permits. Some days I have lots of time and other’s not so much but as I can I’ll do them (and If I have enough charts left)

Stocks to Watch 11/29/2020The Bull Market is strong, but many stocks are extended and sentiment seems to be extremely bullish. I am cautious with new buys until the sentiment cools off a little. This video is my watchlist. Most of these names are at or near all time highs or multi year highs. There are 28 total stocks on this list. Many of these have IPO'd in the last few years and still have a growth story ahead of them. There are also some "COVID" stocks which may be setting up again. . Know your time frame and risk tolerance, grab a pencil and paper and jot down the names that look interesting to you and then make the trade your own. Good Luck!

Remain Bullish on SPT (If the market doesn't crash)I bought SPT at 13.2 and these are the reason why I'm still holding. Keep in mind that I could also be wrong. SPT is down to Today at -2.79% so is the S$P500 at -2.81%. SPT's technical analysis though has been looking solid: creating a divergence as u can see in the chart. The price has broken resistance line few days earlier at around $15. This is a plus. Indicator checkmarks, passing previous high of Stoch RSI, and RSI. Keep in mind though that Stoch RSI has crossed down. Looking at Fibonacci retracement, the price has passed $15.59(38.2% retracement line) and later tested at $16.79(50% retracement line), which didn't pass. At the point, SPT is just testing the $16.79 line and previous high at $16.82 . I can't say what the market will look like on Monday, the systematic risk could cause a little dip on SPT (if the market doesn't crash lol). Nevertheless, my technical analysis indicates more upside potential for SPT. I'm confident in SPT, but keep in mind that I could also be wrong. p.s. My stop loss is at $15.60.

Update on SPTI've received several DMs to make an update on my previous call on SPT...Here it is.... For the short term period, there could be a small bounce due to oversold momentum. But using 1-day interval, SPT is overbought and has downward momentum. It's probably going to come down to test the 38.2% FIbo support at around $22.23. imo SPT is a really good firm. Its next quarter is promising, indeed. However, due to the previous spike in price of SPT, I've decided to lock in the profit and sought new investments with higher upside potential. Until there's a bigger dip on SPT....

* Disclaimer: This is just my view on the investment. It is not a recommendation for a buy or sell. and most importantly, I could be wrong!*